Top Trending Business News & Highlights

One accord, three setbacks India's use of the EU trade pact to boil Turkey, Pakistan, and Bangladesh

The United States has also been affected by India's trade agreement with the European Union. The historic trade deal between India and the EU would not only affect Bangladesh and Pakistan but also the United States and Turkey. The agreement calls for the elimination or reduction of tariffs on more than 90% of EU goods exports to India, including hefty charges of up to 44% on machinery, 22% on chemicals, and 11% on pharmaceuticals, which will be phased down over time.Following nearly two decades of negotiations, officials announced on Tuesday that India and the European Union have achieved a free trade agreement to strengthen economic and strategic ties. Up to 2 billion people might be impacted by the agreement, which the president of the EU's executive body referred to as the "mother of all deals." The accord won't go into force for some months. The agreement between two of the largest markets in the world comes as Washington imposes high import taxes on both the EU bloc and the Asian behemoth, upsetting long-standing trade patterns and forcing major economies to look for new alliances. The FTA, which both India and the 27-nation EU refer to as "the mother of all deals," provides a "decisive boost" to the labor-intensive textile industry by improving price competitiveness and expanding market access in one of the most sophisticated consumer markets in the world, according to a note released today by the Indian Textile Ministry.

Published 29 Jan 2026 12:51 PM

India and New Zealand wrap up free trade negotiations despite persistently high US tariffs

Free trade agreement (FTA) talks between India and New Zealand came to an end on Monday amid hefty US tariffs that have unsettled investors and led to the cancellation of orders from India's biggest export market. In the context of 50% US tariffs, the New Zealand agreement, if signed, would be India's second free trade agreement (FTA) following the Oman agreement. It would also be the country's third accord this year as it works to diversify its exports.According to information made public by the government, Wellington would remove tariffs on 100% of its tariff lines for all Indian exports, while India has committed to lower tariffs on 95% of New Zealand exports. However, New Zealand's typical tariffs are among the lowest in the world—between two and three percent—and their removal could not immediately boost exports. In order to bring some symmetry to the agreement, New Zealand has "committed" to investing $20 billion in India over the next fifteen years in exchange for market access in a rapidly expanding Indian consumer market that is subject to high tariffs (over 15%). Because of the unfair tariff rates, New Zealand may benefit more from goods trade than India.In 2024–2025, bilateral trade between India and New Zealand was only $1.3 billion. "This FTA opens doors for Indian businesses in the region through well-integrated directional exports and gives our youth choices to learn, work, and grow on a global stage," stated Commerce Minister Piyush Goyal."India's strengths are expanding exports, supporting labor-intensive growth, and power services," stated Commerce Secretary Rajesh Agrawal. New Zealand's access to India's sizable and expanding economy is deeper and more reliable. These qualities are brought together by the migration of individuals, professionals, students, and skilled workers. The FTA contains provisions to address non-tariff barriers through improved regulatory cooperation, transparency, and streamlined customs, sanitary and phyto-sanitary (SPS) measures, and technical barriers to trade disciplines, according to the Commerce and Industry Ministry, in addition to tariff liberalization. According to the Ministry, "all systemic facilitations and fast-track mechanisms for imports that serve as inputs for our manufactured exports ensure that tariff concessions translate into effective and meaningful market access."

Published 22 Dec 2025 10:28 PM

What workers, brokers, and policyholders stand to gain from travelers' agreement to preserve 1,400 jobs in Canada

The Canadian business of Travelers will be acquired by Definity Financial Corp. The total value of the acquisition is $3.3 billion. Definity will become the fourth-largest property and liability insurer in Canada as a result of this transaction. Every one of Travelers Canada's 1,400 employees will continue to work there. Consumers can anticipate competitive pricing and additional options. Regulatory permission is needed for the deal. By early 2026, it should be closed.Definity Financial Corp. plans to pay $3.3 billion to acquire the Canadian operations of the US behemoth Travelers, one of the largest transactions in Canada's insurance industry in recent memory. This merger could change the competitive environment for both insurers and consumers. More than 1,400 Traveler employees across Canada will retain their employment when the two companies combine under a single brand, despite the fact that large acquisitions frequently result in job losses.Definity will move up from sixth place to become Canada's fourth-largest property and liability insurer as a result of the purchase. Its expanding presence in the insurance industry is demonstrated by the $6 billion in total yearly premiums it currently manages.

Published 28 May 2025 07:58 PM

Why did India decide to remove the "Google tax" in response to pressure from the US?

The Center intends to eliminate the 6% equalization levy (EL) it levies on digital advertisements as part of the 35 modifications to the Finance Bill, 2025, effective April 1, 2025.The Central government has suggested to eliminate the equalization levy on internet advertisements as part of revisions to the Finance Bill, 2025, a move that is anticipated to help American large technology companies and allay US worries about India being a high tariff country.As part of changes to the Finance Bill, 2025, the central government has proposed doing away with the equalization levy on online ads. This is expected to benefit big IT companies in the US and ease concerns about India being a high-tariff nation.The equalization charge, also referred to as the Google tax, will be eliminated by the Center on April 1. The clause is one of 59 changes to the Finance Bill that Finance Minister Nirmala Sitharaman made on Monday and presented to Parliament.

Published 25 Mar 2025 08:42 PM

Business

Business globally are the pillars of any economy and they contribute in huge amount to take any country ahead financially and economically and boost the country grwoth.

