Top Trending Business News & Highlights

One accord, three setbacks India's use of the EU trade pact to boil Turkey, Pakistan, and Bangladesh

The United States has also been affected by India's trade agreement with the European Union. The historic trade deal between India and the EU would not only affect Bangladesh and Pakistan but also the United States and Turkey. The agreement calls for the elimination or reduction of tariffs on more than 90% of EU goods exports to India, including hefty charges of up to 44% on machinery, 22% on chemicals, and 11% on pharmaceuticals, which will be phased down over time.Following nearly two decades of negotiations, officials announced on Tuesday that India and the European Union have achieved a free trade agreement to strengthen economic and strategic ties. Up to 2 billion people might be impacted by the agreement, which the president of the EU's executive body referred to as the "mother of all deals." The accord won't go into force for some months. The agreement between two of the largest markets in the world comes as Washington imposes high import taxes on both the EU bloc and the Asian behemoth, upsetting long-standing trade patterns and forcing major economies to look for new alliances. The FTA, which both India and the 27-nation EU refer to as "the mother of all deals," provides a "decisive boost" to the labor-intensive textile industry by improving price competitiveness and expanding market access in one of the most sophisticated consumer markets in the world, according to a note released today by the Indian Textile Ministry.

Published 29 Jan 2026 12:51 PM

India and New Zealand wrap up free trade negotiations despite persistently high US tariffs

Free trade agreement (FTA) talks between India and New Zealand came to an end on Monday amid hefty US tariffs that have unsettled investors and led to the cancellation of orders from India's biggest export market. In the context of 50% US tariffs, the New Zealand agreement, if signed, would be India's second free trade agreement (FTA) following the Oman agreement. It would also be the country's third accord this year as it works to diversify its exports.According to information made public by the government, Wellington would remove tariffs on 100% of its tariff lines for all Indian exports, while India has committed to lower tariffs on 95% of New Zealand exports. However, New Zealand's typical tariffs are among the lowest in the world—between two and three percent—and their removal could not immediately boost exports. In order to bring some symmetry to the agreement, New Zealand has "committed" to investing $20 billion in India over the next fifteen years in exchange for market access in a rapidly expanding Indian consumer market that is subject to high tariffs (over 15%). Because of the unfair tariff rates, New Zealand may benefit more from goods trade than India.In 2024–2025, bilateral trade between India and New Zealand was only $1.3 billion. "This FTA opens doors for Indian businesses in the region through well-integrated directional exports and gives our youth choices to learn, work, and grow on a global stage," stated Commerce Minister Piyush Goyal."India's strengths are expanding exports, supporting labor-intensive growth, and power services," stated Commerce Secretary Rajesh Agrawal. New Zealand's access to India's sizable and expanding economy is deeper and more reliable. These qualities are brought together by the migration of individuals, professionals, students, and skilled workers. The FTA contains provisions to address non-tariff barriers through improved regulatory cooperation, transparency, and streamlined customs, sanitary and phyto-sanitary (SPS) measures, and technical barriers to trade disciplines, according to the Commerce and Industry Ministry, in addition to tariff liberalization. According to the Ministry, "all systemic facilitations and fast-track mechanisms for imports that serve as inputs for our manufactured exports ensure that tariff concessions translate into effective and meaningful market access."

Published 22 Dec 2025 10:28 PM

What workers, brokers, and policyholders stand to gain from travelers' agreement to preserve 1,400 jobs in Canada

The Canadian business of Travelers will be acquired by Definity Financial Corp. The total value of the acquisition is $3.3 billion. Definity will become the fourth-largest property and liability insurer in Canada as a result of this transaction. Every one of Travelers Canada's 1,400 employees will continue to work there. Consumers can anticipate competitive pricing and additional options. Regulatory permission is needed for the deal. By early 2026, it should be closed.Definity Financial Corp. plans to pay $3.3 billion to acquire the Canadian operations of the US behemoth Travelers, one of the largest transactions in Canada's insurance industry in recent memory. This merger could change the competitive environment for both insurers and consumers. More than 1,400 Traveler employees across Canada will retain their employment when the two companies combine under a single brand, despite the fact that large acquisitions frequently result in job losses.Definity will move up from sixth place to become Canada's fourth-largest property and liability insurer as a result of the purchase. Its expanding presence in the insurance industry is demonstrated by the $6 billion in total yearly premiums it currently manages.

