Top Trending Government News News & Highlights

Don't you feel guilty about selling Bharat Mata Rahul Gandhi criticizes the US accord and the Center

Speaking in the Lok Sabha following days of deadlock, Rahul Gandhi criticized the Central government, led by Prime Minister Narendra Modi, for the recently concluded trade agreement with the United States, saying the administration should be embarrassed of it. In a vicious attack, Gandhi said that the Center "sold India" and that the government was endangering farmers' livelihoods by permitting US goods to enter."India is no longer yours. Do you not feel guilty for selling India? In reference to the trade deal, he declared, "You have sold our mother, Bharat Mata." He added that it was a "wholesale surrender" in which the interests of farmers were jeopardized and India's energy security was given to America. Gandhi went on to say that Donald Trump would have been advised to treat India equally if an INDIA Bloc administration had negotiated the trade deal with the US."This is total capitulation. The fact that it is a capitulation by more than simply the prime minister makes it tragic. He has given up the 1.5 billion Indians' future. Gandhi claimed that he had given up the future in order to save the BJP's financial structure, which is the subject of a case in the US.Gandhi claimed that the farmers' interests had been compromised and that they were facing a "storm" as American agricultural products flooded Indian markets. Additionally, he claimed that the Indian textile sector is "finished."We are about to enter a period of unrest, and the country has been sold. The country is sold out. "Its farmers and data have been sold," Gandhi reaffirmed as he wrapped up his remarks.Following Rahul Gandhi's address, Union Parliamentary Affairs Minister Kiren Rijiju declared that no one could sell India and charged that the Congress party was undermining the nation. "Congress is sad because India is progressing," he stated, asserting that Prime Minister Narendra Modi is India's strongest PM. He claimed that before leaving Parliament, the Congress MP gave speeches full of falsehoods and unfounded accusations. Rijiju remarked, "He never stays back to hear the minister's response."It is regrettable that we lack a serious personality or a person with a serious character that would be appropriate for the role of opposition leader. Rahul Gandhi's lies will be refuted by our party both within and outside the House.

Published 11 Feb 2026 11:10 PM

Updates for the 10th day of the Parliament Budget Session The Government-Opposition deadlock ends, and both Houses begin discussing the budget

The Lok Sabha began discussing the Union Budget on Tuesday, February 10, 2025, in the afternoon, signaling the end of the impasse between the opposition and treasury benches. The discussion had been delayed for days due to the opposition's insistence that LoP Rahul Gandhi be given the opportunity to speak on a number of topics. Following two adjournments, the House reconvened at 2 p.m., and the Speaker, Krishna Prasad Tenneti, invited Congressman Shashi Tharoor to commence the debate. The Thiruvananthapuram MP then began discussing the matter. Soon after opposition parties filed a notice to introduce a motion to oust Om Birla as Speaker of the Lok Sabha, the thaw occurred. Sukhendu Sekhar Roy of the Trinamool Congress emphasized that rising inequality could cause a "social upheaval," akin to what was seen in neighboring countries, as opposition parties criticized the government for failing to address issues like unemployment and inflation in the Union Budget during the budget discussion."If the situation is not brought under control, I fear that the country will soon experience social unrest similar to what has recently occurred in some of our neighboring countries. We have never witnessed such skyrocketing inequality between the rich, super rich, upper middle class, middle class, and the poor," Mr. Roy stated.

Published 11 Feb 2026 11:06 PM

India displays its entire armed might on the 77th Republic Day, with Operation Sindoor taking front stage on the Kartavya Path.

Top national leaders and prominent foreign visitors joined the festivities, which had as their subject 150 years of "Vande Mataram." About 10,000 distinguished guests saw the parade, which combined military might with cultural cohesion.At its 77th Republic Day parade on Monday, January 26, 2026, India put military might front and centre. Kartavya Path was transformed into a sweeping display of missiles, armour, mechanised columns, and combat aircraft, with a keen focus on weapon systems related to Operation Sindoor, the high-intensity military operation carried out in May of last year.The BrahMos supersonic cruise missile, Akash air defence system, Suryastra rocket launcher, and Arjun Main Battle Tank were among the major armament systems on exhibit at the start of the military demonstration, which emphasised India's focus on battlefield readiness and domestic defence manufacturing. A large portion of the equipment on exhibit was either used in Operation Sindoor, the confrontation with Pakistan that took place from May 7–10, or it was directly inspired by lessons learnt.A tri-services tableau featuring replicas of key weapon systems used during the operation was a big draw. A glass-cased integrated operational command centre served as its focal point, providing a visual representation of Operation Sindoor's execution through the coordinated use of systems including the S-400 air defence system and BrahMos. Akash and S-400 systems were depicted as offering a protective air-defense shield during the fight, while BrahMos missiles were predicted to perform decisive offensive attacks.Lt. General Bhavnish Kumar, a second-generation officer and General Officer Commanding, Delhi Area, led the procession. The Indian Army demonstrated a phased "Battle Array Format," including its airborne component, for the first time. The reconnaissance element included high-mobility reconnaissance vehicles after the historic 61 Cavalry in active battle uniform. Flying in Prahar formation, the domestic Dhruv Advanced Light Helicopter and its armed counterpart Rudra displayed aerial battlefield shaping.

