Top Trending StartUps News & Highlights

Medibuddy reports FY25 revenue of Rs 725 Cr, reducing losses by 37%.

MediBuddy, a digital healthcare platform, reported a little increase in its operational scale in FY25 after growing by more than two times in the fiscal year that ended in March 2024. Nonetheless, the business was able to reduce its losses by 37% over that time. According to MediBuddy's annual financial records submitted to the Registrar of Companies (RoC), the company's operating revenue increased 12.3% year over year to Rs 724.6 crore in FY25 from Rs 645.4 crore in FY24.MediBuddy is a digital healthcare business that offers insurance services, lab testing, procedures, online and offline medical consultations, and medication delivery. Together, these services' revenue of Rs 722 crore continued to be the company's main source of income, with additional operating sources contributing Rs 2.5 crore. The company's total income in FY25 was Rs 743 crore after earning Rs 18.42 crore from non-operating sources, such as interest on current assets and fixed deposits, written-off liabilities, and other miscellaneous income.The cost of materials, which was Rs 333 crore in the previous fiscal year, accounted for the highest portion of total expenses at 38%. Employee benefits costs came next, rising slightly by 8% to Rs 176.8 crore, which included Rs 6 crore in ESOP costs. During the year, sales payout expenses, which include commissions paid to selling agents, decreased by 7% to Rs 155.47 crore. Additionally, the corporation spent Rs 32.5 crore on information technology and Rs 42.5 crore on safety and security. In FY25, additional overheads totalling Rs 138.7 crore included advertising, legal and professional fees, depreciation and amortisation, and financing charges.In the previous fiscal year, the Bengaluru-based company's total expenses stayed constant at Rs 879 crore. The company's losses were reduced by 37% to Rs 137 crore from Rs 215.7 crore in FY24 thanks to controlled spending and a 12% increase in sales.

Published 23 Dec 2025 11:33 PM

Urban Company Receives Penalty Notice and INR 56 Cr GST Demand

GST regulators believed that the startup's services, such painting and appliance repair, were within Section 9(5) of the CGST Act and would need to be taxed appropriately. Urban Company, which intends to challenge the ruling, further asserted that the demand notice will not affect the business's operations or finances. In addition, the GST authorities of Tamil Nadu, Maharashtra, and Haryana have sent the corporation at least three further demand notifications totalling INR 51.3 Cr.Unicorn Urban Company's hyperlocal servicesMaharashtra goods and service tax (GST) authorities have sent Urban Company Datalabs_in-article-icon a tax demand and penalty notice amounting INR 56.4 Cr.Unicorn hyperlocal services Maharashtra GST authorities have sent Urban Company a ₹56.4 crore tax demand and penalty notice for the April 2021–March 2025 period. The notice relates to alleged non-payment of GST on reimbursements to service providers, particularly over services like painting and appliance repair, and contains a primary tax of ₹51.3 crore and a penalty of ₹5.13 crore. Urban Company intends to file an appeal, claiming that the demand won't affect its business operations and that it has a compelling argument. This comes after several tax complaints from several states totalling ₹51.3 crore.

Published 21 Dec 2025 10:23 PM

The founder of Organic Harvest introduces the multi-brand venture RASA Group.

Former D2C brand Organic HarvestOrganic Harvest Datalabs_in-article-icon founder Rahul Agarwal has introduced his new multi-brand company, RASA Group. At the moment, RASA Group runs six verticals:Avani Infratech is a high-end, sustainable real estate and commercial infrastructure developer in Goa and Delhi-NCR. Agarwal told Inc42 that it began approximately four and a half years ago and is currently operating at INR 100 Cr ARR. Sarvagun: It specialises in providing ayurvedic therapies that are supported by evidence. RASA Group operates a boutique hospital in Vasant Kunj under this vertical, and it intends to grow throughout Delhi-NCR and beyond. AdventX is a Jim Corbett adventure vertical that now provides mild adventure activities for all ages, including paragliding and hot air ballooning. In Mahabaleshwar, a second site is under development. Friday Night Cars: It imports luxury American vehicles, changes their left-hand drive to right-hand drive, and then sells them to Indian HNIs.Jee Bhar Ke is a food and beverage vertical with four locations, rapid commerce, and a central kitchen. NexGen Drycleaners: Using a hub-and-spoke architecture, it seeks to organise the historically unstructured dry cleaning industry so that clients can track clothing and manage orders via the app for a more efficient experience.Each of these verticals was added at a different time. Sarvagun is the newest vertical introduced by the RASA Group, whereas Avani Infratech is the oldest. "I've been working on this informally for the past four years, and each brand began at a different moment. However, all of the brands were recently consolidated under one roof, according to Agarwal. Avani Infratech, Jee Bhar Ke, and NexGen Drycleaners are currently the main emphasis since they can be quickly scaled up, Agarwal said, adding that all the verticals are commercially functioning.

Published 04 Dec 2025 05:53 PM

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/images/post_image/693058a82ccf4.webp)

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/assets/images/logo.png)