Published 28 May 2025 07:58 PM

Why did India decide to remove the "Google tax" in response to pressure from the US?

The Center intends to eliminate the 6% equalization levy (EL) it levies on digital advertisements as part of the 35 modifications to the Finance Bill, 2025, effective April 1, 2025.The Central government has suggested to eliminate the equalization levy on internet advertisements as part of revisions to the Finance Bill, 2025, a move that is anticipated to help American large technology companies and allay US worries about India being a high tariff country.As part of changes to the Finance Bill, 2025, the central government has proposed doing away with the equalization levy on online ads. This is expected to benefit big IT companies in the US and ease concerns about India being a high-tariff nation.The equalization charge, also referred to as the Google tax, will be eliminated by the Center on April 1. The clause is one of 59 changes to the Finance Bill that Finance Minister Nirmala Sitharaman made on Monday and presented to Parliament.

Published 25 Mar 2025 08:42 PM

Business

Business globally are the pillars of any economy and they contribute in huge amount to take any country ahead financially and economically and boost the country grwoth.

In Jaipur, French President Macron to explore pink citys living past

French President Emmanuel Macron will kick-start his two-day trip to India on Thursday by visiting Jaipur's stunning hilltop fort of Amber, iconic Hawa Mahal and astronomical observation site of Jantar Mantar. Macron will be the chief guest at the 75th Republic Day celebrations on January 26 at Delhi's Kartavya Path that would make him the sixth leader from France to grace the prestigious annual extravaganza. In his nearly six-hour stay in Jaipur, Macron will also join Prime Minister Narendra Modi in a road show before the two leaders hold wide-ranging talks at luxury hotel Taj Rambagh Palace on all key aspects of bilateral India-France ties and various geopolitical upheavals. In Jaipur, President Macron will visit Amber Fort, Jantar Mantar, Hawa Mahal, besides participating in a road show, officials said, refusing to elaborate further. The French president's aircraft is scheduled to land at Jaipur airport at 2:30 PM on Thursday and he will depart for Delhi at around 8:50 pm, according to the Ministry of External Affairs.The road show is scheduled to start at Jantar Mantar area at 6 pm while Modi and Macron are set to begin their talks at 7:15 pm. Ways to boost bilateral cooperation in a range of areas, including digital domain, defence, trade, clean energy, youth exchanges, easing of visa norms for Indian students are set to be the focus of the talks, sources said.

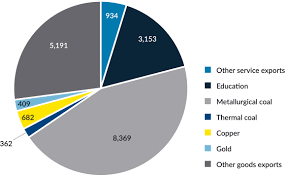

Indian investments key target of Western Australia’s minerals reforms

NEW DELHI : The state of Western Australia has implemented a series of reforms aimed at attracting investments in minerals and resources, including from India. In an interview with Mint, Western Australia deputy premier Rita Saffioti said there was much interest for greater investments and collaborations between Indian and Australian firms in the rare earths sector. The approvals reforms are aimed at supporting projects that assist with decarbonization, she said. Western Australia has been in focus for its supply of key critical minerals including lithium, nickel and cobalt, as well as rare earth metals, which are used in smartphones, computers, batteries and electronics. Australia accounts for roughly half of the world’s lithium production and has a similarly important position in cobalt production. It is also the fourth-largest rare-earths producer. Western Australia has attracted investments from Indian state-owned firms including NMDC Ltd. Indian mines minister Prahlad Joshi visited the state in 2022, following which the Indian government announced that a bilateral critical minerals investment partnership between the two sides had identified two lithium projects and three cobalt projects. “Investments under the partnership will seek to build new supply chains underpinned by critical minerals processed in Australia, that will help India’s plans to lower emissions from its electricity network and become a global manufacturing hub, including for electric vehicles," India’s mines ministry had said in a statement. Saffioti said her visit to India was also aimed at promoting Western Australia as an investment destination for private Indian companies. “There are opportunities for Indian investment in Western Australia through offtake agreements for key battery minerals," Saffioti said.