HNIs chase mid, small caps, IEX under bear attack, I-Pru Life tumbles, NHPC in focus

“Current earnings, future prospects, management, marketability are all factors more or less independent of assets which contribute their share to the intrinsic value.” - Benjamin Graham. Sentiment has turned cautious after three successive sessions of fall, but two days of gains could change that. In the past, mid and small caps would take a battering during market corrections and investors would flee to the safety of large caps. But now exactly the opposite is taking place — large caps are sliding harder than second-line stocks when the market falls.Whispers in market is that many of the mid and small cap companies say they have good earnings visibility for the next few quarters. And that is giving HNIs the comfort to hold on their positions in the stocks. The stock prices so far indicate that the market is willing to believe the earnings story. They would flag when there's still a couple of quarters of earnings growth left. Bull argument: Spot LNG prices have softened. Strong demand for LNG across sectors of late, and this trend is likely to strengthen going forward.Bear argument: Competition is rising, also domestic gas production is increasing. The capex on its proposed petrochemicals foray could weigh on margins. Stock has fallen 16 percent in last couple of trading sessionsBear argument: Huge build up of speculative positions in F&O segment. Uncertainty over the market coupling policy for power exchanges an overhang on the stock.Bull argument: Stock has good support in the Rs 120-125 band. Also, concerns about the market coupling have already been priced in. Stock under pressure as government to sell 2.5 percent stakeBull argument: Seen benefitting from India’s commitment to net-zero as hydro power not polluting like thermal power. Capacity expected to go up sharply in the coming years.Bear argument: Increase in floating stock could be an overhang in the short term. Right now, power is a fancied sector and there is unusually high demand for PSU stocks. This could change. Earnings could be volatile because of dependency on monsoon. GQG Partners upped its stake in ITC to 2.79 percent from 1.58 percent.Bull argument: A good defensive bet if the market continues to correct further. Cigarette volumes increased in Q2 and the trend is likely to sustain.Bear argument: Revenues from agri-business is under stress in FY24 due to a ban on the exports of wheat and rice. Re-rating story is largely over. Further gains will depend on ability to grow earnings.

IndusInd Bank Q3 results impress analysts. Should you buy or sell?

IndusInd Bank impressed the street with a healthy set of number for the December quarter and analysts remain bullish on the counter, counting steady margins, improving retail deposit mix and strong loan growth as some of the key positives. In the past year, the stock has jumped more than 31 percent, outperforming Bank Nifty index which is up 8 percent. The stock hit a 52-week high of Rs 1,694 on January 15.The bank's net profit grew 17 percent on-year to Rs 2,301 crore, aided by healthy net interest income (NII) growth of 18 percent and lower provisions, the private lender said on January 18. At a time when banking sector is grappling with higher cost of funds, its net interest margin (NIM) saw a modest expansion of two basis points (bps) YoY to 4.29 percent in the December quarter. Analysts at Jefferies shared a "buy" call for IndusInd, with a target price of Rs 2,070, saying the lender's NII growth was among the best across coverage. "IndusInd's profit met estimates but they used Rs 200 crore of contingent buffers. We see 20 percent profit compounded annual growth rate (CAGR) in FY24-26, with return of equity (RoE) of 16 percent in FY25," they wrote in their result review. HSBC, too, shared a "buy" call, with a target price of Rs 2,040 apiece on the back of in-line Q3 operating performance, but remain wary of higher slippages. "We forecast CAGR of 23 percent for operating profit and 21 percent earnings per share (EPS) over FY24-26," they said. The rise in fresh slippages, or bad loans, however, remained a key concern during the quarter, analysts at Morgan Stanley said, trimming EPS by 0.5 percent for FY24 and a percent for FY25. The brokerage firm, however, shared an "overweight" call with a target price of Rs 1,850 per share. IndusInd Bank's fresh slippages rose 20.5 percent on a sequential basis to Rs 1,700 crore in the December quarter due to a elevated slippages in corporate and vehicle finance books. However, the management guided that they will normalise to Rs 1,200 crore going ahead. Gross non-performing asset (GNPA) and net NPA ratios were stable at 1.9 percent and 0.5 percent, respectively, due to asset reconstruction company (ARC) sale of Rs 3,100 crore. On the business front, analysts at Macquarie said 24 percent on-year growth in retail book was encouraging during the quarter. "The retail book growth was driven by vehicle book growth. As per liquidity coverage ratio classification mix, retail deposit improved to 45 percent YoY," the brokerage firm said, sharing an "outperform call" with a target price of Rs 1,900 a share. The lender's loan growth was up by 20 percent YoY, while deposits grew by 13 percent YoY. The management expects loan growth to be in the range of 18-23 percent, with the retail loan mix at 55-60 percent. "We estimate 21 percent earnings CAGR over FY24-26, leading to RoE of 16.2 percent in FY25," analysts at Motilal Oswal Financial Services said, reiterating a "buy" rating for IndusInd Bank with a target price of Rs 1,900. Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

HDFC Bank tremors rock banking stocks, Nifty Bank plunges 4%

Banking stocks saw heavy selling on January 17, as all 12 Nifty Bank index names traded with cuts in the afternoon after negative commentary on heavyweight HDFC Bank's below-par December numbers weighed heavy on sentiment for the sector. HDFC Bank, which takes up over 29 percent of weightage in Nifty Bank, plunged nearly 7 percent, putting pressure on the sectoral index, which was down nearly 4 percent. The weakness also rubbed off on other lenders, pulling them down by up to 4 percent. Other index heavyweights, IndusInd Bank, ICICI Bank, Kotak Mahindra Bank, SBI and Axis Bank, which have a cumulative weightage of nearly 49 percent in Nifty Bank, lost 2-4 percent. HDFC's Q3 net profit came largely in-line with Moneycontrol's estimates but there was a twist. Brokerage firm Jefferies noted that the net profit was lifted with a lower tax expense in the third quarter. Brokerage firm Citi also issued a cautious outlook for private lenders, as it lowered FY25/26 net interest margin estimates for Kotak Mahindra Bank, HDFC Bank, Axis Bank, Federal Bank and ICICI Bank.The firm said that quarterly business updates reflected further loan-to-deposit expansion and loan-to-credit contraction, which points towards further downside to net interest margin.The brokerage downgraded state-lender SBI to “sell” and lowering its price target for the stock by over 14 percent to Rs 600. Citi also initiated a 90-day negative catalyst on SBI. It also downgraded Federal Bank to “neutral” and reduced the target price by 20.5 percent to Rs 135.Manish Gunwani, fund manager at Bandhan AMC, warned against being overweight on private banks, saying the segment doesn't offer great risk-reward at the current juncture. Banking stocks saw heavy selling on January 17, as all 12 Nifty Bank index names settled with sharp cuts after negative commentary on heavyweight HDFC Bank's below-par December numbers weighed heavy on sentiment for the sector. HDFC Bank, which takes up over 29 percent of weightage in Nifty Bank, dived over 8 percent, putting pressure on the sectoral index, which was down 4.3 percent. The weakness also rubbed off on other lenders, pulling them down by up to 4 percent.HDFC's Q3 net profit came largely in-line with Moneycontrol's estimates but there was a twist. Brokerage firm Jefferies noted that the net profit was lifted with a lower tax expense in the third quarter.Other index heavyweights, IndusInd Bank, ICICI Bank, Kotak Mahindra Bank, SBI and Axis Bank, which have a cumulative weightage of nearly 49 percent in Nifty Bank, lost 2-4 percent.

