Top Trending StartUps News & Highlights

OYO Pre-Files DRHP for IPO of INR 6,650 Cr.

Days after getting shareholder approval for its third attempt at a public listing, PRISMPRISM Datalabs_in-article-icon, the parent company of hospitality upstart OYO, pre-filed draft documents for an IPO.As part of the IPO, which is anticipated to include an offer-for-sale component, the business hopes to raise INR 6,650 Cr through a new issuance. The company is aiming for a valuation of $7 billion to $8 billion for the public offering, according to sources who spoke to Inc42. Bankers from ICICI Securities, Axis Capital, Goldman Sachs, and Citibank have been selected as the book running lead managers for the initial public offering.The INR 6,650 Cr IPO was authorised by PRISM's shareholders earlier this month at an extraordinary general meeting (EGM). In addition, a bonus issue of shares in the ratio of 1:19—that is, one fully paid equity share for every 19 shares held—was approved by the shareholders. In September 2025, it also authorised the issuance of a 1:1 bonus. Interestingly, OYO initially submitted draft documents for an IPO in 2021 but then withdrew them due to market instability. Later, it pre-filed its DRHP but withdrew it last year, opting instead to refinance its $1.2 billion term debt from 2021 through a private capital deal.It is anticipated that the corporation will utilise a sizable portion of the money received from the new IPO to pay down debt. For more than a year, the business has been methodically getting ready to go public. It improved its profitability, expanded its premium range in India and outside, and changed the parent company name from OYO to PRISM earlier this year.

Published 31 Dec 2025 11:16 PM

Key Certification for Ola Electric's 4680 Bharat Cell-Powered Roadster X+

Ola Electric, an EV manufacturerThe government has certified Ola Electric Datalabs_in-article-icon's Roadster X+ (9.1 kWh) electric motorcycle, which is powered by an internal 4680 Bharat Cell battery pack. The International Centre for Automotive Technology (iCAT) approved the Roadster X+ in accordance with the Central Motor Vehicle Rules (CMVR), 1989, the firm reported to the stock exchanges. The Roadster X+, which Ola Electric claims is the first electric motorcycle in India to be certified with a wholly in-house built battery pack, would then start to be delivered. The Automotive Research Association of India (ARAI) certified the Bhavish Aggarwal-led company's 5.2 kWh configuration variant of their battery cell pack a few months prior to this breakthrough.Interestingly, the 9.1 kWh battery pack has also been certified by ARAI. The starting prices for the Roadster X series are INR 74,999 for the Roadster X, INR 1,04,999 for the Roadster X+ 4.5kWh, and INR 1,54,999 for the Roadster X+ 9.1kWh, which has a 501 km/charge range. With the most recent approval, Ola Electric will be able to use its 4680 Bharat Cell technology in all of its two-wheeler products, including electric bikes and scooters. The company's next battery energy storage system (BESS), called "Ola Shakti," will also use the same cell platform. The heavy industries ministry recently issued an order authorizing Ola Electric to release INR 366.78 Cr in incentives under the production-linked incentive program.The EV major has been attempting to put out fires on several fronts at this time. For the majority of 2025, the company was under pressure due to high losses, falling revenues and market share, and regulatory issues.

Published 30 Dec 2025 10:06 PM

Medibuddy reports FY25 revenue of Rs 725 Cr, reducing losses by 37%.

MediBuddy, a digital healthcare platform, reported a little increase in its operational scale in FY25 after growing by more than two times in the fiscal year that ended in March 2024. Nonetheless, the business was able to reduce its losses by 37% over that time. According to MediBuddy's annual financial records submitted to the Registrar of Companies (RoC), the company's operating revenue increased 12.3% year over year to Rs 724.6 crore in FY25 from Rs 645.4 crore in FY24.MediBuddy is a digital healthcare business that offers insurance services, lab testing, procedures, online and offline medical consultations, and medication delivery. Together, these services' revenue of Rs 722 crore continued to be the company's main source of income, with additional operating sources contributing Rs 2.5 crore. The company's total income in FY25 was Rs 743 crore after earning Rs 18.42 crore from non-operating sources, such as interest on current assets and fixed deposits, written-off liabilities, and other miscellaneous income.The cost of materials, which was Rs 333 crore in the previous fiscal year, accounted for the highest portion of total expenses at 38%. Employee benefits costs came next, rising slightly by 8% to Rs 176.8 crore, which included Rs 6 crore in ESOP costs. During the year, sales payout expenses, which include commissions paid to selling agents, decreased by 7% to Rs 155.47 crore. Additionally, the corporation spent Rs 32.5 crore on information technology and Rs 42.5 crore on safety and security. In FY25, additional overheads totalling Rs 138.7 crore included advertising, legal and professional fees, depreciation and amortisation, and financing charges.In the previous fiscal year, the Bengaluru-based company's total expenses stayed constant at Rs 879 crore. The company's losses were reduced by 37% to Rs 137 crore from Rs 215.7 crore in FY24 thanks to controlled spending and a 12% increase in sales.