[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1

Aequs’ IPO opened to robust demand on Day 1 with the issue getting oversubscribed 3.4X. Investors placed bids for 14.4 Cr shares against the 4.2 Cr shares available. The strong subscription came from retail investors, who oversubscribed their allotment 11.46X. These investors submitted bids for 8.81 Cr shares against 76.91 shares reserved for them. The non institutional investor (NII) part was oversubscribed 3.4X, with these investors submitting bids for 3.92 Cr shares against 1.15 Cr shares on offer. Within this, investors with a bidding sum of over INR 10 Lakh applied for 2.2 Cr shares, while those bidding for shares between INR 2 Lakh to INR 10 Lakh applied for 1.7 Cr shares.Meanwhile, the qualified institutional buyers (QIBs) were also active on day one, subscribing their quota by 66%. In contrast to the 2.26 Cr shares set aside for them, these investors bargained for 1.5 Cr shares. Foreign institutional investors bid for 1.48 lakh shares under the QIB segment. The employee quota was exceeded 6.7X, garnering bids for 12.57 shares against 1.87 Cr shares authorised for them.Contract manufacturing company AequsAequs Datalabs_in-article-icon initial public offerings (IPO) launched on a strong note today, getting oversubscribed within hours of opening. As of 13:15 IST, the offering received bids for 7.32 Cr shares against the 4.20 Cr shares available for subscription. This corresponds to an oversubscription of 1.72X. Leading the way were retail investors, who bid for 5.54 Cr shares instead of the 76.92 Lakh allotted for them, oversubscribing their quota 7.2X. Additionally, non-institutional investors (NIIs) overloaded their stake by 1.63X, placing bids for 1.88 Cr shares as opposed to the 1.15 Cr shares that were set aside for them. Employees of the company have also placed bids for 8.21 lakh shares, exceeding their stake by 4.42 times.As is customary with IPOs, qualified institutional buyers’ (QIBs) showed the least interest in Aequs’ public float on day one. These investors bid for 1.09 Cr shares against the 2.26 Cr shares on sale, equivalent to a 48% subscription. Aequs’ IPO contains a fresh issue of shares worth up to INR 670 Cr and an offer for sale (OFS) component of up to 2.03 Cr shares. Through OFS, investors like Amicus Capital, the Dempo family trusts, Ravindra Mariwala, and Raman Subramanian will sell their shares. Yesterday, December 2, the contract manufacturing company raised INR 413.9 Cr from anchor investors. As many as 33 investors subscribed to 3.3 Cr equity shares, of which around 57% shares were lapped by domestic mutual funds.

Published 03 Dec 2025 09:06 PM

StartUps

StartUps are the backbone of any country and in any Industry as these are the new ventures which entrepreneurs establish and then contribute to the nation growth and progress. The stratups will then grow and become unicorns and create thousands of employments in different sector boosting the economy and take it to the next level.

Medibuddy reports FY25 revenue of Rs 725 Cr, reducing losses by 37%.

MediBuddy, a digital healthcare platform, reported a little increase in its operational scale in FY25 after growing by more than two times in the fiscal year that ended in March 2024. Nonetheless, the business was able to reduce its losses by 37% over that time. According to MediBuddy's annual financial records submitted to the Registrar of Companies (RoC), the company's operating revenue increased 12.3% year over year to Rs 724.6 crore in FY25 from Rs 645.4 crore in FY24.MediBuddy is a digital healthcare business that offers insurance services, lab testing, procedures, online and offline medical consultations, and medication delivery. Together, these services' revenue of Rs 722 crore continued to be the company's main source of income, with additional operating sources contributing Rs 2.5 crore. The company's total income in FY25 was Rs 743 crore after earning Rs 18.42 crore from non-operating sources, such as interest on current assets and fixed deposits, written-off liabilities, and other miscellaneous income.The cost of materials, which was Rs 333 crore in the previous fiscal year, accounted for the highest portion of total expenses at 38%. Employee benefits costs came next, rising slightly by 8% to Rs 176.8 crore, which included Rs 6 crore in ESOP costs. During the year, sales payout expenses, which include commissions paid to selling agents, decreased by 7% to Rs 155.47 crore. Additionally, the corporation spent Rs 32.5 crore on information technology and Rs 42.5 crore on safety and security. In FY25, additional overheads totalling Rs 138.7 crore included advertising, legal and professional fees, depreciation and amortisation, and financing charges.In the previous fiscal year, the Bengaluru-based company's total expenses stayed constant at Rs 879 crore. The company's losses were reduced by 37% to Rs 137 crore from Rs 215.7 crore in FY24 thanks to controlled spending and a 12% increase in sales.

Urban Company Receives Penalty Notice and INR 56 Cr GST Demand

GST regulators believed that the startup's services, such painting and appliance repair, were within Section 9(5) of the CGST Act and would need to be taxed appropriately. Urban Company, which intends to challenge the ruling, further asserted that the demand notice will not affect the business's operations or finances. In addition, the GST authorities of Tamil Nadu, Maharashtra, and Haryana have sent the corporation at least three further demand notifications totalling INR 51.3 Cr.Unicorn Urban Company's hyperlocal servicesMaharashtra goods and service tax (GST) authorities have sent Urban Company Datalabs_in-article-icon a tax demand and penalty notice amounting INR 56.4 Cr.Unicorn hyperlocal services Maharashtra GST authorities have sent Urban Company a ₹56.4 crore tax demand and penalty notice for the April 2021–March 2025 period. The notice relates to alleged non-payment of GST on reimbursements to service providers, particularly over services like painting and appliance repair, and contains a primary tax of ₹51.3 crore and a penalty of ₹5.13 crore. Urban Company intends to file an appeal, claiming that the demand won't affect its business operations and that it has a compelling argument. This comes after several tax complaints from several states totalling ₹51.3 crore.

The founder of Organic Harvest introduces the multi-brand venture RASA Group.

Former D2C brand Organic HarvestOrganic Harvest Datalabs_in-article-icon founder Rahul Agarwal has introduced his new multi-brand company, RASA Group. At the moment, RASA Group runs six verticals:Avani Infratech is a high-end, sustainable real estate and commercial infrastructure developer in Goa and Delhi-NCR. Agarwal told Inc42 that it began approximately four and a half years ago and is currently operating at INR 100 Cr ARR. Sarvagun: It specialises in providing ayurvedic therapies that are supported by evidence. RASA Group operates a boutique hospital in Vasant Kunj under this vertical, and it intends to grow throughout Delhi-NCR and beyond. AdventX is a Jim Corbett adventure vertical that now provides mild adventure activities for all ages, including paragliding and hot air ballooning. In Mahabaleshwar, a second site is under development. Friday Night Cars: It imports luxury American vehicles, changes their left-hand drive to right-hand drive, and then sells them to Indian HNIs.Jee Bhar Ke is a food and beverage vertical with four locations, rapid commerce, and a central kitchen. NexGen Drycleaners: Using a hub-and-spoke architecture, it seeks to organise the historically unstructured dry cleaning industry so that clients can track clothing and manage orders via the app for a more efficient experience.Each of these verticals was added at a different time. Sarvagun is the newest vertical introduced by the RASA Group, whereas Avani Infratech is the oldest. "I've been working on this informally for the past four years, and each brand began at a different moment. However, all of the brands were recently consolidated under one roof, according to Agarwal. Avani Infratech, Jee Bhar Ke, and NexGen Drycleaners are currently the main emphasis since they can be quickly scaled up, Agarwal said, adding that all the verticals are commercially functioning.