Budget 2024: A pressing issue that may not wait till full budget

The fiscal deficit target of 5.3% will be set by the government in FY25, keeping in view the fiscal consolidation path till FY26, as it normalises capital spending and refrains from any major announcements in the interim budget before the general elections, Icra and Barclays economists have said. ICRA expects the fiscal deficit target for FY25 to be set at 5.3% of GDP, midway through the expected print of 6.0% for FY2024 and the medium-term target of sub-4.5% by FY26. India's Fast Moving Consumer Goods (FMCG) sector, which has 34% of its market in rural areas, is a good indicator of rural economic health. It is facing challenges in rural areas due to sluggish demand. The deficiency in rainfall in key agricultural states has disrupted the revival of rural demand seen in the first two quarters of the financial year. President of All India Consumer Products Distributors Federation, Dhairyashil Patil, has told TOI that FMCG sales in rural areas are 20-30% lower than usual. Demand for daily household products and groceries continued to be challenging in villages during October-December quarter, potentially hurting volume growth of the overall consumer goods sector. Godrej Consumer Products said demand trends in the fast-moving consumer sector during the third quarter were like the earlier quarter, while Marico said urban markets stayed steady but rural markets offered little cheer."High rural unemployment, along with demand for NREGS, reflects rural stress. El Nino derailed the initial green shoots seen at the start of FY24. Increased aggression of smaller players and alternative avenues of spending such as higher spends on education, medical, telecom charges, are leading to softer growth in the FMCG sector," Abneesh Roy, executive director at Nuvama Institutional Equities, has said. Consumer goods companies and analysts say demand for daily groceries and personal and home products in villages continued to trail urban growth in the December quarter but expect a steady recovery across markets on improving macro indicators, positive consumer sentiment and, importantly, increase in government spending in the election year.Another marker of rural distress is stiff demand for work under the Mahatma Gandhi National Rural Employment Guarantee Scheme. The budgetary outlay of Rs 60,000 crore for the shceme for fiscal 2024 was exhausted by November itself. The government subsequently provided Rs 10,000 crore in urgent assistance to meet demand.The FMCG companies have high hopes from election-year spending that will spur rural consumption. "During an election year, governments often extends benefits which are provided as part of various schemes, offer sops, helping rural households," said Akshay D'souza, chief of growth and insights at retail intelligence platform Bizom.

Suspect allegedly involved in shooting of Spain Vox party co-founder is arrested in Colombia

Colombian police say they have arrested a Venezuelan suspected of involvement in the alleged attempted assassination in Madrid last year of a co-founder of Spain’s far-right Vox party. Greg Oliver Higuera Marcano was wanted in connection with last year’s shooting of Alejo Vidal-Quadras, a former leader of Spain’s main rightwing political party in Catalonia who went on to co-found Vox, and is a former vice-president of the European parliament. The 78-year-old survived being shot in the head in November last year. Colombian police said in a statement that according to Spanish investigations, the Venezuelan had allegedly “participated logistically in the attack on Vidal-Quadras”.Higuera was “detected” by immigration officials on Tuesday as he “intended to enter Colombia via the Simón Bolívar international bridge” on the border with Venezuela, police said.A “coordination process” was now under way for Higuera to be presented to a court in Spain, the police statement said.Vidal-Quadras was leader of the conservative PP party in the north-eastern Catalonia region in the 1990s. He went on to be an MEP and then was among the founders of Vox, which he left shortly after its creation.Vidal-Quadras has previously accused the Iranian regime of being behind the assassination attempt. In October 2022, Vidal-Quadras was included in an Iranian sanctions list in retaliation for EU sanctions imposed on the country after the death in custody of a 22-year-old Iranian-Kurdish woman, Mahsa Amini.A Paris-based Iranian opposition group, the Committee of the National Council of Resistance of Iran, has previously described Vidal-Quadras as a staunch ally and blamed the Iranian government for the attack.In November last year, Spain announced the arrest of three suspects in the “attempted terrorist assassination” of Vidal-Quadras.The suspected gunman, described by Spanish authorities as a Frenchman of Tunisian origins, has not been caught.

Google to remove 17 underutilised features from Assistant: Here is the complete list

Google announced that it will remove 17 skills from Google Assistant starting January 26. In a recent blog post, the company said that these were some of the most underutilised features and that users would get a notification about skills that would not be available after a certain date. Here’s the full list of commands which will soon stop working on Google Assistant. The company is also making some changes to the Google app, with the microphone icon now triggering search results. While you can continue using the ‘Hey Google’ or ‘Ok Google’ keywords to trigger the digital assistant, the microphone icon in the Google app search bar will no longer be able to complete actions like turning off the light or sending messages. The change affects the microphone icon in the Pixel Search bar as well, which will now trigger voice search instead of Assistant. Google says that it is doing so to offer an improved user experience and that these skills weren’t used much in the first place. But this might also be a glimpse of what’s about to come. The company is also reportedly rebranding Google Assistant to ‘Assistant with Bard’, but a new report suggests it might rename the product to just ‘Bard.’ With Samsung rumoured to offer on-device generative AI features on the upcoming Galaxy S24 series and Microsoft Copilot directly competing with Bard, it looks like Google’s recent move may be a part of a bigger restructuring plan we might not know about. Ability to play and control audiobooks on Google Play Books.Settings or using media alarms, music alarms and radio alarms on Google Assistant-enabled devices.Managing cookbooks, transferring recipes from one device to another, playing instructional recipe videos and showing step-by-step recipes.Managing stopwatch on Smart Displays and Speakers.Using voice to call a device or broadcast messages on Family Group.Ability to send email, video or audio message using voice.Rescheduling events in Google Calendar with voice.Using the app launcher to read and send messages, make calls and control media in Google Assistant driving mode.Ability to schedule or hear previously scheduled Family Bell announcements.Asking Google Assistant to meditate with Calm.Control activities with voice on Fitbit Sense and Versa 3.Viewing sleep summary on Google Smart Displays.Calls made from Smart Displays and speakers will no longer show caller ID unless it’s made on Google Duo.Smart Displays will no longer show the ambient ‘Commute to Work’ time.Checking personal itineraries using voice.Using voice to perform actions like making payments, making reservations or posting to social media.Asking for information about contacts.