Published 27 Jan 2026 09:07 PM

Why rising demonstrations are centered around India's Aravalli hills

The Supreme Court's redefinition of the Aravalli hills, one of the oldest geological formations in the world, which encompass the states of Rajasthan, Haryana, Gujarat, and Delhi, has sparked protests throughout northern India. Any landform rising at least 100 meters (328 feet) above the surrounding terrain is considered an Aravalli hill under the revised definition, which the court adopted in response to proposals from the federal government. An Aravalli range consists of two or more of these hills within 500 meters of one another, as well as the terrain in between. Environmentalists contend that classifying Aravalli hills according to height runs the risk of leaving many lower, scrub-covered but ecologically significant slopes vulnerable to mining and development. However, according to the federal government, the new definition is intended to increase uniformity and reinforce regulations rather than weaken rights.Protests have erupted across northern India after the Supreme Court redefined the Aravalli hills - one of the world's oldest geological formations spanning the states of Rajasthan, Haryana, Gujarat, and the capital, Delhi.

Published 22 Dec 2025 10:25 PM

Government News

Government News & Trends where we share you the latest updates under the government authorities globally starting from India to USA, China, Russia, Pakistan, UK and many more nations.

France and India Decide To Step Up Their Collaboration In The Southwest Indian Ocean

Building on their joint surveillance missions conducted from the French island of La Reunion in 2020 and 2022, India and France have decided to step up their cooperation in the Southwest Indian Ocean. The two nations applauded the expansion of those exchanges into India's maritime neighborhood as well. Following French President Emmanuel Macron's visit to India for the Republic Day celebrations, the two countries released a joint statement suggesting that these interactions could have a positive impact on the securitization of strategic sea lanes of communication.The leaders emphasized how important the area is to their individual sovereign and geopolitical goals. The importance of their partnership in the region for the development of a free, open, inclusive, safe, and peaceful Indo-Pacific and beyond was also acknowledged. Citing the July 2023 finalized Comprehensive Roadmap for the Indo-Pacific, they conveyed satisfaction with the growing scope of their involvement in the area.The joint statement states that the India-France partnership in the Indo-Pacific area, which encompasses a wide range of bilateral, multinational, regional, and institutional initiatives, particularly in the Indian Ocean Region, has its foundation in the defence and security partnership. According to the statement, PM Modi and French President Macron promised to revive trilateral cooperation with Australia, strengthen their relationship with the UAE, and look into establishing new ones in the area.The two leaders requested that their governments come up with specific project ideas after realizing the value of cooperative and multilateral efforts in promoting human welfare, resilient infrastructure, innovation, and connectivity in the region as well as sustainable economic development. In the joint statement, the two leaders also demanded that the Indo-Pacific Triangular Development Cooperation Fund be established as soon as possible to help with the expansion of green technology development in the area. They decided to look into ways to coordinate Pacific-wide economic initiatives and programs. The French Development Agency was acknowledged by both leaders for its work in India. The two leaders talked about how the India-Middle East-Europe Corridor (IMEC) was introduced in September 2023 in Delhi, outside of the G20 Summit. Prime Minister Modi received praise from President Macron for spearheading this momentous project. Both leaders concurred that this project would be extremely important strategically and would improve the potential and robustness of the energy and trade flows between Europe, the Middle East, and India.The project's Special Envoy, President Macron, was duly appointed, a development that Prime Minister Modi welcomed. The two leaders also recalled talking about other connectivity projects that would connect Southeast Asia to the Middle East and Africa during their July summit in Paris, and they decided to look into particular projects. PM Modi and President Macron reaffirmed their call for effective multilateralism that is reformed in order to address urgent global challenges, maintain a just and peaceful international order, and get the world ready for new developments, particularly in the economic and technological spheres. PM Modi and President Macron reaffirmed their call for effective multilateralism that is reformed in order to address urgent global challenges, maintain a just and peaceful international order, and get the world ready for new developments, particularly in the economic and technological spheres. France reaffirmed its unwavering support for India's UNSC permanent membership. The two leaders decided to have more in-depth discussions about how to govern the use of the veto in the event of mass atrocities. The two leaders concurred that the Paris Global Financing Summit and the G20 Summit in Delhi had highlighted the necessity of reforming Multilateral Development Banks to make them larger, better, and more efficient in order to be able to address the related issues of climate change and development in developing and least developed nations.

Prime Minister Benjamin Netanyahu calls the accusation of genocide against Israel "outrageous

The accusation of genocide made against Israel, according to Israeli Prime Minister Benjamin Netanyahu, is "outrageous" and "decent people everywhere should reject it." In response to South Africa's genocide claim against Israel being rejected by the International Court of Justice (ICJ), the Israeli Prime Minister declared, "The charge of genocide levelled against Israel is not only false, it's outrageous, and decent people everywhere should reject it." Speaking on the eve of International Holocaust Remembrance Day, Prime Minister Netanyahu declared, "Never Again." Israel will not give up its defense of itself against the murderous terrorist group Hamas."According to him, Israel's sacred commitment to upholding international law and continuing to defend "our country and defend our people" are both unwavering. Israel has the inherent right to self-defense, just like any other nation. It is obvious discrimination against the Jewish state to attempt to deny Israel this fundamental right, and it was rightly rejected." The International Court of Justice in the Hague on Friday ordered Israel to 'take all measures' to prevent genocide in Gaza. However, the court did not order that a ceasefire be implemented.The court voted 15 to 2 in favor of its decision. Israel was also mandated to submit a report to the court within a month. Netanyahu, the prime minister of Israel, stated: "On October 7, Hamas perpetrated the most horrific atrocities against the Jewish people since the Holocaust, and it vows to repeat these atrocities again and again and again." He declared that Israel is not fighting Palestinian civilians, but rather Hamas terrorists. "We will continue to facilitate humanitarian assistance, and to do our utmost to keep civilians out of harm's way, even as Hamas uses civilians as human shields."