Published 23 Dec 2025 11:33 PM

Urban Company Receives Penalty Notice and INR 56 Cr GST Demand

GST regulators believed that the startup's services, such painting and appliance repair, were within Section 9(5) of the CGST Act and would need to be taxed appropriately. Urban Company, which intends to challenge the ruling, further asserted that the demand notice will not affect the business's operations or finances. In addition, the GST authorities of Tamil Nadu, Maharashtra, and Haryana have sent the corporation at least three further demand notifications totalling INR 51.3 Cr.Unicorn Urban Company's hyperlocal servicesMaharashtra goods and service tax (GST) authorities have sent Urban Company Datalabs_in-article-icon a tax demand and penalty notice amounting INR 56.4 Cr.Unicorn hyperlocal services Maharashtra GST authorities have sent Urban Company a ₹56.4 crore tax demand and penalty notice for the April 2021–March 2025 period. The notice relates to alleged non-payment of GST on reimbursements to service providers, particularly over services like painting and appliance repair, and contains a primary tax of ₹51.3 crore and a penalty of ₹5.13 crore. Urban Company intends to file an appeal, claiming that the demand won't affect its business operations and that it has a compelling argument. This comes after several tax complaints from several states totalling ₹51.3 crore.

Published 21 Dec 2025 10:23 PM

StartUps

StartUps are the backbone of any country and in any Industry as these are the new ventures which entrepreneurs establish and then contribute to the nation growth and progress. The stratups will then grow and become unicorns and create thousands of employments in different sector boosting the economy and take it to the next level.

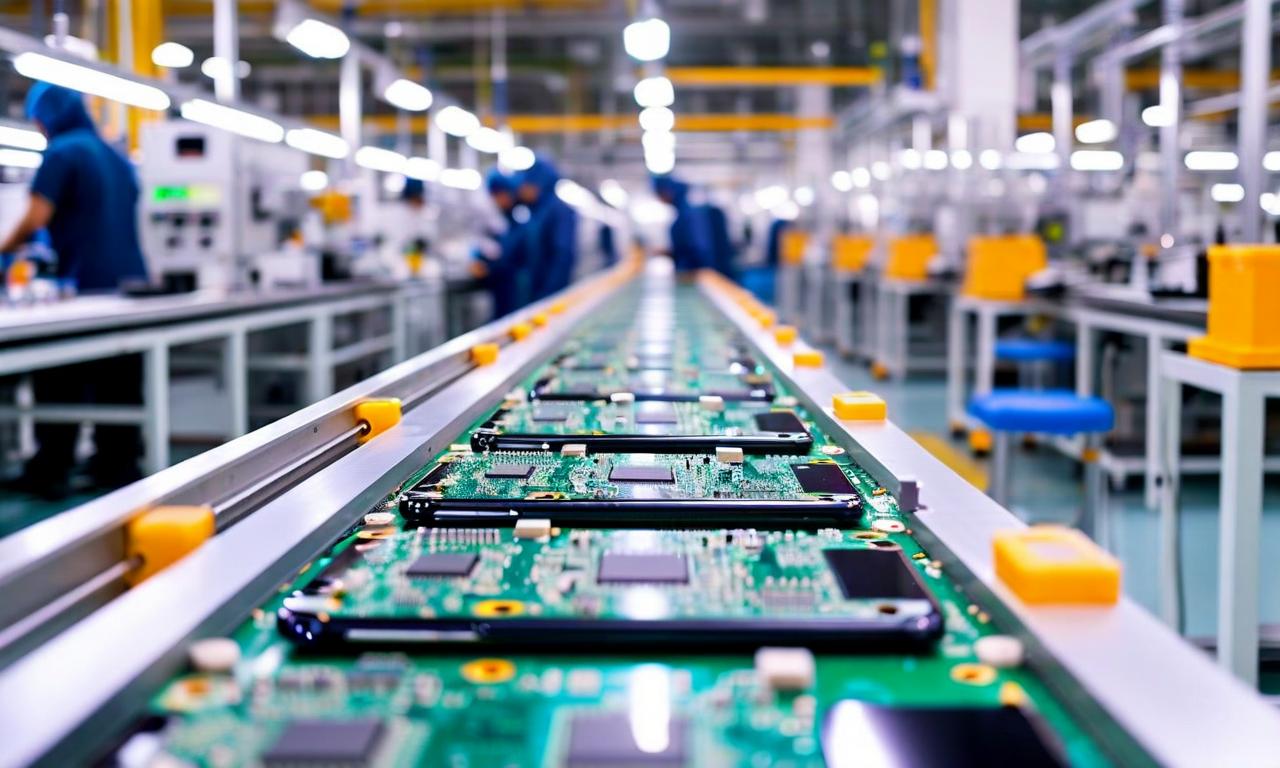

Nothing Partners with Optiemus to Reinforce Commitment to Indian Manufacturing

Nothing has declared its collaboration with Noida-based Optiemus Infracom to position India as the worldwide production and export center for Nothing and CMF products The JV will facilitate the establishment of Nothing’s sub-brand CMF (Color, Material, Finish) as an independent entity, assisting the company in making India its hub for operations, research and development, and manufacturing in the future. Nothing’s CMF and Optiemus Infracom are collaborating to invest more than $100 million (INR 886.7 crore) in the country over the next three yearsThe smartphone giant Nothing, headquartered in London, has revealed its collaboration with Noida's Optiemus Infracom to create a global production and export center for Nothing and CMF products in India. The JV will result in the establishment of Nothing’s sub-brand CMF (Color, Material, Finish) as an independent entity, aimed at helping the company establish India as its hub for operations, research and development, and manufacturing in the future. Nothing has teamed up with Optiemus Infracom to enhance smartphone production in India, pouring in more than $100 million and generating 1,800 jobs. The company intends to position India as a worldwide center for its CMF brand, with an emphasis on research, development, and manufacturing.

P-TAL, a D2C brand, secures $3 million from investors including Grid and Rainmatter.

