Top Trending StartUps News & Highlights

OYO Pre-Files DRHP for IPO of INR 6,650 Cr.

Days after getting shareholder approval for its third attempt at a public listing, PRISMPRISM Datalabs_in-article-icon, the parent company of hospitality upstart OYO, pre-filed draft documents for an IPO.As part of the IPO, which is anticipated to include an offer-for-sale component, the business hopes to raise INR 6,650 Cr through a new issuance. The company is aiming for a valuation of $7 billion to $8 billion for the public offering, according to sources who spoke to Inc42. Bankers from ICICI Securities, Axis Capital, Goldman Sachs, and Citibank have been selected as the book running lead managers for the initial public offering.The INR 6,650 Cr IPO was authorised by PRISM's shareholders earlier this month at an extraordinary general meeting (EGM). In addition, a bonus issue of shares in the ratio of 1:19—that is, one fully paid equity share for every 19 shares held—was approved by the shareholders. In September 2025, it also authorised the issuance of a 1:1 bonus. Interestingly, OYO initially submitted draft documents for an IPO in 2021 but then withdrew them due to market instability. Later, it pre-filed its DRHP but withdrew it last year, opting instead to refinance its $1.2 billion term debt from 2021 through a private capital deal.It is anticipated that the corporation will utilise a sizable portion of the money received from the new IPO to pay down debt. For more than a year, the business has been methodically getting ready to go public. It improved its profitability, expanded its premium range in India and outside, and changed the parent company name from OYO to PRISM earlier this year.

Published 31 Dec 2025 11:16 PM

Key Certification for Ola Electric's 4680 Bharat Cell-Powered Roadster X+

Ola Electric, an EV manufacturerThe government has certified Ola Electric Datalabs_in-article-icon's Roadster X+ (9.1 kWh) electric motorcycle, which is powered by an internal 4680 Bharat Cell battery pack. The International Centre for Automotive Technology (iCAT) approved the Roadster X+ in accordance with the Central Motor Vehicle Rules (CMVR), 1989, the firm reported to the stock exchanges. The Roadster X+, which Ola Electric claims is the first electric motorcycle in India to be certified with a wholly in-house built battery pack, would then start to be delivered. The Automotive Research Association of India (ARAI) certified the Bhavish Aggarwal-led company's 5.2 kWh configuration variant of their battery cell pack a few months prior to this breakthrough.Interestingly, the 9.1 kWh battery pack has also been certified by ARAI. The starting prices for the Roadster X series are INR 74,999 for the Roadster X, INR 1,04,999 for the Roadster X+ 4.5kWh, and INR 1,54,999 for the Roadster X+ 9.1kWh, which has a 501 km/charge range. With the most recent approval, Ola Electric will be able to use its 4680 Bharat Cell technology in all of its two-wheeler products, including electric bikes and scooters. The company's next battery energy storage system (BESS), called "Ola Shakti," will also use the same cell platform. The heavy industries ministry recently issued an order authorizing Ola Electric to release INR 366.78 Cr in incentives under the production-linked incentive program.The EV major has been attempting to put out fires on several fronts at this time. For the majority of 2025, the company was under pressure due to high losses, falling revenues and market share, and regulatory issues.

Published 30 Dec 2025 10:06 PM

Medibuddy reports FY25 revenue of Rs 725 Cr, reducing losses by 37%.

MediBuddy, a digital healthcare platform, reported a little increase in its operational scale in FY25 after growing by more than two times in the fiscal year that ended in March 2024. Nonetheless, the business was able to reduce its losses by 37% over that time. According to MediBuddy's annual financial records submitted to the Registrar of Companies (RoC), the company's operating revenue increased 12.3% year over year to Rs 724.6 crore in FY25 from Rs 645.4 crore in FY24.MediBuddy is a digital healthcare business that offers insurance services, lab testing, procedures, online and offline medical consultations, and medication delivery. Together, these services' revenue of Rs 722 crore continued to be the company's main source of income, with additional operating sources contributing Rs 2.5 crore. The company's total income in FY25 was Rs 743 crore after earning Rs 18.42 crore from non-operating sources, such as interest on current assets and fixed deposits, written-off liabilities, and other miscellaneous income.The cost of materials, which was Rs 333 crore in the previous fiscal year, accounted for the highest portion of total expenses at 38%. Employee benefits costs came next, rising slightly by 8% to Rs 176.8 crore, which included Rs 6 crore in ESOP costs. During the year, sales payout expenses, which include commissions paid to selling agents, decreased by 7% to Rs 155.47 crore. Additionally, the corporation spent Rs 32.5 crore on information technology and Rs 42.5 crore on safety and security. In FY25, additional overheads totalling Rs 138.7 crore included advertising, legal and professional fees, depreciation and amortisation, and financing charges.In the previous fiscal year, the Bengaluru-based company's total expenses stayed constant at Rs 879 crore. The company's losses were reduced by 37% to Rs 137 crore from Rs 215.7 crore in FY24 thanks to controlled spending and a 12% increase in sales.