Amber, Titagarh Rail Systems in deal for train components business

Both TRSL and Amber group, via its wholly-owned subsidiary Sidwal Refrigeration Industries Pvt Ltd, will invest approximately ₹120 crore each to obtain around 50% each in the SPV.The SPV will set up a new facility in India to manufacture critical railway components and subsystems used in the manufacture of railway and metro coaches and will also make fresh equity investments into Titagarh Firema. Titagarh Firema SpA, Italy, is an associate company of the Titagarh group where govt of Italy is also an equity stake holder. The new SPV will also invest in Titagarh Firema while government of Italy will invest in the entity for which it has already taken approval from Invitalia, the Italians government’s investment arm. Under the agreement, Firema will grant Sidwal, Titagarh Rail as well as the SPV a preferred supplier status and right of first refusal (ROFR) for all their products.Titagarh Rail is involved in the railway rolling stock space for both freight and passenger rolling stocks. Apart from being an established railway wagon and metro coach manufacturer, it is also currently executing the projects of Vande Bharat trains, Surat, Ahmedabad, Pune metros as well as executing its first export order for passenger rail components received from Firema. Titagarh is targeting a capacity of almost 800-850 coaches per year in the coming years. The Amber group is a diversified B2B company having three business verticals: consumer durables, electronics and railway subsystems and mobility. Sidwal, an Amber group company, has emerged as a leader in the train air conditioner market and has also signed a technology licensing agreement with Ultimate group to manufacture passenger coach doors and gangways. Sidwal is also planning to enter the European market for its products portfolio, a company statement said.The strategic partnership in Firema will not only facilitate Sidwal’s entry into the European market, but will also give Sidwal a preferred access to Firema’s own demand, the statement added. Both companies are investing to grow capabilities and capacities for various products that can be exported to Europe such as train mechanical and electrical components by TRSL and HVAC, doors, gangways and pantry systems by Sidwal. Firema is one of the largest and reputed designers and manufacturers of passenger trains in Italy and has executed marquee projects in Italy and other parts of Europe. Firema has an order book of almost euro 1 billion for producing new coaches and has an existing capacity to produce upwards of 240 coaches per year and has plans to double this capacity.

Vi Combines Its Vi Max Postpaid Plans With Swiggy One Subscription

In India, Vi (Vodafone Idea) has added new benefits to its Vi Max Postpaid plans. The telecom giant has introduced Swiggy One membership for Vi Max Individual and Vi Max Family Postpaid users at no additional cost. With this promotion, Swiggy is offering VI users unlimited free deliveries of food orders over Rs. 149 and groceries over Rs. 199. Additional savings will also be available for its restaurant partners. Customers of Vi with postpaid plans that exceed Rs. 501 are eligible to become members of Swiggy One. Swiggy One membership is free for Vi Max Postpaid users with plans priced at Rs. 501, Rs. 701, Rs. 1,101 for the REDX plan, and Rs. 1,001 and Rs. 1,151 for the Vi Max Family plans. These plans all come with 3,000 SMS messages, unlimited voice calls, and roaming benefits. In addition to free, limitless deliveries, the Swiggy One membership offers savings on a range of Swiggy services. For three months, the plan currently costs Rs. 599. It provides unlimited free deliveries on food orders above Rs. 149 with up to 30 percent additional discount on over 30,000 restaurantsSwiggy One subscribers can get free delivery for as long as they want on Instamart on orders over Rs. 199. A maximum 40 percent discount on Dineout is also provided by the subscription, and users will receive two additional coupons each month worth Rs. 150. There will also be a 10% discount on all Swiggy Genie delivery costs. The Vi Max Postpaid individual and family plan offers access to a variety of streaming services in addition to Swiggy One, such as Amazon Prime Video, Disney+ Hotstar, SonyLIV, and SunNXT. They will also receive services from EazyDiner, Norton 360 Mobile Security, and EaseMyTrip. Customers using a single postpaid recharge plan can use any two of the previously mentioned subscriptions. The postpaid plans come with free access to Vi Mobies and TV app, Hungama Music in the Vi app and Vi Games.

