Top Trending Acquisitions & Mergers News & Highlights

Invest in six mid-cap stocks with up to 47% upside potential from various sector groups to learn to deal with volatility.

These are unusual times, and they probably will be for a while. Think about the events of the last five days alone.The US Supreme Court overturned President Trump's tariff policy on Friday, Day One. The unpredictable Trump responded by enacting a 10% import tax on all goods. He increased the fee from 10% to 15% on Day Two, which was within 24 hours. For investors looking for growth potential without the usual volatility of small-cap stocks, mid-cap businesses can offer a sweet spot. These businesses are typically growing, gaining market share, and innovating, all of which can result in a significant increase in stock price.Market research archives

Published 25 Feb 2026 05:51 PM

Mubadala Capital and TWG will purchase Clear Channel Outdoor for $6.2 billion.

According to the business, Apollo Global Management funds have committed to investing preferred equity in the sale, while Mubadala Capital and TWG Global would provide equity financing for the transaction.A 45-day "go-shop" period is included in the agreement, according to Clear Channel Outdoor, which enables the business to request alternative takeover offers. Clear Channel Outdoor Holdings announced Monday that it had reached an agreement to be purchased by Mubadala Capital, in collaboration with TWG Global, for a sum of $6.2 billion. According to the agreement, shareholders of Clear Channel Outdoor would get $2.43 in cash per share, which is 71% more than the company's unchanged share price, the statement stated.

Published 10 Feb 2026 05:50 PM

Tax Question: Calculating capital gains tax on the sale of post-merger stock bl-premium-article-image

You originally paid ₹72,800 (700 shares * ₹104 per share) for the shares of Allahabad Bank that you purchased in 2013. After Allahabad Bank and Indian Bank merged in 2020, you were given 80 shares of Indian Bank instead of the initial 700 shares of Allahabad Bank.In 2013, I bought 700 shares of Allahabad Bank at an average price of ₹104. I received 80 shares of Indian Bank following the bank's 2020 merger. What is the price of the shares I must purchase in order to calculate my capital gain or loss if I decide to sell these shares right away?You originally paid ₹72,800 (700 shares * ₹104 per share) for the shares of Allahabad Bank that you purchased in 2013. After Allahabad Bank and Indian Bank merged in 2020, you were given 80 shares of Indian Bank instead of the initial 700 shares of Allahabad Bank.The nature of capital gain shall be Long term capital gain as the period of holding shall be calculated from the original share purchase, and not from the date of merger

Published 22 Dec 2025 10:30 PM

This Diwali, OOH ad sales increase by 20%, while data-driven campaigns increase DOOH share by 24%.

This year's Diwali brilliance extended beyond diyas and fireworks, illuminating billboards, computer screens, and Indian cityscapes. Brands transformed the outdoors into a canvas of color, emotion, and commerce by painting the streets with joyous tales in both Tier-II communities and busy metropolises. The outcome? For the Out-of-Home (OOH) advertising sector in India, this was one of the busiest holiday seasons to date. Due to early holiday planning, daring creative executions, and a swift transition to digital and data-led outdoor solutions, the industry saw impressive double-digit growth as consumer sentiment skyrocketed and advertiser confidence returned in full force.The OOH sector has grown significantly over this holiday season, which is indicative of both the restored vigor in consumer markets and economic optimism. Vaishal Dalal, co-founder of Excellent Publicity, emphasized this momentum and noted that the industry's growth trajectory is still strong. This holiday season, the OOH sector has experienced strong double-digit growth. OOH advertising revenues increased steadily across the country, from ₹4,140 crore in 2023 to ₹4,650 crore in 2024, and are expected to surpass ₹5,200 crore in 2025. The entire OOH ad expenditure increased by more than 15–20% year over year during Diwali, thanks to robust seasonal campaigns in industries including retail, FMCG, consumer durables, automotive, and BFSI."Internal estimates indicate a ~40% YoY increase in Diwali-related OOH bookings at Excellent Publicity, surpassing the industry average," he added. Early festive planning, strong advertiser confidence, and nearly full occupancy across premium billboard sites were credited with this spike.Vikas Nowal, CEO of Interspace Communications, echoed this pattern, stating that the company also experienced a notable Christmas bump. Our OOH company has performed well throughout the Diwali holiday season this year, with a projected 20% increase in sales over the previous year. Higher consumer involvement and greater advertising confidence throughout the festival period are reflected in this uptick," he continued. With companies aiming for both quantifiable engagement and widespread effect, both leaders concur that the OOH medium has become one of the most dependable and prominent options for festive storytelling.