Tiger Woods Net Worth and Businesses—PGA, Nike, Gatorade, and a Mini Golf Chain

Golf legend Tiger Woods may have parted ways with Nike after 27 years, but he has made millions from his career as a pro golfer and lucrative endorsement deals with other major brands including Gatorade, Rolex, and Monster Energy. Considered one of the best golfers of all time, Woods is one of the few billionaire athletes in the world—and is only the second active athlete who is a billionaire, behind NBA star LeBron James. Woods has a net worth of $1.1 billion as of January 2024, according to Forbes.1 Here's how Tiger Woods built his fortune. In his 27-year career as a professional golfer, Woods accumulated 106 worldwide wins and 15 majors. He has 82 PGA Tour wins, tied with golfer Sam Snead for the most PGA Tour wins in history.Throughout his career as a pro golfer, Woods has earned about $1.8 billion, according to an estimate by Forbes.1 Woods has also earned a record-setting $121 million in prize money from PGA tours.3 PGA Tour. "Career Earnings."However, Woods' impressive earnings from golf are not the only way he amassed his wealth—in fact, they account for less than 10% of his net worth, according to Forbes. The rest of his fortune comes from major endorsement deals and a series of business ventures.Woods' 27-year partnership with Nike certainly contributed to his massive fortune as the sporting company was his biggest backer. Woods' deal with Nike was said to be worth about $500 million throughout the life of the contract. That's not the only major partnership Woods had, though. The golfer had a lucrative tie-up with sports drink company, Gatorade, which paid him an estimated $100 million over several years. However, the company ended its partnership with Woods in 2010 after news of several extramarital affairs surfaced. AT&T and technology consulting company Accenture were also among the brands that ended their partnerships with Woods at the time. Woods partnered with energy drink company, Monster Energy, in 2016 and has continued his endorsement deal with them. The pro golfer has been seen playing out of a Monster-branded golf bag and has also represented the brand's other drink, Monster Hydro Super Sport since 2022.Several of Woods' businesses have to do with golf—he owns a golf course design firm, TGR Design, golf simulator tool Full Swing, as well as an indoor mini golf chain, Popstroke. Popstroke has nine locations across Florida, Arizona, and Texas and anticipates opening an additional 15 sites in 2024 and 2025.Woods is also a shareholder in global real estate development company Nexus Luxury Collection, along with singer Justin Timberlake. In October 2023, the company announced that Woods and Timberlake will be opening a sports and entertainment gastropub in St. Andrews, Scotland, through Nexus. The premium venue includes dining and lounge areas, and Woods' own Full Swing golf simulators.Woods is no stranger to real estate and has bought and sold multiple million-dollar properties. His home on Jupiter Island costs an estimated $54 million.

Price cuts mar HUL’s Q3 show, posts flat revenue and profit growth

Consumer goods major Hindustan Unilever posted a flat 0.5% growth in net profit to ₹2,519 crore in the December quarter from ₹2,505 crore in the corresponding quarter last year. Its volumes grew at 2% year on year in the quarter ending December. Its sales growth was flat, registering a marginal decline of 0.3% to ₹14,928 crore due to price cuts taken by the company. “Looking forward we expect gradual recovery in market demand to continue aided by increased government spending, recovery in winter crop sowing and better crop realization. Rural income growths and winter crop yields are key factors that will determine the pace of recovery,” said Rohit Jawa, CEO and MD of HUL. The company also expects competitive intensity to stay due to benign commodity prices. Going ahead, the company expects price growth to be marginally negative if commodity prices remain where they are.“HUL remains well positioned to unlock this opportunity whilst navigating the short-term challenges,” Jawa added. Its earnings before interest tax depreciation and amortization (EBIDTA) expanded by 10 basis points year on year to 23.7% in Q3. The FMCG major gets three-fourths of its business from home care and BPC business. Both these businesses saw mid-single digit growth in volumes. The company’s sales were affected due pricing action. Its home care’s revenues fell by 1%, with the BPC segment posting no change. “Skin cleansing revenue declined due to the impact of price reductions taken to pass on the benefits of lower commodity costs to consumers. Market development actions in body wash continue to yield good results. While delayed winter impacted skin care performance in the quarter, premium non-winter portfolios continued to do well,” said HUL in its press release.Food and refreshment business however saw a low-to single digit fall in volumes, as this segmental revenues went up by 1%. The company said that tea further strengthened value and volume market leadership, with green tea and flavoured tea performing well“Coffee grew in double-digits driven by pricing. Health Food Drinks delivered competitive modest price-led growth driven by Plus range,” HUL said.During the quarter, it launched Knorr Korean K-Pot noodles; and Bru Gold in Vanilla, Caramel and Hazelnut flavours.

Retail Retail’s net profit jumps 32% to ₹3,165 crore on festive fervour

Reliance Retail’s third quarter net profit grew 31.9% growth to ₹3,165 crore from ₹2,400 crore in the same quarter last year. Its revenue from operations also registered a 23.8% growth to ₹74,373 crore in the festive quarter, aided by aggressive store expansions. The Isha Ambani-led company added 252 stores during the quarter. On a YoY basis, its store count is higher by 1,549 to a total of 18,774 stores as of December 2023 end. “Reliance Retail has delivered strong performance during the festive quarter. Our business success is intricately woven into the larger fabric of India's economic growth, and together, we are shaping a compelling story of innovation and world class possibilities for the future,” said Isha M Ambani, executive director of Reliance Retail Ventures.Its footfalls grew by a robust 40.3%. Its digital and new commerce businesses now contribute to 19% of its revenue. “The retail segment has delivered an impressive financial performance with its rapidly expanding physical as well as digital footprint,” said Mukesh D Ambani, chairman and managing director, Reliance Industries.All its business segments exhibited double digit growth in the December quarter. Its mainstay grocery business grew by 41%. “Stores witnessed strong growth in non-food categories led by general merchandise & home and personal care. Catalogue expansion across home, cookware, furnishings and travel needs have enabled consumers in extending their shopping mission at Smart Bazaar as a one stop destination,” the company said.Its nascent consumer brands business also grew 3x aided by distribution reach. The company which re-launched Campa line of soft drinks said that its beverage, general merchandise and stapes are driving growth momentum of its own brands. It had also launched its staples business under the brand name Independence.It also launched new namkeens and sweets under Masti Oye! Brand, along with Deluxe assorted toffees under Toffeeman. The festival and wedding season also drove business in its fashion and lifestyle segments with good performance from its jewels business. “Tira is expanding its store network across top tier cities and has received strong customer traction. The business has delivered strong performance across various operating metrics including sales productivity, average bill value, repeats,” the company said.