P-TAL, a D2C brand, has secured $3 million in its Series A funding round, which was spearheaded by the VC Grid syndicated fund from Venture Catalysts and Rainmatter, led by Nikhil Kamath. The funding round included contributions from the US-based VC firm Connecticut Innovations, Bipin Shah’s new VC fund Zero Pearl, Anicut Capital, and others. P-TAL stated that it will use the new funding for product innovation, creating technology-driven efficiencies in its supply chain, and empowering artisan communities in India.P-Tal (Punjab Thathera Art Legacy), a high-end kitchenware brand that is bringing back India’s traditional craftsmanship of hand-forging copper, brass, and bronze utensils, has secured $3 million in a new funding round. Connecticut Innovations, Anicut Capital, Zeropearl VC, and various angel investors also took part in the round, which was co-led by VC Grid and Rainmatter, an investment initiative founded by Zerodha’s Nithin Kamath. The firm intends to use the new funds for the purpose of expanding its international operations, which currently account for almost 60% of revenue. P-Tal, having established a stronger foothold in the US, is now aiming to penetrate the European, UK, and Middle Eastern markets and is focused on developing R&D capabilities for designing product lines tailored to these regions.P-Tal, established by Aditya Agrawal (CEO), is rethinking traditional Indian kitchenware for contemporary homes. Its offerings encompass cookware, dinnerware, serveware, and essentials for daily use, with prices beginning at ₹1,500. Each item is hand-made by over 110 artisan families from Moradabad and Chandigarh, merging cultural heritage with modern design. The brand's distribution channels include its D2C website, e-commerce and quick-commerce platforms, as well as two offline stores in India.P-Tal had previously raised approximately $550,000 in 2023 in a round spearheaded by Titan Capital, bringing its total funding to $3.6 million. The firm gained exposure by appearing on Shark Tank India (Season 3), where it obtained ₹1 crore from investors Aman Gupta, Anupam Mittal, Amit Jain, Namita Thapar, and Vineeta Singh. As global consumers increasingly seek authentic, sustainable, and artisanal products, P-Tal is establishing itself as India’s cultural ambassador in the premium kitchenware market.

Zaggle Increases 5% Following Partnerships With Mastercard and AU Small Finance Bank

At 12:45 on the BSE, the stock had recovered some of its gains and was up 1.5% at INR 360.30, bringing the company's market capitalization to $544 million. The rally followed Zaggle's announcement of collaborations with Mastercard for co-branded domestic prepaid cards and AU Small Finance Bank (AU SFB) for co-branded retail credit cards, co-branded prepaid cards, and commercial cards. This year, the company's shares have mostly stayed in a corrective phase, reflecting the 18% year-to-date decline in the Nifty IT index and the 6% increase in the Nifty 50.Details of the Partnership The five-year partnership between Zaggle and Mastercard is outlined in the Customer Business Agreement, which goes into force on September 22, 2025, and ends on September 30, 2030. In order to establish and promote co-branded domestic prepaid cards on the Mastercard network, Mastercard will offer Zaggle incentives under this arrangement. Strategic Consequences For Zaggle, this collaboration is a big step toward increasing the range of prepaid cards company offers. Zaggle hopes to expand its product line and maybe gain market share in the quickly expanding fintech industry by utilizing Mastercard's extensive worldwide network and experience.Important Aspects of the Agreement Character of the Agreement: The contract is categorized as a Mastercard Domestic Prepaid Card Co-Branded with "Zaggle" Customer Business Agreement. Range: The transactions will be domestic in character, even if the cooperation involves an international organization (Mastercard Asia/Pacific Pte. Ltd). Duration: The agreement offers a solid foundation for sustained cooperation and lasts for just over five years. Governance of Companies According to Zaggle, there are no related party transactions involved in this arrangement. Furthermore, there is no interest in Mastercard on the part of the promoter or the promoter group, guaranteeing openness and compliance with corporate governance guidelines.

Exclusive: Whoa! Momo is expected to raise $8.5 million in the current round.

Chain of quick-service restaurants Whoa! Momo is now seeking Rs 75 crore, or roughly $8.5 million, in its Series D round, which is being headed by 360 ONE and includes Kyrush Investments. Three months after Stride Ventures provided the company with debt finance of Rs 85 crore, the new investment was made. Wow, with this! Over Rs 650 crore has been invested in Momo overall through its Series D financing. According to Wow! Momo's regulatory filings obtained from the Registrar of Companies (RoC), the board has decided to issue 7,837 Series D6 CCPS at an issue price of Rs 95,699 per share in order to raise Rs 75 crore.In this round, Kyrush Investments will contribute the remaining Rs 4.99 crore, while 360 One would invest Rs 70 crore. Entrackr estimates that the company's post-money valuation is between Rs $315 and Rs 320 million. These earnings will be used by the business for general corporate objectives, working capital needs, and capital expansion. According to the company's filing, Kyrush Investments will own 0.18% of the company, while 360 One Portfolio will control 2.53%.Wow! was introduced by Sagar Daryani and Binod Homagai in 2008. Momo owns brands including Wow! and runs more than 700 stores across 70 locations. Momo, Whoa! Wow, China! Wow, and chicken! Kulfi. In the following three years, the company also intends to build its HORECA sector, increase its FMCG business to Rs 100 crore, and open 1,500 outlets in 100 locations. Wow, according to the new data intelligence platform TheKredible! From Rs 413 crore in FY23 to Rs 470 crore in FY24, Momo's operating revenue increased 13% annually. In FY24, it continued to incur consistent losses of Rs 114 crore. The business has not yet disclosed its FY25 financials.