Published 21 Oct 2025 07:55 PM

Acquisitions & Mergers

Acquisitions & Mergers are the latest trend in the globe.

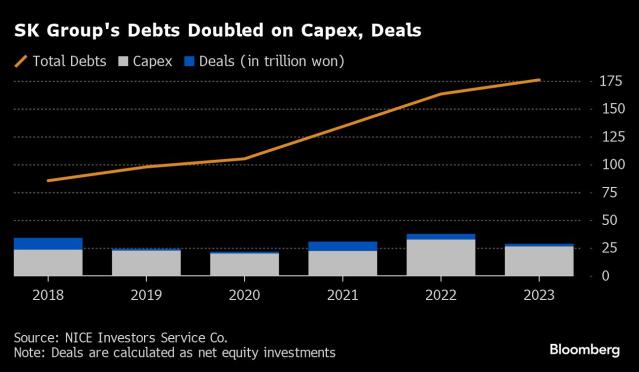

SK Faces the Largest Reorganization in Two Decades Following Deals Spree

(Source: Bloomberg) The issue facing SK Inc. is that, following a $21 billion acquisition binge, the second-largest company in South Korea has grown too large.On Friday, Chairman Chey Tae-won will meet with top executives who oversee $240 billion worth of businesses, including manufacturers of batteries, mobile carriers, and suppliers of chips for artificial intelligence. According to observers, the outcomes might cause the business to undergo its largest restructuring since he assumed leadership more than 20 years ago.A six-year acquisition binge has left the company, according to one estimate, $170 trillion in debt, right before the crown jewel SK Hynix Inc. and its affiliates are set to make historic investments to take advantage of the market for AI memory chips. Chey has a personal stake in the outcome as well because he needs to raise $1 billion to finalize his divorce. Investors anticipate numerous asset sales and mergers.According to Park Ju-gun, president of Seoul-based corporate analysis company Leaders Index, "it's looking pretty bad for SK." "In the last six or seven years, every division under SK Inc. went on an extravagant buying binge to increase its size, and those excessive acquisitions have now made the group unmanageable, while the chairman is engulfed in a divorce."Chey Chang-won, Chey's cousin, is the head of the consultative committee known as SK Supex. Chey will host the meeting via video conference from the United States. The main priorities will be rearranging the portfolio and pursuing "quality growth," according to a statement released by SK on Thursday.SK stated that during the two-day retreat, the executives will also talk about ways to enhance the biotechnology and battery industries, among other things. Around 18% of SK Inc., which oversees more than 200 SK companies through a complex network of cross-shareholdings, is controlled by Chair Chey. The founding of the organization dates back to 1953.Following the Seoul High Court's decision last month to order 63-year-old Chey to pay the largest-known divorce payment in the nation, market expectations for a restructuring have grown. Two days following the ruling, SK Inc.'s shares shot up more than 20% on speculation that the business might raise its price to support the chairman.

IT companies seeking acquisitions to improve their capabilities and revenue

A downturn in global demand is preventing prospects for organic expansion, therefore Indian IT services are relying on acquisitions to drive growth in the face of an urgent need to invest in new skills, particularly in GenAI.Indian information technology (IT) services may be depending on acquisitions to support expansion in the face of an urgent need to invest in more advanced capabilities, particularly in GenAI, as organic growth prospects are further pushed back in an environment of cautious global demand. "Over the next 12 months, there will be a rise in M&A (mergers and acquisitions) activity due to the flat markets for BPO and IT services at the moment. The majority of new purchases will be in sectors that add

Sensex and Nifty are up and are trading in a narrow range close to their all-time highs.