TestClear THC Detox Products Review 2024

"Every day, life becomes harder, more demanding, and more stressful. Work in the industry is ""relentless,"" involving long hours, a great deal of responsibility, daily stress, and a constant need for efficiency improvements. But is this really possible for a human being? Hence, it is not a coincidence that statistics show a rise in drug use worldwide, which improves efficiency and concentration while lowering work-related stress. Given these facts, there is an obvious rise in the use of illegal substances, but there is also a marked increase in drug and other illegal substance testing (which is required by employers).Large corporations, which are all multinational corporations, have now implemented this new security measure for both new hires and current staff (on a regular basis). The majority of drugs that are tested for in a drug test that an employer typically requires is marijuana, but there are many more illegal substances that can be found. With these new products, the pharmaceutical industry has once again offered the answer, making them effective for both ""cheating"" drug tests and instantaneous detoxification of the user's body. One of the most cutting-edge and reputable businesses in this space, TestClear provides a comprehensive range of products (TestClear THC Detox Products) so you can choose the one that best suits your needs."How does TestClear operate and is it "Right" for me? TestClear is a company that has created an advanced and effective line of detox products to help those who need to "cheat" a drug test. Speaking of "detoxification" we are not talking about gradual and time-consuming detoxification. With TestClear (any of the options offered with the TestClear THC Detox product line) you have rapid and immediate detoxification of the organism, so that you can come out "clean" in a possible test. However, as the drug detection test is not done in only one way, TestClear has created different products so that you can "fool" the test (whether it's a urine, hair, saliva test, etc.).

Shark Tank India: Deepinder Goyal of Zomato is compared to Ashneer Grover online after he questions a contestant

This week saw the release of Shark Tank India's third season on Netflix. In a couple of days, fans of the show have started to draw comparisons between a current judge, Zomato Founder Deepinder Goyal and BharatPe's former MD Ashneer Grover, who was one of the judges in the first season of the show. This came after Mr Goyal was seen grilling pitchers in one of the clips shared by the official social media handle of the show.The business owner can be seen in the video asking the competitors about the grammar they used in their presentations. He talked about the value of accuracy and how, in a work setting, small mistakes can have a significant impact on decisions. "Why does the phone number you mentioned have nine digits instead of ten?" he asked the participant at one point in the video. He added that the Shark Tank India pitchers should have paid more attention to the details, especially since they knew they would be presenting to potential investors on national television. He even remarked that job seekers are often rejected based on even the smallest grammatical errors on their resumes. Meanwhile, Ashneer Grover was often seen as the strict and straightforward investor on the show in the first season, who never hid away from giving proper feedback and pointing out faults in the business models. Since being shared, the clip has amassed many reactions online with some users calling the Zomato Founder "soft Ashneer Grover" and "Ashneer Grover lite". "Deepinder Goyal from Zomato is a fantastic addition to the Shark Tank. Could be the next Ashneer Grover," said a user. Another added, "The way he pointed out the small faults in that 'WTF fitness' was amazing, he is a soft Ashneer Grover." Yet another person commented, "He's not wrong, in my opinion. I've been a part of multiple pitch decks and have showcased my pitch in front of influential investors. It's so important to be precise and accurate with your presentation and to go into the specifics."Ahhhhhh. So we have a new Ashneer now?" said someone. "Really, the phone number thing is a major error. The rest appears to be reasonable criticism, albeit a bit too detailed. But those are minor details that can be ignored if the product or business plan is truly exceptional," said someone.One person commented, "Talking to the entrepreneurs taking part in Shark Tank India in such a disrespectful way is really offensive. This manner of speaking is undoubtedly worse than Ashneer Grover's." "Many aspire to emulate @Ashneer_Grover for his popularity, but it's essential to recognize that no one can fill his shoes," a user on X tweeted.

Netflixs universal strategy overlooks rugby unions true selling point.

