Top Trending Government News News & Highlights

Don't you feel guilty about selling Bharat Mata Rahul Gandhi criticizes the US accord and the Center

Speaking in the Lok Sabha following days of deadlock, Rahul Gandhi criticized the Central government, led by Prime Minister Narendra Modi, for the recently concluded trade agreement with the United States, saying the administration should be embarrassed of it. In a vicious attack, Gandhi said that the Center "sold India" and that the government was endangering farmers' livelihoods by permitting US goods to enter."India is no longer yours. Do you not feel guilty for selling India? In reference to the trade deal, he declared, "You have sold our mother, Bharat Mata." He added that it was a "wholesale surrender" in which the interests of farmers were jeopardized and India's energy security was given to America. Gandhi went on to say that Donald Trump would have been advised to treat India equally if an INDIA Bloc administration had negotiated the trade deal with the US."This is total capitulation. The fact that it is a capitulation by more than simply the prime minister makes it tragic. He has given up the 1.5 billion Indians' future. Gandhi claimed that he had given up the future in order to save the BJP's financial structure, which is the subject of a case in the US.Gandhi claimed that the farmers' interests had been compromised and that they were facing a "storm" as American agricultural products flooded Indian markets. Additionally, he claimed that the Indian textile sector is "finished."We are about to enter a period of unrest, and the country has been sold. The country is sold out. "Its farmers and data have been sold," Gandhi reaffirmed as he wrapped up his remarks.Following Rahul Gandhi's address, Union Parliamentary Affairs Minister Kiren Rijiju declared that no one could sell India and charged that the Congress party was undermining the nation. "Congress is sad because India is progressing," he stated, asserting that Prime Minister Narendra Modi is India's strongest PM. He claimed that before leaving Parliament, the Congress MP gave speeches full of falsehoods and unfounded accusations. Rijiju remarked, "He never stays back to hear the minister's response."It is regrettable that we lack a serious personality or a person with a serious character that would be appropriate for the role of opposition leader. Rahul Gandhi's lies will be refuted by our party both within and outside the House.

Published 11 Feb 2026 11:10 PM

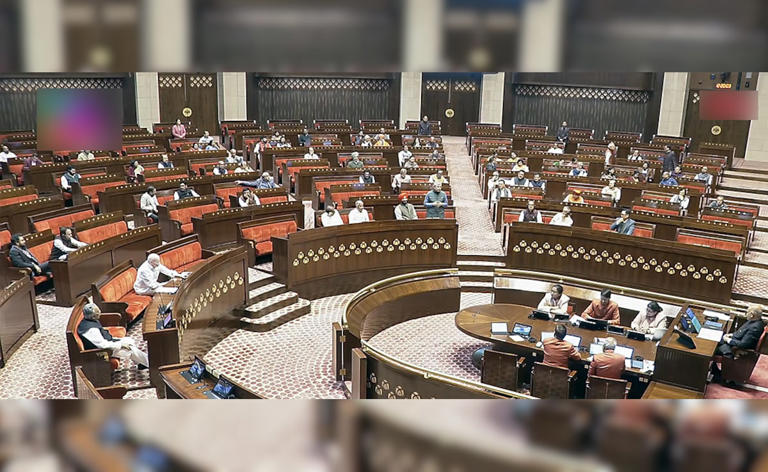

Updates for the 10th day of the Parliament Budget Session The Government-Opposition deadlock ends, and both Houses begin discussing the budget

The Lok Sabha began discussing the Union Budget on Tuesday, February 10, 2025, in the afternoon, signaling the end of the impasse between the opposition and treasury benches. The discussion had been delayed for days due to the opposition's insistence that LoP Rahul Gandhi be given the opportunity to speak on a number of topics. Following two adjournments, the House reconvened at 2 p.m., and the Speaker, Krishna Prasad Tenneti, invited Congressman Shashi Tharoor to commence the debate. The Thiruvananthapuram MP then began discussing the matter. Soon after opposition parties filed a notice to introduce a motion to oust Om Birla as Speaker of the Lok Sabha, the thaw occurred. Sukhendu Sekhar Roy of the Trinamool Congress emphasized that rising inequality could cause a "social upheaval," akin to what was seen in neighboring countries, as opposition parties criticized the government for failing to address issues like unemployment and inflation in the Union Budget during the budget discussion."If the situation is not brought under control, I fear that the country will soon experience social unrest similar to what has recently occurred in some of our neighboring countries. We have never witnessed such skyrocketing inequality between the rich, super rich, upper middle class, middle class, and the poor," Mr. Roy stated.

Published 11 Feb 2026 11:06 PM

India displays its entire armed might on the 77th Republic Day, with Operation Sindoor taking front stage on the Kartavya Path.