Nifty, Sensex, and Stock Prices LIVE: The benchmark Indian indices, the Sensex and Nifty, began trading higher on Tuesday but remained in a limited range as investors watched for new catalysts, with the indexes close to record highs. The BSE Sensex was up by 0.31 percent, or 242 points, at 77,583, while the NSE nifty was up by 0.21 percent, or 49, to 23,587 points. After reaching a new high last Friday, the Nifty finished 0.2% higher on Monday, moving inside a 450-point trading range over the previous ten days. Anand James, Chief Market Strategist at Geojit Financial Services, predicts that there will be little chance of an upside break and that the market will likely consolidate inside a given range. At a certain point, the upward marker is still present, indicating the potential for a deeper decline. DealersStock Market Today | Share Market Live Updates - Get all the latest information on the Indian stock markets, share prices, Sensex, Nifty, BSE, and NSE for June 25, 2024, right here.

Systems and Components India will see a majority acquisition by Kirloskar Pneumatic

In the event that closing modifications and due diligence are completed, the deal is anticipated to be completed within the following three months.A memorandum of understanding (MoU) has been signed by Kirloskar Pneumatic Company Ltd (KPCL), a well-known participant in the air, refrigeration, and gas compressor industries, to purchase a controlling stake in Systems and Components India Private Ltd (S&C). As a result of this calculated maneuver, KPCL will control over 51% of S&C.With over 700 installations throughout India, The S&C is a seasoned player in the industrial refrigeration market, having served important industries including dairy, pharmaceuticals, chemicals, and fertilizers for over 30 years. Their manufacturing facility is situated in the Maharashtra village of Patgaon, close to Murbad.The existing promoter and technocrat of S&C, V Sundararajan, will keep a share in the business and be instrumental in helping KPCL expand its activities. With the help of the acquisition, KPCL hopes to strengthen its position and increase its presence in related market sectors. Subject to closing adjustments and due diligence, the transaction is anticipated to be completed in the upcoming three months.According to a statement from KPCL, this acquisition is a big step in strengthening its market position and expanding the range of products it offers in the industrial refrigeration space.

Paytm and Zomato are in talks to buy each other's movie and ticketing businesses.

Zomato and Paytm are in negotiations to buy the movie and ticketing businesses, with an emphasis on growing the entertainment market.According to reports, Zomato is in negotiations to buy Paytm's movie and ticketing division. Paytm is a fintech player. This occurs when the fintech company is concentrating on its primary lines of business, which include financial services and payments. The leading meal delivery company is simultaneously trying to capitalize on the expanding demand from customers for entertainment and going out.Zomato disclosed in a BSE filing that it is in talks with Paytm to buy its movie and ticketing division. As per the company's declared strategy of concentrating solely on its four primary operations at now, the aforementioned conversation aims to enhance its Going-out division, according to the meal delivery service. The business has been investing more in its events division. Zomato Entertainment, which specializes in selecting and offering tickets for events including concerts, parties, and festivals, is receiving an investment of Rs ₹100 crore from it.Additionally, it is investing ₹300 crore in its rapid commerce division, Blinkit.

NCLT authorizes the merger of Vistara and Air India.

On Thursday, the National Company Law Tribunal (NCLT) approved the merger of Vistara and Air India.The airlines intend to finish the integration by the end of December, but NCLT has given them an extra nine months to do so, provided they secure all the required licenses from the civil aviation ministry, including security clearances and approvals for foreign direct investment.Plans to unite Singapore Airlines (SIA) and Tata Sons were announced in November 2022. SIA would invest ₹2,059 crore in Air India as part of the merger deal. Following the consolidation, SIA will own 25.1% of Air India's shares. The parties' original goal was to close the deal by March 2024.Plans to unite Singapore Airlines (SIA) and Tata Sons were announced in November 2022. SIA would invest ₹2,059 crore in Air India as part of the merger deal. Following the consolidation, SIA will own 25.1% of Air India's shares. The parties' original goal was to close the deal by March 2024.By the end of this year, Air India hopes to finalize its merger with Vistara. The National Company Law Tribunal (NCLT) Chandigarh branch has finally approved the merger, which was first announced in November 2022.