Sundar Pichai asks Google employees to brace for more job cuts

San Francisco, Google CEO Sundar Pichai has reportedly warned employees to brace themselves for more job cuts this year.Google, which has let go over a thousand employees across various departments in the last one week or so, is likely to go for more job cuts, reports The Verge, citing an internal memo."We have ambitious goals and will be investing in our big priorities this year," Pichai told employees in the memo."The reality is that to create the capacity for this investment, we have to make tough choices," he added. In the memo, Pichai said that latest "role eliminations are not at the scale of last year's reductions, and will not touch every team". "But I know it's very difficult to see colleagues and teams impacted," the Google CEO added.The layoffs this year are about "removing layers to simplify execution and drive velocity in some areas"."Many of these changes are already announced, though to be upfront, some teams will continue to make specific resource allocation decisions throughout the year where needed, and some roles may be impacted," Pichai further wrote.After laying off nearly 1,000 employees last week, Google is also reportedly slashing "a few hundred" more jobs in its advertising sales team as part of an ongoing restructuring exercise. Philipp Schindler, Google's chief business officer, told staff in a memo that the fresh job cuts "were the result of changes to how Google's sales team operated", Business Insider reported.A Google spokesperson also confirmed that "a few hundred roles globally are being eliminated" as part of the restructuring.In January last year, Google cut its workforce by 12,000 people, or around 6 per cent of its full-time employees.

2024 will be a perilous year for the world economy as geopolitical tensions ramp up, top economists warn

The year 2024 will likely be a stormy one for the global economy as growth slows and geopolitical tensions ramp up around the world, according to a World Economic Forum survey. The foundation polled over 60 chief economists ahead of its annual meeting, which is taking place in the Swiss ski resort town of Davos this week. More than half the respondents said the world economy will get weaker this year, and 70% predicted looser financial conditions – implying that they believe central banks, including the US Federal Reserve, will start lowering interest rates at some point in 2024. Over 80% of the economists surveyed by the WEF expect geopolitical tensions to drive up stock-market volatility and economic uncertainty, while around three-quarters of those polled said they're expecting artificial intelligence to boost innovation in advanced economies this year. "Amid accelerating divergence, the resilience of the global economy will continue to be tested in the year ahead," WEF managing director Saadia Zahidi said. "Though global inflation is easing, growth is stalling, financial conditions remain tight, global tensions are deepening and inequalities are rising." Wall Street executives have been fretting about heightened geopolitical volatility since war broke out in the Middle East in October, although those worries didn't stop stocks from charging higher over the final two months of 2023. Despite their gloomy outlooks, the Chicago Board Options Exchange's VIX index – a widely-followed Wall Street "fear gauge" – is trading close to its lowest level since before the pandemic, suggesting that traders aren't so worried.

India emerges strong amid global economic challenges, feels Citis Tyler Dickson

Tyler Dickson, head of investment banking at Citi feels that India stands out as a shining star in Asia in the midst of global macroeconomic challenges, The Economic Times reported. Dickson expressed bullish sentiments about India's mergers and acquisition (M&A) segment and equity market activities, during an interview with the paper.Questioned about his thoughts on how well India has fared amid the global macroeconomic challenges compared to other emerging markets in Asia, Dickson noted that the country is currently the fifth-largest economy globally and is poised to climb to the third position. The enthusiasm of Indian business leaders, coupled with the 'China plus one' strategy, makes India an attractive market for global investors, he said. Citi sees it as one of the best opportunities for both Indian and international clients, it reported. On the environment regarding M&As and tighter global liquidity conditions, Dickson felt that India's M&A market remains robust at around $85 billion despite global challenges. While the debt capital markets (DCM) face challenges due to fluctuating rates, Citi maintains a positive long-term perspective on the M&A landscape in India, he added. In terms of deal activity he feels that higher interest rates globally indicate slower economic growth and necessitate adjustments in deal activity. He however noted that stability in the cost of capital is crucial, and that as the market recalibrates, confidence will increase. The focus on quality in earnings, cash flow, and growth becomes more significant in a higher interest rate environment, he added. Further, Dickson also expressed a long-term bullish outlook on technology, considering it a fundamental driver of growth, the report said. While acknowledging the challenges faced during the "technology winter," Citi is cautiously optimistic about increased activity levels for technology companies in M&A, ECM, and DCM in 2024, he added. Acknowledging that there is a "financing wall in the 2025-2026 era", characterized by the need to refinance debt at higher costs, Dickson said Citi emphasises that this debt is not super expensive. The bank sees an opportunity for the global market to adjust to this reality, considering historical periods with more expensive debt, it said.