To expand its omnichannel presence, lab-grown diamond startup Lucira secures $5.5 million.

diamond jewelry made in a lab Blume Ventures has lead Lucira's $5.5 million fundraising round. Other investors include the founders of Dot&Key, Livspace, Snitch, Bewakoof, SiriusOne Capital Fund, and Spring Marketing Capital. Notably, this is the biggest seed round ever raised by an Indian jewelry start-up. With the additional funding, the start-up will bolster its workforce, launch marketing campaigns, and grow its offline business.Indian buyers are looking for style, authenticity, and a brand they can relate to on an emotional level, going beyond simply purchasing jewelry as an investment. With this support, we hope to establish Lucira as India's most reputable design-first fine jewelry brand," stated Rupesh Jain, Lucira's cofounder. Established by jewelry industry veterans Rupesh and Vandana Jain, Lucira has produced a portfolio of over 1,000 customizable lab-grown diamond designs, all of which are guaranteed to last a lifetime and come with exchange and buyback policies.After transforming Candere into one of India's first digital jewelry success stories—later acquired by Kalyan Jewellers—the fundraiser represents a wager on Rupesh's "second innings. " This month, the brand is also opening its first retail location in Mumbai. By the end of FY26, Lucira intends to open four additional flagship locations to bolster its digital-first purchasing strategy and make investments in technology-driven personalization. In order to achieve our goal of making Lucira the most design-first fine jewelry brand in India, we must strategically develop our omnichannel presence, design leadership, and customer trust. This fundraise is a vote of confidence from partners who recognize we’re not simply selling jewelry, we’re influencing mindsets,” said Rupesh.We're making significant investments in our design studio, expanding both digital and physical retail, and making sure each item is backed by reliable certification and warranties. We envision Lucira being the preferred fine jewelry brand for a new generation of Indian consumers thanks to our methodical approach," he continued.Jain added that during the next three to five years, the lab-grown diamond market in India, which is currently worth $400–500 million, is anticipated to reach a value of about $1.5 billion. He previously started the jewelry company Candere, which Kalyan Jewellers later bought after acquiring an 85% interest in Singularity Strategic.

PharmEasy Can Raise Debt of INR 1,700 Cr

This Sunday, here's an interesting thought for you: Startups that buy up larger companies or legacy firms typically don't end up successful. Consider the billion-dollar agreement between BYJU'S and coaching behemoth Aakash, which has largely fallen through due to BYJU's issues. Or Ola, a ride-hailing firm that spent around $200 million to buy FoodPanda and go into the food delivery business before realizing it was more than just buying a business.In June 2021, PharmEasy went one step further and became the first startup to purchase Thyrocare, a publicly traded firm, for INR 4,440 Cr (about $600 million at the time), a 9X revenue multiple.Although the company's FY25 loss of INR 1,517 Cr was 40% lower than FY24, its top line remained nearly unchanged, so this was not a significant improvement. Nevertheless, that is better than the 15% drop in revenue in FY24. Before delving further into the problems facing B2B and B2C pharmaceutical companies, let's take a look at this week's top stories from our newsroom:PhysicsWallah's Litmus Test for IPOs: The edtech giant submitted its revised DRHP earlier this week in an attempt to raise INR 3,820 Cr through an IPO. The ranking might be a welcome change in the deteriorating situation of Indian edtech. However, is the lauded listing from PW more smoke than fire? The Goldmine of Q-Commerce Ads: The world of rapid commerce has become a battlefield for marketers. What began as a convenience play has developed into the newest advertising goldmine in India, posing a threat to Meta and Google. The Premium Q-Comm Sizzle from FirstClub: The firm offers "high-quality" daily necessities and lifestyle items at reasonable costs, in contrast to other fast commerce companies. Can it compete with industry titans like Zepto, Blinkit, and Instamart with its premium-focused model?Building a comprehensive health and wellness platform that could source, prescribe, and sell medications through both online and offline touchpoints was the goal of Siidharth Shah, his close friends Dharmil Sheth, Dhaval Shah, Harsh Parekh, and Hardik Dedhia. Before losing steam, the startup managed to get halfway there. In order to expand verticals such pharmaceutical supply chain, health consultations, diagnostics, and testing, it purchased Aknamed in 2018, Thyrocare, and B2C pharmacy Medlife in 2021. During the pandemic, when the fiscal policy of zero interest rates was in effect, the corporation also took on a lot of debt. Although it was simple to raise these cash, PharmEasy found that repaying them grew increasingly expensive.Except for Thyrocare, cashburn was the cause of any growth at this point. Five years after that well-known transaction, PharmEasy, which was once valued at $5 billion, is having trouble turning a profit. The $300 million (INR 2,220 cr) loan from Goldman Sachs, which ultimately resulted in an annual interest rate of 17–18%, has been the primary cause of its difficulties.

Real Money Gaming Ban: Zupee Axes 170 Jobs and Joins Peers

Following India's passage of a bill in August that outlawed online games involving money, Zupee announced on Thursday that it will lay off 170 workers, or around 30% of its workforce. Zupee is the latest real-money gaming (RMG) company to fire staff following the ban, including Games24x7, Baazi Games, and Mobile Premier League. "We had to make this difficult decision in order to adjust to the new legal framework. We will always be grateful for the contributions of our departing colleagues, who have played a crucial role in Zupee's development," stated Dilsher Singh Malhi, the company's founder and CEO. "We had to make this difficult decision in order to adjust to the new legal framework. We will always be grateful for the contributions of our departing colleagues, who have played a crucial role in Zupee's development," stated Dilsher Singh Malhi, the company's founder and CEO.Based in Gurugram According to Zupee, the company is providing the 170 workers with "additional financial support linked to years of service" in addition to money in place of the notice period. After the impacted employees depart the organization, their health and insurance coverage will remain in effect for the duration of their employment."To ensure that no one feels unprotected as they pursue their next opportunity, we have also established a medical support fund of Rs 1 crore," the statement added. When new positions become available, the organization will give priority to rehiring its employees. Zupee intends to concentrate on online social gaming and entertainment items, and it now has 150 million registered members.