Nazara Technologies' stock rises 6.22% following the acquisition of a US-based SoapCentral.com

Shares of Nazara Technologies Limited increased by 6.22% following the company's announcement of an expansion through Absolute Sports, a subsidiary. To buy all of the assets of the US-based entertainment content website SoapCentral.com, the subsidiary signed an asset acquisition agreement.According to the corporation, Dan J. Kroll created SoapCentral.Com in 1995, and it quickly became known as a US source of entertainment information, drawing in over 400K monthly visitors. Through this acquisition, the business hopes to strengthen Soap Central for US consumers by utilizing its experience with content scalability and operational techniques."We are thrilled to announce our expansion in the entertainment segment with the acquisition of Soap Central," stated Absolute Sports CEO Ajay Pratap Singh. We have a huge opportunity to expand into other content categories because the entertainment publishing market is more than twice as large as the sports publishing industry (Similarweb, 2024). We acquired Pro Football Network last year to test our hyper-growth and content publication strategies, and we are certain that we can scale Soap Central quickly.

"Nazara Technologies' stock rises 6.22% following the acquisition of a US-based SoapCentral.com "

Shares of Nazara Technologies Limited increased by 6.22% following the company's announcement of an expansion through Absolute Sports, a subsidiary. To buy all of the assets of the US-based entertainment content website SoapCentral.com, the subsidiary signed an asset acquisition agreement.According to the corporation, Dan J. Kroll created SoapCentral.Com in 1995, and it quickly became known as a US source of entertainment information, drawing in over 400K monthly visitors. Through this acquisition, the business hopes to strengthen Soap Central for US consumers by utilizing its experience with content scalability and operational techniques."We are thrilled to announce our expansion in the entertainment segment with the acquisition of Soap Central," stated Absolute Sports CEO Ajay Pratap Singh. We have a huge opportunity to expand into other content categories because the entertainment publishing market is more than twice as large as the sports publishing industry (Similarweb, 2024). We acquired Pro Football Network last year to test our hyper-growth and content publication strategies, and we are certain that we can scale Soap Central quickly.

Lear to Acquire WIP Industrial Automation Strategically in Order to Boost Automation and AI Capabilities

June 3, 2024, SOUTHFIELD, MI /PRNewswire/ -- A definitive agreement has been reached by Lear Corporation (NYSE: LEA), a leader in automotive technology globally for Seating and E-Systems, to acquire WIP Industrial Automation ("WIP"), a privately held systems integrator with headquarters in Spain that specializes in cutting-edge automation solutions for industrial applications. By the third quarter of 2024, the acquisition is anticipated to completion, subject to regulatory clearances and other standard closing conditions.With 25 years of automation experience, WIP has been a trusted Lear supplier. They develop, integrate, and implement state-of-the-art technology to offer bespoke automation solutions for manufacturing applications. WIP provides Lear with robust robotics and AI-based computer vision capabilities, which are critical for productivity, quality, and safety in a contemporary production setting. WIP puts Lear in a more advantageous operating position, enabling the business to more skillfully handle the macroeconomic difficulties of the present, like high wage inflation.This acquisition expands on Lear's previous successful integration of ASI Automation ("ASI"), Thagora Technology SRL ("Thagora"), and InTouch Automation ("InTouch"). It will be the company's newest strategic investment aimed at expanding its global automation and digital capabilities. Lear benefits from a broad range of automation solutions and technical knowledge covering all important aspects of the manufacturing process, thanks to the combined expertise of WIP, ASI, Thagora, and InTouch. This will spur innovation in the creation of next-generation automation technologies.Ray Scott, President and CEO of Lear, stated, "WIP brings valuable manufacturing engineering capabilities that are essential to advancing innovative automation solutions across our global operations." "This acquisition will help Lear achieve its long-term goal of improving our operational excellence and market leadership. We are ecstatic to have the WIP crew join the Lear family.

The merger of equals between Orrstown Financial Services, Inc. and Codorus Valley Bancorp, Inc. has been approved by the shareholders.