Will Use Arrow To Hunt Lion: Bilawal Bhutto Warns Nawaz Sharif Before Pakistani Elections

As he vowed to hunt the "Lion" with "Arrow," Pakistan Peoples Party chief Bilawal Bhutto-Zardari poked fun at the leaders of the Nawaz Sharif-led PML-N party for not trying to win the polls on February 8 because they believed the result was "fixed" in their favor. Speaking at a rally in Multan, the 35-year-old former foreign minister—the scion of a family that produced two prime ministers for the country—said that voting for the Pakistan Peoples Party (PPP) was the only way to stop Sharif and his allies from plundering the nation.According to Bhutto-Zardari, leaders of the Pakistan Muslim League-Nawaz (PML-N) did not leave their homes and anticipated winning the election without making an attempt to engage with voters, believing they had "fixed the match," but this is untrue. She went on to say that the PPP and its allies would work together to hunt the "Lion" with the "Arrow." The PML-N's poll symbol is the lion, while the PPP's is the arrow. Separately, Bilawal invited Sharif to a candid discussion about the issues confronting the nation in a post on X."[International norms dictate that] the PML-N candidate (Nawaz Sharif) should come forward and engage in a debate with me as a PPP candidate running for the PM post [in the upcoming general elections]," he said on the official X account. Bilawal was announced as the party's nominee for prime minister in the upcoming general elections earlier this month. "I extend an invitation to Nawaz Sharif, the PML-N candidate, to participate in a debate with me on any day before February 8," stated Bilawal.He claimed that in every country, candidates for president and prime minister take part in televised debates, giving the public vital information about their platforms. "Transparency is essential for a knowledgeable electorate prior to the election," he continued. At the Multan rally, Bilawal vowed to bring the nation together and address public issues, such as the security and economic conditions, while criticizing traditional political leaders for fomenting division and hatred for their own personal gain. He attacked rival political parties for their disregard for the issues facing the nation and their narrow concentration on acquiring power.In an apparent jab at Sharif, Bilawal stated, "Politicians who have held the Prime Minister's Office thrice are angling for the chair for a fourth time." According to Bilawal, the former three-time prime minister was uninterested in addressing the urgent problems that the populace was facing. He chastised the PML-N for failing to even release its manifesto. In addition, he said that the PML-N leaders were attempting to mimic the PPP's platform.

Supreme Court to Have Chief Justice Lead Special Ceremonial Bench as it Turns 75

New Delhi: The Supreme Court will celebrate its 75th anniversary tomorrow with a special ceremonial bench. The composition of the bench will be set up to replicate the Supreme Court's inaugural session on January 28, 1950. Sources claim that Chief Justice of India DY Chandrachud is leading the first-ever assembly of this ceremonial bench. Prior to the start of the ceremonial sitting, Prime Minister Narendra Modi will take part in the program.The Chief Justice Chandrachud's courtroom will house the ceremonial bench. There will be attendance from all 34 Supreme Court justices, including Chief Justice Chandrachud. Chief Justices of all 25 high courts will be present, as was the case in 1950. The meeting will be broadcast live online. According to sources, the purpose of the ceremonial sitting is to reassure the public that the judiciary will always act as the Constitution's guardian.To finalize tomorrow's event, sources said Chief Justice Chandrachud held consultations and examined pictures of the Supreme Court's original bench from 1950. Judges of the high courts had previously sat on the same bench as the Supreme Court. Therefore, the bench has been ready to hold the 25 Chief Justices of the High Court, but only in their capacity as judges, for tomorrow's event, since all 34 Supreme Court judges will be seated on it in Chief Justice Chandrachud's courtroom.The court registry states that the livestream will run for thirty minutes. The event is expected to showcase digital initiatives taken by the Supreme Court under Chief Justice Chandrachud's leadership.The programme will include the inauguration of the Supreme Court's new website.

Entrepreneurship World Cup 2024 Malaysia Final Officially Announced

Kaula Lampur, Malaysia – In a momentous announcement at the RCEP Tech Forum, the Steering Committee members of the Entrepreneurship World Cup (EWC) Malaysia unveiled the details for the highly anticipated EWC Malaysia 2024 Final. The announcement was made by the Management Committee members, Raffles Chan and Zentrix Chiu, who provided a brief introduction to the Global Entrepreneurship Network and the rich history of the Entrepreneurship World Cup global final. The Steering Committee members present at the event included Herman Syah Abdul Rahim, Chief Investment Officer, Kumpulan Modal Perdana Sdn Bhd (KMP), Arsalaan (Oz) Ahmed, Chairman, mmob, and Melissa Chin representing Noor Amy Ismail, Chief Operating Officer, Malaysia Venture Capital Management (MAVCAP). The distinguished committee members discussed their crucial roles in EWC and highlighted the competition's significance for Malaysia. They emphasized how EWC contributes to fostering a robust economy, generating employment, and attracting innovation to the country. “EWC is not merely a contest, it is a catalyst for economic development, job creation and innovation. The innovations that will emerge from this competition have the potential to revolutionize industries, attract investments, and position our country as a leader in the respective sector.”, said Herman Syah Abdul Rahim“The EWC Malaysia provides a unique opportunity to profile Malaysian companies at an idea, early and growth stage to a global audience of potential clients and investors. The EWC Malaysia also fosters the growth of the Malaysian entrepreneurial eco-system and therefore also supports innovation and potential economic growth for the country.”, said Arsalaan (Oz) Ahmed.“As the largest Venture Capital in the country, we’re responsible to continue enhancing and strengthening our VC ecosystem. Bringing EWC to Malaysia is one of our initiatives in charting our future VC ecosystem globally.”, said Noor Amy Ismail. Karunjit Kumar Dhir, a Partner at Kuber Ventures and another member of the Steering Committee, was unable to attend the event. However, he extended his best wishes to the team for the successful launch of the EWC Malaysia 2024 Final.The EWC 2024 Malaysia Final promises to be a showcase of entrepreneurial talent and innovation, providing a platform for startups to gain international recognition and support. The event aims to bolster Malaysia's position in the global startup landscape, fostering economic growth and establishing the country as a hub for entrepreneurial excellence.Swethal Kumar, CEO of Startupscale360, expressed enthusiasm about being the proud national organizer of the Malaysia edition. He stated, "We are fully committed to making the Malaysian ecosystem more vibrant with the support of key enablers of the startup ecosystem. Our goal is to create more employment opportunities, attract international startups to the Malaysian market, bring forth innovations, and expand the business of Malaysian startups to the global market through the Entrepreneurship World Cup. It's more than just a competition; it's a golden opportunity to showcase innovative ideas on a global stage."