Published 23 Dec 2025 11:33 PM

Urban Company Receives Penalty Notice and INR 56 Cr GST Demand

GST regulators believed that the startup's services, such painting and appliance repair, were within Section 9(5) of the CGST Act and would need to be taxed appropriately. Urban Company, which intends to challenge the ruling, further asserted that the demand notice will not affect the business's operations or finances. In addition, the GST authorities of Tamil Nadu, Maharashtra, and Haryana have sent the corporation at least three further demand notifications totalling INR 51.3 Cr.Unicorn Urban Company's hyperlocal servicesMaharashtra goods and service tax (GST) authorities have sent Urban Company Datalabs_in-article-icon a tax demand and penalty notice amounting INR 56.4 Cr.Unicorn hyperlocal services Maharashtra GST authorities have sent Urban Company a ₹56.4 crore tax demand and penalty notice for the April 2021–March 2025 period. The notice relates to alleged non-payment of GST on reimbursements to service providers, particularly over services like painting and appliance repair, and contains a primary tax of ₹51.3 crore and a penalty of ₹5.13 crore. Urban Company intends to file an appeal, claiming that the demand won't affect its business operations and that it has a compelling argument. This comes after several tax complaints from several states totalling ₹51.3 crore.

Published 21 Dec 2025 10:23 PM

StartUps

StartUps are the backbone of any country and in any Industry as these are the new ventures which entrepreneurs establish and then contribute to the nation growth and progress. The stratups will then grow and become unicorns and create thousands of employments in different sector boosting the economy and take it to the next level.

Moglix FY25 Loss halves as revenue approaches the $700 million mark.

The operating sales of B2B e-commerce company Moglix approached $700 million in the fiscal year that concluded in March 2025. According to its Singapore filings, the Bengaluru-based business generated operational revenue of $681.5 million in FY25, up 15% from $591 million the year before. The startup's overall revenue, including other income, increased from $601 million in FY24 to $692.8 million in the reviewed year.On the strength of improved margins and a restrained increase in spending, MoglixMoglix Datalabs_in-article-icon saw its loss almost halve to $11.3 Mn in FY25 from $21.7 Mn in the prior fiscal year. Moglix, which was founded in 2015 by Rahul Garg, supplies a variety of industrial tools and equipment to customers in the metals, mining, oil and gas, consumer durables, FMCG, cement, automotive, and pharmaceutical industries. The firm has established a manufacturing facility to create a variety of bitumen products as part of its entry into the energy industry. Additionally, INR 600 Cr was set aside for the purchase of a space company.India is where Moglix makes the most money. With 3% of the unicorn's revenue in FY25, the UAE came in second. Cost of Sales: The startup spent the most money under this heading, mostly for other operating costs and procurement costs. The cost of sales increased 14.7% from $561 million to $644 million over the reviewed year. Employee Benefit Costs: In FY25, employee costs increased 5.8% from $25.8 million to $27.3 million. Advertising Expenses: Moglix's advertising expenses decreased by 12% to $2.9 million in the year under review from $3.3 million in FY24, perhaps in an effort to boost its bottom line.