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/images/post_image/693058a82ccf4.webp)

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/assets/images/logo.png)

[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1

Aequs’ IPO opened to robust demand on Day 1 with the issue getting oversubscribed 3.4X. Investors placed bids for 14.4 Cr shares against the 4.2 Cr shares available. The strong subscription came from retail investors, who oversubscribed their allotment 11.46X. These investors submitted bids for 8.81 Cr shares against 76.91 shares reserved for them. The non institutional investor (NII) part was oversubscribed 3.4X, with these investors submitting bids for 3.92 Cr shares against 1.15 Cr shares on offer. Within this, investors with a bidding sum of over INR 10 Lakh applied for 2.2 Cr shares, while those bidding for shares between INR 2 Lakh to INR 10 Lakh applied for 1.7 Cr shares.Meanwhile, the qualified institutional buyers (QIBs) were also active on day one, subscribing their quota by 66%. In contrast to the 2.26 Cr shares set aside for them, these investors bargained for 1.5 Cr shares. Foreign institutional investors bid for 1.48 lakh shares under the QIB segment. The employee quota was exceeded 6.7X, garnering bids for 12.57 shares against 1.87 Cr shares authorised for them.Contract manufacturing company AequsAequs Datalabs_in-article-icon initial public offerings (IPO) launched on a strong note today, getting oversubscribed within hours of opening. As of 13:15 IST, the offering received bids for 7.32 Cr shares against the 4.20 Cr shares available for subscription. This corresponds to an oversubscription of 1.72X. Leading the way were retail investors, who bid for 5.54 Cr shares instead of the 76.92 Lakh allotted for them, oversubscribing their quota 7.2X. Additionally, non-institutional investors (NIIs) overloaded their stake by 1.63X, placing bids for 1.88 Cr shares as opposed to the 1.15 Cr shares that were set aside for them. Employees of the company have also placed bids for 8.21 lakh shares, exceeding their stake by 4.42 times.As is customary with IPOs, qualified institutional buyers’ (QIBs) showed the least interest in Aequs’ public float on day one. These investors bid for 1.09 Cr shares against the 2.26 Cr shares on sale, equivalent to a 48% subscription. Aequs’ IPO contains a fresh issue of shares worth up to INR 670 Cr and an offer for sale (OFS) component of up to 2.03 Cr shares. Through OFS, investors like Amicus Capital, the Dempo family trusts, Ravindra Mariwala, and Raman Subramanian will sell their shares. Yesterday, December 2, the contract manufacturing company raised INR 413.9 Cr from anchor investors. As many as 33 investors subscribed to 3.3 Cr equity shares, of which around 57% shares were lapped by domestic mutual funds.

Eternal Q2: Revenue Up 183% YoY, Profit Drops 63% YoY To INR 65 Cr

The combined profit for Q2 FY26 of Zomato and Blinkit parent company Eternal fell 63% to INR 65 Cr from INR 176 Cr in the same quarter last year. On a sequential basis, the company’s profit jumped 160% from INR 25 Cr PAT reported in the previous quarter.For the second quarter (July-September) of FY26, food delivery business Eternal, formerly known as Zomato, reported a dramatic 63% year-over-year fall in its consolidated net profit, which came in at Rs 65 crore as opposed to Rs 176 crore in the same quarter the previous year. The company's net profit, however, improved sequentially from Rs 25 crore during the April–June quarter.Eternal's operating revenue increased by an astounding 183% year over year to Rs 13,590 crore in Q2FY26 from Rs 4,799 crore in the same period of the previous fiscal year, despite the decline in profitability. However, the topline decreased by about 90% sequentially from the Rs 7,167 crore recorded in Q1FY26.The business blamed strategic expenditures meant to propel long-term growth, especially in its rapid commerce division, Blinkit, for the sequential impact on margins and topline. Although absolute losses decreased, Eternal pointed out that the rate of margin improvement was slower than anticipated, mostly as a result of aggressive spending in crucial areas including infrastructure, store expansion, and marketing.

To go outside of Delhi NCR, HouseEazy has raised INR 150 Cr.

The proptech business HouseEazyHouseEazy Datalabs_in-article-icon has recently announced raising INR 150 Cr ($16.9 Mn) in its Series B investment round, almost six months after Inc42 reported that the company was in advanced talks with investors to seek fresh funds. Accel led the round, with a few unnamed investors joining in addition to current investors Chiratae Ventures and Antler.The proptech business, which was in advanced talks with investors to secure more funds, has today announced that it has raised INR 150 Cr ($16.9 Mn) in its Series B fundraising round. Accel led the round, with a few unnamed investors joining in addition to current investors Chiratae Ventures and Antler. According to OpenAI, prejudice erodes trust, which is why it wants ChatGPT to be "objective by default." There is presently no industry-wide definition of political bias in AI, nor is there a technique that can totally eradicate it, according to the company's description of political and ideological bias in big language models as an open research challenge in this study.

In negotiations to raise $100 million in a round headed by General Atlantic, Snapmint

Snapmint is in advanced negotiations with General Atlantic to raise around $100 million, or INR 886 crore, in a fresh investment round. There will be primary and secondary components to the financing, and some early angel investors may partially withdraw. A few early angel investors are probably going to partially depart the round, which will have both primary and secondary components.Mumbai: According to four persons with knowledge of the situation, consumer lending platform Snapmint is currently gathering $100 million in a funding round headed by General Atlantic and involving current backers Elev8 Venture Partners and Kae Capital.Snapmint is in advanced negotiations with General Atlantic to raise around $100 million, or INR 886 crore, in a fresh investment round. There will be primary and secondary components to the financing, and some early angel investors may partially withdraw.is in advanced discussions to raise over $100 million (roughly INR 886 crore) in a fresh investment round headed by General Atlantic, according to sources.