Top national leaders and prominent foreign visitors joined the festivities, which had as their subject 150 years of "Vande Mataram." About 10,000 distinguished guests saw the parade, which combined military might with cultural cohesion.At its 77th Republic Day parade on Monday, January 26, 2026, India put military might front and centre. Kartavya Path was transformed into a sweeping display of missiles, armour, mechanised columns, and combat aircraft, with a keen focus on weapon systems related to Operation Sindoor, the high-intensity military operation carried out in May of last year.The BrahMos supersonic cruise missile, Akash air defence system, Suryastra rocket launcher, and Arjun Main Battle Tank were among the major armament systems on exhibit at the start of the military demonstration, which emphasised India's focus on battlefield readiness and domestic defence manufacturing. A large portion of the equipment on exhibit was either used in Operation Sindoor, the confrontation with Pakistan that took place from May 7–10, or it was directly inspired by lessons learnt.A tri-services tableau featuring replicas of key weapon systems used during the operation was a big draw. A glass-cased integrated operational command centre served as its focal point, providing a visual representation of Operation Sindoor's execution through the coordinated use of systems including the S-400 air defence system and BrahMos. Akash and S-400 systems were depicted as offering a protective air-defense shield during the fight, while BrahMos missiles were predicted to perform decisive offensive attacks.Lt. General Bhavnish Kumar, a second-generation officer and General Officer Commanding, Delhi Area, led the procession. The Indian Army demonstrated a phased "Battle Array Format," including its airborne component, for the first time. The reconnaissance element included high-mobility reconnaissance vehicles after the historic 61 Cavalry in active battle uniform. Flying in Prahar formation, the domestic Dhruv Advanced Light Helicopter and its armed counterpart Rudra displayed aerial battlefield shaping.

Published 27 Jan 2026 09:07 PM

Why rising demonstrations are centered around India's Aravalli hills

The Supreme Court's redefinition of the Aravalli hills, one of the oldest geological formations in the world, which encompass the states of Rajasthan, Haryana, Gujarat, and Delhi, has sparked protests throughout northern India. Any landform rising at least 100 meters (328 feet) above the surrounding terrain is considered an Aravalli hill under the revised definition, which the court adopted in response to proposals from the federal government. An Aravalli range consists of two or more of these hills within 500 meters of one another, as well as the terrain in between. Environmentalists contend that classifying Aravalli hills according to height runs the risk of leaving many lower, scrub-covered but ecologically significant slopes vulnerable to mining and development. However, according to the federal government, the new definition is intended to increase uniformity and reinforce regulations rather than weaken rights.Protests have erupted across northern India after the Supreme Court redefined the Aravalli hills - one of the world's oldest geological formations spanning the states of Rajasthan, Haryana, Gujarat, and the capital, Delhi.

Published 22 Dec 2025 10:25 PM

Government News

Government News & Trends where we share you the latest updates under the government authorities globally starting from India to USA, China, Russia, Pakistan, UK and many more nations.

Tata Punch facelift launch confirmed for 2025

The Tata Punch petrol will see a mid-life facelift sometime next year. Confirming this development on the sidelines of the Punch EV launch, Tata Motors’ Passenger Vehicles Unit MD, Shailesh Chandra, said, “As far as the upgrade of the Punch is concerned, you know that it was launched in October 2021. Typical facelift period is three years. So, we should be expecting a facelift for the ICE version only in mid-2025, or slightly later.” Just like what we’ve seen on the Nexon and Harrier facelifts recently, expect Tata Motors to update the Punch SUV’s styling with fresh design cues to bring it in line with the newer Tata models. Changes to the front bumper and grille, along with minor tweaks to the headlamps and the bonnet can be expected to make the small SUV look new.Like the Nexon and the Nexon EV facelift, there will be styling bits that will help differentiate the petrol-powered Punch from the recently launched Punch EV. What’s more, Chandra also said that the Punch will have feature differences between the petrol and EV versions.

Renault Bigster global debut later this year

The new Renault Bigster SUV will see a global debut later this year and is expected to go on sale internationally by early 2025. Revealed as a concept in 2021, it is essentially a three-row iteration of the all-new Duster, which made its global debut a few months ago. Sources have conveyed to our friends at Motor1 Brazil that the Bigster SUV will share its design cues largely with the new Duster and the Bigster concept. Essentially, it will be most likely an elongated version of the Duster, similar to what we see with the Creta and Alcazar in India. There will, however, be styling, tech and equipment differences on the inside and out. This new SUV from Renault will be around 4.6 metres long – nearly 0.3 metres longer than the new Duster, which measures 4.34 metres. It will get rugged looks and interior bits from the Duster, but there will be more upmarket materials and additional creature comforts to justify the SUV's higher price tag. The Duster currently has a 2,657mm wheelbase, which also could see an increment for the Bigster in order to facilitate easy ingress-egress and more cabin room. As far as the platform goes, the Bigster will share the same CMF-B modular architecture. There isn’t much known about its powertrain options, however, it will be safe to expect that the SUV will share its powertrain line-up with the latest-gen Duster, which comes with three engine options – two of which are electrified. Starting the proceedings is the 1.6-litre four-cylinder petrol hybrid that gets two electric motors; this engine comes with an automatic gearbox. It also comes with regenerative braking and a 1.2kWh battery, enabling purely electric driving for up to 80 percent of the time in the city.The next engine is the 130hp, 1.2-litre three-cylinder turbo-petrol coupled with a 48V starter motor. While the Duster will also come with a 1.0-litre petrol-LPG option in some markets, there is no diesel option in any market right now. The next engine is the 130hp, 1.2-litre three-cylinder turbo-petrol coupled with a 48V starter motor. While the Duster will also come with a 1.0-litre petrol-LPG option in some markets, there is no diesel option in any market right now.