In FY25, Avanse's net profit increased 47% to INR 502 Cr.

The combined net profit of NBFC Avanse Financial Services, which focuses on educationIn the fiscal year that concluded on March 31, 2025 (FY25), Avanse Financial Services Datalabs_in-article-icon increased 46.6% to INR 502 Cr from INR 342.4 Cr in the prior fiscal year. The operating revenue of the IPO-bound NBFC increased by 36% from INR 1,727 Cr in FY24 to INR 2,347 Cr.In FY25, the company's total asset under management (AUM) climbed from INR 13,303 Cr to INR 18,985 Cr, a YoY rise of 1.4X. In the meantime, loan disbursement increased by 9% to INR 6,914 Cr in FY25 from INR 6,335 Cr the year before. Avanse, which was founded in 2013 by Amit Gainda, provides education loans to students who wish to study in India or outside. Additionally, it makes it easier for educational establishments like schools to obtain funding for the construction of infrastructure. The majority of the business for the Mumbai-based NBFC comes from Indian students who want to study overseas. During the year, loan disbursements totaled INR 5,152 Cr, while the segment's AUM was INR 15,275 Cr. The sector that serves educational institutions came next, with an AUM of INR 3,068 Cr and a total loan disbursement of INR 1,501 Cr in FY25.According to the company's annual report, the number of Indian students studying overseas has skyrocketed and continued to rise over time. From 9 Lakh in CY22 to 13.3 Lakh in CY24, this figure has increased by 48%. Additionally, India's education system is undergoing significant transformation as a result of its increased emphasis on providing pupils with comprehensive learning and development. This has forced them to spend money on edtech, labs, digital classrooms, and sports facilities for after-school activities.A significant portion of the lending major's revenue came from interest income, which rose 39.5% from INR 1,443.7 Cr in the prior fiscal year to INR 2,014.4 Cr in FY25. In FY25, revenue from fees and commissions increased by 23% year over year, while net gain on fair value charges increased by 10.6%. During the year, net gain on fair value charges was INR 14.6 Cr, despite fee and commission revenues totaling INR 227 Cr. The net benefits from the company's financial instrument derecognition increased its top line by INR 91 Cr in FY25, a 6% increase from INR 85.6 Cr the year before.