SHIPPENSBURG, PA. and YORK, PA (CNN) — The parent companies of Orrstown Bank, Orrstown Financial Services, Inc. (NASDAQ: ORRF) and PeoplesBank, A Codorus Valley Company, Codorus Valley Bancorp, Inc. (NASDAQ: CVLY), each announced today that they had received shareholder approval for the previously announced merger of equals. The merger of Codorus Valley with and into Orrstown, with Orrstown as the surviving corporation (the "Merger"), the Agreement and Plan of Merger, dated as of December 12, 2023 (the "Merger Agreement"), by and between Orrstown and Codorus Valley, and the compensation payable to the named executive officers of Codorus Valley in connection with the merger were approved by the shareholders at a special meeting of shareholders held on May 30, 2024.The president and CEO of Orrstown, Thomas R. Quinn, Jr., stated, "The ratification of our merger by shareholders represents a significant step forward for our merger of equals. The deal was unanimously approved by the shareholder base of each company, which makes Craig and I proud. We anticipate that this will increase shareholder value and open up new prospects for our clients, staff, and communities. The vote today moves us one step closer to offering our esteemed clients better financial services, according to Craig L. Kauffman, President and CEO of Codorus Valley. I can't wait to begin developing our Pennsylvania and Maryland markets into the best community banking franchise. If the customary closing conditions are met, the merger and related transactions are anticipated to close in the third quarter of 2024.Concerning Orrstown A comprehensive range of consumer and business financial services is offered in Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York Counties, Pennsylvania; Anne Arundel, Baltimore, Howard, and Washington Counties, Maryland; and Baltimore City, Maryland by Orrstown Financial Services, Inc. and its wholly owned subsidiary, Orrstown Bank. Along with neighboring counties in Pennsylvania and Maryland, Loudon County, Virginia, and Berkeley, Jefferson, and Morgan Counties, West Virginia, are also included in the company's lending region. Orrstown Bank is an Equal Housing Lender, and the FDIC insures all of its deposits up to the highest amount permitted by law. The common stock of Orrstown Financial Services, Inc. is traded with the ticker code "ORRF" on the NASDAQ Global Select Market.

The Gately Report TD Synnex Partners Cybercriminals Use AI to Trick Them

Cybercriminals are using artificial intelligence (AI) to boost the likelihood of their attacks succeeding, posing a growing threat to TD Synnex partners.Ed Morales, worldwide vice president of security and high-growth business development at TD Synnex, says as much. He spoke with us at the TD Synnex Beyond Security event held in Boston last week.In order to boost development and profitability, TD Synnex presented at the conference how its portfolio of suppliers, which includes the cloud, artificial intelligence, and security, can assist partners in pursuing these high-growth technologies.Morales stated, "You have to be able to defend against those threats because the bad actors are leveraging AI." Additionally, we've observed that AI is widely used in many of the technologies that some of our vendors are implementing. It's quite remarkable. It aims to always be one step ahead.Equipping TD Synnex Partners: According to Morales, many TD Synnex partners may be knowledgeable about network security or more basic security, but they may not be aware of the AI advances that suppliers have incorporated into their products. "There's a convergence now that we're trying to take to market AI around cloud and security, so we've got to be able to be a step ahead of what's happening in the technology market and the environment. And that's not just a North American statement, that is global. One really great thing about this is that our job is to make sure that we curate all of what the vendors are providing and then provide that information to our customers at scale," he said.

OnePlus Open 2 with Snapdragon 8 Gen 4 SoC is expected to launch in Q1 2025.

