Top Trending Finance & Stock Market News & Highlights

What becomes more expensive and less expensive following Budget 2026. Check entire list

With the release of the Union Budget 2026, Indian consumers are anticipated to pay more for some items and less for others. As finance minister Nirmala Sitharaman delivered the budget in Parliament today, she spoke about specific commodities on which the government is planning to lower customs duty.She added that the government was thinking about decreasing taxes on a few imports from other nations, which would result in lower prices for Indian customers. Finance Minister Nirmala Sitharaman stated during the Budget's presentation in Parliament on Sunday that the Union Budget 2026–27's changes to customs duties will reduce the cost of a number of necessities, such as 17 cancer medications and medications and specialized nutrition used to treat seven uncommon diseases. Duties have also been lowered on microwave oven components, lowering production expenses. The Budget proposed a range of tariff cuts and tax rationalisations targeted at alleviating costs for consumers, exporters and critical sectors. TCS reduced the price of overseas tour packages from 5–20% to 2% with no minimum. Foreign remittances for education and medical care under LRS: TCS cut to 2% from 5% Microwave ovens: Customs duty exemption on selected manufacturing parts Imports for personal use by foreign visitors: Customs duty was reduced from 20% to 10%.Imports for personal use by foreign visitors: Customs duty was reduced from 20% to 10%. Textile and leather exporters: Export realisation time extended to one year, alleviating working capital constraint Cancer and critical disease medicines: Basic customs duty totally waived on 17 pharmaceuticals Foods, medications, and drugs for specific medical needs pertaining to seven uncommon disorders Imported medications and drugs for individual use Essential Parts of Microwave Ovens Components or parts, including engines of aircraftSolar glass ingredients Goods purchased for nuclear power projects Capital products for essential minerals

Published 02 Feb 2026 06:03 PM

GST reform: starting Monday, these goods will be subject to the highest tax. View the complete list

September 22 GST changes: Under the new tax structure, which goes into effect on Monday, items falling within these categories will be subject to the newly revised highest tax rate of 40% GST. View the items' list here.After its 56th meeting on September 3, 2025, the GST Council, which is led by the Indian federal government, voted to streamline the indirect tax system in India by redesigning the current goods and service tax (GST) slab structure into a "two-tier" system.Indian customers will benefit from a revamped "two-tier" tax structure that goes into effect on Monday, September 22, 2025. Depending on the type of commodity sold in the country, it will be subject to either the 5% or 18% tax band. In India, GST is now imposed in four slabs: 5%, 12%, 18%, and 28%. However, the government has since modified these slabs. Many products sold in the Indian economy will see price reductions as a result of the federal government's action; nevertheless, starting Monday, a wide range of products will also be subject to higher consumer taxes. 1. Sin Goods: Generally speaking, sin goods are things that are detrimental to society and health, such as cigarettes and pan masala. Cigarettes, pan masala, beedi, and other tobacco goods including chewing tobacco and gutka, as well as online gaming and gambling, would all be subject to a 40% GST tax starting on Monday, September 22, 2025. 2. Luxury cars: Four-wheelers with an internal combustion engine (ICE) capacity greater than 1,200cc and a length greater than four meters were also placed in a 40% tax level by the GST Council. In the past, the ex-showroom pricing of SUVs and MPVs, which are included in this group, was increased by 28% GST and 22% Cess. 3. Over 350cc two-wheelers: The GST Council raised the tax rate for two-wheelers with engines larger than 350cc from 28% GST and 3% Cess to 40%. Despite the removal of the Cess levy, two-wheelers with engines larger than 350cc will now be subject to a higher tax rate. 4. Soft drinks: The central government raised the GST rate from 28% to 40%, which will result in a price increase for soft drinks and other non-alcoholic beverages like Coca-Cola, Pepsi, Mountain Dew, Fanta, and flavor-infused waters. 5. Items that cost more when you're in the 18% tax bracket: Items that will be subject to GST at the higher 18% slab starting on Monday, September 22, 2025, include dining at restaurants, particularly those with air conditioning and premium outlets; consumer durables like refrigerators, washing machines, and air conditioners; beauty and grooming services at salons and spas; and high-end smartphones and imported devices.

Published 23 Sep 2025 01:19 PM

Live Updates on New GST Rates: When GST 2.0 goes into effect, food, cars, and televisions all get cheaper.

GST Reforms 2025 List: Goods and Services Tax (GST) reforms have become effective today, September 22, marking a historical shift in the country’s indirect taxation by merging four slabs into two (5% and 18%) and a special tax slab of 40% for “sin goods".The GST council, led by Finance Minister Nirmala Sitharaman, early in September announced a major overhaul in the indirect taxation system, aimed at simplifying the slabs, boosting the consumption and rationalizing the rates. Under the new plan, the government is set to merge the four slabs into two main categories with an additional “sin tax" bracket: 5% slab — for essential goods. 18% slab – for most other goods and services. 40% slab – for luxury and sin goods such as tobacco, alcohol, betting, and online gaming. This consolidation is expected to make tax compliance easier and also reduce prices on many items currently taxed at 12% or 28%.This consolidation is expected to make tax compliance easier and also reduce prices on many items currently taxed at 12% or 28%.Consumers will see essential items becoming cheaper from September 22, as several sectors from FMCG to Auto have announced earlier to pass on the benefits of lower GST to them.

Published 22 Sep 2025 05:13 PM

Live updates for the ITR due date: Will there be another extension of the income tax return deadline?