In Jaipur, French President Macron to explore pink citys living past

French President Emmanuel Macron will kick-start his two-day trip to India on Thursday by visiting Jaipur's stunning hilltop fort of Amber, iconic Hawa Mahal and astronomical observation site of Jantar Mantar. Macron will be the chief guest at the 75th Republic Day celebrations on January 26 at Delhi's Kartavya Path that would make him the sixth leader from France to grace the prestigious annual extravaganza. In his nearly six-hour stay in Jaipur, Macron will also join Prime Minister Narendra Modi in a road show before the two leaders hold wide-ranging talks at luxury hotel Taj Rambagh Palace on all key aspects of bilateral India-France ties and various geopolitical upheavals. In Jaipur, President Macron will visit Amber Fort, Jantar Mantar, Hawa Mahal, besides participating in a road show, officials said, refusing to elaborate further. The French president's aircraft is scheduled to land at Jaipur airport at 2:30 PM on Thursday and he will depart for Delhi at around 8:50 pm, according to the Ministry of External Affairs.The road show is scheduled to start at Jantar Mantar area at 6 pm while Modi and Macron are set to begin their talks at 7:15 pm. Ways to boost bilateral cooperation in a range of areas, including digital domain, defence, trade, clean energy, youth exchanges, easing of visa norms for Indian students are set to be the focus of the talks, sources said.

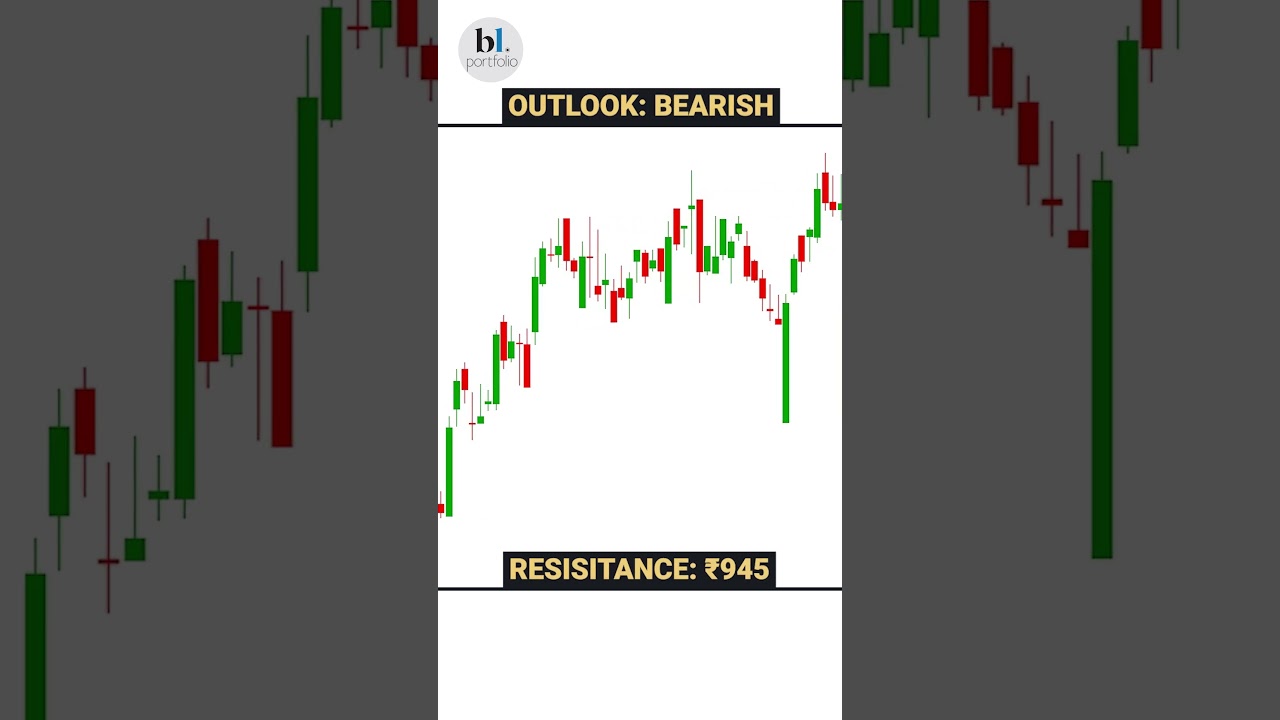

Market Outlook for 25 January 2024

Our markets witnessed high volatility ahead of the F&O expiry day. Nifty sneaked below 21200 mark during the day, but it recovered sharply towards the end and closed above 21450 with gains of about a percent from previous day’s close. Nifty Today: Nifty has corrected sharply in last few days from the high of 22124 to sub-21200 levels. The volatility has increased recently and when the range is broad, the 40-day EMA becomes an important level for the short term. This average support is placed around 21200 and the Nifty index has managed to recover and close well above this support in Wednesday’s session. Although the daily RSI remains negative, the readings on the hourly charts have given a positive crossover from the oversold zone and hence, we could see a pullback move in next few sessions. Thus, although the intraday volatility could remain high, the index can see some pullback towards 21600-21700 zone while 21300-21200 would be seen as immediate support. Traders are advised to trade with a stock specific approach for a while.