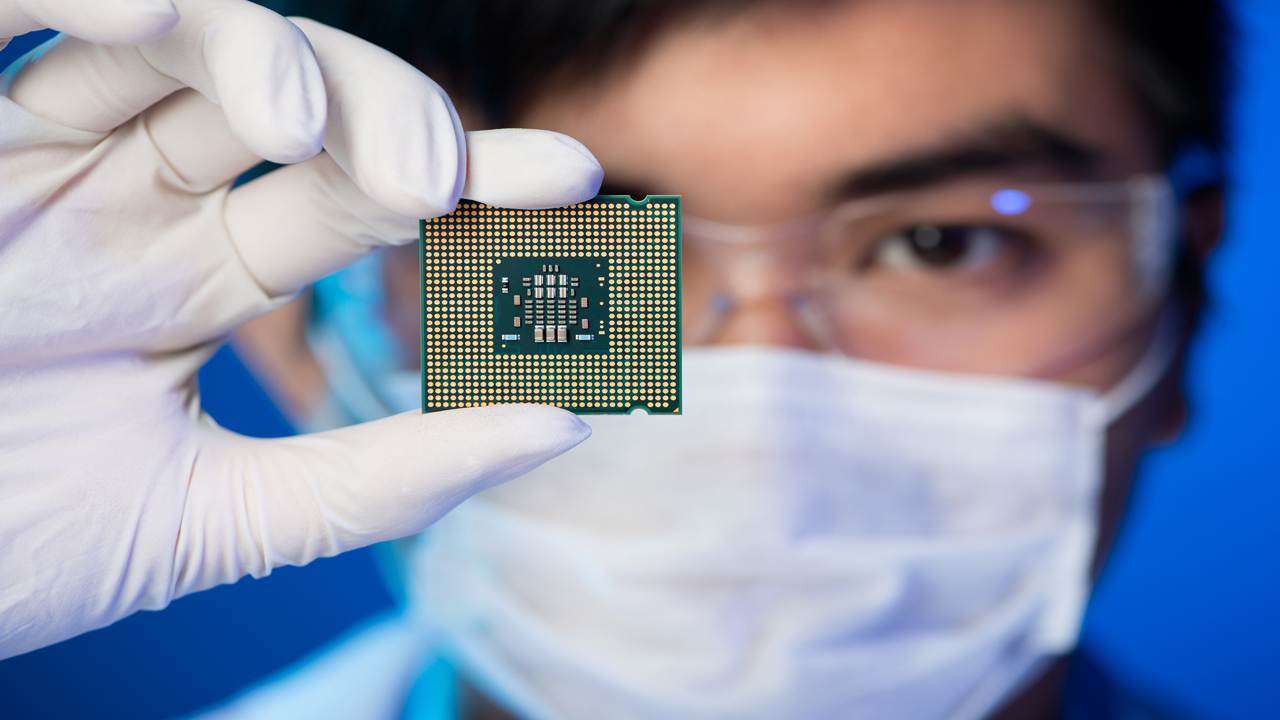

97% of the Chip Manufacturing Fund is Committed by the Government: Report

According to reports, the government has allocated approximately INR 62,900 Cr, or nearly 97% of the INR 65,000 Cr, for incentives related to semiconductor manufacturing. Only minor projects can be funded with the remaining monies, according to a PTI article that quoted Electronics and IT Secretary S Krishnan. He added that INR 65,000 Cr was set aside for chip manufacturing, INR 10,000 Cr for the modernization of the Semiconductor Laboratory in Mohali, and INR 1,000 Cr for the design-linked incentive program under the INR 76,000 Cr India Semiconductor Mission. This follows reports that Jitin Prasada, the Minister of State for Electronics and Information Technology, stated that the nation's first indigenous chip would be released by the end of this year. According to an ANI report, the minister stated that the first packaged chip would be available by December 2025. Prasada He went on to say that the government has mapped out a plan for India to become a worldwide center for chips, incorporating every step of the supply chain, from design and assembly/testing to imports and production.During his speech at the World Economic Forum in Davos in January, Union Minister Ashwini Vaishnaw presented the idea for a "Made in India" chip, highlighting the nation's goal of releasing its first chip by the end of the year.