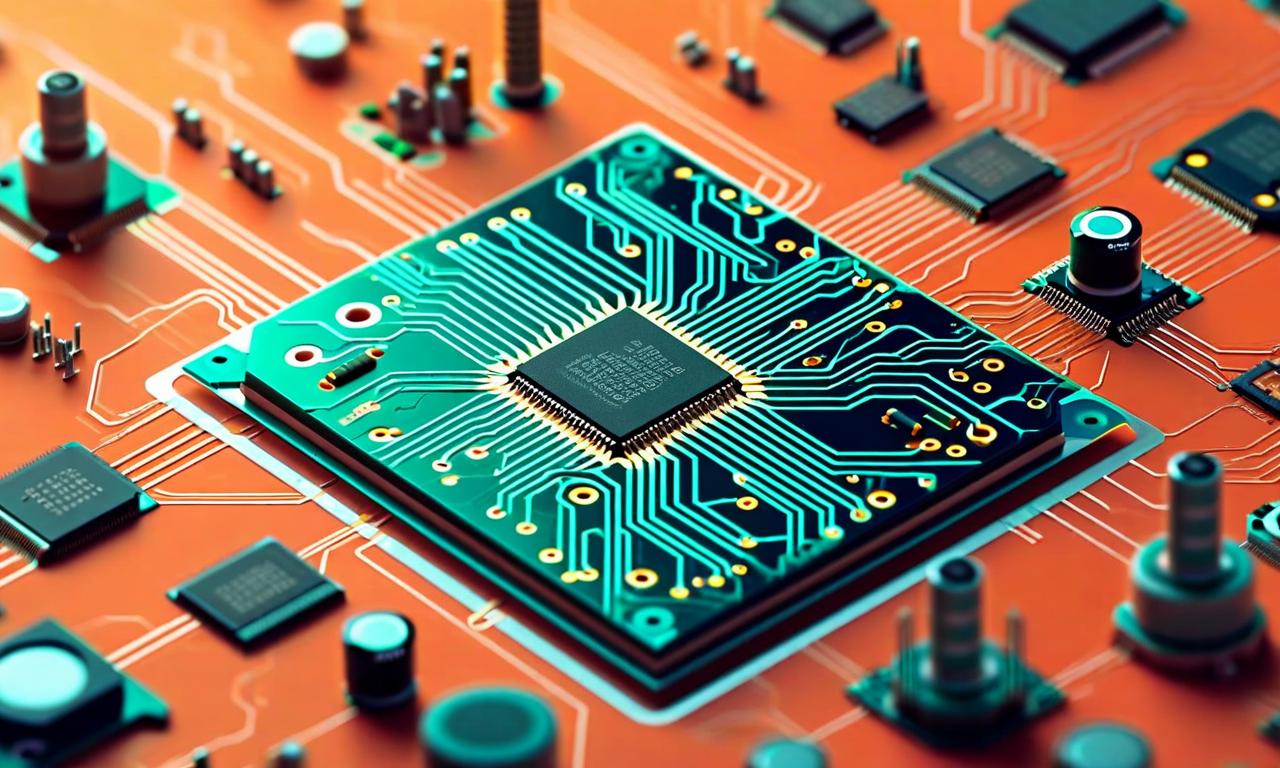

Center Considers $20 Billion in Semiconductor Mission 2.0 Incentives

The Center is proposing a $20 billion package to boost the India Semiconductor Mission, which may greatly accelerate India's desire to become a semiconductor powerhouse. In order to increase the current incentives under ISM, the Ministry of Electronics and IT (Meity) has submitted a proposal to the finance ministry for approval. By December, the Union Cabinet is expected to give its final approval.Officials claim that Meity is working on an economic forecast study that will compare the first phase of ISM to other comparable international programs, such as those in the US, EU, and East Asia, and demonstrate the program's success and returns. While the EU has raised over €43 billion and nations like the US have implemented subsidies totaling $52 billion under the Chips Act, India wants to create a full-stack semiconductor ecosystem via design, production, and packaging. The government has so far approved billion-dollar projects under ISM, including those from CG Power-Renesas, HCL-Foxconn, Micron, TSAT, and Tata Electronics-PSMC. It is anticipated that the first fabs would go online in 2025. Stronger incentives for design-linked schemes are anticipated to be introduced in the second phase to support domestic participants and to draw in foreign investors by creating a stable policy environment.Although India has made positive strides, industry analysts point out that chipmaking is still very competitive and capital-intensive. In order to secure their places in the semiconductor supply chain, multinational corporations from China, Japan, and South Korea are also spending billions of dollars through grants, tax exemptions, and direct funding.

PayU wants to raise $300 million before going public.

PayU, a payments business funded by Prosus, is reportedly looking to generate $300 million by selling off a minority stake. The company has enlisted HSBC as its financial partner for the project, which is still in its early stages, according to a Moneycontrol story. The minority share sale is intended to determine investor demand and provide a benchmark valuation for PayU's initial public offering (IPO), which is anticipated to take place in 2026. The fundraising effort precedes a plan to list on Indian stock exchanges.PayU purchased a 43.5% strategic investment in Mindgate Solutions, a company that develops real-time payment technology, in March. The business collaborates with the top banks in the nation and is among the biggest UPI technology service providers in the sector. Prosus is still a major shareholder in PayU, and it recently supported the Mindgate investment and invested $35 million in the company's credit division. Through a gateway that accepts cards, UPI, wallets, EMIs, and QR codes, PayU India assists companies in accepting digital payments. It provides no-code features like payment linkages and invoicing to make setup easier for its half a million businesses. Additionally, the business provides value with enterprise-grade capabilities including split payments, analytics, tokenization, fraud protection, and AI-driven recommendations.In terms of lending, PayU offers loans to people and companies that are underserved by conventional banks. With an NBFC license recognized by the Reserve Bank of India, it provides "buy now, pal later" options, EMIs, and quick loans.Transaction fees from its payments division and interest or processing fees from its loans division are how PayU makes money. PayU's overall revenue increased 21% to $669 million for the fiscal year that ended in FY25, while its India payments business climbed 12% to $498 million.

In FY25, Apple's sales in India reached a record $9 billion.

With the establishment of multiple new retail locations, the Cupertino-based computer giant is rapidly growing its presence in India. The company most recently opened Apple Koregaon Park in Pune and Apple Hebbal in Bengaluru. According to Bloomberg, the business generated yearly sales revenue of around $9 billion in the most recent fiscal year, which is consistent with this development. The numbers show that as Apple continues to expand its retail presence in India, there is an increasing demand from consumers for its products.According to a private source cited by Bloomberg, Apple's income increased by roughly 13% in the 12 months ending in March, from $8 billion in the same period last year. Although MacBook Macs were also well-liked during this retail push, iPhones accounted for the majority of purchases. There are currently four authorized Apple stores in the nation, and more are on the horizon. This week, the business opened Apple Hebbal in Bengaluru and Apple Koregaon Park in Pune, joining its two existing locations, Apple BKC in Mumbai and Apple Saket in New Delhi. Both locations satisfy the company's international quality standards and have the same amenities as the other two. Every store features a dedicated pickup area for online orders, an Apple Genius Bar for product support, daily Today at Apple events to teach customers about gadgets and subjects like artificial intelligence and photography, and Business Pros to assist businesses in expanding.The two new Apple stores are carbon neutral and run entirely on renewable energy, much like all Apple locations in India and outside. According to reports, Apple has plans to open more stores in Mumbai and the National Capital Region in the near future. This growth is consistent with a Bloomberg report that indicates Apple's revenue in India is still increasing, indicating that the company's retail and sales strategy are working together.

Amazon Completes Acquisition of Fintech Startup Axio

Eight months after reaching a final agreement, e-commerce behemoth Amazon has finally acquired digital lending firm Axio (previously Capital Float). Amazon announced in a statement that the deal was finalized after receiving RBI regulatory approval. Axio will help Amazon expand its buy now, pay later (BNPL) product line in India. Notably, in 2018, Amazon used its Sambhav Venture Fund to make its first $22 million investment in Axio. Before ultimately choosing to buy it in January, it doubled down on the wager by investing an additional $20 million in the firm.Our collaboration with Axio has allowed us to unlock credit for over 10 million customers over the last six years. In the upcoming years, we will be able to extend responsible lending to millions more customers and small companies thanks to Axio's experience in digital lending, Amazon's reach, technological know-how, and bank partnerships," stated Mahendra Nerurkar, vice president for payments for emerging markets at Amazon. Amazon described the deal as "one of the company's largest" in the nation, although it did not provide the transaction's financial details. According to sources cited in an ET report, the deal was valued at approximately $200 million (INR 1,762 crore). Amazon refused to respond to Inc42's inquiries regarding the acquisition price. Axio, which was founded in 2013 by Gaurav Hinduja and Sashank Rishyasringa, offers solutions for managing personal finances, credit, and pay later.Axio states that it has managed assets worth INR 2,200 Cr and has served around 10 million users to date. Since its founding, the Bengaluru-based firm has raised over $200 million from investors such as Elevation Capital, Peak XV Partners, and Lightrock. Amazon has been promoting the expansion of its fintech division at the time of the development. To take advantage of India's fintech market, it invested INR 350 Cr in Amazon Pay in April.