Indian Railway Finance Corporation share price Today Live Updates

Indian Railway Finance Corporation Share Price Today : The last day of trading for Indian Railway Finance Corporation saw an open price of ₹164.18 and a close price of ₹161.48. The stock had a high of ₹173.14 and a low of ₹150.81. The market capitalization for the company is ₹224,595.34 crore. The 52-week high for the stock is ₹160.89, while the 52-week low is ₹25.45. The BSE volume for the day was 30,763,279 shares.Disclaimer: This is an AI-generated live blog and has not been edited by LiveMint staff.Indian Railway Finance Corporation share price NSE Live :Indian Railway Finance Corporation trading at ₹174.21, up 1.37% from yesterday's ₹171.86. The stock price of Indian Railway Finance Corporation (IRFC) is currently ₹174.21, with a percent change of 1.37 and a net change of 2.35. This indicates that the stock has seen a slight increase in value. However, without further information, it is difficult to determine the overall trend or significance of this change.

Share Market Highlights: Sensex, Nifty close around 1% up; Broader markets, sectoral indices rallied

Sensex Today | Share Market Highlights: After a bout of choppy trading, both the benchmark indices consolidated in the green after opening in the red. Although they had dipped in the negative zone a few times through the day.Stocks gained as investors rewarded companies for positive earnings updates and as China’s latest move to stimulate its economy boosted resources shares.Europe’s Stoxx 600 index climbed 0.8% as mining stocks jumped the most in almost six weeks after the People’s Bank of China said it would cut the reserve requirement ratio for banks on Feb. 5. The move should boost the economy by freeing up liquidity for customer loans and bond purchases. US equity futures gained, led by tech stocks, after Wall Street set fresh closing highs on Tuesday. Asian stocks advanced, with Chinese shares traded in Hong Kong extending their rally after the stimulus news. Japanese government bond yields and bank stocks jumped Wednesday as investors decided that monetary policymakers are on track to scrap negative interest rates in the near term after all.As traders increased bets that the Bank of Japan will push ahead in the next few months with its first rate hike since 2007, 10-year note yields climbed as much as 10.5 basis points. Shares of Japanese banks, who have struggled through decades of deflation, rose on expectations higher interest rates will improve their lending margins.Elsewhere, the timing and extent of expected Federal Reserve rate cuts this year have dominated markets in recent weeks with less attention paid to Japan’s central bank. That left economists looking more bullish over the BOJ’s looming move than market players. After a day of choppy trading, both the benchmark indices ended in the green, around 1% above the previous day's close, after they had opened in the red.At close, Sensex was up 689.76 points, or 0.98%, at 71,060.31, Nifty was up 215.15 points, or 1.01%, at 21,453.95.Broader market indices also closed up 1%, whereas among sectoral indices, only the Nifty Private Bank ended the day in the red.Global shares rose on Wednesday, fuelled by positive tech earnings and optimism Chinese authorities will offer support to its stock markets, while the dollar showed resilience on growing expectations the U.S. Federal Reserve won't rush to cut rates.European stocks climbed 0.8%, with tech stocks adding over 3.6% to their highest in two years. Investors are also focused on manufacturing purchasing managers' index (PMI) figures - seen as a good gauge of economic health - from the euro zone, Germany, France and Britain later in the day.The European Central Bank (ECB) meets on Thursday and is widely expected to keep rates unchanged - though traders are pricing in as much as 130 basis points of interest rate cuts this year. Wall Street was set to gain, with e-mini futures for the S&P 500 up 0.4% as investors focused on a slew of earnings. The yield on 10-year U.S. Treasury notes was last at 4.097%, while the two-year Treasury yield, which typically moves in step with interest rate expectations, was at 4.314%.Markets are now pricing in a 47% chance of a rate cut in March from the Fed, according to the CME FedWatch tool, compared to the 88% chance of a rate cut priced in a month earlier.The MSCI world equity index, which tracks shares in 47 countries, gained 0.3%. The MSCI's broadest index of Asia-Pacific shares outside Japan gained 1%. Still, the index is down around 4.7% so far this month.After a bout of choppy trading, both the benchmark indices consolidated in the green after opening in the red. Although they dipped in the negative zone a few times through the day.At 3 pm, Sensex was up 683.54 points, or 0.97%, at 71,054.09, Nifty was up 211.30 points, or 0.99%, at 21,450.10.

Share Market Highlights 24 January 2024:

Sensex, Nifty updates on 24 January 2024: India’s equity markets are volatile on Wednesday. The BSE Sensex rose 689.75 pts or 0.98% to close at 71,060.31. The NSE Nifty jumped 215.15 pts or 1.01% to close at 21,453.95. Analysts anticipated sustained selling pressure from foreign portfolio investors, emphasizing the significance of upcoming results and heightened volatility during the monthly F&O settlement. Siddhartha Khemka, Head of Retail Research at Motilal Oswal Financial Services, highlighted caution in global sentiments due to Fitch Group’s warning about the impact on South Asian economies and increased hostilities in the Red Sea. Technical analyst Pravesh Gour noted Nifty’s breakdown, signalling potential testing at 50-DMA at 21000, while Bank Nifty faces hurdles and support challenges. Market Update: Sensex surges 690 points to reclaim 71k leve Equity benchmark indices Sensex and Nifty rebounded sharply by one per cent on Wednesday after sliding for the past two sessions, propelled by bargain hunting in metal, commodity, and telecom stocks. Currency Market Live Updates: Rupee ends slightly higher, aided by yuan’s uptick, dollar’s slip. The rupee ended marginally higher on Wednesday, aided by a slight uptick in the offshore Chinese yuan and a pullback in the dollar index.The rupee ended at 83.1225 against the US dollar, compared with its close at 83.15 in the previous session.Bharat Dynamics reported its standalone net profit for the quarter ended December 2023 at ₹135.03 crore as against ₹83.74 crore in December 2022. The stock closed at ₹1,696.50 on the NSE, up by 1.61%.“The market rebounded from yesterday’s sell-off taking cues from global peers. The sentiment was reinforced by the PBOC’s 0.5% cut in reserve ratio to boost growth and financial liquidity. However, overall sentiment is muted as concerns persist on FIIs selling due to premium valuations in India and below expectation Q3 earnings so far.”