GIVA Raises ₹530 Cr in New Funding Round Led by Creaegis

Bengaluru-based jewellery startup GIVA has raised ₹530 crore in a fresh funding round led by Creaegis, with participation from Premji Invest, Epiq Capital, and Edelweiss Discovery Fund. The round values the company at $374 million, up from $254 million in October 2024. GIVA plans to use the new funds to grow both its retail and online presence, improve its tech-driven supply chain, and expand its lab-grown diamond collection. It also aims to launch new jewellery categories and open 145 to 150 additional stores, focusing on tier II cities. The brand currently operates over 240 outlets across India. GIVA competes with Tata Group-owned CaratLane, Kushal’s, Palmonas, Voylla, among others, in the Indian online jewellery market. Recently, Tiger Global-backed wealthtech startup Jar also launched its D2C jewellery brand Nek. The company said the fresh funds will be used to strengthen its retail and online footprint, upgrade its technology-led supply chain, and deepen its focus on lab-grown diamond jewellery. GIVA also plans to enter new product categories as part of its long-term growth strategy. Founded in 2019, GIVA has grown quickly by offering modern jewellery designs in silver and lab-grown diamonds, catering especially to younger consumers. The company’s blend of affordability, design, and direct-to-consumer approach has helped it stand out in a competitive market. To support this expansion, GIVA is planning to open new stores across India, with a strong focus on tier II, aiming to reach more customers through a mix of offline and digital channels. In addition to the funding news, GIVA also announced the elevation of its Chief Operating Officer, Aditya Labroo, to the role of cofounder. The move reflects his growing leadership role and contribution to the brand’s rapid growth.

KiranaPro Purchases Likeo To Support Its Gen Z Fashion App Users' Virtual Trial Room Experience

KiranaPro wants to give its clients an immersive trial room experience by integrating Likeo's products with its online fashion marketplace BLACK. On May 16, 2025, the fast commerce platform debuted its fashion marketplace, which is accessible on the Google Playstore. Saurav Kumar, the creator and CEO of Likeo, will join KiranaPro to spearhead BLACK's advancement in AI and visual computing.KiranaPro is a quick commerce platform.In an all-stock transaction, KiranaPro Datalabs_in-article-icon acquired Likeo, an AI-powered platform that specializes in virtual try-on technology powered by its augmented reality tech stack. The agreed upon price was $1 million (INR 8.55 crore). Through this acquisition, Kerala-based KiranaPro hopes to give its clients an immersive trial room experience by fusing Likeo's products with its online fashion marketplace BLACK. Products from the clothing, jewelry, and eyewear categories will be able to use the function. On May 16, 2025, KiranaPro released its fashion marketplace, which is accessible on the Google Play Store.

BlackBuck Reports Q4 Tax Credit Profit of INR 280 Cr

BlackBuck would have reported a profit of roughly INR 35.1 Cr in Q4 FY25 if the tax credit of INR 245 Cr had been excluded. In Q4 of FY25, operating revenue increased by 30.6% to INR 121.8 Cr from INR 93.2 Cr in the same period the previous year. BlackBuck reported a net loss of just INR 8.6 Cr for the entire fiscal year FY25, with the assistance of an INR 244.6 Cr tax credit.BlackBuck BlackBuck Datalabs_in-article-icon, a logistics company, reported a consolidated net profit of INR 280.1 Cr in Q4 FY25, compared to a net loss of INR 90.8 Cr in the same quarter last year. In the prior quarter, the company posted a net loss of INR 48 Cr. However, a tax credit of INR 245 Cr was one of the main drivers of the earnings in Q4. Without it, BlackBuck would have reported a profit for the reviewed quarter at roughly INR 35.1 Cr. In Q4 of FY25, BlackBuck's operating revenue increased by 30.6% to INR 121.8 Cr from INR 93.2 Cr in the same period the previous year. It increased 6.9% sequentially from INR 113.9 Cr.

Operations at Zepto Cafe Are Halted in Several Cities

Zepto Cafe, the company's rapid meal delivery division, has temporarily ceased operations in a number of minor cities, primarily in northern India. Over 400 workers have been impacted by the 44 eateries that have suspended operations. By the conclusion of the upcoming quarter, the business now anticipates starting up again in these areas.Platform for rapid trade According to persons familiar with the situation, Zepto has suspended operations of its 10-minute food delivery vertical, Zepto Cafe, in a number of locations, including Delhi, Agra, Chandigarh, Mohali, Amritsar, and Meerut, because of supply chain problems, ETtech reported. This will affect how 44 Zepto Cafe locations operate.Platform for rapid trade Zepto has suspended Zepto Cafe, its 10-minute meal delivery service, in several North Indian towns. The company has temporarily halted the services because of supply chain problems, according to a report by Economic Times. According to the article, 44 Zepto Cafe locations in the area will be impacted by the company's decision. About 700 gig workers have been impacted by the company's decision to stop providing the service. According to the Economic Times, Zepto Cafe's services were suspended in April of this year because the company was unable to meet quality standards due to the spike in demand. Zepto Cafe received greater demand than anticipated, hence the decision was made to halt operations in these cities. Meeting the volumes without sacrificing quality proved challenging, the individual with knowledge of the situation told ET.