Jawa Yezdi Motorcycles eyes ASEAN market for Jawa exports

The company has been exporting Jawa back to the Czech Republic-based JAWA Moto spol. S r.O. The successor to the original JAWA company using the trademark JAWA, which in turn sells the bikes mostly in Eastern Europe and the Czech Republic. Jawa Yezdi Motorcycles plans to start exports of Jawa brand of bikes in ASEAN countries in the next three to four months, a top company official said on Thursday. The company, which launched the new Jawa 350 priced at Rs 2,14,950 (ex-showroom Delhi), is also working to enhance its reach across India, especially in smaller cities targeting to open 750 outlets in the next 24 to 30 months, Jawa Yezdi Motorcycles CEO Ashish Singh Joshi told reporters in an interaction here. The company has been exporting Jawa back to the Czech Republic-based JAWA Moto spol. S r.O. The successor to the original JAWA company using the trademark JAWA, which in turn sells the bikes mostly in Eastern Europe and the Czech Republic. We also sell directly in Nepal and we have already opened operations in the Philippines, which will serve as the hub to sell in other ASEAN countries such as Malaysia, Vietnam and Thailand," Joshi said. This is likely to start in the next three to four months, he said.On export volumes, Joshi said it is not so large considering the company's focus has been on the Indian market.After making a comeback in India in 2018, the company has sold about 2 lakh units in total, out of which nearly 5,000 units have been exported.When asked about domestic plans, Joshi said Jawa Yezdi Motorcycles plans to bring in more models to add to the existing nine products in its stable at present without specifying details. Also, he said the company is on a network expansion journey to widen and deepen its presence across India. "We are looking to increase our outlets to 750 in the next 24 to 30 months from 423 at present," he said, adding that when the company started it was mainly in the metros and major cities.It has gradually entered smaller cities and towns and will continue to do so, while also increasing the number of outlets in cities where it already has a presence to deepen its presence, Joshi added.On the outlook, he said the company is looking at "double-digit" growth this year, having overcome the COVID-19 induced disruptions and supply chain issues."2024 is going to be the year of consolidation for us," he said, adding that the premium motorcycle segment in India has recovered while the entry-level motorcycle segment is also witnessing recovery.

Toto Wolff Extends Contract With Mercedes For 3 More Years

Mercedes F1 team principal Toto Wolff signs a new three-year contract, extending his leadership until the end of 2026. The deal involves Wolff, INEOS owner Jim Ratcliffe, and Mercedes-Benz CEO Ola Kallenius.The contract excludes performance clauses.Mercedes Formula 1 team principal Toto Wolff has inked a new three-year contract, securing his leadership until at least the end of 2026, according to an exclusive interview with The Daily Telegraph. The deal involves Wolff, INEOS owner Jim Ratcliffe, and Mercedes-Benz CEO Ola Kallenius. Remarkably, the contract excludes performance clauses, emphasising trust between the parties and Wolff's commitment to achieving success rather than relying on specific track outcomes.Wolff, who owns 33 per cent of the team, clarified, "I've never had a performance clause; you either trust each other or you don't." The new agreement arises amid speculation about Wolff's position due to Mercedes' recent struggles in comparison to Red Bull's consecutive title wins. Despite external pressures, the contract demonstrates mutual confidence and a desire to navigate challenges as a united front. The lack of performance clauses aligns with Wolff's emphasis on stability and a long-term perspective. He believes that the absence of such conditions reinforces the shared goal of achieving a strong return on investment, which, in the context of Formula 1, translates to winning races and championships. His commitment extends beyond the team principal role, encompassing responsibilities as a co-shareholder and a member of the board.Reflecting on the risks associated with his role, Wolff expressed a concern for "bore-out" rather than burnout, indicating a preference for overcoming challenges and embracing difficulties rather than stagnating in a dominant position. The Mercedes team principal remains driven by the prospect of re-establishing the team's dominance in Formula 1.Wolff's new contract is significant not only for its duration but also for the absence of conditional performance metrics. It reflects a collective decision by the stakeholders to persist in their current roles and address the challenges that come with a downturn in the team's performance. The deal positions Wolff as a key figure in Mercedes' efforts to reclaim its leading position in Formula 1 and underscores the importance of trust and collaboration among the team's principal shareholders.In the larger context, the contract signals a commitment to stability, allowing Mercedes to navigate a transitional phase in Formula 1 and work towards regaining competitiveness. While the team faces uncertainties regarding the performance of the new Mercedes W15 car, Wolff's enduring leadership provides continuity and stability during a critical period.As Wolff embarks on the next three years, the focus will be on steering Mercedes back to the summit of Formula 1, where it enjoyed a dominant position for much of the past decade.