To be honest, winning has never been the most interesting aspect of reality TV. Whether it's someone being disemboweled by the judges, gorging on kangaroo testicles, or dressing up as a cat and licking milk out of the woman from Coronation Street's cupped hands, what people really want to see is a little bit of suffering. Therefore, it should come as no surprise that Italy, who dropped all five of their games and finished last, is the true star of Netflix's new rugby series, Six Nations: Full Contact, rather than France, who came very close to defeating Ireland, who won the grand slam last year, or Ireland. Spoiler alert: the show concludes with their head coach, Kieran Crowley, considering the likelihood that he will soon

Chinas changes to its monetary policy to support economic recovery

A number of monetary policy changes were announced by the People's Bank of China (PBOC) on Wednesday with the goal of boosting liquidity and encouraging national economic expansion. Reducing the reserve requirement ratio (RRR) is one of the PBOC's primary actions. The RRR is the amount of cash that banks are required to hold as reserves. The PBOC will lower the RRR by 0.5 percentage point, effective from February 5, 2024. This move will inject 1 trillion yuan ($139.45 billion) into the market, thereby increasing liquidity. Beginning on January 25, 2024, the PBOC will reduce the re-lending and rediscount rates by 0.25 percentage points, from 2 percent to 1.75 percent, in addition to the RRR reduction. It is anticipated that this cut will lower social financing's overall cost, accelerating economic recovery. The announcement of these policy adjustments has had a positive impact on the Chinese stock market. Following the news, the Shanghai Composite Index climbed by 1.80 percent, while the Shenzhen Component Index and the ChiNext Index increased by one percent and 0.51 percent, respectively.JLL Greater China's chief economist and head of research, Bruce Pang, emphasized the PBOC's dedication to a steady and exacting monetary policy. The goals are to support credit allocation to the real economy, guarantee stable liquidity in the banking system, and lower funding costs for financial institutions. In spite of the challenges posed by the global economy, financial institutions and markets in China remain stable, as PBOC Governor Pan Gongsheng reassured.The PBOC plans to enhance its financial risk monitoring and assessment capabilities. It seeks to create a system for resolving financial risks that strikes a balance between accountability and authority. This initiative reflects the PBOC's commitment to managing financial risks and maintaining stability in the face of global economic challenges. The PBOC plans to use a range of monetary policy instruments in the future to ensure that there is enough liquidity. Aligning the money supply and social financing with targets for price level and economic growth is the aim. Additionally, the PBOC wants to enhance financial services for the actual economy, especially by helping small and private companies. Zhu Hexin, deputy governor of the PBOC and head of the State Administration of Foreign Exchange, predicts that the stability of China's cross-border capital flows will further improve in 2024. The current account is expected to maintain a reasonable surplus, with an increase in foreign capital inflows under the capital account.The recent monetary policy adjustments by the PBOC reflect China's proactive approach to navigating its economic trajectory amid global uncertainties. By reducing the RRR and cutting re-lending and re-discount rates, the PBOC aims to enhance liquidity, support economic growth, and ensure stability in the banking system.

Zee-Sony Merger Called Off: These mutual funds have exposure to the stock

India's mutual fund houses have increased their stake in Zee Entertainment in all of the nine quarters since the Sony merger announcement in December 2021. As of the December quarter, the domestic mutual funds held a 32.49% stake in Zee Entertainment, which is more than double the 12.16% stake they held at the end of the December 2021 quarter when the deal was announced. The increase in stake also corresponds with the exit of its largest shareholder Invesco, which along with Oppenheimer, held close to 18% stake in Zee at the time of the merger announcement. While Invesco Developing Markets Fund exited the stock by selling its 7.8% stake in April 2022, the OFI Global China Fund earlier pared a 5% stake between October and December 2022, before making a complete exit in April 2023. Among the funds that own a substantial stake in Zee Entertainment as of the December quarter include ICICI Prudential Value Discovery Fund, Nippon India Multi-Cap Fund, and HDFC Mid-Cap Opportunities Fund, among others. Some of India's largest insurance companies, all listed, also own a stake in Zee Entertainment, including the country's largest insurer LIC, along with HDFC Life and SBI Life Insurance.