Exclusive: Avanse Names New Independent Director and Strengthens Board Before IPO

Focused on education loans Rakesh Bhatt, the former COO of Bajaj Finserv, has been named as an independent director of NBFC Avanse Financial Services in advance of the company's INR 3,500 Cr initial public offering (IPO).According to Avanse's regulatory report, "it was proposed to onboard one more independent director in order to further strengthen the board, given the growth trajectory."Avanse has delayed to submit its red herring prospectus (RHP) more than six months after receiving SEBI's approval for its first public offering (IPO). A number of fintech companies are preparing for a public offering in the near future, and the new-age tech IPO season is well underway. Razorpay and PhonePe became public companies in April prior to their listing in India.has named Rakesh Bhatt, a former COO of Bajaj Finserv, as an independent director of the business in advance of its INR 3,500 Cr IPO.

In preparation for its IPO, Pine Labs becomes a public entity.

On May 16, shareholders approved the fintech unicorn's name change from "Pine Labs Private Limited" to "Pine Labs Limited." Amrita Gangotra and Smita Chandramani Kumar have also been named as independent directors of Pine Labs in anticipation of its first public offering. According to estimates, Pine Labs plans to launch a $1 billion initial public offering (IPO) in the second half of 2025. Pine Labs becomes a public company in preparation for its initial public offering (IPO). According to its regulatory papers, which Inc. was able to access, Pine Labs' shareholders approved the proposal on May 16 to rename the firm from "Pine Labs Private Limited" to "Pine Labs Limited."42.2 hours prior

Oxyzo Collects Neo Group and Other Debt for INR 533 Cr

The money will be used for the fintech unicorn's daily operations, which will include lending to small and medium-sized businesses. Oxyzo offers loans to modern tech startups in a variety of industries, including logistics, agritech, mobility, and climate tech, as well as to SMEs for the purchase of raw materials. According to earlier reports, Oxyzo was considering an IPO, just like its parent company, OfBusiness. But there haven't been any new developments on the NBFC's public issue.As the startup's problems worsen, Oxyzo and HSBC are thinking of taking legal action against the financially stressed Good Glamm Group (GGG) to recoup unpaid debts, insiders informed The IndianStartupNews (ISN). Companies who provided loans to GGG, Oxyzo and HSBC, are now thinking about suing the business. One of the sources mentioned above told ISN, "Oxyzo is dragging GGG to the National Company Law Tribunal (NCLT) to recover pending dues worth Rs 2.5 crore." The first significant business to bring Accel-backed GGG before the NCLT is Oxyzo. Another major lender, HSBC, is probably going to take Oxyzo's lead and collect its outstanding debts.Funding for Velocity fails Problems are getting worse for GGG at a time when it is struggling financially and its most recent funding source, which was its only hope, is about to fail. In order to revitalize its company and maintain the viability of brands like Sirona and others, GGG was in negotiations to obtain Rs 150–200 crore from Veloce, a Gujarat-based debt provider and investment broker. A second source told ISN that "Rs 150 crore would have solved 90% of GGG's current issues as all creditors would have been repaid their pending dues." But because Veloce has withdrawn, it is extremely doubtful that the business will now receive any compensation.

Peak XV Scores From Porter Exit Nearly 10X Return

According to sources who spoke to Inc42, Peak XV left with a payout of over INR 1,200 Cr on an investment of about INR 116 Cr. Porter became a unicorn a few days ago after raising $200 million in a financing round. Approximately $120 to $150 million of the total funds were raised through secondary share sales, which were mostly carried out by investors such as Peak XV and Kea Capital.Mumbai: According to a person acquainted with the situation, Peak XV Partners made more than ₹1,200 crore after withdrawing its investment in the most recent funding round for logistics startup Porter. In several rounds during the previous ten years, the profit was more than eleven times the return on investments of ₹116 crore. Mumbai: According to a person acquainted with the situation, Peak XV Partners made more than ₹1,200 crore after withdrawing its investment in the most recent funding round for logistics startup Porter. In several rounds during the previous ten years, the profit was more than eleven times the return on investments of ₹116 crore.