Date of ITR due REAL-time updates: The deadline for filing Income Tax Returns (ITR) for the assessment year 2025–2026 is now. Over 6.69 crore returns have already been received by the Income Tax Department, of which over 6.03 crore have been validated and 4 crore have been processed.Taxpayers who miss today's deadline risk interest on unpaid taxes, delayed refunds, and late fines of up to ₹5,000 (limited at ₹1,000 for individuals with incomes up to ₹5 lakh). Therefore, it is essential to file and confirm returns on time in order to prevent fines and guarantee prompt refund processing.The deadline is applicable to non-audit instances, such as the majority of salaried individuals, small enterprises or professions under the presumptive taxation plan, and Hindu Undivided Families (HUFs). It is recommended that taxpayers refrain from spreading false information about extensions and instead rely solely on official updates from Income Tax India.In order to assist last-minute filers in appropriately completing submissions, the department's helpdesk is open around-the-clock and provides assistance via phone, live chat, WebEx sessions, and social media.The department's help line is open around-the-clock, providing assistance via phone, live chat, WebEx sessions, and social media to help filers who are submitting at the last minute appropriately.

Published 15 Sep 2025 05:53 PM

Finance & Stock Market

Finance & Stock Market is financial management, which covers tasks including forecasting, budgeting, borrowing, lending, and investing. Finance can be broadly classified into three categories:

- Personal Finance

- Corporate Finance

- Public/government Finance

Lending, banking, investing, forecasting, and a wide range of other topics pertaining to the distribution and trade of financial assets are all included in the broad industry that is finance.

- NYSE - USA

- Nasdaq - USA

- Euronext - Netherlands

- Shanghai Stock Exchange - China

- Japan Exchange Group - Japan

- Shenzhen Stock Exchange - China

- Hong Kong Exchanges - Hong Kong

- National Stock Exchange of India - India

- LSE Group - UK

- Saudi Exchange - Saudi Arabia

HDFC Bank sees period of consolidation as it absorbs mega merger: Report

HDFC Bank, India's largest private sector lender, will take 4-5 years to fully digest its merger with its parent last July but expects to restore a key financial metric to pre-merger levels at the end of that period, two sources familiar with the bank's thinking said. The lender's quarterly earnings last week prompted a sharp 15% decline in the stock, even as its profit beat expectations, as analysts raised concerns about lending margins and sluggish deposit growth in its second quarterly report since merging with Housing Development Finance Co. "We will see a period of consolidation for 4-5 years during which growth rates and trajectory of some of the metrics will differ from what we were used to in the bank but this a different institution now after the merger," said one of the sources quoted above. Before the merger, the bank's return on equity was above 17%, but it has since declined to 15.8% as of December-end. "We are very focused on profitable growth and we will see the return on equity move back to the levels we saw before the merger over this 4-5 year period," this person said.Other metrics, including the net interest margin, deposit and loan growth will be contingent on the economic environment and the strategic decisions the bank makes to adapt to the environment, the person said.Following the earnings, investors and analysts criticised the bank for over-promising and under-delivering on certain metrics, particularly margins.

Sony scraps $10 bn merger as Zee failed to meet financial terms: Report

Sony scrapped the $10 billion merger of its Indian arm with Zee Entertainment in part because Zee failed to meet some financial terms of the deal and come up with a plan to address them, according to a termination notice reviewed by Reuters. India's Zee denied the allegations in a letter to Sony, also reviewed by Reuters, and accused the Japanese company of "bad faith" in calling off the merger. A Zee-Sony merger in India would have created a media powerhouse in the world's most populous nation with 90-plus channels across sports, entertainment and news. But Sony terminated the plans on Jan. 22, saying in a statement it was doing so because "closing conditions" were not satisfied after two years of negotiations. Neither Sony nor Zee made the contents of the termination notice public. Reviewed by Reuters, Sony's notice said Zee had "failed to take commercially reasonable" efforts to meet some financial thresholds, including with regards to cash availability, while a "lack of commercial prudence" by the Indian network contributed to its decision.In the 62-page notice, Sony said several breaches of the merger agreement were "not remediable and any further attempts to mutually discuss would be an empty formality, especially given ... plain denial (by Zee) and failure to provide a proposal to protect" Sony's interests.

Indian luxury car buyers move from diesel to electric

Sales of diesel vehicles in the luxury vehicle segment have more than halved in the last five years even as the rich and well-heeled have taken the lead in adoption of electric vehicles in the country. The share of diesel in total sales of luxury vehicles in the local market declined to 35% last year from about 80% in 2018, and electric vehicles now account for 6% of overall volumes in the segment - thrice the share of EVs in the mass market, as per industry estimates. Ease of installing charging points at homes or offices for more affluent buyers who can also buy electric as a second or third vehicle has been fuelling demand for these cleantech vehicles at the upper end of the market, industry executives said. The "better than expected demand" for EVs in a country where charging infrastructure is yet not widely accessible has surprised carmakers like BMW, Audi, and Mercedes Benz, who have together lined up more than half a dozen EV models for launch in the next one year to capitalise on latent demand. Market leader Mercedes Benz India has even commenced local assembly of EV EQS 580 at its facility in Pune (its first assembly plant outside Germany for EVs), while others are fast-tracking feasibility studies for the same, to bring down costs of electric vehicles in the country. The luxury carmakers are clearly not as gung-ho about their diesel offerings. "The share of diesel in vehicle sales is already on a decline," Balbir Singh Dhillon, head of Audi India, told ET. "Going ahead, we will see a transition to petrol and electric vehicles in the market, which was earlier dominated by diesel." Once the share of diesel in sales of luxury vehicles dips to 20%, it is unlikely to be viable for any manufacturer to continue to offer the fuel option to customers, Dhillon said. Audi India had stopped sales of diesel vehicles in the country ahead of the transition to BSVI emission norms, and has on offer only petrol and electric cars here. The company, which has on offer four EVs in the country with prices starting at Rs 1.2 crore, has plans to strengthen its portfolio with more affordable battery electric cars to expand its share in the space. BMW, which leads the Indian luxury EV market with 50% share in 2023, plans to drive in two new EV models in 2024 while Mercedes Benz India has scheduled three new EV launches in the country this calendar year. BMW, which saw the share of diesel vehicles slide to 36% last year from 65% four years back, is working on introducing more electric vehicles in India at varied price points to cater to a wider array of customers. "We have the most diverse product portfolio in electric with five distinct products and will continue to strengthen our range to build on our leadership position in EVs," BMW Group India president Vikram Pawah said.