Republic Day 2024: Over 1,100 personnel awarded Gallantry and Service medals. Details here

On the occasion of the Republic Day 2024, a total of 1132 personnel of Police, Fire Service, Home Guard and Civil Defence and Correctional Service have been awarded Gallantry and Service Medals, the Ministry of Home Affairs said in a statement on 25 January. Of these 1,132 personnel, President's Medal for Gallantry (PMG) has been awarded to two personnel, Medals for Gallantry (GM) to 275, President's Medals for Distinguished Service (PSM) to 102 and Medal for Meritorious Service (MSM) to 753. "On the occasion of the Republic Day, 2024, a total of 1132 personnel of Police, Fire Service, Home Guard and Civil Defence and Correctional Service have been awarded Gallantry and Service Medals," the Ministry of Home Affairs (MHA) said in a statement. Among the majority of the 277 Gallantry Awards, 119 personnel from Left-wing extremist-affected areas, 133 personnel from the Jammu and Kashmir region and 25 personnel from other regions are being awarded for their gallant action. Out of 277 gallantry medals, 275 GM have been awarded to 72 personnel from J&K Police, 18 personnel from Maharashtra, 26 personnel from Chhattisgarh, 23 personnel from Jharkhand, 15 personnel from Odisha, 8 personnel from Delhi, 65 personnel from CRPF, 21 personnel from SSB and the remaining personnel from the other states, Union Territories (UTs) and Central Armed Police Forces (CAPFs). Out of 102 President's Medals for Distinguished Service (PSM), 94 have been awarded to Police Service and four each to Fire Service and civil guard and Home Guard Service. Out of 753 Medals for Meritorious Service (MSM), 667 have been awarded to Police Service, 32 to Fire Service, 27 to Civil Defence and Home Guard Service and 27 to Correctional Service. As per the MHA, the government has taken many steps in recent years to rationalise and transform the entire award ecosystem of various awards. In this regard, sixteen gallantry and service medals (for police, fire service, home guard and Civil service) have been rationalised and merged into four medals: the President's Medal for Gallantry (PMG), Medal for Gallantry (GM), President's Medal for Distinguished Service (PSM), and the Medal for Meritorious Service (MSM).

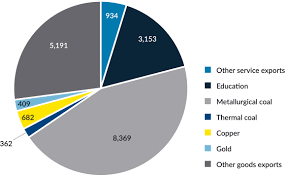

Indian investments key target of Western Australia’s minerals reforms

NEW DELHI : The state of Western Australia has implemented a series of reforms aimed at attracting investments in minerals and resources, including from India. In an interview with Mint, Western Australia deputy premier Rita Saffioti said there was much interest for greater investments and collaborations between Indian and Australian firms in the rare earths sector. The approvals reforms are aimed at supporting projects that assist with decarbonization, she said. Western Australia has been in focus for its supply of key critical minerals including lithium, nickel and cobalt, as well as rare earth metals, which are used in smartphones, computers, batteries and electronics. Australia accounts for roughly half of the world’s lithium production and has a similarly important position in cobalt production. It is also the fourth-largest rare-earths producer. Western Australia has attracted investments from Indian state-owned firms including NMDC Ltd. Indian mines minister Prahlad Joshi visited the state in 2022, following which the Indian government announced that a bilateral critical minerals investment partnership between the two sides had identified two lithium projects and three cobalt projects. “Investments under the partnership will seek to build new supply chains underpinned by critical minerals processed in Australia, that will help India’s plans to lower emissions from its electricity network and become a global manufacturing hub, including for electric vehicles," India’s mines ministry had said in a statement. Saffioti said her visit to India was also aimed at promoting Western Australia as an investment destination for private Indian companies. “There are opportunities for Indian investment in Western Australia through offtake agreements for key battery minerals," Saffioti said.

Amber, Titagarh Rail Systems in deal for train components business

Both TRSL and Amber group, via its wholly-owned subsidiary Sidwal Refrigeration Industries Pvt Ltd, will invest approximately ₹120 crore each to obtain around 50% each in the SPV.The SPV will set up a new facility in India to manufacture critical railway components and subsystems used in the manufacture of railway and metro coaches and will also make fresh equity investments into Titagarh Firema. Titagarh Firema SpA, Italy, is an associate company of the Titagarh group where govt of Italy is also an equity stake holder. The new SPV will also invest in Titagarh Firema while government of Italy will invest in the entity for which it has already taken approval from Invitalia, the Italians government’s investment arm. Under the agreement, Firema will grant Sidwal, Titagarh Rail as well as the SPV a preferred supplier status and right of first refusal (ROFR) for all their products.Titagarh Rail is involved in the railway rolling stock space for both freight and passenger rolling stocks. Apart from being an established railway wagon and metro coach manufacturer, it is also currently executing the projects of Vande Bharat trains, Surat, Ahmedabad, Pune metros as well as executing its first export order for passenger rail components received from Firema. Titagarh is targeting a capacity of almost 800-850 coaches per year in the coming years. The Amber group is a diversified B2B company having three business verticals: consumer durables, electronics and railway subsystems and mobility. Sidwal, an Amber group company, has emerged as a leader in the train air conditioner market and has also signed a technology licensing agreement with Ultimate group to manufacture passenger coach doors and gangways. Sidwal is also planning to enter the European market for its products portfolio, a company statement said.The strategic partnership in Firema will not only facilitate Sidwal’s entry into the European market, but will also give Sidwal a preferred access to Firema’s own demand, the statement added. Both companies are investing to grow capabilities and capacities for various products that can be exported to Europe such as train mechanical and electrical components by TRSL and HVAC, doors, gangways and pantry systems by Sidwal. Firema is one of the largest and reputed designers and manufacturers of passenger trains in Italy and has executed marquee projects in Italy and other parts of Europe. Firema has an order book of almost euro 1 billion for producing new coaches and has an existing capacity to produce upwards of 240 coaches per year and has plans to double this capacity.