Acceleration and Elevation will receive huge returns on Dalal Street from the Urban Company's IPO.

An important milestone for the Gurugram-based home services market and a significant payout for its investors are anticipated from Urban Company's Rs 1,900 crore IPO. The company is worth about Rs 15,000 crore ($1.7 billion) at the highest price range of Rs 103 per share. This gives its initial supporters multi-bagger returns while providing late-stage funds with large liquidity.At 10.84%, or around Rs 1,626 crore, Elevation Capital owns the single-largest institutional position. The fund is resting on a 19x paper return, with an average purchase cost of Rs 5.39 per share. Accel India owns Rs 1,576 crore, or 10.51% of the company. According to DRHP, the venture firm is the largest winner by multiples with a 28x return, while having an average CoA of only Rs 3.61 per share.Strong returns will also be made by Vy Capital, which made an investment later at a CoA of Rs 20.4. With a 5x return, its 9.18% stake is equivalent to roughly Rs 1,377 crore. The respective 6.8% shares held by Steadview Capital and Prosus will be valued at around Rs 1,020 crore. They rank among the biggest benefactors on paper due to the sheer value of their holdings, even if their entrance costs are not revealed in the DRHP.Tiger Global's 4.73% stake, in stark contrast, is worth almost Rs 710 crore. The New York-based investor will only receive a 70% return, though, which is small in comparison to the early backers, given the average entry fee of Rs 60.25 a share. The forthcoming offering expands on pre-IPO secondary deals worth Rs 1,395 crore that were completed between late 2024 and early 2025. About Rs 780 crore worth of shares were sold by the company's founders, Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra, mostly to pay off debt from a partially completed rights issue in 2019. Prior to the public offering, early investors Accel, Bessemer, and Tiger Global also sold shares to Prosus, Vy Capital, and others for a total of Rs 615 crore.Earlier this week, SEBI approved the company's first public offering (IPO). In terms of finances, Urban Company's revenue increased by 38% year over year to Rs 1,144 crore in FY25, with profits of Rs 28.5 crore. With the promoters not taking part in the share sale, the IPO will see a new issue of Rs 429 crore and an offer for sale of Rs 1,471 crore. As one of the first significant consumer internet listings in FY26, Urban Company's market debut will be closely observed.

At $150 million, Venturi Partners announces the first close of its second fund.

Venturi Partners, a consumer-focused venture capital firm, closed its second fund at $150 million, or roughly INR 1,300 crore. The fund aims to raise $225 million, or roughly INR 2,000 crore. In March of this year, the venture capital firm opened its second fund to support entrepreneurs in India and Southeast Asia that are involved in the retail, education, healthcare, and fast-moving consumer goods sectors. With an average ticket size of $15 million to $40 million, it intends to invest in 10 businesses in these industries.Venturi Partners is a platform for family offices seeking to engage in consumer-led businesses in Asia. It was founded in 2020. The company participates in the Series B to Series D rounds of consumer-focused growth stage companies. With a corpus of $175 million, it established its first fund in 2022 and made investments in seven businesses in industries like retail, education, cosmetics, and home furnishings. Three pillar limited partners (LPs) supported the fund: Frederic De Mevius, Ackermans & Van Haaren, and Peugeot Invest. The fund also included family offices from Asia and Europe.Among the startups in its portfolio are Cult.fit, Livspace, Country Delight, and K-12 Techno Services. At a time when the ecosystem has expanded significantly over the last ten years, the venture capital company is stepping up its efforts to support India's consumer-focused startup story. The consumer-focused startup ecosystem is home to several unicorns, such as Zepto, Meesho, Mamaearth, Blinkit, Lenskart, and Swiggy, due to the growth of direct-to-consumer (D2C) businesses, the rapid adoption of digital technology, and steady inflows of both domestic and foreign investment.Due to advancements in the nation's digital infrastructure, rising smartphone usage, and a new generation of digital-first consumers looking for convenience and specialty goods, the D2C industry alone is expected to grow into a $300 billion opportunity by 2030. Additionally, the fund's initial close coincides with the rapid expansion of the Indian startup ecosystem as a whole. As a result, several new funds have been established by businesses to support startups. A99 announced its third fund this week with a $100 million corpus to support 12–15 entrepreneurs in the infrastructure and manufacturing industries. Elevation Capital also announced the opening of its $400 million fund to support companies aiming to go public that same week.

50% of PokerBaazi's employees will be let go after the MPL.