Fitch expects RBI to cut interest rates by 75 basis points in FY25

Mumbai, Federal Bank on Tuesday reported 23 per cent increase in consolidated net profit at Rs 1,035.42 crore for December quarter 2023-24, helped by a sharp decline in provisions and also surge in non-interest income. On a standalone basis, the private sector lender's net profit in the quarter increased 25 per cent to Rs 1,007 crore, its highest ever. The growth in the core NII was constrained because of narrowing of net interest margin at 3.19 per cent from the 3.55 per cent in the year-ago period, and the 18 per cent asset growth provided a limited succour. Chief executive and managing director Shyam Srinivasan said the bank has posted 19 per cent growth in deposits by giving higher rates, but was quick to add that the deposit growth is from individual clients which will yield dividends over a period of time. He admitted that the bank has not been able to deliver on its guidance of expanding NIMs in the second half of FY24 due to the challenging external environment where funds are coming at a higher cost, and added that it will look at maintaining NIM at the 3.20 per cent level in the near term. The net advances at the end of the December quarter stood at Rs 199,185 crore, 18% year-on-year (YoY) growth over Rs 168,173 crore in Q3FY23. In the previous quarter, the bank had reported net advances at Rs 192,817 crore.The retail book was up by 24% YoY in Q3Y24, while the business banking book registered an 18% YoY growth. The bank also reported a 23% YoY growth in gold loans.The deposits in the said quarter stood at Rs 239,591 crore and were up 19% versus Rs 201,408 crore in Q3FY23. On a quarter-on-quarter (QoQ) basis, the uptick was 3% against Rs 232,868 crore in Q2FY24.The bank reported a slight uptick in its gross non-performing assets (NPAs) in Q3FY24 at Rs 2.29% on a sequential basis against 2.26% in Q2FY24. However, GNPA was down YoY from 2.43% in Q3FY23. The net NPA was flat on a QoQ basis at 0.64% in Q3FY23. In the year-ago period, the lender had reported NNPA at 0.73%.The PCR improved by 189 bps YoY and 5 bps QoQ, while the collection efficiency ensured recoveries upgradations of Rs 290 crore, the company filing said. The PCR remains elevated at 11-quarter high.The returns on assets for Q3FY24 stood at 1.39% versus 1.36% in Q2FY24 and 1.33% in Q3FY23. The net interest margins (NIMs) were reported at 3.19%, down from 3.22% in Q2FY24 and 3.55% in Q3FY23.The bank reported its October-December quarter earnings during market hours and the share fell 0.55% to the day's low of Rs 152.10.Federal Bank posted strong growth in the branch network, adding 65 new branches in FY24.

Federal Bank Q3 consolidated profit jumps 23% to Rs 1,035 cr

Mumbai, Federal Bank on Tuesday reported 23 per cent increase in consolidated net profit at Rs 1,035.42 crore for December quarter 2023-24, helped by a sharp decline in provisions and also surge in non-interest income. On a standalone basis, the private sector lender's net profit in the quarter increased 25 per cent to Rs 1,007 crore, its highest ever. The growth in the core NII was constrained because of narrowing of net interest margin at 3.19 per cent from the 3.55 per cent in the year-ago period, and the 18 per cent asset growth provided a limited succour. Chief executive and managing director Shyam Srinivasan said the bank has posted 19 per cent growth in deposits by giving higher rates, but was quick to add that the deposit growth is from individual clients which will yield dividends over a period of time. He admitted that the bank has not been able to deliver on its guidance of expanding NIMs in the second half of FY24 due to the challenging external environment where funds are coming at a higher cost, and added that it will look at maintaining NIM at the 3.20 per cent level in the near term.The net advances at the end of the December quarter stood at Rs 199,185 crore, 18% year-on-year (YoY) growth over Rs 168,173 crore in Q3FY23. In the previous quarter, the bank had reported net advances at Rs 192,817 crore. The retail book was up by 24% YoY in Q3Y24, while the business banking book registered an 18% YoY growth. The bank also reported a 23% YoY growth in gold loans.The deposits in the said quarter stood at Rs 239,591 crore and were up 19% versus Rs 201,408 crore in Q3FY23. On a quarter-on-quarter (QoQ) basis, the uptick was 3% against Rs 232,868 crore in Q2FY24.The bank reported a slight uptick in its gross non-performing assets (NPAs) in Q3FY24 at Rs 2.29% on a sequential basis against 2.26% in Q2FY24. However, GNPA was down YoY from 2.43% in Q3FY23. The net NPA was flat on a QoQ basis at 0.64% in Q3FY23. In the year-ago period, the lender had reported NNPA at 0.73%.The PCR improved by 189 bps YoY and 5 bps QoQ, while the collection efficiency ensured recoveries upgradations of Rs 290 crore, the company filing said. The PCR remains elevated at 11-quarter high.The returns on assets for Q3FY24 stood at 1.39% versus 1.36% in Q2FY24 and 1.33% in Q3FY23. The net interest margins (NIMs) were reported at 3.19%, down from 3.22% in Q2FY24 and 3.55% in Q3FY23.The bank reported its October-December quarter earnings during market hours and the share fell 0.55% to the day's low of Rs 152.10.Federal Bank posted strong growth in the branch network, adding 65 new branches in FY24.

RE Shotgun 650 vs Kawasaki Eliminator – new twin engines but which one suits your pocket and need

Indian bike maker Royal Enfield has launched its latest bike, the Shotgun 650, the fourth bike in the company’s 650cc series in India. The Shotgun 650 is inspired by the company’s Super Meteor 650, with some design changes that give it a distinct look. While the Shotgun 650 has no direct rivals, it takes on the Kawasaki Eliminator as both are new twin-engine bikes. While the Eliminator is priced significantly higher than the Shotgun 650, it is one of the closest rivals to the new offering from Royal Enfield. The Kawasaki Eliminator is powered by a 451cc liquid-cooled engine compared to the 648cc air-cooled engine on the Shotgun 650cc. In terms of design, the Royal Enfield Shotgun 650 is inspired by the Royal Enfield Super Meteor 650 and is based on the same platform. However, the Shotgun 650 comes with a bobber design. It comes with a rugged design and features a round headlamp and rear-view mirrors. It comes with a single-piece seat and minimal body panels. It features blacked out engine parts that give it a retro look. It features a large 13.8-litre fuel tank and comes with an 18-inch front-wheel and a 17-inch rear wheel.Kawasaki Eliminator Price starts at Rs. 5.62 Lakh which is Rs. 2.02 Lakh costlier than base model of Royal Enfield Shotgun 650 priced at Rs. 3.59 Lakh. In technical specifications, Kawasaki Eliminator is powered by 451 cc engine , while Royal Enfield Shotgun 650 is powered by 648 cc engine. Kawasaki Eliminator is available in 1 different colours while Royal Enfield Shotgun 650 comes with 4 colours. The Comparison Kawasaki Eliminator vs Royal Enfield Shotgun 650 can be described on the basis of price and specifications.BikeWale brings you comparison of Kawasaki Eliminator and Royal Enfield Shotgun 650. The ex-showroom price of Kawasaki Eliminator is ₹ 5,62,000 and Royal Enfield Shotgun 650 is ₹ 3,59,430. Kawasaki Eliminator is available in 1 colour and 1 variant and Royal Enfield Shotgun 650 is available in 1 colour and 3 variants. Apart from prices, you can also find comparison of these bikes based on displacement, mileage, performance, and many more parameters. Comparison between these bikes have been carried out to help users make correct buying decision between Kawasaki Eliminator and Royal Enfield Shotgun 650.