HeroMotoCorp unveils CE001 Limited Edition: A tribute to founder on 100th birth anniversary

HeroMotoCorp, the renowned two-wheeler giant, stole the spotlight at the Hero World 2024 event with the dazzling showcase of the Mavrick and Xtreme 125R. However, the real showstopper turned out to be the unexpected unveiling of the highly anticipated CE001 limited edition motorcycle. This exclusive model, based on the new Hero Karizma XMR 210, is set to capture the hearts of motorcycle enthusiasts, as it pays homage to Hero Group's founder, Dr. Brijmohan Lall Munjal, on his 100th birth anniversary.Marking a significant milestone, the Hero CE001 represents the company's first foray into crafting limited edition offerings for its customers. Described by the manufacturer as the "most special bike built in India," this commemorative edition is a testament to the legacy of Dr. Brijmohan Lall Munjal and the rich history of the Hero Group. The choice of the Hero Karizma XMR 210 as the base for the CE001 holds sentimental value, as the original Karizma was conceived during the tenure of Dr. Brijmohan Lall Munjal as the Chairman Emeritus. The CE001 maintains the essence of the original design, incorporating the distinctive half-fairing version that pays homage to the classic motorcycle. Adding to its allure, the limited edition motorcycle features bodywork crafted from lightweight carbon fiber, ensuring a substantial reduction in weight compared to the stock model. Riders can also expect an upright riding posture for enhanced comfort. While HeroMotoCorp has not disclosed specific details about engine modifications, it is anticipated that the CE001 will boast a power boost over the standard model. The Hero Karizma XMR, serving as the foundation, boasts a trellis frame housing a potent 210 cc single-cylinder, liquid-cooled engine, producing 25 bhp and 20 Nm of peak torque. The CE001 is expected to offer a superior power-to-weight ratio, accompanied by a range of performance upgrades, including the inclusion of an Akrapovic exhaust. The company has committed to delivering all 100 units of the CE001 by July this year, with the entire stock available for purchase online. New Delhi: The upcoming interim budget is unlikely to have any additional incentives for hybrid vehicles, people aware of discussions in the government said. A scheme, FAME-II, already exists to incentivize both hybrid and electric vehicles. In addition, a committee instituted by the ministry of heavy industries (MHI) will seek the Indian auto industry’s views on the possibility of reducing taxes on hybrid vehicles. According to documents released by the U.S. National Highway Traffic Safety Administration, Tesla acknowledges that software instability may impede the display of images from the backup camera while the vehicle is in reverse, thereby heightening the risk of a potential collision. Tesla emphasizes in the documents that it is currently unaware of any reported crashes or injuries related to this issue. The problem has reportedly been rectified through an online software update.Owners of the affected vehicles will receive notification letters starting March 22.