Deal values in India plunge to $66 billion in 2023, investors cautious, reports Grant Thornton

There was a significant drop in deal values in India for the year 2023, reaching $66 billion, marking a decrease of over 50 percent, a recent report from consultancy firm Grant Thornton Bharat found. Released on January 19, the report found a decline of over 20 percent in deal volume, with 1,641 deals compared to the previous year. Shanthi Vijetha, a partner at Grant Thornton Bharat, pointed out several factors contributing to this. The lack of liquidity in international markets, volatile market conditions, and cautious investor sentiment were identified as key hindrances to deal activities throughout 2023."While India's focus on sustainability and environmental responsibility positions it as an attractive hub for global economic opportunities, overcoming challenges such as currency strength and global instability is crucial," added Vijetha. Merger and Acquisition Impact The report indicates a significant impact on merger and acquisition (M&A) deal values, which plummeted by 72 percent to $25.2 billion across 494 transactions. Outbound M&As were particularly affected, dropping to $3.2 billion from $17.9 billion in the previous year. The sluggish M&A trend in the first half of 2023 recorded deal values of only $7.8 billion. The largest transaction during this period was Suraksha Group's $2.5 billion acquisition of Jaypee in the real estate sector. Private Equity and IPO Trends On the private equity (PE) front, 2023 witnessed a 23 percent decline in both deal volume and value, with 1,045 deals amounting to $27.4 billion. The most significant deal in this category was Temasek Holdings' $2 billion investment in Manipal Health Enterprises.

Regardless of the president, Canada must deal with a more protectionist United States: former envoy

"No matter who wins the election in November, Canada needs to get ready for a more isolationist and protectionist U.S., according to the country's ambassador to the United States for the majority of Donald Trump's administration. David MacNaughton stated in an interview with Global News, ""What you've got down there is a challenging situation where we need to be able to demonstrate to them that we are a reliable, good friend and good partner."" ""The last time, we spent a lot of time demonstrating to them our importance from an economic standpoint.""Trump defeated Nikki Haley in the Republican New Hampshire primary Tuesday night with 54 per cent of the vote, putting him one step closer to securing the GOP nomination. Trump, according to Prime Minister Justin Trudeau, adds a level of ""unpredictability"" to ties with the United States." No matter who wins in November, MacNaughton emphasized how crucial it is for Canada to sell its economic friendship by offering to supply vital minerals and hydroelectricity, but more importantly, by sharing how it can work with the United States on priorities. "I believe that this time, even more importantly, is going to be to assist them with some of the things that they're most concerned about, which include drugs entering the country, illegal immigration, and possible terrorism," MacNaughton remarked.A Jan. 15 Angus Reid poll indicates that 53% of Canadians believe a Biden win would be better for the country's economy, while only 18% believe a Trump win would be advantageous. In anticipation of the upcoming American administration, Trudeau declared that he had assigned current Ambassador Kirsten Hillman, Industry Minister Francois-Philippe Champagne, and Trade Minister Mary Ng to spearhead a "Team Canada" strategy in their dealings with the United States. According to MacNaughton, Canada frequently brings up a list of demands during these talks, but it frequently pays little attention to our largest trading partner. It resembles spending all of your time talking about yourself while out on a date. Most likely, it will be your one and only."Although you can't always meet everyone's needs, you should consider what they need and see what we can do to meet it."

Chinas changes to its monetary policy to support economic recovery

A number of monetary policy changes were announced by the People's Bank of China (PBOC) on Wednesday with the goal of boosting liquidity and encouraging national economic expansion. Reducing the reserve requirement ratio (RRR) is one of the PBOC's primary actions. The RRR is the amount of cash that banks are required to hold as reserves. The PBOC will lower the RRR by 0.5 percentage point, effective from February 5, 2024. This move will inject 1 trillion yuan ($139.45 billion) into the market, thereby increasing liquidity. Beginning on January 25, 2024, the PBOC will reduce the re-lending and rediscount rates by 0.25 percentage points, from 2 percent to 1.75 percent, in addition to the RRR reduction. It is anticipated that this cut will lower social financing's overall cost, accelerating economic recovery. The announcement of these policy adjustments has had a positive impact on the Chinese stock market. Following the news, the Shanghai Composite Index climbed by 1.80 percent, while the Shenzhen Component Index and the ChiNext Index increased by one percent and 0.51 percent, respectively.JLL Greater China's chief economist and head of research, Bruce Pang, emphasized the PBOC's dedication to a steady and exacting monetary policy. The goals are to support credit allocation to the real economy, guarantee stable liquidity in the banking system, and lower funding costs for financial institutions. In spite of the challenges posed by the global economy, financial institutions and markets in China remain stable, as PBOC Governor Pan Gongsheng reassured.The PBOC plans to enhance its financial risk monitoring and assessment capabilities. It seeks to create a system for resolving financial risks that strikes a balance between accountability and authority. This initiative reflects the PBOC's commitment to managing financial risks and maintaining stability in the face of global economic challenges. The PBOC plans to use a range of monetary policy instruments in the future to ensure that there is enough liquidity. Aligning the money supply and social financing with targets for price level and economic growth is the aim. Additionally, the PBOC wants to enhance financial services for the actual economy, especially by helping small and private companies. Zhu Hexin, deputy governor of the PBOC and head of the State Administration of Foreign Exchange, predicts that the stability of China's cross-border capital flows will further improve in 2024. The current account is expected to maintain a reasonable surplus, with an increase in foreign capital inflows under the capital account.The recent monetary policy adjustments by the PBOC reflect China's proactive approach to navigating its economic trajectory amid global uncertainties. By reducing the RRR and cutting re-lending and re-discount rates, the PBOC aims to enhance liquidity, support economic growth, and ensure stability in the banking system.