Eternal Shares Reach New 52-Week High Following Citi's Target Price Increase

Shares of Eternal and SwiggySwiggy Datalabs_in-article-icon rose during the intraday trading on the BSE today after brokerage Citi raised the target price (TP) for both the companies.During intraday trading, Eternal reached a new 52-week high of INR 347.50 after Citi elevated its target price for the stock from INR 320 to INR 395. Citi reports that the growth momentum for Eternal's quick commerce business, Blinkit, remains impressive, and the increase in app traffic indicates a focus on user acquisition. Citi raised the target price for Swiggy from INR 465 to INR 495, representing a 17% upside from yesterday’s close of INR 421On the BSE, shares of Eternal rose to a 52-week high of Rs 347.50 on Thursday, increasing by as much as 1.7%. In 2025, the stock has risen by almost 25%, and over the last month, it has increased by approximately 6%. Citi kept its 'buy' rating for Zomato while changing the target price from Rs 320 to Rs 395 per share. The share price of Eternal Ltd. was bolstered by research firm Citi, which raised the price target from Rs 320 to Rs 395 while keeping a 'buy' rating on the stock. The 23% increase is mainly fueled by the impressive growth momentum and robust market leadership of its Quick Commerce business—Blinkit. The brokerage has raised its valuation multiple significantly and has increased its

Ather Energy Hits New Record High, HSBC Increases Target Price to INR 700

After HSBC increased its target price (TP) for the company, shares of EV manufacturer Ather EnergyAther Energy Datalabs_in-article-icon rose 7.8% to INR 678.50, reaching a new all-time high during today’s intraday trading on the BSE. The TP for Ather was raised by the brokerage from INR 600 to INR 700. The new target price translates to an increase of over 11% from Ather’s closing price yesterday (INR 629.55). HSBC estimates that Ather’s sales volumes will consistently rise due to the growing number of stores. “Volumes have consistently risen over the past few months, even as competition from incumbents has intensified, due to the company opening more stores,” it stated in its report.HSBC anticipates Ather's sales to surge by 22% quarter-on-quarter in Q2 FY26, as retail sales during the quarter averaged 18,000 units. Ather’s EBITDA loss margin is projected to enhance by 110 basis points (bps) on a quarterly basis and by 420 bps on a yearly basis, owing to improved operating leverage. “Ather has positioned itself as a robust brand within the EV sector, and we anticipate that the response to the EL platform will surpass our prior expectations; consequently, we are increasing our estimates and adjusting our target price to INR 700 (up from INR 600),” it added. In the meantime, HSBC lowered its rating for Ola Electric from ‘Hold’ to ‘Reduce’ and reduced the target price from INR 55 to INR 45.The brokerage noted that Ola Electric was losing market share amid growing competition, even with catalysts that should have benefited it in Q2 FY26. “According to Vahan registrations, we anticipate a quarterly decrease of 20% in Ola volume, bringing it down to 55K units,” it stated. It does foresee, though, that Ola Electric’s gross margin will increase by 220 basis points quarter on quarter to reach 28% in the second quarter, thanks to cost optimisation from the Gen 3 platform. Additionally, the brokerage highlighted that Ola Electric incurs fixed costs that exceed those of its rivals.“Ola exhibits greater vertical integration in the production of components (such as batteries and motors). “The sales are conducted through COCO distribution models (company owned, company operated), which is detrimental to Ola’s profitability in the low-volume environment,” it said.

FICCI FRAMES 2025: Kevin Vaz of JioStar advocates for "light-touch" legislation to enable India's aspirations for international content

Today, Kevin Vaz, Chairman of FICCI’s Media & Entertainment Committee, inaugurated the 25th edition of FICCI FRAMES, marking a crucial milestone for India’s media and entertainment sector. He called for a reimagining of growth, recalibration of regulation, and reaffirmation of India’s global storytelling ambitions. Vaz stated, while speaking to a full auditorium of industry leaders, policymakers, creators, and changemakers, “This goes beyond being an anniversary — it is a time for reflection, refocusing, and rising.” The event, themed RISE Together (Reimagine, Innovate, Strengthen, Empower), commemorates FRAMES' 25 years as a platform for policy dialogue, business exchange, and cultural diplomacy.A voyage from acknowledgment to self-reinvention Vaz, while reminiscing about the inception of FRAMES in 2001, underscored the pivotal moment when the Indian government granted industry status to the media and entertainment (M&E) sector. This decision opened the door for capital influxes, institutional investments, and a professional approach throughout the value chain. Vaz noted, “We’ve come a long way — from the rise of satellite TV and cable to the boom in OTT, VFX, and immersive tech,” acknowledging the contributions of stalwarts like Yash Chopra, Karan Johar, and Uday Shankar, who have guided the FICCI M&E Committee over the years. “Their legacy continues through our endeavors to expand the creative economy in India.”Television and Digital: An Indian AND Story Vaz challenged global assumptions about disruption by asserting that India is a rare “AND” market, where television and digital platforms are not rivals but co-existing engines of growth. “Pay TV, Free TV, and Connected TV are growing in tandem with digital. This dual-track growth is contributing to the overall expansion of the M&E pie, rather than dividing it,” he noted.Sports, Streaming Services, and the Emergence of Regional Narratives The sports ecosystem in India, particularly in cricket, kabaddi, and esports, is experiencing unmatched momentum. This growth is being fueled by digital platforms that enhance reach through interactive, multilingual, and immersive content. In the realm of film, regional cinema and Indian OTT are driving India’s soft power on the global stage. Vaz stated, “Our narratives, spanning from RRR to The Elephant Whisperers, are clinching Oscars, dominating box office sales, and capturing hearts.” Cross-border collaborations are being fueled by co-production treaties and a revitalized NFDC.Sports, Streaming Services, and the Emergence of Regional Narratives The sports ecosystem in India, particularly in cricket, kabaddi, and esports, is experiencing unmatched momentum. This growth is being fueled by digital platforms that enhance reach through interactive, multilingual, and immersive content. In the realm of film, regional cinema and Indian OTT are driving India’s soft power on the global stage. Vaz stated, “Our narratives, spanning from RRR to The Elephant Whisperers, are clinching Oscars, dominating box office sales, and capturing hearts.” Cross-border collaborations are being fueled by co-production treaties and a revitalized NFDC.