The online gaming sector in India is experiencing new challenges, as Mobile Premier League (MPL), a major gaming platform in the nation, is set to dismiss around 480 employees, representing nearly 60% of its workforce in India. The severe action is a reaction to a recent government prohibition on online gambling, which has greatly affected the company's primary business activities.The job cuts result directly from a legislative reform that gained parliamentary approval on August 22, which effectively prohibits all cash-based online games. As a result, MPL has halted all such services on its platform. Although free-to-play games continue to operate, the regulatory changes have significantly affected the company's revenue model, much of which depended on real-money gaming in India.This isn't MPL's initial series of layoffs caused by policy adjustments. In August 2023, the firm dismissed 350 staff members after the GST Council suggested a 28% tax on all real-money games, a regulation that became effective in October 2023.Earlier this month, the Indian government prohibited paid online games because of worries regarding financial dangers and addiction in youth. This action has resulted in the shutdown of numerous gaming applications that provide fantasy cricket, rummy, and poker games. The sector was expected to attain a worth of $3.6 billion by 2029 prior to the prohibition.MPL is not alone in facing the consequences of the regulatory clampdown. Leading gaming firms like Dream Sports (Dream11), Gameskraft, Zupee, and Moonshine Technology (PokerBaazi) have also accepted the government's decision without legal contest.

Vutto, a Used Two-Wheeler Marketplace, Raises $7 Million

The used two-wheeler marketplace Vutto has raised $7 million, or around Rs 61.4 crore, in a Series A fundraising round that was headed by RTP Global and included Blume Ventures, an existing investor. The Delhi-based business had already collected $1 million in seed money from Blume Ventures and other angel investors before this investment round. According to a news statement from Vutto, the money raised will be used to increase the company's presence throughout Delhi NCR, penetrate new markets, and improve its core competencies in areas like supply, renovation, and customer support.In 2024, Rohit Khurana and Sitaram Ankilla co-founded Vutto, a full-stack platform for secondhand two-wheeler buying and selling. Users can acquire two-wheelers that come with a six-month guarantee and assistance with paperwork, insurance, and finance, as well as explore certified automobiles online and test drive them in-store. A market study estimates that about 9 million used two-wheelers were sold in India in FY24, bringing in an estimated $3.8 billion in income. In the first year of its launch, Vutto says it sold 1,500 cars. According to the firm, which has three shops in Delhi, cars listed on its platform usually sell within 12 days. Additionally, it says that it has partnered with banks and other financial institutions to sell two-wheelers that have been repossessed.A similar firm, BeepKart, recently ceased operations after operating for over five years. In October of last year, its competitor CredR ceased operations, and Cars24 also departed from its Moto company, which was in a similar vertical. RoamPrime, Bikewale, and BikeDekho are the other prominent participants in this market.

FanCode Owned by Dream Sports to Close Sports Merchandise Business

By October of this year, Dream11Dream11 Datalabs_in-article-icon parent Dream Sports' sports media company FanCode plans to close its online sports goods store, FanCode Shop. According to a statement from FanCode, the startup chose to close its sports merchandise division in June and reallocate funds to its main content business. This will enable us to concentrate on the things that are expanding the quickest and providing our users with the greatest value. A FanCode representative stated, "FanCode Shop will remain open until October and we will complete all orders placed during that time."ET was the first to report on the development. According to a report by the journal, the merchandise industry is facing ongoing challenges with profitability and the unregulated spread of fake goods, both of which have very little room for expansion. With relationships with IPL teams, the NBA, international cricket organizations, and top football clubs worldwide, FanCode Shop, which debuted in 2020, sells official sportswear, fan gear, and collectibles. It was designed to give FanCode, a company that provides live sports streaming, analysis, and commentary, another source of income. This comes shortly after Dream Sports closed its actual gaming operations after the Parliament passed the "Promotion and Regulation of Online Gaming Bill, 2025."According to Dream11 CEO Harsh Jain, the startup's 95% revenue vanished overnight as a result of the real money gaming ban. The startup will now concentrate on FanCode, the recently launched investment tech product Dream Money, the online game DreamCricket, and the sports hospitality brand DreamSetGo rather than contesting the Bill in court.

The first global short drama championship is launched by WinZO.

With 250 million users using its rich platform, which includes over 100 competitive esport and social games in 15 languages, WinZO, India's largest domestic interactive entertainment platform, today announced the launch of the WinZO Short Drama Championship, the first-ever global competition created to provide microdrama creators with a worldwide platform and audience.Together with long-term collaborations to create original content for WinZO TV, the company's recently created microdrama platform, the victors will land production deals and a 100% sponsorship to commission the project. In addition to monetary rewards, competitors will get the chance to attend prestigious events and connect with WinZO's 250 million global audience. The final winners will be chosen using audience engagement analytics, and submissions will be evaluated on their uniqueness and narrative power. Additionally, WinZO will collaborate with them to promote and broadcast their content and tell their tales at important events.We at WinZO have long thought that India's greatest export is its cultural capital. First in gaming and now in narrative, we created WinZO as a platform to democratize possibilities for creators. India is capable of spearheading the worldwide microdrama revolution due to its talent, artistry, and size. With the platform, the resources, and the audience, it is our responsibility to empower them," stated Paavan Nanda, WinZO co-founder. WinZO has been at the forefront of interactive entertainment since its launch in 2018, giving developers and creators the opportunity to reach hundreds of millions of consumers and make large profits. With more than 250 million users in the US, Brazil, and India, as well as a portfolio of more than 100 games, WinZO has become the go-to platform for international developers and the face of India's exports of digital entertainment.The firm is expanding its aim beyond games to include tales with the debut of WinZO TV on August 24, 2025, opening up a new type of mobile-first, vernacular entertainment. The WinZO Short Drama Championship is the first daring step toward creating the greatest microdrama content collection in the world, sourced from a variety of Indian and international creators. The goal of the WinZO Short Drama Championship is to seize this opportunity by providing creators with funding to realize their ideas, international recognition, and—above all—the opportunity to pen India's next major cultural export tale.