The company's first folding smartphone, the OnePlus Open, debuted last year with triple back cameras bearing the Hasselblad name and a high-resolution cover display (Read our Review). There are already rumors that a foldable's replacement is in the works. Thanks to a tipster, we now know some additional information regarding the impending foldable. The OnePlus Open 2, which may be a repackaged Oppo Find N5, is rumored to operate on the unreleased Snapdragon 8 Gen 4 SoC.A well-known Weibo tipster named Digital Chat Station (whose username is translated from Chinese) stated that the OnePlus Open 2 is expected to launch in 2025's first quarter. It is rumored to be powered by Qualcomm's upcoming Snapdragon 8 Gen 4 SoC. In October of this year, Qualcomm is anticipated to introduce the chipset.The anticipated OnePlus Open replacement is expected to include a slim design, a high-resolution cover screen, an updated hinge to minimize weight, and a "ultra-flat" inside screen. It is probably going to be slim, and it might keep the OnePlus Open's periscope camera. It is very likely to launch as the Oppo Find N5, rebranded. The Find N3 was rebranded as the predecessor.In October 2023, the OnePlus Open made its debut in India, retailing for Rs. 1,39,999 for the 16GB RAM + 512GB storage model alone. It sports a 6.31-inch (1,116x2,484 pixels) 2K LTPO 3.0 Super Fluid AMOLED cover screen and a 7.82-inch (2,268x2,440 pixels) 2K Flexi-fluid LTPO 3.0 AMOLED inner display. It is powered by a Snapdragon 8 Gen 2 SoC and has 16GB of LPDDR5x RAM.The Hasselblad-branded triple rear camera arrangement on the OnePlus Open is powered by a 48-megapixel primary camera. Its two front cameras include a 32-megapixel secondary camera and a 20-megapixel primary selfie camera. The 4,800mAh battery within the foldable allows for 67W SuperVOOC charging.

Zee wants Sony to pay a $90 million termination fee.

Zee Entertainment said on Thursday that in order to terminate the $10 billion media pact, it has requested that Bangla Entertainment Pvt. Ltd. (BEPL), Culver Max Entertainment, and the India media division of Sony Group Corporation pay a termination fee of $90 million.sixteen hours beforeZee Entertainment announced on Thursday that it has demanded payment of a termination fee of $90 million from Bangla Entertainment Pvt. Ltd. (BEPL), Culver Max Entertainment, and the India media business of Sony Group Corporation in order to end the $10 billion media contract.sixteen hours prior toZee Entertainment said on Thursday that in order to terminate the $10 billion media contract, it has demanded payment of a termination fee of $90 million from Bangla Entertainment Pvt. Ltd. (BEPL), Culver Max Entertainment, and the Sony Group Corporation's India media unit.sixteen hours before

Price and Features of Microsoft Surface Pro 11 and Surface Laptop 7, the companys first Copilot+ PCs, were introduced.

Monday, May 20, Microsoft held an event to announce the Surface Pro 11 and Surface Laptop 7 to the general public. These gadgets come after the tech giant's Surface Pro 10 and Surface Laptop 6, which were unveiled in March of this year and are geared at business. The Windows manufacturer incorporates artificial intelligence (AI) capabilities into the consumer-oriented machines, which also become the company's first Copilot+ PCs. Interestingly, the Snapdragon X series chipsets from Qualcomm power these PCs rather than the Intel Core Ultra chipsets used in the Surface devices targeted for corporate users. Pricing and availability of the Microsoft Surface Pro 11 and Surface Laptop 7 The Microsoft Surface Pro 11 with an LCD panel and 16GB RAM and 256GB SSD built-in storage starts at $999, or around Rs. 83,000. This version has the Qualcomm Snapdragon X Plus chipset installed. Similar to this, the 13.8-inch display model of the Microsoft Surface Laptop 7 with a Snapdragon X Plus CPU, 16GB RAM, and 256GB SSD internal storage starts at $999 (about Rs. 83,000). There will be four gadget colors available: Black, Sapphire, Platinum, and Dune. Starting on June 18, both Surface models will be available for purchase. Anyone interested can place a preorder right now on the Microsoft website.

Indonesian Telecoms Industry Analysis Report 2024–2031: Indosat and Tri Indonesia Merger, XL Axiata Acquires Link Net, Towecos Consolidation, 5G Service Launch, FTTH Investments