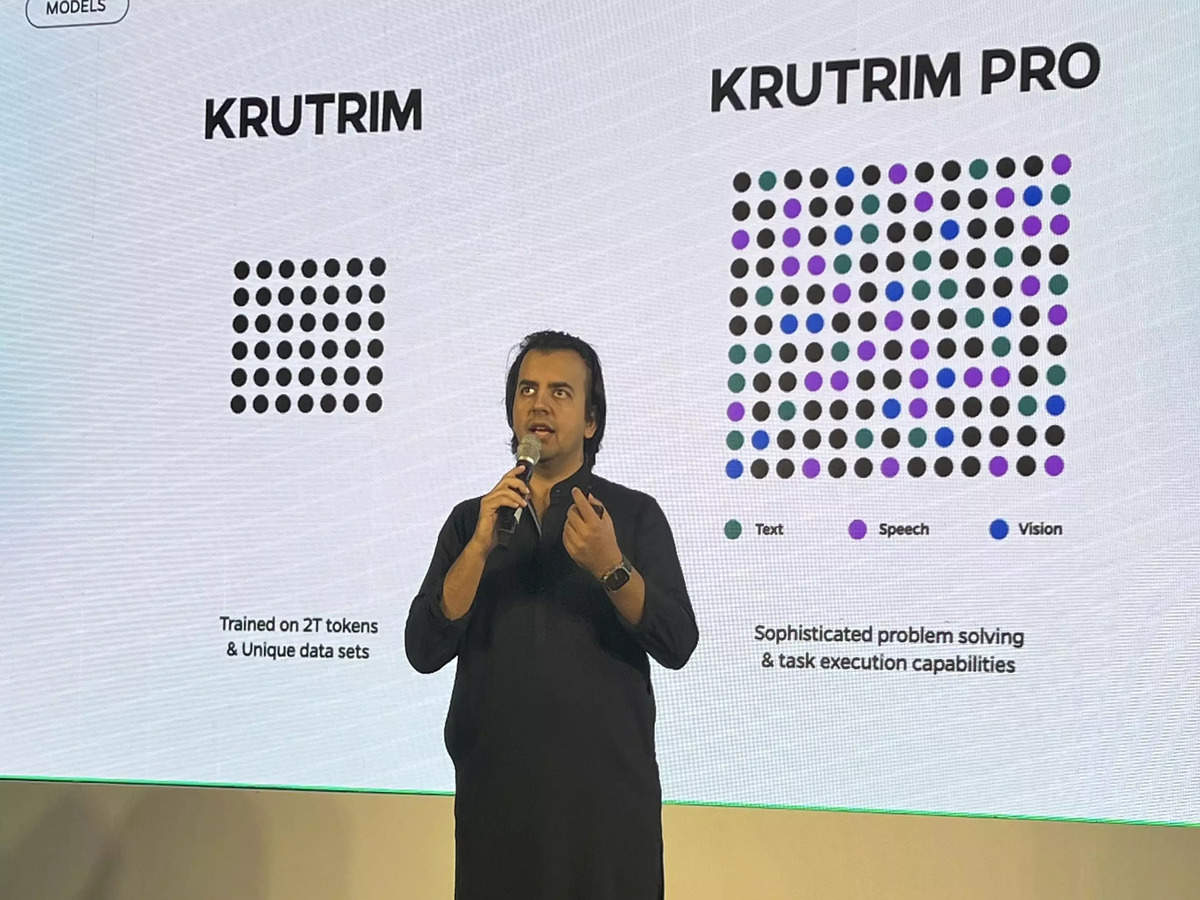

Ola founder’s Krutrim turns unicorn after raising $50 mn

BENGALURU: Ola founder Bhavish Aggarwal’s AI start-up Krutrim has turned unicorn after raising $50 million in equity. The round was led by investors including Matrix Partners India and others. Krutrim also becomes the country’s first AI start-up to attain a unicorn status. The funds raised will be instrumental in accelerating the company’s mission to revolutionise the AI landscape, drive innovation, and expand its reach globally, the start-up said. Bhavish Aggarwal, founder of Krutrim said, “India has to build its own AI, and at Krutrim, we are fully committed towards building the country’s first complete AI computing stack.” “We are thrilled to announce the successful closure of our first funding round, which not only validates the potential of Krutrim’s innovative AI solutions but also underscores the confidence investors have in our ability to drive meaningful change out of India for the world.” Last month, Krutrim unveiled its base Large Language Model (LLM). With the largest representation of Indian data used for its training, it powers generative AI applications for all Indian languages. Trained by a team of leading computer scientists, based in Bengaluru and San Francisco, this model will power Krutrim’s conversational AI assistant that understands and speaks multiple Indian languages fluently, it said. Krutrim is a family of Large Language Models, including Krutrim base and Pro that will have multimodal, larger knowledge capabilities, and many other technical advancements for inference. Trained on over 2 trillion tokens, Krutrim accomplishes better performance on multiple well known, global, LLM evaluation benchmarks including MMLU, HellaSwag, BBH, PIQA and ARC, the start-up said. Krutrim will be available in beta version for consumers in February 2024. Additionally, it will also be available as an API for enterprises and developers, seeking to create AI applications. The company is working on AI infra to develop indigenous data centers and eventually, server-computing, edge-computing and super-computers.

Yes Bank Q3 Results: Net profit soars 349.7% to Rs 231.6 crore; asset quality stable

Yes Bank Ltd's fiscal third-quarter profit surged more than fourfold but fell short of analysts' estimates. Net profit rose to Rs 231.6 crore for the quarter ended December 31 from Rs 51.5 crore a year ago, the bank said in a statement to stock exchanges on January 27. That compares with the Rs 415.1 crore quarterly profit estimate of brokerage Emkay Global.The lender's gross non-performing assets (NPA) remained steady at 2 percent in the three months ended December 31, while net NPA improved to 0.9 percent. Net interest income (NII) increased 2.3 percent from a year earlier. Operating profit rose 5.4 percent to Rs 864 crore.The bank also reported a 13.2 percent growth in deposits to Rs 2.4 lakh crore from last year. The current and savings account ratio (CASA) saw a slight decline to 29.4 percent in the quarter ended December 31 from 29.7 percent in the year earlier.

Bajaj Finance Q3 Preview: NII to rise 26%, net profit to jump 25% on strong AUM growth

All eyes will be on Bajaj Finance on January 29 as the non-banking financial company (NBFC) will declare its December quarter results. As per a poll of six brokerages, the lender's consolidated net profit is expected to rise 25 percent year-on-year to Rs 3,716 crore. An average of four brokerages shows that net interest income is expected to rise 26 percent YoY to Rs 9,344 crore. Stable asset quality and strong AUM (assets under management) growth will drive earnings, as per analysts. Bajaj Finance, on January 3, declared provisional numbers for the December quarter AUM. On the back of a strong festive season, the company's AUM crossed the Rs 3-lakh-crore mark for the first time in the quarter gone by, surging 35 percent YoY. As per the Q3 update, its deposit book grew by 35 percent to Rs 58,000 crore. During the quarter, it booked 98.6 lakh new loans, a YoY growth of 26 percent.According to domestic broking firm Motilal Oswal Financial Services margins and spreads are likely to decline sequentially by ~25 basis points and 15 basis points, respectively. Credit costs are expected to rise ~10 basis QoQ to ~1.7 percent. Axis Securities also sees margins declining by ~10-15 basis points QoQ owing to an inch-up in cost of funds. Inching up of the cost of funds is an industry-wide trend, noted Jefferies, due to the lagged repricing of MCLR-linked loans. In November 2023, the Reserve Bank of India asked Bajaj Finance to stop issuing new loans through its “eCOM” and “Insta EMI Card” for non-compliance with digital lending guidelines. It is important to watch out for management commentary on the same. Bajaj Finance Q3 results also come after RBI's caution against unsecured lending and risk-weightage increase for consumer credit. While analysts are confident of Bajaj Finance's liquidity position on the back of Rs 10,000 crore fundraising, it will be crucial to monitor management commentary on how Bajaj Finance's borrowing mix will change going ahead as banks' lending to NBFCs slows down. Apart from that, the Street will also be monitoring how new products are scaling up and if any segments are showing signs of stress.