Chinese envoy finds it unacceptable that the Israeli leadership is rejecting the two-state solution.

" A Chinese envoy stated on Tuesday that the Israeli leadership's rejection of the two-state solution is intolerable. Chinese permanent representative to the UN, Zhang Jun, stated that the two-state solution is the only practical means of bringing peace to Palestine and Israel and that it is also a serious prerequisite for the execution of pertinent Security Council resolutions. Chinese envoy stated on Tuesday that the Israeli leadership's rejection of the two-state solution is intolerable. Chinese permanent representative to the UN, Zhang Jun, stated that the two-state solution is the only practical means of bringing peace to Palestine and Israel and that it is also a serious prerequisite for the execution of pertinent Security Council resolutions.The remarks made by the Israeli leadership last week, which rejected the two-state solution and denied Palestine the right to become a state, give us great concern. This is intolerable,"" he declared during a high-level Security Council open discussion. Chinese envoy stated on Tuesday that the Israeli leadership's rejection of the two-state solution is intolerable. The process of establishing an independent Palestinian state must be final. China is in favor of Palestine's immediate full membership in the UN as a first step in the process. Under the current circumstances, the Security Council needs to send a clear and unequivocal signal, reaffirming the urgency of the two-state solution as the sole feasible way out, he said. Chinese envoy stated on Tuesday that the Israeli leadership's rejection of the two-state solution is intolerable. Zhang stated that for the time being, an immediate cease-fire must be given top priority. Extended hostilities will only increase the death toll and further distance us from peace. An instantaneous ceasefire is a necessity for all parties, not just one specific party. He stated that it is a fundamental requirement for achieving peace, freeing hostages, extending humanitarian aid, and saving lives. Israel needs to stop destroying Gaza and launching indiscriminate military attacks on it right away. He said that all pertinent members of the international community ought to use diplomacy to encourage an instant ceasefire.Chinese envoy stated on Tuesday that the Israeli leadership's rejection of the two-state solution is intolerable. All possible measures should be taken to stop the situation from spreading to the Red Sea and the surrounding areas while advocating for a ceasefire in Gaza. He said that China urges all sides to use caution and refrain from taking any steps that might cause the tension to rise. Zhang demanded that steps be taken to remove barriers that stand in the way of the expansion of aid to Gaza. The full implementation of Security Council Resolutions 2712 and 2720 is imperative. And Israel needs to help with that 100%. He stated that in order to guarantee safe, prompt, and unimpeded humanitarian access to Gaza, the Security Council should be prepared to act further. "

Why Is Every Years Republic Day Parade Celebrated Along the Kartavya Path?

India is preparing to commemorate its 75th Republic Day on January 26, 2024, a momentous occasion in the history of the country. It is the day that India became a republic in 1950 and the recently adopted Constitution went into effect. The spectacular Republic Day Parade on Kartavya Path (formerly Rajpath) in New Delhi serves as the centerpiece of the holiday celebrations. With marching contingents from all three branches of the armed forces, eye-catching displays of military hardware, and exhilarating performances by motorcycle teams, this magnificent event highlights India's military might. India has extended an invitation to French President Emmanuel Macron to join in the Republic Day festivities this year.Why is Kartavya Path the site of Republic Day celebrations? Kartavya Path, formerly known as Rajpath, is a significant historical route that runs from Rashtrapati Bhavan to India Gate. It was a major player in the Indian independence movement. Originally named Kingsway, this ceremonial boulevard is the main thoroughfare in New Delhi, which was established in 1911 when the British Raj moved its capital from Calcutta (now Kolkata). Kingsway was renamed Rajpath shortly after independence, and Queensway, which ran parallel to it, was renamed Janpath.Rajpath has experienced colonial rule, witnessed the dawn of independence, and basked in the glory of a free, democratic nation over the course of the last seven decades, from hosting yearly Republic Day celebrations to hosting the event. The path represents India's transition from colonial domination to independence as a democratic republic. When was Kartavya Path renamed as Rajpath? In September 2022, "Rajpath" was renamed "Kartavya Path," and PM Modi soon after inaugurated it as a component of the renovated Central Vista Avenue. The government claimed that it represented a change from the Rajpath, which served as a symbol of power in the past, to the Kartavya Path, which serves as an example of public ownership and empowerment. PM Modi declared in his speech following the inauguration that Kingsway, also known as Rajpath, a "symbol of slavery," has been permanently erased and consigned to the past. The Republic Day Parade's schedule and location in 2024 Time: 10:00 am (Commencement time: 9:30 am) Location: The procession begins at Raisina Hill, close to Rashtrapati Bhavan, and travels more than five kilometers along the Kartavya Path, passing India Gate en route to the Red Fort. There are 77,000 seats available at the venue, 42,000 of which are set aside for the general public.