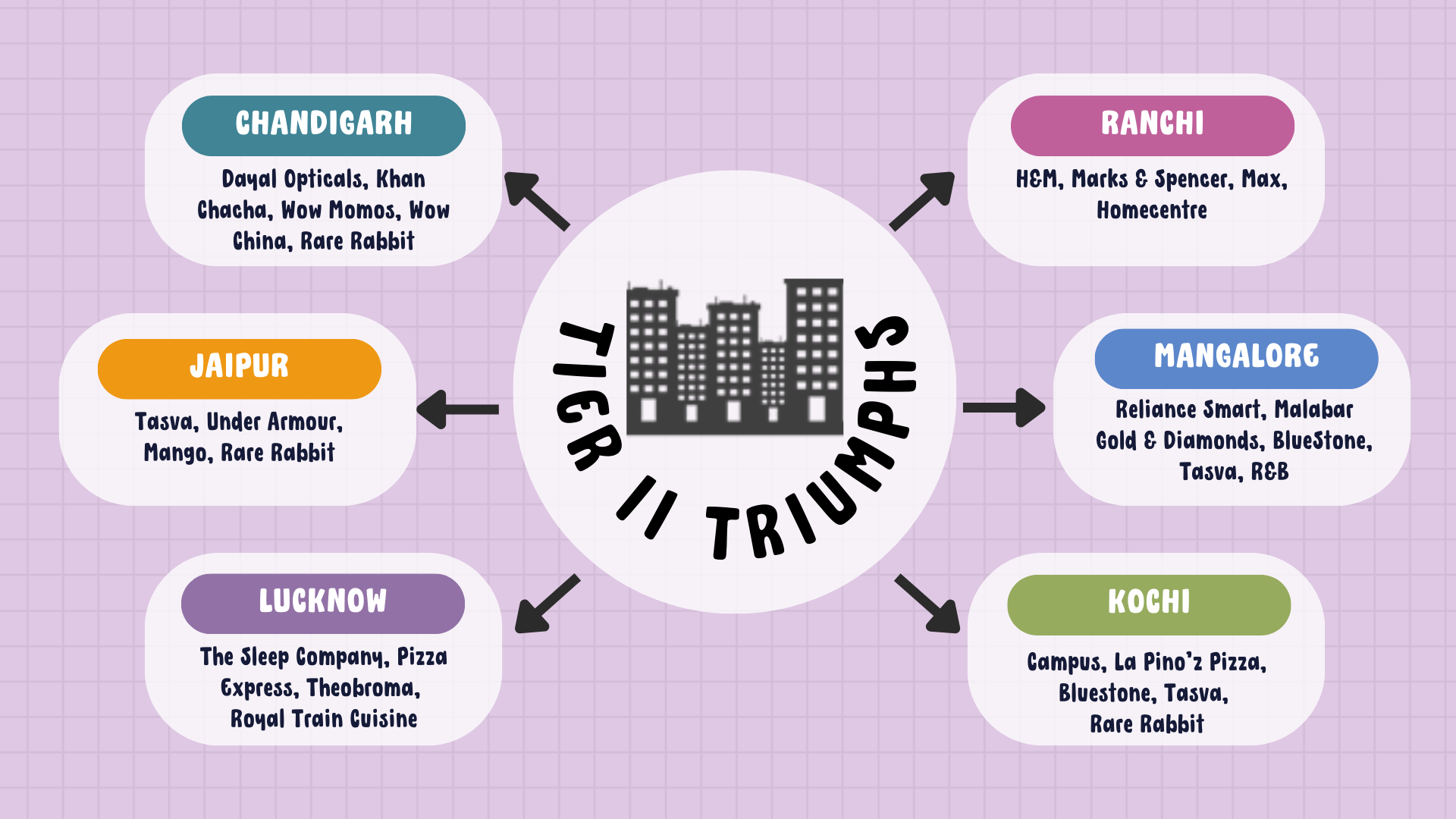

Big brands, chain stores boost retail developments in tier-2 cities

Last year, H&M opened its store in Ranchi, GAP too opened its doors to Guwahati; and Rare Rabbit did the same in Kochi. It’s not just top apparel chains that are going deeper into Bharat, fine dining restaurants like Royal Train Cuisine too have set up shop in Lucknow and Wow chain is wooing Chandigarh. In summation, as many as 35 major retail brands expanded their footprint to 14 tier-2 cities between January to September 2023, says a report by real estate services and investment firm CBRE. This flurry of activity has triggered a retail space boom in 14 cities that include Chandigarh, Jaipur, Indore, Goa, Mangalore, Kochi, Lucknow, Patna, Ranchi, Guwahati, Bhubaneshwar, Vizag, Mysore, and Coimbatore. Chains like Armani Exchange, Malabar Gold & Diamonds, Tanishq, Marks & Spencer, Starbucks, Pizza Express, Under Armour are now catering to a growing set of consumers in these cities. “Domestic and international fashion brands are looking to expand in non-metro cities, fueled by a well-aware and well-travelled consumer set,” said Ram Chandnani, MD, advisory & transactions services of CBRE India. Changing consumption patterns are affecting the retail dynamics in these cities, the report says. E-commerce trends also point to a highly-aspiring consumer base in these cities, which has brought in an influx of quality retail supply. “A striking example of evolving consumer patterns in these cities is the fact that 50% of online urban shoppers were residing in these tier-2 and tier-3 cities. A percentage that’s projected to reach nearly 60% by 2030,” the report adds.As high-end retailers make a beeline for tier-2 city business, the retail developments in the cities also picked up pace. The total retail stock in these 14 cities stood at 29 million square feet, as of September 2023. Amongst them, Jaipur, Lucknow, and Chandigarh each boast retail stock ranging between 3-7 million square feet.In the three months between July and September 2023, around 2.4 million square feet was added in the 14 cities. Most of it was added in Chandigarh, Jaipur and Lucknow. Also, a similar amount – again 2.4 million square feet – was absorbed across these cities, led by Kochi, Jaipur, and Goa.“The e-commerce boom, tech-savvy consumer base, growing aspirations and surge in discretionary purchasing are defining the retail growth in tier-II cities. Most non-metro cities are established trade and business hubs and are now witnessing multinational corporations and start-ups setting up offices as well,” said Anshuman Magazine, chairman & CEO, India, Southeast Asia, Middle East & Africa of CBRE.The retail developments have a healthy mix of malls and high streets. But, they too are evolving from vanilla stores in high-streets to malls by top-end developers. A lot of high-end malls have also come up in recent times like Nexus Elante Mall in Chandigarh; World Trade Park Mall in Jaipur; DLF Mall in Panjim and more.“Investment-grade developers are setting up large-sized contemporary malls in these cities, which are seen as an entertainment destination and not just as a place to shop,” adds Magazine.