Day 2 Box Office Collection for Fighter: Deepika Padukone and Hrithik Roshans eyes The ₹100 crore club

Day 2 of Fighter Box Office Collection: The film, starring Hrithik Roshan and Deepika Padukone, was released on January 25, one day ahead of Republic Day. During the second day of the national holiday, the movie gained momentum and earned over 1.5 times its opening day total.During its two-day run in theaters across all languages, "Fighter" brought in a net collection of ₹61.5 crore in India, according to film industry tracker Sacnilk. On Republic Day, the movie earned ₹39 crore in net revenue. On the day of its release, it brought in ₹22.5 crore in India across all languages.Fighter Box Office Collection Day 2: During its two days in theaters, the movie "Fighter" has made a net collection of ₹61.5 crore in India. On Friday, its Hindi version had an overall occupancy rate of 41.57%.After making a reasonable (albeit not very impressive) Rs 24 crore on the first day, the big-budget Hrithik Roshan flick Fighter truly took off on the second day. Due to favorable buzz about the film's airborne action sequences, Fighter's profits on its second day of release—which fell on Republic Day holiday—are predicted to have soared by more than 70%. This raises the domestic two-day total of the film to Rs 61 crore. The anticipated amount for the domestic launch weekend is between Rs 120 crore and Rs 150 crore.Siddharth Anand's patriotic action film Fighter follows the lives of a few Air Force fighter pilots during a conflict. Supporting roles go to Karan Singh Grover and Akshay Oberoi in addition to Deepika Padukone and Anil Kapoor. According to Sacnilk, Fighter reported occupancy rates of 41% for the 2D standard version and 42% for the 3D edition. For both of the film versions, evening performances drew the majority of viewers. Chennai recorded occupancy of over 80% of its capacity, but Mumbai and the Delhi NCR area reported occupancy of roughly 50%. Fighter is not being marketed as a pan-Indian film, despite current trends. The first-day box office receipts for the film did not quite match the high expectations that Hrithik has set for himself recently (his two previous films with Siddharth Anand had larger debuts); nonetheless, they did signify a return to form for the actor, who was thought to have underperformed in his last film, Vikram Vedha. Fighter will beat the roughly Rs 80 crore that Vikram Vedha completed its domestic run with on day three alone.War remains Hrithik Roshan's highest-grossing movie to date, taking in over Rs 470 crore worldwide after earning Rs 53 crore the previous year. After its premiere at Rs 27 crore, Bang Bang made over Rs 350 crore globally. Siddharth, Deepika, and Anil Kapoor recently wrapped their successful film projects. The most recent film in which Anil appeared was the controversial hit Animal, whereas Siddharth and Deepika worked together in the Shah Rukh Khan movie Pathaan.

By2029, the media, advertising, and entertainment vertical will represent a $17.9 billion opportunity.

ResearchAndMarkets.com now offers the "Generative AI Market by Technology, Component, Application, Industry Vertical, and Region 2024-2029" report.The expected effects of the generative AI industry are evaluated in this research across multiple domains, such as ChatGPT in software, general-purpose platforms, IoT systems, and embedded consumer products. In addition to discussing the potential applications and use cases in several business verticals, the research also examines the underlying relationship between generative AI and AGI, ASI, and strong AI, as well as the influence of enabling technologies like 5G, business 4.0, MEC, self-driven networks, and others.A few of the report's findings: Through 2029, North America will dominate the worldwide generative AI market. Through 2029, the top industry vertical for generative AI will be healthcare. Through 2029, API-enabled solutions will have the fastest rate of growth (CAGR of 47%). By 2029, generative AI services will have grown to a $2.5 billion market at a 43.9% CAGR. By 2029, the media, advertising, and entertainment sector will represent a $17.9 billion potential.Artificial intelligence that can create unique and novel data or content, including literature, music, or graphics, is known as generative AI. Generative AI use algorithms to produce new data that did not previously exist, in contrast to other forms of AI that are intended to identify and categorize existing data. In order to accomplish this, the data is analyzed for patterns and relationships, and new content is created in response to those patterns.New models and architectures are being developed to enhance the diversity and quality of generated content as a result of the rapid advancement of technology. The use of technologies like GANs, transformers, and VAEs made it possible to create generative models that are more intricate and lifelike. To guarantee the moral and equitable use of technology, there were still issues to be resolved in areas like bias and data privacy.The growing requirement for automation and the expanding use of generative AI across a range of industries are driving the industry. Large datasets and the development of deep learning algorithms have also contributed to the market's expansion.

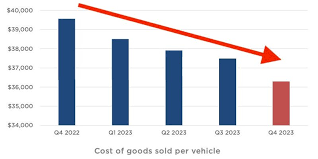

This chart shows how Tesla can keep cutting prices and stay ahead of the competition

Tesla keeps lowering the price of its cars.It's taken a margin hit, but its input costs are going down too.Tesla's price war sent shock waves through the industry, and the fallout is far from over.Still, Elon Musk's electric automaker is lapping the competition as old-guard automakers like Ford and General Motors switch to electric vehicles.That's in large part thanks to tremendous cost savings found in manufacturing.The average cost of building a Tesla in the fourth quarter fell once again, according to the company's earnings report released Wednesday. On average, Tesla spent just over $36,000 per vehicle it sold in the October to December period, down from over $37,000 per vehicle in the same quarter in 2023.At the same time, Tesla has been selling its vehicles for cheaper, showing Tesla's might over its competitors when it comes to EV pricing.Tesla has always had a lot of room to run on pricing, given its industry-leading profit margins. But Elon Musk's strategy to slash prices has chipped away at its once-40% gross margins, bringing them down to 17.6% in the fourth quarter.Still, that's far above the industry average of around 9%.While Tesla continues to play with prices, other automotive CEOs have warned against the practice. Stellantis CEO Carlos Tavares said last week he was keen to stay out of any EV price wars, but stopped short of mentioning Tesla by name. "If you go and cut pricing disregarding the reality of your costs, you will have a bloodbath. I am trying to avoid a race to the bottom," he said.Last year, Ford CEO Jim Farley compared Musk's strategy to that of Henry Ford."I think what he's going to learn is product freshness means a lot," Farley said of Musk at the time. "The product gets commoditized and then you lose your pricing premium. That's a really dangerous thing."