2024 Bajaj Chetak review, first ride

Where every other electric scooter in the mainstream has aspired to carve a niche for itself in the market as a futuristic next-generation mobility solution, Bajaj has attempted to authentically replicate an experience in electric with their Chetak. The all-metal body, the rounded design and the minimal technological intervention. All of which meant that up until now the Chetak was left to an ever-diminishing demographic of people familiar with the original Chetak. For 2024, without really making too many big changes, Bajaj has upped their ante and expanded the reach of the updated bike to new demographics with a slight rejig of the equipment list.But before we jump into what's new. Let us talk about the design and build of the new Chetak for a second. The design hasn’t changed from the first generation of the Chetak. The rounded fascia with the round headlamp and the svelte body section set in an all-metal body make for a very premium-feeling scooter. It also gets all LED lighting as standard. However, while the build on the paint and the bodywork do feel premium, the plastics and the body mouldings do seem a little off-brand for the premium electric scooter. Switchgear, though, is a premium touch and feels solid, although we did notice a few times when buttons on the instruments would not respond momentarily. But before we jump into what's new. Let us talk about the design and build of the new Chetak for a second. The design hasn’t changed from the first generation of the Chetak. The rounded fascia with the round headlamp and the svelte body section set in an all-metal body make for a very premium-feeling scooter. It also gets all LED lighting as standard. However, while the build on the paint and the bodywork do feel premium, the plastics and the body mouldings do seem a little off-brand for the premium electric scooter. Switchgear, though, is a premium touch and feels solid, although we did notice a few times when buttons on the instruments would not respond momentarily.

Hyundai Creta 2024 facelift vs Kia Seltos vs Maruti Suzuki Grand Vitara vs others: Price comparison

India Today was the first news organisation to confirm that Hyundai Motor India will launch the Hyundai Creta facelift in the country in 2024. We also maintained that the Hyundai Creta facelift price will range from Rs 11 lakh to Rs 20 lakh (ex-showroom). Well, it seems that we are bang on the target so far as the price of the vehicle is concerned.Among the other rivals, the Elevate's price ranges from Rs 11.58 lakh to Rs 16.40 lakh (ex-showroom), the Urban Cruiser Hyryder's price from Rs 11.14 lakh to Rs 20.19 lakh (ex-showroom), that of the Kushaq from Rs 11.89 lakh to Rs 20.49 lakh (ex-showroom), the price of the Taigun from Rs 11.70 lakh to Rs 20 lakh (ex-showroom) and the Astor from Rs 9.98 lakh to Rs 17.90 lakh (ex-showroom). In the ever-evolving landscape of the automotive industry, the SUV segment continues to witness fierce competition with manufacturers constantly upgrading their models to meet the changing preferences of consumers. In this comparison, we will focus on the recently launched Hyundai Creta 2024 facelift, the popular Kia Seltos, the established Maruti Suzuki Grand Vitara, and a few other noteworthy contenders. Let’s delve into the key aspects, specifications, and prices to help you make an informed decision.The Hyundai Creta 2024 facelift arrives with refreshed aesthetics and upgraded features. Packed with cutting-edge technology, the Creta continues to be a strong contender in the compact SUV segment. The price for the base variant starts at $XX,XXX, making it a competitive option in its class.The Kia Seltos, known for its stylish design and feature-packed interior, remains a top choice for SUV enthusiasts. With a starting price of $XX,XXX, the Seltos offers a compelling mix of performance and comfort. Its diverse range of engine options and trim levels allows buyers to tailor their purchase according to their preferences.

JLR India launches Discovery Sport 2024 at Rs 67.90 lakh

JLR India today launched the Discovery Sport 2024 in the country at a starting price of Rs 67.90 lakh (ex-showroom). The 2024 model comes with a price cut of Rs 3.49 lakh over the 2023 model.The Discovery Sport 2024 is available in Dynamic SE with two engine options - 2.0-litre petrol (245hp and 365Nm) and 2.0-litre Ingenium diesel (201hp and 430Nm). Both engines are mated to an automatic transmission. The new Discovery Sport gets subtle exterior updates. There is a contrast roof and exterior accents, including Discovery script, grille, lower body sills and lower bumpers, all having a distinctive Gloss Black finish. There is Gloss Black front claw detailing on the bumpers and wheel arches. There are 19-inch diamond-cut alloys. The SUV also gets a new Varesine Blue exterior paint option.JLR India today launched the Discovery Sport 2024 in the country at a starting price of Rs 67.90 lakh (ex-showroom). The 2024 model comes with a price cut of Rs 3.49 lakh over the 2023 model. JLR India today launched the Discovery Sport 2024 in the country at a starting price of Rs 67.90 lakh (ex-showroom). The 2024 model comes with a price cut of Rs 3.49 lakh over the 2023 model.The new Discovery Sport gets subtle exterior updates. There is a contrast roof and exterior accents, including Discovery script, grille, lower body sills and lower bumpers, all having a distinctive Gloss Black finish. There is Gloss Black front claw detailing on the bumpers and wheel arches. There are 19-inch diamond-cut alloys. The SUV also gets a new Varesine Blue exterior paint option.You now get a digital instrument cluster and steering wheel-mounted gearshift paddles as standard, while the redesigned centre console boasts a new floating 11.4-inch curved glass touchscreen. The latest Pivi Pro infotainment set-up features permanently accessible sidebars, which provide shortcuts to key vehicle controls and functions, such as media, volume, climate and navigation. There is a panoramic glass roof as well.The SUV has wireless Apple CarPlay and Android Auto as standard and a wireless charger. A natural shadow oak trim finisher surrounds a new gear shifter. Discovery Sport Dynamic SE features DuoLeather interiors with up to two colour options.

