StartUps

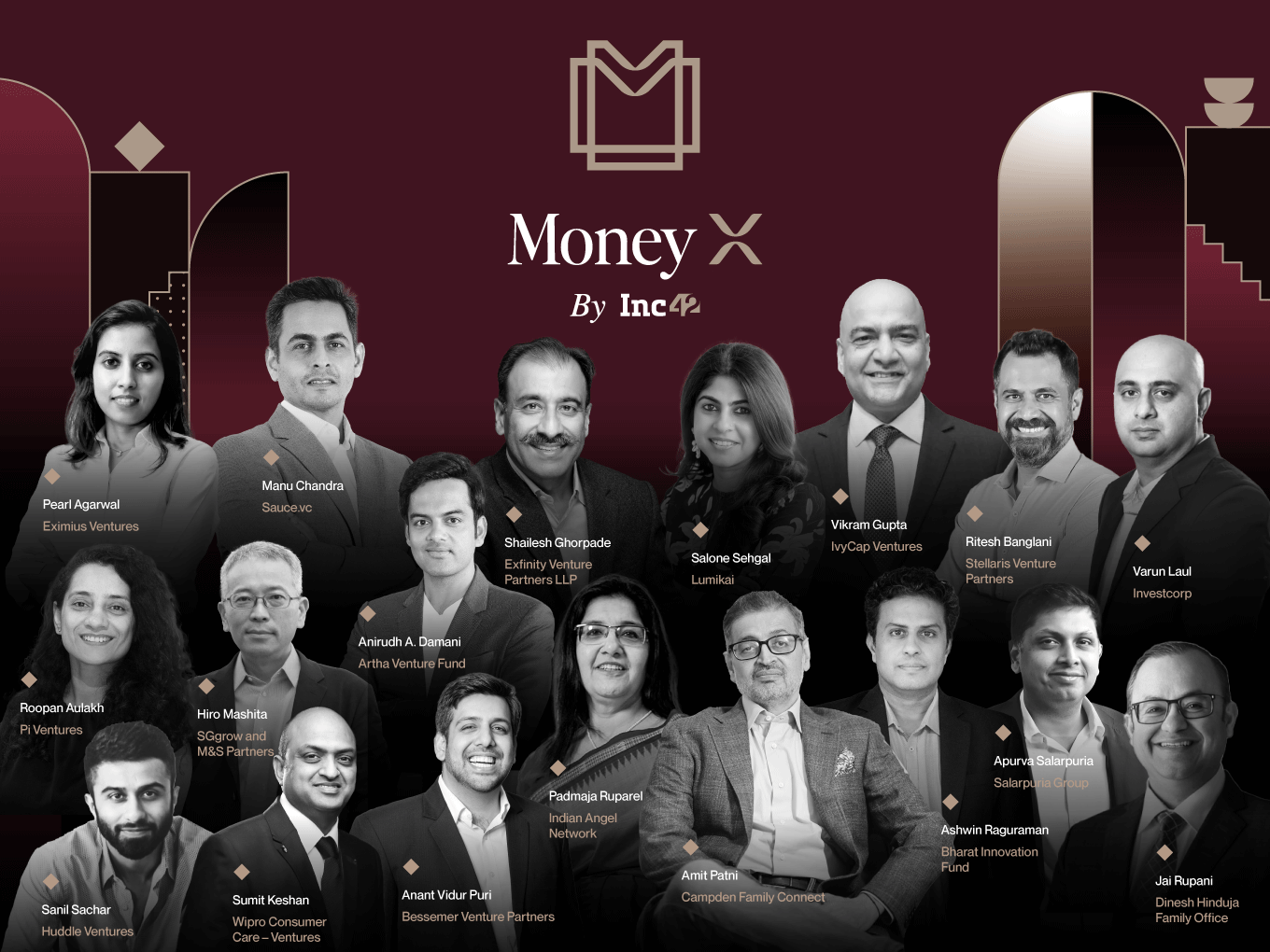

With over 50 investors reshaping VC playbooks, MoneyX Dialogues makes its debut in Bengaluru.

By Kajal Sharma - 01 Oct 2025 04:00 PM

The inaugural edition of MoneyX Dialogues — Venture Capital Unplugged brought together over 50 investors to discuss the evolving playbooks and sector priorities The fire-side chat featuring V. Vaidyanathan from IDFC FIRST Bank underscored the necessity for venture capitalists and banks to collaborate closely in order to establish a robust financial foundation for startups. With recast playbooks, rebuilt partnerships, and robust value creation in sight, the investing community plans to redefine the rules for VCs.In late August, it was a breezy evening in Bengaluru, and amidst an august gathering of investors, a chortle erupted. It was sufficiently loud to be overheard. Nothing appears more natural than the presence of artificial intelligence in business. Almost as a rule, every pitch deck appears to start with an AI-first approach. The laughter was set off by that. However, it pertained to understanding the truth of the technological era and was definitely not about a rhetoric that dismissed technology.

Under the humor, there lay a serious truth: the deployment of capital in India is changing rapidly, and investors are adjusting their playbooks to balance conviction with caution.This was corroborated by a recent Inc42 investor survey, which found that AI was the top choice for both early and growth stage investments. In order to decipher these signals, Inc42 collaborated with IDFC FIRST Bank to organize the inaugural MoneyX Dialogues — Venture Capital Unplugged event, which was supported by Rukam Capital, in Bengaluru on August 21. Over the course of the evening, more than 50 of India’s most astute investment professionals gathered, including early-stage VCs, fund managers focused on emerging and growth stages, HNIs, family offices, and angel investors.The event included a closed-door roundtable discussion with early and growth stage fund managers, high-net-worth individuals, and family offices, moderated by Amit Nawka, a partner at PwC Deals. It also featured a fireside chat with V. Vaidyanathan, the MD and CEO of IDFC FIRST Bank, moderated by Inc42 cofounder and CEO Vaibhav Vardhan. They discussed the evolution of venture capital in India and the strategies that would drive the next wave of startups.