JSW One Platforms Secures INR 575 Cr to Broaden Operations and Fortify NBFC Division

JSW Group’s B2B ecommerce marketplace, JSW One Platforms, has secured an extra INR 235 Cr, bringing the total of its current funding round to INR 575 Cr. State Bank of India (SBI), Principal Asset Management, One-Up, International Conveyors Ltd. (ICL), Scarlett Ventures, and JSW Steel participated in the funding round. This year in May, the company commenced the funding round. At that time, the JSW One Platforms declared a fundraising of INR 340 Cr at a unicorn valuation.JSW One Platforms stated that it will use the new capital to invest in its own technology platform, broaden its operations, and reinforce its non-banking financial company (NBFC) division. The company will use the funds to improve credit access, strengthen underwriting capabilities, and create tailored financial products for small businesses. It also intends to enhance its distribution and logistics network across key industrial clusters to improve last-mile delivery, fulfilment, and the provision of embedded financial services, according to a statement.JSW One Platforms, established in 2020, serves as a B2B tech-enabled marketplace aimed at construction and manufacturing MSMEs. Its services encompass procurement, credit, fulfilment, and private brands. JSW One Platforms also runs JSW One Homes, which links clients with contractors and professionals to manage the full process from purchasing a plot to constructing a home.In 2023, JSW One Platforms secured Series A funding amounting to INR 205 Cr ($25 Mn) at a valuation of INR 2,750 Cr. Mitsui & Co Ltd. took the lead in the round. The company stated at that time that the funding round in May resulted in a valuation increase of more than three times compared to the round in April 2023. JSW One Platforms stated that its gross merchandise value (GMV) grew 2.4 times year-on-year, reaching INR 12,567 crore in FY25. The firm stated that it is expected to exceed INR 8,000 Cr in GMV during H1 FY26. According to Tofler, the company reported a revenue of INR 70.7 Cr in FY24. The net loss amounted to INR 199.8 Cr.

"On day five of the Zappfresh IPO, 94% of subscribers signed up; retail interest is still low. "

Today is the fifth day of Zappfresh's public offering, which was extended on September 30. By the end of October 3, 94% of the issue was subscribed, according to data from Chittorgarh. The company's IPO was most eagerly anticipated by qualified institutional buyers (QIBs), who oversubscribed their quota by 1.45 times. Against the 11.16 lakh shares that were set aside for them, these investors placed bids for 16.16 lakh shares. Additionally, non-institutional investors (NIIs) bid for 10.50 lakh shares against the 8.39 lakh shares designated for them, oversubscribing their quota by 1.25X.However, as of Day 5, the overall subscription was down due to a lack of interest from ordinary investors. A 51% subscription resulted from retail investors bidding for just 9.96 lakh shares, compared to the 19.54 lakh shares that were set aside for them. The BSE SME IPO was originally scheduled to close on September 30, but due to low investor interest, it has been extended to Monday, October 60, for subscriptions. Only 52% of the offering had been subscribed for at that point, with investors purchasing 22.44 lakh shares out of the 42.39 lakh available.Consequently, the meat delivery company changed its price range from INR 96 to INR 101 to INR 95 to 100 and prolonged the IPO. The company now wants to raise roughly INR 59 Cr from the public float at a valuation of about INR 223 Cr, which is at the upper end of the revised bracket.ZappfreshZappfresh Datalabs_in-article-icon raised INR 16.8 Cr from 11 anchor investors prior to the issue opening by offering 16.7 Lakh shares at INR 101 per. With an investment of more than INR 4 Cr, Craft Emerging Market Fund held the greatest proportion among them, followed by Viney Growth Fund with INR 2.5 Cr and Narnolia India Opportunity Fund with INR 2 Cr.