Stock Market Nifty 50 falls below 21,500, Zee Entertainment shares down 25%

The Bombay Stock Exchange (BSE) has revised the Dynamic Price Band of shares of Zee Entertainment to 30% downward from 25% earlier. In case further relaxation is needed, it will be done at an interval of 15 minutes, a circular from the BSE said.It must be noted that the stock is currently in the F&O ban and hence there are circuit limits being imposed, something that is a practice with non-F&O stocks. Otherwise, for F&O stocks, there is no price band. Barring ICICI Bank, the remaining 11 stocks in the Nifty Bank index are contributing negatively towards its downside. Reliance Industries shares were in focus on January 23 with analysts expecting up to 23% upside in the Mukesh Ambani-led conglomerate’s stock following the results for the October to December 2023 quarter. Reliance shares traded more than a percent lower after the firm reported a steady third quarter with retail business revenue hitting a record high, Jio reporting a 2% rise in average revenue per user (ARPU) and oil and gas business witnessing record high margin of 86%. Shares of HDFC Bank Ltd. remain the top contributors to the Nifty 50’s downside on Tuesday, declining another 2%. India’s largest private lender is contributing 56 points to the index downside on Tuesday. The lender’s market capitalisation has also slipped below the mark of ₹11 lakh crore, compared to its peak of ₹12.97 lakh crore, which it had on December 29.With Tuesday’s drop, the stock has declined in four out of the last five trading sessions, during which it has seen a drop of 13% from closing levels of January 16. Shares of Medi Assist Healthcare Services listed on the bourses on Tuesday, January 23. The stock listed at a premium of 11% at ₹465 a share on the BSE, and went on to scale an intra-day high of ₹509.60. On the NSE, it listed at ₹460, a premium of 10% against an issue price of ₹418. Ahead of its debut, shares of Medi Assist were commanding a premium of ₹32-36 in the unlisted market. As per trends, the company’s shares were expected to list at a premium of 8%. The initial public offering (IPO) of Nova Agritech Limited (NATL) will open for subscription on Tuesday (January 23). The public offer was postponed by a day due to the market’s holiday on January 22 and would close on January 25. Ahead of the issue launch, the company’s shares are commanding a premium of ₹20 in the unlisted market.Nova Agritech has fixed its price band at ₹39-41 per share, with a lot size of 365 equity shares in one lot and its multiples thereafter.

Ram Mandir Inauguration: TN govt slams Finance Minister for spreading falsehood over live telecast ban

The Tamil Nadu government has hit back at Union Finance Minister Nirmala Sitharaman's claims that the state has prohibited the live telecast of Ayodhya Ram Mandir programmes scheduled for January 22. P Sekar Babu, Tamil Nadu Minister for Hindu Religious & Charitable Endowments, dismissed these allegations and criticised Sitharaman for "purposefully propagating this erroneous information"."The Hindu Religious and Charitable Endowments department hasn't imposed any limitations on devotees' freedom to offer food, conduct poojas in the name of Shri Ram, or provide prasad in Tamil Nadu temples. It is unfortunate that people in office, like Union Finance Minister Mrs. Nirmala Sitharaman and others, are purposefully porpagating this erroneous information," Sekar Babu said in a post on X (formerly Twitter). Earlier on Sunday, Sitharaman claimed that the Tamil Nadu government prohibited the live telecast of the prgrammes and took to social media to denounced the Chief Minister MK Stalin-led DMK government, labelling the it as "anti-Hindu" and "hateful."Sitharaman had alleged that the "ban" extends to Hindu Religious and Charitable Endowments (HR&CE) managed temples, where she claimed activities such as puja, bhajan, prasadam, and annadanam in the name of Lord Ram are not permitted. She further accused the police of intervening in privately held temples, preventing them from organising events and issuing threats of dismantling pandals.Sitharaman alleged that individuals are facing obstacles and threats while attempting to organize bhajans, provide food to the needy, distribute sweets, and celebrate, all to witness Prime Minister Narendra Modi's participation in the Ram Temple consecration ceremony at Ayodhya.The Finance Minister went on to claim that cable TV operators have been warned about possible power cuts during the live telecast, branding it as an "anti-Hindu move" orchestrated by the DMK, a key partner in the INDIA alliance. Sitharaman accused the Tamil Nadu government of "unofficially" citing law and order concerns as a justification for the ban on live telecast.