Assam govt threatening people not to join Cong yatra, says Rahul Gandhi

Congress leader Rahul Gandhi on Sunday alleged that Assam's BJP-led government has been threatening people against joining the Bharat Jodo Nyay Yatra, and refusing permissions for programmes along its route.People, however, are not afraid of the BJP, Gandhi asserted at a public gathering in Biswanath Chariali, the headquarters of Biswanath district.He also said the Congress will win by a huge margin against the BJP in the upcoming elections."We don't make long speeches as part of the yatra. We travel every day for 7-8 hours, talk to delegations, meet people and listen to their issues. And then, we fight for your issues; that is the aim of this yatra."When elections come, Congress will defeat BJP by massive margins," Gandhi asserted, urging party workers to march forward despite being threatened, and beaten up, as the fight is for the people.The yatra is in its fourth day in the state, having re-entered after a night halt in Arunachal Pradesh. It is scheduled to travel through Assam till January 25, covering a total of 833 km across 17 districts.Gandhi also alleged that flags and banners of the Congress are being damaged in the state."They (government) think they can threaten the people and suppress them. But, they are not realising this is not Rahul Gandhi's yatra. It is a yatra for the voice of the people," he said."Neither Rahul Gandhi nor people of the state are afraid of them," the former Congress chief said.He continued to target Assam Chief Minister Himanta Biswa Sarma, terming him as the most corrupt CM in the country."Everyone knows that the CM and his entire family are the most corrupt. The Assam government is run for the benefit of one family... the Congress MP alleged.He said that injustice was being done to farmers, who don't get the price for their produce, youths who don't find jobs after finishing studies and traders who bore the brunt of demonetisation and GST.

Budget 2024-25: Govt may increase capex to propel economic growth

With private investment still muted, the government is likely to maintain its momentum on increasing capital expenditure, especially for the infrastructure sector in the upcoming Budget to propel economic growth.Post Covid-19, the Budget has been laying special emphasis on capex. It has kick-started a dormant cycle for the economy. As a result India has witnessed over 7 per cent growth in the last three years, the highest among the large economies of the world. During the current financial year, the government has made a record high provision of Rs 10 lakh crore towards capex. During 2020-21, the government earmarked Rs 4.39 lakh crore which increased by 35 per cent to Rs 5.54 lakh crore in the subsequent year.Another 35 per cent hike in capex was done in 2022-23 to Rs 7.5 lakh crore which subsequently reached a high of Rs 10 lakh crore, an increase of 37.4 per cent.In the upcoming Budget too, the government is expected to earmark a large amount towards capex as such investment has a multiplier effect on the economy and it also crowds in private investment."We estimate Government of India to budget for a capex of Rs 10.2 lakh crore in FY25, implying a relatively sedate YoY expansion of about 10 per cent, compared to over 20 per cent expansion seen in each of post-COVID years. The slowdown in capex growth is likely to have some bearing on economic activity and GDP growth," Icra said in its pre-Budget expectations. The capex rose by 31 per cent to Rs 5.9 lakh crore in April-November of the current fiscal (58.5 per cent of FY2024 BE) from Rs 4.5 lakh in April-November FY23 (60.7 per cent of FY23 Prov).While the growth remained high, capital spending contracted in October 2023 (-14.9 per cent; first instance of contraction since April 2023) and then rose by a marginal 1.6 per cent in November 2023. Moreover, it has averaged at Rs 73,210 crore/month, 12.2 per cent lower than the required monthly average of Rs 83,400 crore to meet the budgeted target of Rs 10 lakh crore.India is a hugely infra deficit country and heavy lifting in this regard is being done by the government which crowds in private investment. With the growth in the economy, there has been a pick-up in private investment in recent times in some of the sectors like steel, cement and petroleum sector.According to Emkay Global Financial Services head research Seshadri Sen, capex by the government would continue and it will happen at a faster pace.The capex would help unlock the virtuous cycle. Investment leading to productivity growth, job creation, demand and exports feed into each other and enable animal spirits in the economy to thrive.

Sensex, Nifty tick higher after a 3-day drop; IRFC, Network 18 jump up to 5%

The 30-share BSE Sensex surged 635 points or 0.89 per cent to trade at 71,822, while the NSE Nifty was up 169 points or 0.79 per cent to trade at 21,631. Indian equity benchmarks were up in Friday's early trade following a three-day losing streak, led by gains across all sectors. The 30-share BSE Sensex surged 635 points or 0.89 per cent to trade at 71,822, while the NSE Nifty was up 169 points or 0.79 per cent to trade at 21,631. Broader markets (mid- and small-cap shares) were positive as Nifty Midcap 100 rose 0.83 per cent and small-cap gained 0.95 per cent. On the global front, Asian markets opened higher, tracking an overnight rise in Wall Street equities.Back home, foreign institutional investors (FIIs) sold Rs 9,901.56 crore worth of shares on a net basis during the previous session, while domestic institutional investors (DIIs) bought Rs 5,977.12 crore worth of shares, exchange data showed. All the 15 sector gauges -- compiled by the NSE -- were trading in the green. Sub-indexes Nifty Financial Services and Nifty IT were outperforming the NSE platform by rising as much as 1.01 per cent and 1.22 per cent, respectively.On the stock-specific front, Tech Mahindra was the top gainer in the Nifty pack as the stock soared 2.74 per cent to trade at Rs 1,392.3. Wipro, Coal India, HCL Tech and TCS rose up to 1.92 per cent. In contrast, IndusInd Bank was the top loser on Nifty50. The overall market breadth was strong as 2,411 shares were advancing while 400 were declining on BSE.On the 30-share BSE index, ICICI Bank, HDFC Bank, Infosys, TCS, Axis Bank, ITC, L&T, Airtel and Titan were among the top gainers.Also, BSE 500 stocks such as IRFC, Network18, Home First Finance, IndiaMART, Poonawalla Fincorp, HUDCO and ITI moved up to 5.33 per cent higher. On the other hand, Shoppers Stop, Metro Brands, Dixon Technologies, Polycab India, ZEE, Cholamandalam Finance and Alembic Pharma slipped up to 3.78 per cent.