May 21, 2024, Dublin (GLOBE NEWSWIRE) -- ResearchAndMarkets.com is now introducing the "Indonesia Telecoms Industry Report 2024-2031" study to its database.Welcome to the Indonesia Telecoms Industry Report, which provides a thorough analysis of one of the telecom markets with the quickest rate of growth in the globe. The telecom industry is crucial to national economies because it attracts significant infrastructure funds and spurs economic growth, especially as data infrastructure becomes more and more important in our connected world. Due to its defensive nature, the Indonesian telecoms industry is likely to stay stable despite political unpredictability and the economic impact of inflationary pressure.Important Developments Discussed in the Report on the Indonesian Telecom Sector: Combination of Tri Indonesia and Indosat Link Net is purchased by XL Axiata merging with Towecos introduction of 5G services Strong increase in consumer fixed broadband services is driven by FTTH developments.By 2031, 78% of Indonesia's mobile subscriptions are expected to be 5G users. It is anticipated that the Indonesian market would have close to 300 million 5G users by 2031.The telecommunications sector in Indonesia is a thriving mobile-only market with four major network providers and a near-monopolistic fixed-line provider. Robust economic foundations support the whole industry, establishing Indonesia as one of the world's fastest-growing telecom markets. Both mobile and fixed broadband subscribers are the main drivers of the increase. The publisher projects that mobile subscriptions will continue to rise rapidly after a brief dip in 2018 between 2024 and 2031. There will be a steady increase in fixed broadband subscribers together with a rise in household penetration.Increased data usage, more smartphone penetration, improved services, more affordable options, and broader coverage are the primary factors propelling the telecom industry's expansion. Indonesia is making large capital expenditure investments to extend its 4G coverage and fiber-optic network. The telecom industry has seen a sharp increase in investment, and this trend is anticipated to continue through 2023–2030.The publisher projects robust total telecom industry development through 2031, requiring higher capital expenditures outside of Java and phasing out 3G statewide to make way for 4G to be available to all Indonesians.

Melbourne Storm Has A Ball During The New Hume Homes Opening

A celebration of the Seabrook Reserve Redevelopment in Broadmeadows was held on Saturday, May 18, where elites from the National Rugby League'stormed' the field.The $22 million State Rugby League and Community Center, officially opened by Hume City Council, marks a significant turning point for the sport in Victoria. Broadmeadows will house both the new NRL Victoria headquarters and the male and female pathway programs for the Melbourne Storm.Rugby league has been gaining popularity in Hume, Victoria, especially among ladies and young girls. The council is thrilled about the increased chances that the state-of-the-art facility in the middle of Broadmeadows offers our athletic community.One unique aspect of the new construction is that the center will serve as a community hub, offering conference spaces, kitchens, community rooms, and other amenities for rent to host events of any size, accommodating up to 80 guests.The reserve will continue to house the local team Northern Thunder and act as a new training and administrative hub for NRL Victoria and Touch Football Victoria.As part of a fun family day planned by Council, Melbourne Storm superstars tested out the new rugby pitch at the Reserve for their captains run over the weekend. They also conducted NRL and Touch Football seminars for children.The occasion served as a showcase for the opportunities that arise when residents have access to top-notch facilities in their neighborhood, allowing them to engage with their neighbors and see local athletes compete.The Seabrook Reserve Redevelopment, which included the introduction of a new community play area with outdoor exercise equipment and picnic tables in 2023, was gradually unveiled by the Community Center.The $22 million project, which brings one of the best Touch Football and Rugby League facilities in the state to the center of Hume, is co-funded by Council and supported by a $14.3 million commitment from the State Government, NRL Victoria, and Melbourne Storm. Thanks to a record $558 million four-year capital works budget, Hume City Council is delivering projects that will keep Hume a fantastic location to live, play, and visit.Quotations attributed to Hume City Mayor Cr. Naim Kurt: "The completion of the Seabrook Reserve community centre and pavilion further cements Hume City Council as the home of elite sports in Victoria." "Alongside elite football, cricket, AFL and tennis facilities under construction, this development will set a new standard for women's sport and Rugby League development in Hume.""Not only is this a win for women's sport, it's also a win for the community with the new centre offering accessible space for the Broadmeadows community to host meetings, functions and forums as well as being a new home for the Northern Thunder Rugby League side."Public Announcement. This content from the original author(s) or organization may be point-in-time in nature, and it has been altered for length, clarity, and style. The opinions, stances, and conclusions presented here are entirely those of the author(s), and Mirage.News does not adopt institutional positions or sides.View in its entirety here.