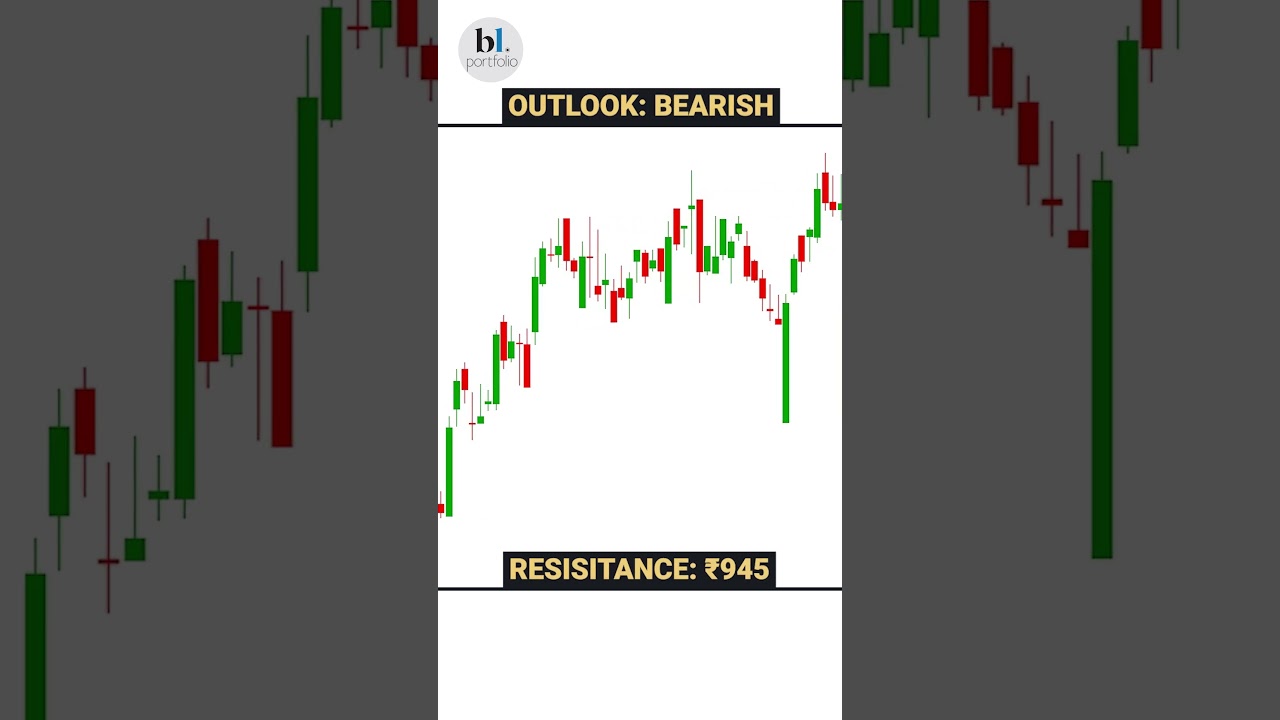

Market Outlook for 25 January 2024

Our markets witnessed high volatility ahead of the F&O expiry day. Nifty sneaked below 21200 mark during the day, but it recovered sharply towards the end and closed above 21450 with gains of about a percent from previous day’s close. Nifty Today: Nifty has corrected sharply in last few days from the high of 22124 to sub-21200 levels. The volatility has increased recently and when the range is broad, the 40-day EMA becomes an important level for the short term. This average support is placed around 21200 and the Nifty index has managed to recover and close well above this support in Wednesday’s session. Although the daily RSI remains negative, the readings on the hourly charts have given a positive crossover from the oversold zone and hence, we could see a pullback move in next few sessions. Thus, although the intraday volatility could remain high, the index can see some pullback towards 21600-21700 zone while 21300-21200 would be seen as immediate support. Traders are advised to trade with a stock specific approach for a while.

Indian Railway Finance Corporation share price Today Live Updates

Indian Railway Finance Corporation Share Price Today : The last day of trading for Indian Railway Finance Corporation saw an open price of ₹164.18 and a close price of ₹161.48. The stock had a high of ₹173.14 and a low of ₹150.81. The market capitalization for the company is ₹224,595.34 crore. The 52-week high for the stock is ₹160.89, while the 52-week low is ₹25.45. The BSE volume for the day was 30,763,279 shares.Disclaimer: This is an AI-generated live blog and has not been edited by LiveMint staff.Indian Railway Finance Corporation share price NSE Live :Indian Railway Finance Corporation trading at ₹174.21, up 1.37% from yesterday's ₹171.86. The stock price of Indian Railway Finance Corporation (IRFC) is currently ₹174.21, with a percent change of 1.37 and a net change of 2.35. This indicates that the stock has seen a slight increase in value. However, without further information, it is difficult to determine the overall trend or significance of this change.

Share Market Highlights: Sensex, Nifty close around 1% up; Broader markets, sectoral indices rallied