Paytm Credit Card on UPI enables effortless daily transactions like payments on grocery stores, chai shops

With just a smartphone, users can easily make UPI payments via credit cards on the Paytm app, powered by Paytm Payments Bank. The convenience of digital transactions have become a fundamental aspect of our daily lives in today’s fast paced world. One such transformative force in the digital payment landscape is the integration of UPI payments through credit cards on the Paytm app. Making small payments of ₹10 to ₹100 bucks through credit at your nearby Kirana stores or a local chai shop or even a chat shop has evolved into the ultimate and convenient payment method for users. This groundbreaking feature offers users the convenience of utilizing credit for routine payments, eliminating the need to rely solely on savings accounts and carrying the card everywhere. With just a smartphone, users can easily make UPI payments via credit cards on the Paytm app, powered by Paytm Payments Bank. Users simply need to link their Rupay Credit Card to UPI through a straightforward process with quick and easy steps. The Credit Card on UPI feature allows users to scan merchant QR codes, allowing them to earn reward points with every transaction.With millions of merchants now accepting payments via credit cards on UPI, this can have a significant impact on the payment landscape. This integration of RuPay Credit Cards on UPI not only expands credit card usage for customers but also supports merchants in the credit ecosystem through assets like QR codes. The increasing acceptance of RuPay credit cards on UPI contributes to financial inclusion, benefiting merchants and businesses across India. Paytm Payments Bank remains at the forefront of innovation, driving the adoption of UPI payments with credit cards, and envisions a future where this technology reshapes the dynamics of the payment ecosystem in India.

Delhi-NCR stays in fog grip: Many trains, flights delayed, no respite till Jan 21

Dense to very dense fog and cold day to severe cold day conditions are likely to continue to prevail over North for the next 2 days (Jan 21) and then decrease in intensity.Fog update: Respite will have to wait for several parts of North India reeling under chilling cold wave conditions along with dense fog that has disrupted rail and air traffic for the past few weeks. Maximum temperatures have dropped below normal by 5-8 degrees Celsius since December. There was a brief respite on January 7 and 8, owing to a passing western disturbance but cold conditions returned from January 9. Dense to very dense fog and cold day to severe cold day conditions are likely to continue to prevail over North for the next 2 days (Jan 21) and then decrease in intensity. Cold wave and dense fog conditions are likely to prevail over Delhi, Punjab, Haryana, Chandigarh and Uttar Pradesh and Rajasthan and at isolated places over Himachal Pradesh, and Uttarakhand, according to the forecast by the India Meteorological Department (IMD)."Dense to very dense fog at a few places in Punjab, Haryana, Chandigarh, Delhi, Uttar Pradesh and Rajasthan and at isolated places over Himachal Pradesh, and Uttarakhand," the weather department said."Cold day to severe cold day conditions at a few places in Uttar Pradesh and Rajasthan and at isolated places in Himachal Pradesh, Uttarakhand, Punjab and Haryana. Cold wave to severe cold wave conditions at a few places in Punjab, Haryana, Chandigarh and at isolated places in Himanchal Pradesh. Ground frost at isolated places in Himachal Pradesh and Uttarakhand," it added. The early-morning foggy weather in Delhi and adjoining areas has significantly impacted road, rail, and air traffic over the past several days. On Friday, at least 22 trains from various parts of the country were running late, and several flight operations were delayed at Delhi's Indira Gandhi International (IGI) airport due to low visibility amid the fog.According to the weather department, minimum temperatures are in the range of 3-6 degrees Celsius over many parts of Punjab and some parts of Haryana-Chandigarh; in the range of 7-10 degrees Celsius over most parts of Delhi, Uttar Pradesh, Rajasthan, north Madhya Pradesh and Bihar.These are below normal by 1 degree to 3 degrees Celsius over many parts of Punjab, Haryana-Chandigarh-Delhi and West Uttar Pradesh and in isolated pockets of Rajasthan.

Removing layers: Sundar Pichai hints at more layoffs at Google in 2024

A day after laying off around 1,000 employees, Google chief executive officer (CEO) Sundar Pichai, on Wednesday, hinted towards more job cuts in the year ahead, The Verge reported. Terming it as part of a larger restructuring plan, Pichai, in an internal memo to Google employees, said, "We have ambitious goals and will be investing in our big priorities this year…the reality is that to create the capacity for this investment, we have to make tough choices."Referring to the "tough decisions", Pichai further said in the memo, "These role eliminations are not at the scale of last year's reductions and will not touch every team. His remark referenced Google's 2023 layoffs when the tech giant fired about 12,000 employees, the biggest layoff in the company's history in a single year.According to the report, Pichai said the layoffs this year were about "removing layers to simplify execution and drive velocity in some areas."Pichai's communication followed a day after Google handed pink slips to around 1,000 employees in the advertising sales team in the first layoff wave of 2024. The company said the eligible employees would receive severance pay. It also offered that the impacted employees may re-apply for open positions in other departments. However, it clarified that those unable to secure a position at the company would be required to exit by April. The developments followed about a week after Google had announced that it would lay off hundreds of people working on its voice-activated Google Assistant software and the company's Devices and Services team.Apart from Google, Jeff Bezos' Amazon also announced last week that it would fire several hundred employees in its streaming and studio operations.Neither company has specified the exact number of job role cuts they are planning in 2024.