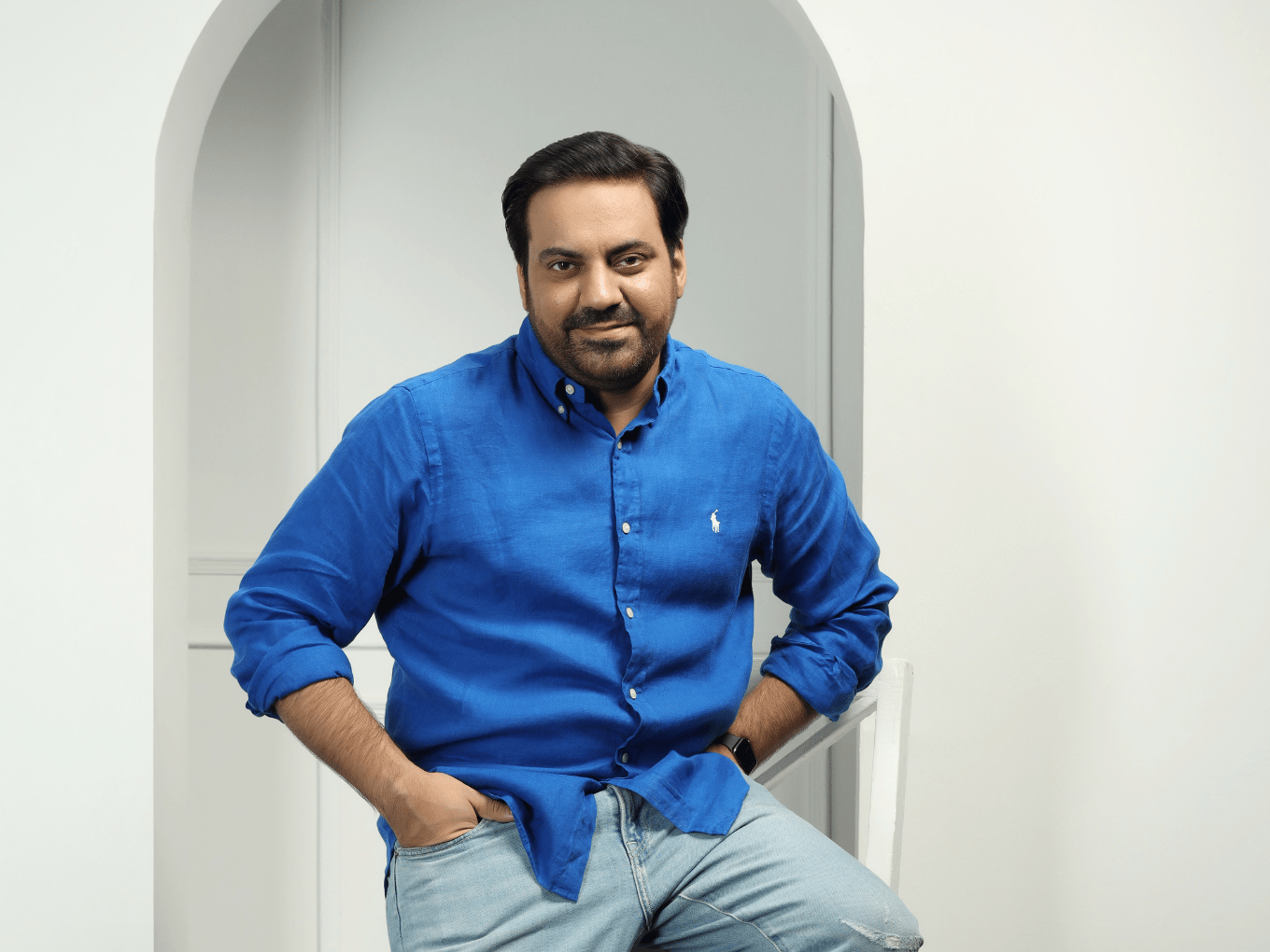

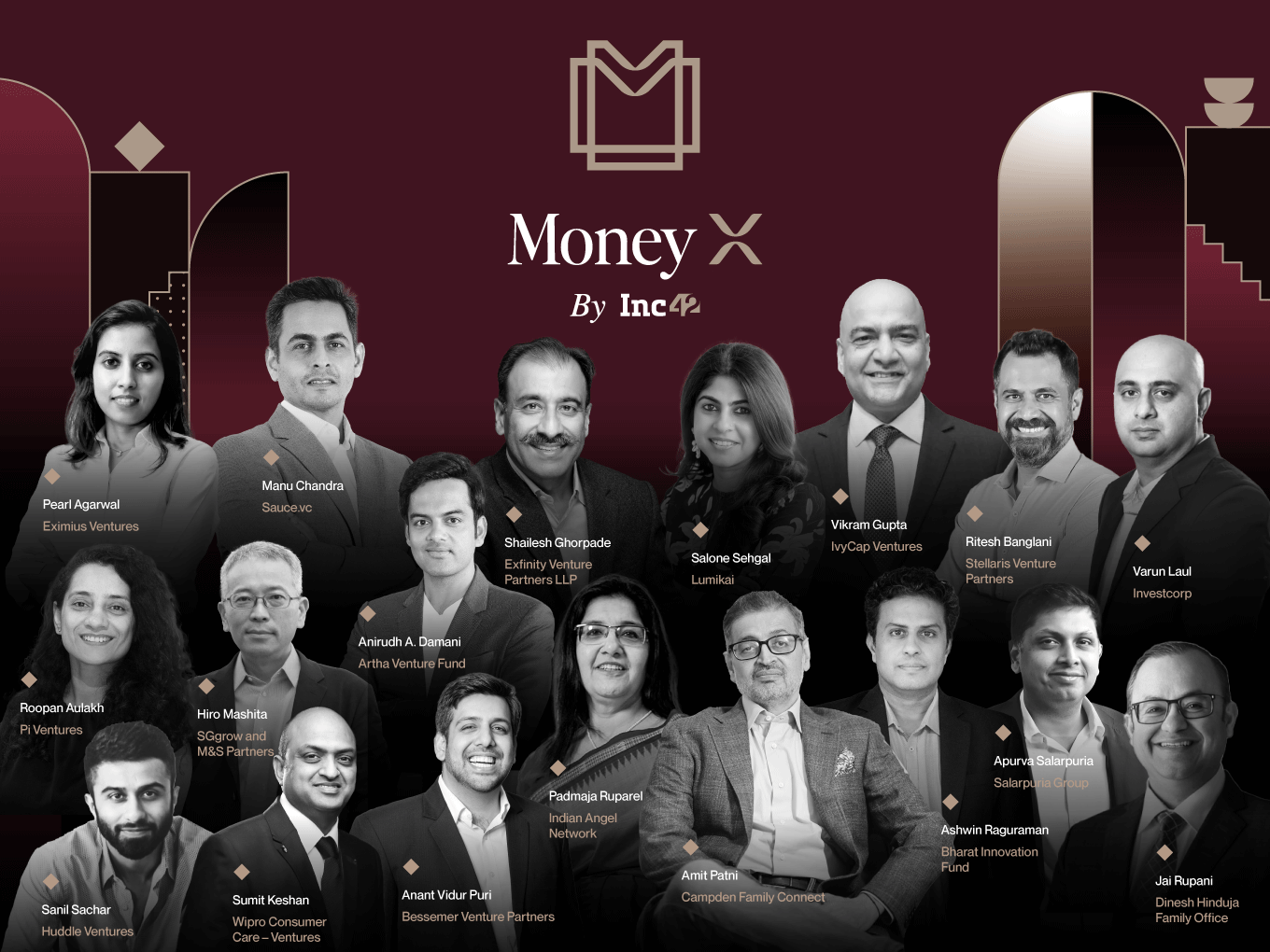

With over 50 investors reshaping VC playbooks, MoneyX Dialogues makes its debut in Bengaluru.

The inaugural edition of MoneyX Dialogues — Venture Capital Unplugged brought together over 50 investors to discuss the evolving playbooks and sector priorities The fire-side chat featuring V. Vaidyanathan from IDFC FIRST Bank underscored the necessity for venture capitalists and banks to collaborate closely in order to establish a robust financial foundation for startups. With recast playbooks, rebuilt partnerships, and robust value creation in sight, the investing community plans to redefine the rules for VCs.In late August, it was a breezy evening in Bengaluru, and amidst an august gathering of investors, a chortle erupted. It was sufficiently loud to be overheard. Nothing appears more natural than the presence of artificial intelligence in business. Almost as a rule, every pitch deck appears to start with an AI-first approach. The laughter was set off by that. However, it pertained to understanding the truth of the technological era and was definitely not about a rhetoric that dismissed technology. Under the humor, there lay a serious truth: the deployment of capital in India is changing rapidly, and investors are adjusting their playbooks to balance conviction with caution.This was corroborated by a recent Inc42 investor survey, which found that AI was the top choice for both early and growth stage investments. In order to decipher these signals, Inc42 collaborated with IDFC FIRST Bank to organize the inaugural MoneyX Dialogues — Venture Capital Unplugged event, which was supported by Rukam Capital, in Bengaluru on August 21. Over the course of the evening, more than 50 of India’s most astute investment professionals gathered, including early-stage VCs, fund managers focused on emerging and growth stages, HNIs, family offices, and angel investors.The event included a closed-door roundtable discussion with early and growth stage fund managers, high-net-worth individuals, and family offices, moderated by Amit Nawka, a partner at PwC Deals. It also featured a fireside chat with V. Vaidyanathan, the MD and CEO of IDFC FIRST Bank, moderated by Inc42 cofounder and CEO Vaibhav Vardhan. They discussed the evolution of venture capital in India and the strategies that would drive the next wave of startups.