Groww settles a case with SEBI over security lapses by paying INR 48 lakh.

SUMMARY In its May 14 ruling, SEBI claimed that Groww had broken several securities contract and stock broker regulations, among other rules. Additionally, SEBI stated that the investment tech startup's trading app offered non-securities services like bill payment, loans, and UPI payments, potentially exposing users to personal financial risk. This comes a day after Groww settled a separate dispute with SEBI for INR 34.12 Lakh, alleging that a technical issue on the site prohibited users from placing transactions.Groww Invest Tech paid Rs 47.85 lakh towards the settlement sum on Wednesday, resolving a complaint concerning the purported breach of stock brokers' regulations and other standards. The order followed the broking firm's application to Sebi "without admitting or denying the facts and conclusion of law" through a settlement order. "The adjudication proceedings initiated against the applicant via SCN dated November 25, 2024, are disposed of in view of the acceptance of the settlement terms," stated Amit Kapoor, the adjudicating officer for Sebi. Groww Invest Tech (previously Nextbillion Technology Pvt Ltd) was the subject of a thorough inspection that led to the case.Groww was accused of breaking numerous securities contracts (regulation) requirements, Sebi circulars, and stock broker rules by the Securities and Exchange Board of India (Sebi).

Paytm's Q4 Loss Flat Was INR 545 Cr Due to the Decrease of Exceptional Items

In Q4 FY25, Paytm recorded a consolidated net loss of INR 544.6 Cr, with unusual items burdening its bottom line by INR 522.1 Cr. Paytm would have reported a loss before tax of INR 19.9 Cr instead of INR 536.4 Cr in the previous year if these costs hadn't been incurred. In the meantime, the company's operational revenue decreased 19% from INR 2,267.1 Cr in Q4 FY24 to INR 1,911.5 Cr in the current quarter. PaytmPaytm Datalabs_in-article-icon, a leading fintech company, recorded a consolidated net loss of INR 544.6 Cr in the March quarter (Q4 FY25), which is 1% less than the INR 550.5 Cr loss it suffered in the same quarter last year. The company's loss increased sequentially from INR 208.5 Cr to 118%.INR 545 Cr Paytm Q4 Loss Flat Due to Exceptional Items Purchased In the March quarter (Q4 FY25), Toll. recorded a consolidated net loss of INR 544.6 Cr, which was 1% less than the INR 550.5 Cr loss it had in the same period the previous year. The company's loss increased sequentially from INR 208.5 Cr to 118%.

"Deciphering the India Playbook of UK-Based Fintech Revolut "

Revolut is scheduled to launch its products in October of this year after obtaining its prepaid payment instrument (PPI) license from the Reserve Bank of India to provide prepaid cards and prepaid wallets with UPI payments. Nik Storonsky and Vlad Yatsenko founded Revolut in 2015 as a forex payments platform, but it has now evolved into a fintech mega app. The London-based business will enter the UPI and quick international payments markets in India. According to the British neobank, 300,000 Indians have already joined its pre-enrollment waiting list. In the future, Revolut hopes to have 25 million Indian customers by 2030.When Revolut, the biggest neobank in Europe, announced its 2021 entry into India, it generated a lot of excitement. It was hailed at the time as a possible rival to some of the nation's largest fintech companies.In the future, Revolut hopes to have 25 million Indian customers by 2030. Revolut's intentions to expand in India are centered on the country's burgeoning fintech sector, which has drawn over $25.8 billion in investments and is home to 22 unicorns and 33 soonicorns.

PM Modi declares WAVES 2025 to be a worldwide celebration of creativity at the ideal moment to "create in India, create for the world."

At the WAVES summit on Thursday, May 1, 2025, Prime Minister Narendra Modi emphasized "creative responsibility," stating that we must protect the next generation from notions that are anti-human. He stated that as the world is searching for fresh approaches to storytelling, this is the ideal moment to "create in India, create for the world."At the Jio World Convention Centre in Mumbai, the Prime Minister opened the World Audio Visual and Entertainment Summit (WAVES) 2025, describing it as a transformative platform that brings together global innovators, storytellers, producers, and policymakers. Speaking in Mumbai at the @WAVESummitIndia. It showcases India's artistic prowess on a worldwide scale. This link: https://t.co/U4WQ4Ujv8q — May 1, 2025, Narendra Modi (@narendramodi)"Today, artists, innovators, investors, and policy makers from more than 100 nations have gathered under one roof," Mr. Modi said in a keynote speech to a crowded auditorium of international delegates from as many as 30 countries. We are establishing the groundwork for a worldwide talent and innovation ecosystem. Every artist and creative has access to WAVES, which is such a global platform.