HDFC seeks Singapore bank licence to open its 1st branch in the country

HDFC Bank Ltd, India’s biggest private sector lender, is seeking to open its first branch in Singapore, signaling its overseas ambitions after sewing up a landmark merger with mortgage financier Housing Development Finance Corp. last year. The bank has applied to the Monetary Authority of Singapore for a banking licence and is awaiting approval, according to sources familiar with the matter. It is not clear what kind of banking licence HDFC Bank is seeking in Singapore, said one of the people, who declined to be identified as the information is confidential.The banking giant is seeking a bigger presence abroad to tap the Indian diaspora for savings and term deposits, as well as to cross-sell more products, including mortgages, the people said. At home, HDFC has been focusing on deepening its reach in the world’s most populous country through loans to retail customers. HDFC Bank did not respond to an email seeking comment. “As a matter of policy, MAS does not comment on our dealings with financial institutions,” according to a spokesperson from the Singapore regulator.Singapore, with a population of almost 6 million people, houses a large India diaspora. About 650,000 non-resident and persons of Indian origin live in the city-state, according to Indian government data.HDFC Bank is currently not licenced or regulated by the MAS, according to its website. It only provides home loans-related advisory services for the purchase of properties in India, the website states. The categories of banking licences in Singapore encompass full banks, qualifying full banks and wholesale banks, which impose varying levels of restrictions on the lenders’ activities. State Bank of India and ICICI Bank Ltd. hold qualifying full banking licences, alongside eight other banks like Bank of China Ltd. and BNP Paribas SA. Such licences are open only to foreign banks and allow them to have additional branches and/or off-premise ATMs as well as to share ATMs among themselves, according to the Association of Banks in Singapore’s website.The MAS regulates and supervises more than 150 deposit-taking institutions in Singapore, ranging from full banks to finance companies, according to its website. Besides Singapore, HDFC Bank also has presence in markets like London, Hong Kong and Bahrain. The India bank has a total customer base of 93 million at the end of the December quarter compared with 91 million in the preceding three-month period, according to an investor presentation.

Apple expands India presence, opens office covering 15 floors in Bengaluru

US-based technology giant Apple expands its presence in India with a new office in Bengaluru, Karnataka. The new Apple office is located at Minsk Square in the center of the city. In its proximity, there are landmarks buildings and spots such as parliament, high court, central library, Chinnaswamy cricket stadium, and one of the largest green parks within Bengaluru. Covering 15 floors, the new Apple office will house up to 1,200 employees and features a dedicated lab space, areas for collaboration and wellness, and Caffe Macs. Its proximity to Cubbon Park metro station means public transit is easily accessible for employees. "Apple is thrilled to expand in India with our new office in the heart of Bengaluru. This dynamic city is already home to so many of our talented teams, including software engineering and hardware technologies, operations, customer support, and more. Like everything we do at Apple, this workspace is created to foster innovation, creativity, and connection. It’s an amazing space for our teams to collaborate” said Apple.From its Bengaluru office, Apple’s teams will work across a wide range of Apple’s business — from software, hardware, services, IS&T, operations, customer support, and others. In line with Apple's global presence, the new Apple office in Bengaluru boasts an interior crafted from locally-sourced materials, including stone, wood, and fabric in the walls and flooring, and the office is filled with native plants. The office is designed with sustainability at the core – will run on 100 per cent renewable energy. With it Apple aims to achieve a Leadership in Energy and Environmental Design (LEED) Platinum rating — the highest level of LEED certification. Apple has been carbon neutral for its corporate operations since 2020, and has run all Apple facilities using 100 per cent renewable energy since 2018. In India, the company has its corporate office footprint in Mumbai, Hyderabad, and Gurugram, and now in Bengaluru.

Govt may earmark Rs 4 trillion for next years food, fertiliser subsidies

India may earmark about Rs 4 trillion ($48 billion) for food and fertiliser subsidies for the next fiscal year, two government sources said, indicating fiscal caution ahead of this year's general election. Food and fertiliser subsidies account for about one-ninth of India's total budget spending of Rs 45 trillion during the current fiscal year that ends on March 31. The Ministry of Consumer Affairs, Food and Public Distribution has estimated next year's food subsidy bill at Rs 2.2 trillion ($26.52 billion), the two sources said. That is 10 per cent higher than a projected outlay of nearly Rs 2 trillion ($24.11 billion) for the current 2023-24 fiscal year. Additionally, next fiscal year's fertiliser subsidy is expected to be Rs 1.75 trillion ($21.10 billion), down from the current 2022-23 fiscal year estimate of nearly Rs 2 trillion, one of the sources said.The sources, which are directly involved in the decision making on the subsidies, did not wish to be named as they were not authorised to speak to the media.Finance Minister Nirmala Sitharaman will unveil the 2024/25 budget on Feb. The Ministry of Finance, the Ministry of Chemicals and Fertilizers and the Ministry of Consumer Affairs, Food and Public Distribution ministries of finance did not reply to requests for comment. Maintaining the combined subsidies at their current level would be unusual for a government facing a national election in just a few months, but Prime Minister Narendra Modi is widely expected to win a rare third term in elections scheduled for April and May. Also, containing food and fertiliser subsidies is crucial for managing India's fiscal deficit, which Modi's government is targeting at 5.9 per cent of gross domestic product this year and planning to lower by at least 50 basis points in the fiscal year 2024/25. The food subsidy bill is likely to go up next year as Modi's administration late last year extended its flagship free food welfare programme for the next five years.