Robotics startup EyeROV secures a contract worth INR 47 crore from the Indian Navy

The startup's UWROVs undergo testing in turbulent waters for deep-sea missions, including in the frigid depths of the Antarctic Sea. The EyeROV TROUT is a military-grade ROV rated for depths of 300 meters, designed for deep-sea missions and equipped with autonomous navigation and advanced imaging capabilities. Its clientele includes Tata, Adani, BPCL, DRDO, and the Indian Coast Guard.EyeROV, a startup specializing in underwater robotics, has landed a contract with the Indian Navy valued at INR 47 crore to provide advanced Underwater Remotely Operated Vehicles. The agreement represents an important advance in bolstering the nation’s naval capabilities with homegrown technology.Kochi-based marine robotics startup EyeROV has been awarded a contract worth ₹47 crores by the Indian Navy for advanced Underwater Remotely Operated Vehicles (UWROVs). The Navy's underwater surveillance and reconnaissance capabilities will be enhanced by EyeROV's locally developed underwater drones, which can operate at depths greater than 400 meters. The startup has executed more than 100 deployments worldwide and counts clients such as DRDO, the Indian Coast Guard, and CSIR. EyeROV, acknowledged as one of the leading defense-tech startups in India, has secured $1.2 million in funding and is in line with India's 'Make in India' campaign aimed at achieving defense self-sufficiency.The Indian Navy has awarded a ₹47 crore contract to EyeROV, a marine robotics startup based in Kochi, for the provision of advanced Underwater Remotely Operated Vehicles (UWROVs), marking a significant advancement for India's defense technology sector. The agreement represents a significant landmark in the nation’s drive for indigenous defense technology and maritime security capabilities.

X, the platform owned by Elon Musk, plans to appeal a ruling by the Karnataka High Court regarding a confidential content removal system called ‘Sahyog’.

The Karnataka high court (HC) has reportedly added another layer to the confrontation between Elon Musk’s X and the central government by dismissing the former’s plea for relief from the Centre’s censorship orders. Justice M Nagaprassana dismissed X’s plea, stating that social media cannot function with total freedom, according to a report by LiveLaw The judge expressed the view that, referencing US regulations regarding social media posts, the government’s attempt to regulate speech on the platform cannot be considered illegal.“We will appeal this order to defend free expression,” X said in a post on the platform, in its first statement since the High Court of Karnataka ruled last week that there was no legal merit to the company's legal challenge to quash India's content removal mechanisms.X is deeply concerned by the recent order from the Karnataka court in India, which will allow millions of police officers to issue arbitrary takedown orders through a secretive online portal called the Sahyog. This new regime has no basis in the law, circumvents Section 69A of…"The Sahyog enables officers to order content removal based solely on allegations of “illegality,” without judicial review or due process for the speakers, and threatens platforms with criminal liability for non-compliance," X said on Monday. X owner Elon Musk, a self-described free-speech absolutist, has clashed with authorities in several countries over compliance and content takedown demands, but the company's Indian lawsuit targeted the entire basis for tightened internet regulation in the world's most populous nation, Reuters reported.Earlier on September 24, the Karnataka High Court dismissed X Corp's petition challenging the government's content takedown system under Section 79 of the Information Technology Act. The court emphasised that social media, as a “modern amphitheatre of ideas,” should not be allowed to operate in a state of “anarchic freedom” and must be subject to regulation.

Government Considers Relaxing Export Regulations for Amazon and Other E-commerce Giants

To alleviate restrictions on foreign investment, the government has allegedly created a proposal permitting e-commerce multinationals such as Amazon to buy products directly from Indian vendors and sell them abroad.NEW DELHI, Sept 26 (Reuters) - A document revealed that the Indian government has prepared a proposal aimed at relaxing foreign investment regulations. This would permit e-commerce firms like Amazon (AMZN.O) to purchase products directly from Indian vendors and sell them to international customers.In India, foreign e-commerce firms are not permitted to sell products directly to consumers, whether domestically or internationally. They can only operate as a marketplace that connects buyers and sellers for a charge.As reported by Reuters, the policy has been disputed between New Delhi and Washington for years, with Amazon lobbying the Indian government to relax export rules. The suggested modifications align with initiatives from both India and the U.S. aimed at reconciling their disparities regarding a trade agreement that has been postponed for an extended period. Additionally, the proposals reject the call from groups supporting millions of small Indian brick-and-mortar retailers for the government to deny Amazon's request based on the assertion that the financial power of the U.S. company poses a threat to their businesses. As stated in a 10-page proposal from The Directorate General of Foreign Trade, which is not public but was reviewed by Reuters on Thursday, less than 10% of small Indian businesses that sell online domestically engage in global e-commerce exports due to being "constrained by complex documentation and compliance requirements."The proposal foresees a model for facilitating exports through a third party, in which compliance would be overseen by a dedicated export entity connected to e-commerce platforms. Neither Amazon nor the directorate responded to Reuters' inquiries. The proposal will need to be approved by India's cabinet. As reported by Reuters, Amazon stated that the move will benefit Indian exporters; however, the Confederation of All India Traders, representing millions of traditional retailers, opposed the proposal on Friday. It was stated that this could be exploited by foreign companies, resulting in increased control over supply chains. B C Bhartia, the national president of the confederation, stated, "It will create a slippery slope, making it nearly impossible to monitor whether goods are genuinely meant for exports or being diverted into the domestic market."