Sensex Today | Share Market Highlights: After a bout of choppy trading, both the benchmark indices consolidated in the green after opening in the red. Although they had dipped in the negative zone a few times through the day.Stocks gained as investors rewarded companies for positive earnings updates and as China’s latest move to stimulate its economy boosted resources shares.Europe’s Stoxx 600 index climbed 0.8% as mining stocks jumped the most in almost six weeks after the People’s Bank of China said it would cut the reserve requirement ratio for banks on Feb. 5. The move should boost the economy by freeing up liquidity for customer loans and bond purchases. US equity futures gained, led by tech stocks, after Wall Street set fresh closing highs on Tuesday. Asian stocks advanced, with Chinese shares traded in Hong Kong extending their rally after the stimulus news. Japanese government bond yields and bank stocks jumped Wednesday as investors decided that monetary policymakers are on track to scrap negative interest rates in the near term after all.As traders increased bets that the Bank of Japan will push ahead in the next few months with its first rate hike since 2007, 10-year note yields climbed as much as 10.5 basis points. Shares of Japanese banks, who have struggled through decades of deflation, rose on expectations higher interest rates will improve their lending margins.Elsewhere, the timing and extent of expected Federal Reserve rate cuts this year have dominated markets in recent weeks with less attention paid to Japan’s central bank. That left economists looking more bullish over the BOJ’s looming move than market players. After a day of choppy trading, both the benchmark indices ended in the green, around 1% above the previous day's close, after they had opened in the red.At close, Sensex was up 689.76 points, or 0.98%, at 71,060.31, Nifty was up 215.15 points, or 1.01%, at 21,453.95.Broader market indices also closed up 1%, whereas among sectoral indices, only the Nifty Private Bank ended the day in the red.Global shares rose on Wednesday, fuelled by positive tech earnings and optimism Chinese authorities will offer support to its stock markets, while the dollar showed resilience on growing expectations the U.S. Federal Reserve won't rush to cut rates.European stocks climbed 0.8%, with tech stocks adding over 3.6% to their highest in two years. Investors are also focused on manufacturing purchasing managers' index (PMI) figures - seen as a good gauge of economic health - from the euro zone, Germany, France and Britain later in the day.The European Central Bank (ECB) meets on Thursday and is widely expected to keep rates unchanged - though traders are pricing in as much as 130 basis points of interest rate cuts this year. Wall Street was set to gain, with e-mini futures for the S&P 500 up 0.4% as investors focused on a slew of earnings. The yield on 10-year U.S. Treasury notes was last at 4.097%, while the two-year Treasury yield, which typically moves in step with interest rate expectations, was at 4.314%.Markets are now pricing in a 47% chance of a rate cut in March from the Fed, according to the CME FedWatch tool, compared to the 88% chance of a rate cut priced in a month earlier.The MSCI world equity index, which tracks shares in 47 countries, gained 0.3%. The MSCI's broadest index of Asia-Pacific shares outside Japan gained 1%. Still, the index is down around 4.7% so far this month.After a bout of choppy trading, both the benchmark indices consolidated in the green after opening in the red. Although they dipped in the negative zone a few times through the day.At 3 pm, Sensex was up 683.54 points, or 0.97%, at 71,054.09, Nifty was up 211.30 points, or 0.99%, at 21,450.10.

Share Market Highlights 24 January 2024:

Sensex, Nifty updates on 24 January 2024: India’s equity markets are volatile on Wednesday. The BSE Sensex rose 689.75 pts or 0.98% to close at 71,060.31. The NSE Nifty jumped 215.15 pts or 1.01% to close at 21,453.95. Analysts anticipated sustained selling pressure from foreign portfolio investors, emphasizing the significance of upcoming results and heightened volatility during the monthly F&O settlement. Siddhartha Khemka, Head of Retail Research at Motilal Oswal Financial Services, highlighted caution in global sentiments due to Fitch Group’s warning about the impact on South Asian economies and increased hostilities in the Red Sea. Technical analyst Pravesh Gour noted Nifty’s breakdown, signalling potential testing at 50-DMA at 21000, while Bank Nifty faces hurdles and support challenges. Market Update: Sensex surges 690 points to reclaim 71k leve Equity benchmark indices Sensex and Nifty rebounded sharply by one per cent on Wednesday after sliding for the past two sessions, propelled by bargain hunting in metal, commodity, and telecom stocks. Currency Market Live Updates: Rupee ends slightly higher, aided by yuan’s uptick, dollar’s slip. The rupee ended marginally higher on Wednesday, aided by a slight uptick in the offshore Chinese yuan and a pullback in the dollar index.The rupee ended at 83.1225 against the US dollar, compared with its close at 83.15 in the previous session.Bharat Dynamics reported its standalone net profit for the quarter ended December 2023 at ₹135.03 crore as against ₹83.74 crore in December 2022. The stock closed at ₹1,696.50 on the NSE, up by 1.61%.“The market rebounded from yesterday’s sell-off taking cues from global peers. The sentiment was reinforced by the PBOC’s 0.5% cut in reserve ratio to boost growth and financial liquidity. However, overall sentiment is muted as concerns persist on FIIs selling due to premium valuations in India and below expectation Q3 earnings so far.”

Zee-Sony Merger Called Off: These mutual funds have exposure to the stock

India's mutual fund houses have increased their stake in Zee Entertainment in all of the nine quarters since the Sony merger announcement in December 2021. As of the December quarter, the domestic mutual funds held a 32.49% stake in Zee Entertainment, which is more than double the 12.16% stake they held at the end of the December 2021 quarter when the deal was announced. The increase in stake also corresponds with the exit of its largest shareholder Invesco, which along with Oppenheimer, held close to 18% stake in Zee at the time of the merger announcement. While Invesco Developing Markets Fund exited the stock by selling its 7.8% stake in April 2022, the OFI Global China Fund earlier pared a 5% stake between October and December 2022, before making a complete exit in April 2023. Among the funds that own a substantial stake in Zee Entertainment as of the December quarter include ICICI Prudential Value Discovery Fund, Nippon India Multi-Cap Fund, and HDFC Mid-Cap Opportunities Fund, among others. Some of India's largest insurance companies, all listed, also own a stake in Zee Entertainment, including the country's largest insurer LIC, along with HDFC Life and SBI Life Insurance.