Adjusted EBITDA Loss at Blinkit Q4 Increases 381% Year Over Year to INR 178 Cr

SUMMARY Blinkit's adjusted EBITDA loss increased by over 73% from INR 103 Cr to INR 103 Cr on a quarterly basis. In Q4 of FY25, Blinkit recorded operational revenue of INR 1,709 Cr, a 122% increase over INR 769 Cr in the same period last year. The impact of faster store expansion in quick commerce caused Eternal to report a 15% year-over-year fall in its adjusted EBITDA profit to INR 165 Cr in Q4 FY25.In the March quarter of the fiscal year 2024-25 (Q4 FY25), Blinkit's adjusted EBITDA loss increased by more than 381% to INR 178 Cr from INR 37 Cr in the same quarter last year due to fierce competition in the rapid commerce sector. The adjusted EBITDA loss increased by over 73% from INR 103 Cr to INR 103 Cr on a quarterly basis.In the March quarter of the fiscal year 2024-25 (Q4 FY25), Blinkit's adjusted EBITDA loss increased by more than 381% to INR 178 Cr from INR 37 Cr in the same quarter last year due to fierce competition in the rapid commerce sector.

After Adani, Zoho Shelves Its $700 Mn Semiconductor Plan

OVERVIEW Zoho has halted its $700 million attempt to enter the silicon industry. According to Sridhar Vembu, the creator of Zoho, the board has chosen to halt chipmaking efforts until a more effective technological solution is found. Last year, the SaaS unicorn requested permission from the Center to establish a chip manufacturing plant and receive incentives under the production-linked incentive system.Tamil Nadu-based software-as-a-service firm Zoho Corporation has postponed its intention to develop a $700-million compound semiconductor fabrication unit, the company’s founder Sridhar Vembu stated.“On our semiconductor fab investment plan, since this business is so capital-intensive, it requires government backing. We wanted to be completely sure of the technology path before we take taxpayer money. On social media platform X (previously Twitter), Vembu stated, "Our board decided to put this idea on hold for the time being, until we find a better tech approach, because we did not have that confidence in the tech."The company applied for government incentives under the India Semiconductor Mission (ISM) in June of last year in order to construct a facility for the manufacture of compound semiconductor chips. For this reason, the SaaS company also established Silectric Semiconductor Manufacturing.Vembu has previously disclosed Zoho's intentions to establish a semiconductor design project in Tenkasi, Tamil Nadu, prior to submitting an application for incentives to construct a chip manufacture plant under ISM. a

Amazon, Flipkart Probe: CCI Requests Apple, Xiaomi Sales Data

OVERVIEW As part of its continuing investigation against e-commerce giants Amazon and Flipkart, the ED has requested that Apple and Xiaomi disclose sales data and other documents. The ED is looking into whether the two e-commerce giants violated Indian law by influencing pricing and managing inventory, which is already prohibited for foreign-owned platforms. However, phone companies were not the probe's goal; they were contacted merely for information. As part of its ongoing investigation into Amazon and Flipkart, the Enforcement Directorate (ED) has requested sales data and other documentation from smartphone manufacturers like as Apple and Xiaomi.As part of a probe into Flipkart, which is owned by Amazon and Walmart, India's financial crime agency has secretly requested sales data and other papers from smartphone companies such as Apple and Xiaomi, according to people familiar with the situation who spoke to Reuters.

Mugafi Makes $3 Million Using AI to Assist Filmmakers With Script Writing

OVERVIEW In addition to StartupXseed, Auxano, Proneur Network, Mars Shot Ventures, Beyond Venture Partners, and We Founder Circle participated in the fundraising round. The money will be used by Mugafi to improve its technology stack, hire personnel, and enter new markets. Ved, Mugafi's main AI bot, helps authors with concept generation, plot structure, character development, and dialogue composition. Mugafi Earns $3 Million By Using AI To Assist Filmmakers With Script Writing. has secured $3 million, or roughly INR 25.5 crore, in its initial funding round, which was spearheaded by StartupXseed.