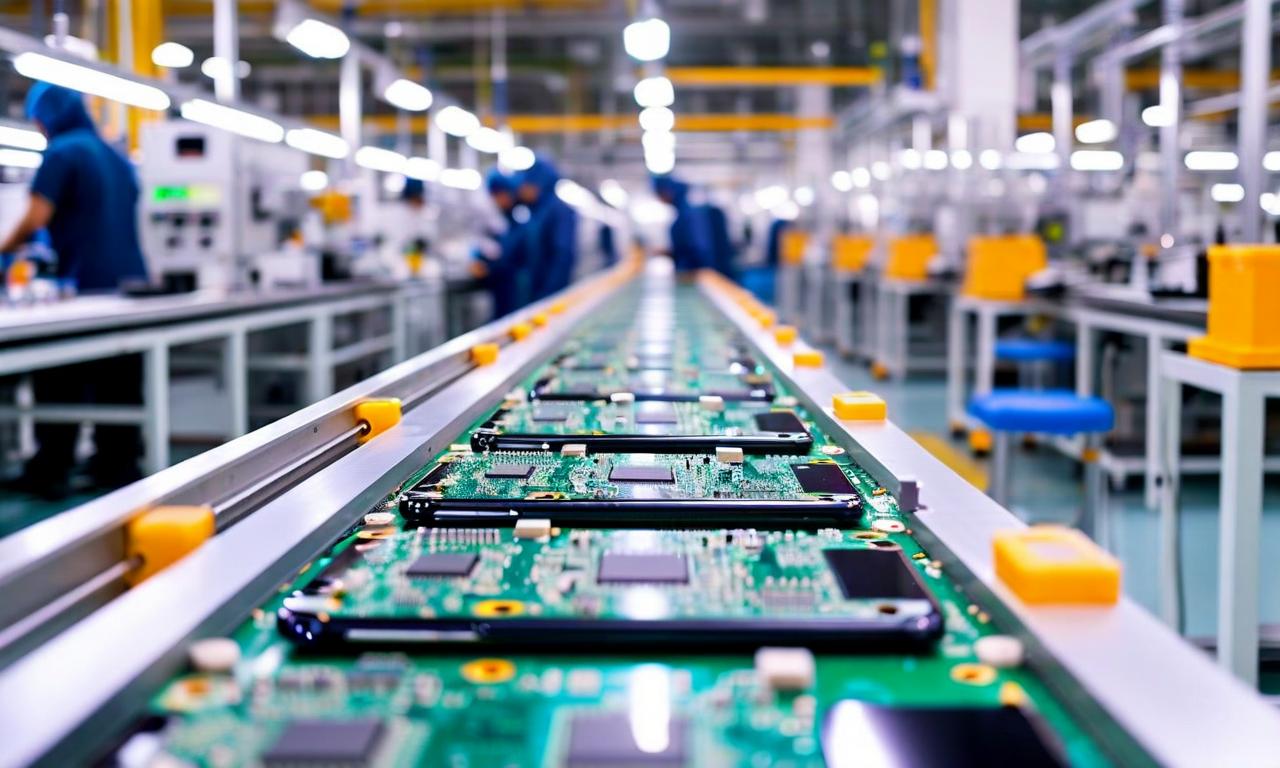

Nothing Partners with Optiemus to Reinforce Commitment to Indian Manufacturing

Nothing has declared its collaboration with Noida-based Optiemus Infracom to position India as the worldwide production and export center for Nothing and CMF products The JV will facilitate the establishment of Nothing’s sub-brand CMF (Color, Material, Finish) as an independent entity, assisting the company in making India its hub for operations, research and development, and manufacturing in the future. Nothing’s CMF and Optiemus Infracom are collaborating to invest more than $100 million (INR 886.7 crore) in the country over the next three yearsThe smartphone giant Nothing, headquartered in London, has revealed its collaboration with Noida's Optiemus Infracom to create a global production and export center for Nothing and CMF products in India. The JV will result in the establishment of Nothing’s sub-brand CMF (Color, Material, Finish) as an independent entity, aimed at helping the company establish India as its hub for operations, research and development, and manufacturing in the future. Nothing has teamed up with Optiemus Infracom to enhance smartphone production in India, pouring in more than $100 million and generating 1,800 jobs. The company intends to position India as a worldwide center for its CMF brand, with an emphasis on research, development, and manufacturing.

P-TAL, a D2C brand, secures $3 million from investors including Grid and Rainmatter.

P-TAL, a D2C brand, has secured $3 million in its Series A funding round, which was spearheaded by the VC Grid syndicated fund from Venture Catalysts and Rainmatter, led by Nikhil Kamath. The funding round included contributions from the US-based VC firm Connecticut Innovations, Bipin Shah’s new VC fund Zero Pearl, Anicut Capital, and others. P-TAL stated that it will use the new funding for product innovation, creating technology-driven efficiencies in its supply chain, and empowering artisan communities in India.P-Tal (Punjab Thathera Art Legacy), a high-end kitchenware brand that is bringing back India’s traditional craftsmanship of hand-forging copper, brass, and bronze utensils, has secured $3 million in a new funding round. Connecticut Innovations, Anicut Capital, Zeropearl VC, and various angel investors also took part in the round, which was co-led by VC Grid and Rainmatter, an investment initiative founded by Zerodha’s Nithin Kamath. The firm intends to use the new funds for the purpose of expanding its international operations, which currently account for almost 60% of revenue. P-Tal, having established a stronger foothold in the US, is now aiming to penetrate the European, UK, and Middle Eastern markets and is focused on developing R&D capabilities for designing product lines tailored to these regions.P-Tal, established by Aditya Agrawal (CEO), is rethinking traditional Indian kitchenware for contemporary homes. Its offerings encompass cookware, dinnerware, serveware, and essentials for daily use, with prices beginning at ₹1,500. Each item is hand-made by over 110 artisan families from Moradabad and Chandigarh, merging cultural heritage with modern design. The brand's distribution channels include its D2C website, e-commerce and quick-commerce platforms, as well as two offline stores in India.P-Tal had previously raised approximately $550,000 in 2023 in a round spearheaded by Titan Capital, bringing its total funding to $3.6 million. The firm gained exposure by appearing on Shark Tank India (Season 3), where it obtained ₹1 crore from investors Aman Gupta, Anupam Mittal, Amit Jain, Namita Thapar, and Vineeta Singh. As global consumers increasingly seek authentic, sustainable, and artisanal products, P-Tal is establishing itself as India’s cultural ambassador in the premium kitchenware market.