Stock Market Nifty 50 falls below 21,500, Zee Entertainment shares down 25%

The Bombay Stock Exchange (BSE) has revised the Dynamic Price Band of shares of Zee Entertainment to 30% downward from 25% earlier. In case further relaxation is needed, it will be done at an interval of 15 minutes, a circular from the BSE said.It must be noted that the stock is currently in the F&O ban and hence there are circuit limits being imposed, something that is a practice with non-F&O stocks. Otherwise, for F&O stocks, there is no price band. Barring ICICI Bank, the remaining 11 stocks in the Nifty Bank index are contributing negatively towards its downside. Reliance Industries shares were in focus on January 23 with analysts expecting up to 23% upside in the Mukesh Ambani-led conglomerate’s stock following the results for the October to December 2023 quarter. Reliance shares traded more than a percent lower after the firm reported a steady third quarter with retail business revenue hitting a record high, Jio reporting a 2% rise in average revenue per user (ARPU) and oil and gas business witnessing record high margin of 86%. Shares of HDFC Bank Ltd. remain the top contributors to the Nifty 50’s downside on Tuesday, declining another 2%. India’s largest private lender is contributing 56 points to the index downside on Tuesday. The lender’s market capitalisation has also slipped below the mark of ₹11 lakh crore, compared to its peak of ₹12.97 lakh crore, which it had on December 29.With Tuesday’s drop, the stock has declined in four out of the last five trading sessions, during which it has seen a drop of 13% from closing levels of January 16. Shares of Medi Assist Healthcare Services listed on the bourses on Tuesday, January 23. The stock listed at a premium of 11% at ₹465 a share on the BSE, and went on to scale an intra-day high of ₹509.60. On the NSE, it listed at ₹460, a premium of 10% against an issue price of ₹418. Ahead of its debut, shares of Medi Assist were commanding a premium of ₹32-36 in the unlisted market. As per trends, the company’s shares were expected to list at a premium of 8%. The initial public offering (IPO) of Nova Agritech Limited (NATL) will open for subscription on Tuesday (January 23). The public offer was postponed by a day due to the market’s holiday on January 22 and would close on January 25. Ahead of the issue launch, the company’s shares are commanding a premium of ₹20 in the unlisted market.Nova Agritech has fixed its price band at ₹39-41 per share, with a lot size of 365 equity shares in one lot and its multiples thereafter.

Ram Mandir Inauguration: TN govt slams Finance Minister for spreading falsehood over live telecast ban

The Tamil Nadu government has hit back at Union Finance Minister Nirmala Sitharaman's claims that the state has prohibited the live telecast of Ayodhya Ram Mandir programmes scheduled for January 22. P Sekar Babu, Tamil Nadu Minister for Hindu Religious & Charitable Endowments, dismissed these allegations and criticised Sitharaman for "purposefully propagating this erroneous information"."The Hindu Religious and Charitable Endowments department hasn't imposed any limitations on devotees' freedom to offer food, conduct poojas in the name of Shri Ram, or provide prasad in Tamil Nadu temples. It is unfortunate that people in office, like Union Finance Minister Mrs. Nirmala Sitharaman and others, are purposefully porpagating this erroneous information," Sekar Babu said in a post on X (formerly Twitter). Earlier on Sunday, Sitharaman claimed that the Tamil Nadu government prohibited the live telecast of the prgrammes and took to social media to denounced the Chief Minister MK Stalin-led DMK government, labelling the it as "anti-Hindu" and "hateful."Sitharaman had alleged that the "ban" extends to Hindu Religious and Charitable Endowments (HR&CE) managed temples, where she claimed activities such as puja, bhajan, prasadam, and annadanam in the name of Lord Ram are not permitted. She further accused the police of intervening in privately held temples, preventing them from organising events and issuing threats of dismantling pandals.Sitharaman alleged that individuals are facing obstacles and threats while attempting to organize bhajans, provide food to the needy, distribute sweets, and celebrate, all to witness Prime Minister Narendra Modi's participation in the Ram Temple consecration ceremony at Ayodhya.The Finance Minister went on to claim that cable TV operators have been warned about possible power cuts during the live telecast, branding it as an "anti-Hindu move" orchestrated by the DMK, a key partner in the INDIA alliance. Sitharaman accused the Tamil Nadu government of "unofficially" citing law and order concerns as a justification for the ban on live telecast.

Governments cash surplus tops Rs 3.4 lakh crore

Apart from the deceleration in government spending, higher direct tax collections and a likely sharp rise in issuances of Treasury Bills by the Centre in FY24 were factors pushing up the government's cash balances, analysts said. The flow of government cash balances to and from the banking system is a key factor that influences liquidity conditions. Mumbai: A constant feature of the Indian banking system over the past couple of months has been the prevalence of large deficit liquidity conditions, and one of the factors behind banks' scramble for funds is a massive build-up of government cash balances as the Centre slows down spending.Apart from the deceleration in government spending, higher direct tax collections and a likely sharp rise in issuances of Treasury Bills by the Centre in FY24 were factors pushing up the government's cash balances, analysts said. The flow of government cash balances to and from the banking system is a key factor that influences liquidity conditions."Government cash surplus as of Janury 12, 2024 is tracking at ₹3.4 lakh crore versus ₹1.6 lakh crore as of January 13, 2023. We see space for expenditure savings for the Centre on transfers to states which consists of finance commission grants, centrally sponsored schemes and central sector schemes, loans for capital expenditure etc," said Gaura Sengupta, economist at IDFC First Bank. "Based on data from Finance Ministry, 15th Finance Commission grants to states are tracking 29%YoY lower in FYTD24 (Apr-Dec)," she said.As on January 16, the headline liquidity deficit in the banking system was at ₹1.94 lakh crore, Reserve Bank of India data showed. Liquidity in the banking system typically tightens around the middle of a month due to tax outflows before easing towards the end of the month as the government spends on salaries and pensions of employees. With banks facing a scarcity of funds at present, the weighted average call rate (WACR) closed at 6.76% on Wednesday, much higher than the repo rate of 6.50%. The elevated money market rates have pushed up costs of funds for banks, and in turn for corporates, looking to raise money through short-term debt."It's speculative to say that the build-up in cash balance is for any particular reason, but one thing is that the government started the year in WMA (Ways and Means Advances), so there might have been a target to build up the cash balance for the end of the year as well," said A Prasanna, head of research at ICICI Securities Primary Dealership. WMA is a funding facility that the RBI extends to the government in order to tide over short-term cash-flow mismatches.Till January 11, the government's net direct tax collections rose 19% annually to ₹14.70 lakh crore, official data released last week showed. Tax collections till then were at 81% of the full-year target.