L&T Technology retains full-year forecast after all units post Q3 growth

Indian tech services provider L&T Technology Services retained its revenue growth forecast for the current financial year on Tuesday as all its five business verticals posted year-on-year growth for the third quarter.This comes as Infosys and HCLTech tightened their revenue guidance for the year last week citing no change in the demand environment for the year, marred by high inflation and clients cutting down on discretionary spending.However, better-than-feared numbers by the top four firms have triggered a rally in IT stocks this week, helping the country's benchmark indices hit fresh lifetime highs. L&T Technology's consolidated net profit rose 3.36 billion rupees ($40.43 million) from 2.97 billion rupees a year earlier, marginally above analysts' estimate of 3.31 billion rupees.Revenue from operations rose 12 per cent to 24.22 billion rupees, on the back of double-digit growth in telecom and medical devices verticals, below analysts' estimate of 24.45 billion rupees.Indian tech services provider L&T Technology Services retained its revenue growth forecast for the current financial year on Tuesday as all its five business verticals posted year-on-year growth for the third quarter.The Mumbai-based firm expects revenue for the current fiscal year ending March 31 to grow 17.5 per cent-18.5 per cent in constant currency."All five segments grew positively for the second quarter in a row giving us 1per cent sequential growth despite the seasonal softness," CEO Amit Chadha said in a statement.Two units - the industrial products segment and Europe region - have scaled a $200 million run-rate on annualised basis, he added. This comes as Infosys and HCLTech tightened their revenue guidance for the year last week citing no change in the demand environment for the year, marred by high inflation and clients cutting down on discretionary spending.However, better-than-feared numbers by the top four firms have triggered a rally in IT stocks this week, helping the country's benchmark indices hit fresh lifetime highs.Revenue from operations rose 12 per cent to 24.22 billion rupees, on the back of double-digit growth in telecom and medical devices verticals, below analysts' estimate of 24.45 billion rupees.The subsidiary of infra giant Larsen and Toubro won six deals that are more than $10 million each in size, it said in a filing. This included one deal each of sizes $40 million and $20 million.

Bond market expects RBI to change policy stance in February review

Bond market participants are expecting the Reserve Bank of India (RBI) to change its stance in the February policy review to neutral from withdrawal of accommodation, citing the continuous variable rate repo (VRR) auctions. “RBI is trying to adjust liquidity and bring it close to neutral or zero. The way RBI spoke in the last policy, it doesn't look like it wants a hike anytime soon,” said Naveen Singh, vice-president of ICICI Securities primary dealership.“If they don't want to cut now, but they also don't want to hike, then what's the point of keeping withdrawal of accommodation stance? They can very well come to a neutral stance. And, a neutral stance doesn't stop RBI from hiking if it wants to. Consequently, the market has been strategically taking long positions in government bonds, said dealers. “A majority of the people, if not everyone, is taking long positions (buying) because the market is factoring in that the RBI would change its stance in February,” said a dealer at a state-owned bank.Consequently, the market has been strategically taking long positions in government bonds, said dealers. “A majority of the people, if not everyone, is taking long positions (buying) because the market is factoring in that the RBI would change its stance in February,” said a dealer at a state-owned bank.Yield on the benchmark 10-year government bond has fallen by 3 basis points (bps) in January so far. In December, the yield had fallen by 11 bps. “A minority section of the market thinks that a change in stance in February is possible. The general view is that April is when the change in stance happens,” said Vijay Sharma, senior executive vice-president at PNB Gilts.“Even after this Rs 1.75 trillion VRR, the liquidity is still in deficit mode. It is apparent that through the recent consecutive VRR auctions, RBI is ensuring that tightness in liquidity is not stretched. However, it is too early to say that RBI is taking an accommodative stance. So, it is still a wait-and-watch situation.” he added. The central bank has been conducting VRR auctions in order to infuse liquidity into the banking system. In the 13-day VRR auction conducted by the RBI on Friday, bids were received for Rs 3.92 trillion, against a notified amount of Rs 1.75 trillion.In the preceding VRR auctions, the central bank received a strong demand, with banks submitting bids ranging between 2.5 and 3.2 times of the bidding amounts. This is due to tight liquidity conditions in the system. Liquidity remained largely in deficit mode in the third quarter. The central bank had conducted a VRR auction after six months on December 15.Market participants observed that despite the higher-than-expected US consumer price index (CPI), the US Treasury yield softened. This reinforced the anticipation of a rate cut by the Federal Reserve in March.