HDFC Bank Q3 consol net profit grows 2.6% sequentially to over ₹ 17,000 crore

Pre-provision operating profit (PPOP) came in at ₹23,650 crore which grew 4% sequentially.HDFC Bank’s third quarter consolidated net profit went up 2.6% sequentially to ₹17,257 crore from ₹16,811 crore in the second quarter of FY24. The year on year numbers are not comparable as HDFC Bank merged with HDFC as of July last year.The reading is better than what the street expected as most analysts predicted a marginal sequential drop in profits. Its total income went up by 6.9% to ₹1,15,015 crore as compared to ₹1,07,566 crore in the second quarter. On a standalone basis, its net interest income grew 3.9% to ₹28,470 crore from ₹27,385 crore in the September quarter. This was less than what the street was expecting. Provisions and contingencies for the quarter stood at ₹4,603 crore versus ₹3,311 crore in Q2. Gross non-performing assets (NPAs) saw an improvement sequentially as they stood at 1.26% of gross advances as compared to 1.34% as of September end. Net NPAs were at 0.34% of net advances for the third quarter.HDFC Bank’s third quarter consolidated net profit went up 2.6% sequentially to ₹17,257 crore from ₹16,811 crore in the second quarter of FY24. The year on year numbers are not comparable as HDFC Bank merged with HDFC as of July last year.The reading is better than what the street expected as most analysts predicted a marginal sequential drop in profits. Its total income went up by 6.9% to ₹1,15,015 crore as compared to ₹1,07,566 crore in the second quarter.Gross non-performing assets (NPAs) saw an improvement sequentially as they stood at 1.26% of gross advances as compared to 1.34% as of September end. Net NPAs were at 0.34% of net advances for the third quarter.Total deposits grew 27.7% while CASA deposits grew 9.5% on a year on year basis. Gross advances saw an increase of 62.4% YoY due to the effects of the merger. The balance sheet as of December 2023 stands at ₹34,82,600 crore.Nomura expected the bank to report a 6% sequential rise in net interest income and a 3% drop in profit after tax QoQ. Yearly growth is not comparable for the bank due to its merger with HDFC in July last year.Most banks are expected to see margin contraction, lack of treasury gains, and higher opex including staff cost and franchise cost in the third quarter. Emkay expects HDFC Bank’s net interest margins (NIMs) to recover from their lows seen in the second quarter.“HDFC reported strong credit revival of around 5% QoQ, but deposit growth has been lower of 2% QoQ, which we believe could be due to the unwinding of ICRR and should help the bank witness some margin recovery from the lows of Q2,” said Emkay.BoBCaps on the other hand expected its benefits from absorption of excess liquidity in the books likely to be offset by higher term deposit rates, leading to contraction in net interest margins.“Credit cost to remain stable. Expect minor YoY improvement in gross non-performing assets (GNPA) and net non-performing assets (NNPA) with controlled slippages,” BoBCaps said.

Recently, in a Meesho commercial, Rashmika Mandanna and Ranveer Singh

A new campaign from Meesho called "Jab Meesho pe hain latest trends, toh sochna kyun just maximise" has been released. Meesho has launched #Trendz, a curation that highlights affordability and modern designs, with an emphasis on Generation Z. Meesho wants to attract youthful consumers who are looking for stylish clothing that doesn't break the bank.A visual narrative starring celebrities like Rashmika Mandanna and Ranveer Singh is at the center of the campaign. Meesho hopes to position itself as a hip destination for fashion where consumers can find the newest styles at reasonable costs by launching this campaign.During the pre-launch stage, the firm showcased its fashionable apparel, the focal point of its campaign, in a transparent refrigerated truck that traveled throughout Bengaluru. The purpose of using the chilled truck is to convey the idea that trends are new and that refrigeration is necessary to keep them delicious. Prominent paparazzi like Viral Bhayani and fashion influencers like Urfi Javed intensified the online and offline dialogues created by the truck. The company created an Instagram page to provide details on the truck's daily travels throughout the city. Engaging social media users generated a lot of discussion, reaching an amazing 100 million people in just four days on various social media platforms."Fashion is ever-evolving, and many people struggle with finding the latest fashion trends at affordable prices," stated Nilesh Gupta, General Manager, Growth at Meesho. We have consistently worked to offer our clients the greatest items over the years, without sacrificing on either cost or quality. Our most recent campaign, "Meesho #trendz," was thoughtfully chosen to give fashion aficionados who appreciate both style and affordability a genuine and approachable platform. Through our partnership with trend-setters Ranveer and Rashmika and our use of humor, we hope to establish a lasting connection with the public.Meesho has partnered with Swiggy Instamart to expand its product offers even more. When clients shop for cold things (items that need to be placed in an insulated packaging) on Instamart, Meesho gives them free jewelry. Similar to the refrigerated truck, this demonstrates how new the trends are.Four films in all are part of the campaign, which will be promoted on television and online. Meesho hopes to make fashion accessible to everyone by offering a wide range of reasonably priced clothing options to its clients through this campaign.