Serum Institute gains 20% in a non-needle tech startup WholeMedical

For an unknown sum, vaccine leader Serum Institute of India has purchased a 20% investment in medical device startup IntegriMedical to promote needle-free injection technology.According to a business statement, the technology helps patients who are afraid of needles by promoting patient compliance, decreasing needle-stick injuries, and improving the effectiveness of liquid medication through needle-free dispersion.After purchasing SCHOTT Kaisha's Indian partner in August 2021, Serum Institute of India (SII), which has been investing in backend businesses, was able to secure the company's supply of pharmaceutical packaging items, which include vials, syringes, ampoules, and cartridges required to package life-saving medication.According to the note, IntegriMedical has created the US-patented needle-free injection system (N-FIS), which uses a high-velocity jet stream and mechanical power to deliver medications and biologics reliably and efficiently. Without providing a timeframe, it was stated that N-FIS will be made available in the Indian private market, providing patients and healthcare professionals with an alternative to conventional needle-based injections.The Chief Executive of SII, Adar Poonawalla, stated that the organization was always looking for ways to invest in technologies that complemented its goals. "We envision a needle-free solution to deliver vaccines and believe that Integral's Needle-Free Injection Systems represent a significant advancement in drug delivery," he stated, going on to say that it would "potentially revolutionize the way we administer vaccines."The investment, according to IntegriMedical's managing director Sarvesh Mutha, is evidence of the promise of NFIS technology and its capacity to completely transform medicine delivery. He continued by saying that SII's experience in vaccine production and international distribution would contribute to the technology's increased accessibility for patients everywhere. IntegriMedical's N-FIS is ISO 13485 certified and has obtained numerous regulatory approvals, including those from the CE (Europe) and CDSCO (India). The message further stated that the technology is patented in the United States. Additionally, it maintains manufacturing and research facilities in Hong Kong, India, and the United States. Ankur Naik, MD, of IntegriMedical, has played a key role in the N-FIS technology's development and clinical studies.

Check Out The Best City-By-City (Delhi, Noida, Mumbai, Chennai, Kolkata) Gas Prices In India

In Mumbai, India, the cost of 14.2 kg of domestic LPG is ₹802.50. The price of LPG has not changed from the previous month. Since March 2024, the price of LPG has been constant at ₹802.50. The LPG price trend has been declining over the last 12 months, falling ₹300 between June 2023 and May 2024. In August 2023, the price dropped by ₹200, the most amount. Visit https://www.goodreturns.in/lpg-price.html to learn more.The state-run oil corporations in India set the price of LPG, and they update it every month. In India, practically every home has an LPG hookup, which is mostly utilized for cooking. The average person will be impacted by an increase in LPG costs since, under the current market conditions, they bear the burden of increased fuel costs. The best thing is that consumers can already purchase home LPG cylinders at a discounted price thanks to an Indian government subsidy. Following the purchase of the cylinder, the subsidy amount is instantly credited to the individual's bank account. The monthly subsidy amount is subject to fluctuations in the average international benchmark LPG prices.The state-run oil corporations in India set the price of LPG (Liquified Petroleum Gas), which is updated every month. The cost of LPG is significant since it directly affects average people's kitchens. Nearly every home has an LPG connection, as do hotels and restaurants that are used for business purposes. Since they suffer the brunt of the growing fuel prices, even a slight fluctuation in price might set off a massive chain reaction across the nation. LPG is priced differently for residential and commercial use. When compared to household use LPG cylinders, commercial LPG is significantly more expensive. Visit https://www.goodreturns.in/lpg-price.html to learn more.The two main variables that determine the cost of LPG cylinders in India are the rupee's value in relation to the US dollar and the global benchmark rate. Each family is eligible for up to 12 free cylinders annually. You have to pay market price for any additional cylinders that you require. LPG prices in India are based on the global market price from the previous month. Visit https://www.goodreturns.in/lpg-price.html to learn more.Currently, domestic users are receiving the subsidy from the Indian government. The money is deposited straight into the recipient's account, which is the nicest aspect of the subsidy. The amount of the subsidy varies from month to month based on fluctuations in the foreign exchange rate and average worldwide benchmark LPG costs. The top three companies in the nation for LPG gas cylinder connections are HP Gas (owned by Hindustan Petroleum Corporation Limited), Indane Gas (owned by Indian Oil Corporation Limited), and Bharat Gas (owned by Bharat Petroleum Gas). Visit https://www.goodreturns.in/lpg-price.html to learn more.