Governments cash surplus tops Rs 3.4 lakh crore

Apart from the deceleration in government spending, higher direct tax collections and a likely sharp rise in issuances of Treasury Bills by the Centre in FY24 were factors pushing up the government's cash balances, analysts said. The flow of government cash balances to and from the banking system is a key factor that influences liquidity conditions. Mumbai: A constant feature of the Indian banking system over the past couple of months has been the prevalence of large deficit liquidity conditions, and one of the factors behind banks' scramble for funds is a massive build-up of government cash balances as the Centre slows down spending.Apart from the deceleration in government spending, higher direct tax collections and a likely sharp rise in issuances of Treasury Bills by the Centre in FY24 were factors pushing up the government's cash balances, analysts said. The flow of government cash balances to and from the banking system is a key factor that influences liquidity conditions."Government cash surplus as of Janury 12, 2024 is tracking at ₹3.4 lakh crore versus ₹1.6 lakh crore as of January 13, 2023. We see space for expenditure savings for the Centre on transfers to states which consists of finance commission grants, centrally sponsored schemes and central sector schemes, loans for capital expenditure etc," said Gaura Sengupta, economist at IDFC First Bank. "Based on data from Finance Ministry, 15th Finance Commission grants to states are tracking 29%YoY lower in FYTD24 (Apr-Dec)," she said.As on January 16, the headline liquidity deficit in the banking system was at ₹1.94 lakh crore, Reserve Bank of India data showed. Liquidity in the banking system typically tightens around the middle of a month due to tax outflows before easing towards the end of the month as the government spends on salaries and pensions of employees. With banks facing a scarcity of funds at present, the weighted average call rate (WACR) closed at 6.76% on Wednesday, much higher than the repo rate of 6.50%. The elevated money market rates have pushed up costs of funds for banks, and in turn for corporates, looking to raise money through short-term debt."It's speculative to say that the build-up in cash balance is for any particular reason, but one thing is that the government started the year in WMA (Ways and Means Advances), so there might have been a target to build up the cash balance for the end of the year as well," said A Prasanna, head of research at ICICI Securities Primary Dealership. WMA is a funding facility that the RBI extends to the government in order to tide over short-term cash-flow mismatches.Till January 11, the government's net direct tax collections rose 19% annually to ₹14.70 lakh crore, official data released last week showed. Tax collections till then were at 81% of the full-year target.

HDFC Bank seeks Singapore bank license to grow overseas

HDFC Bank, India's largest private sector lender, is seeking approval for a banking license in Singapore. The bank aims to tap into the Indian diaspora in Singapore for savings and term deposits, as well as cross-sell products like mortgages. HDFC Bank already has a presence in London, Hong Kong, and Bahrain. With a customer base of 93 million, the bank is expanding its reach overseas after a merger with Housing Development Finance Corp. last year.HDFC Bank Ltd, India’s biggest private sector lender, is seeking to open its first branch in Singapore, signaling its overseas ambitions after sewing up a landmark merger with mortgage financier Housing Development Finance Corp. last year. The bank has applied to the Monetary Authority of Singapore for a banking license and is awaiting approval, according to sources familiar with the matter. It is not clear what kind of banking license HDFC Bank is seeking in Singapore, said one of the people, who declined to be identified as the information is confidential. The banking giant is seeking a bigger presence abroad to tap the Indian diaspora for savings and term deposits, as well as to cross-sell more products, including mortgages, the people said. At home, HDFC has been focusing on deepening its reach in the world’s most populous country through loans to retail customers. HDFC Bank did not respond to an email seeking comment. “As a matter of policy, MAS does not comment on our dealings with financial institutions,” according to a spokesperson from the Singapore regulator. Singapore, with a population of almost 6 million people, houses a large India diaspora. About 650,000 non-resident and persons of Indian origin live in the city-state, according to Indian government data.HDFC Bank is currently not licensed or regulated by the MAS, according to its website. It only provides home loans-related advisory services for the purchase of properties in India, the website states. The categories of banking licenses in Singapore encompass full banks, qualifying full banks and wholesale banks, which impose varying levels of restrictions on the lenders’ activities. State Bank of India and ICICI Bank Ltd. hold qualifying full banking licenses, alongside eight other banks like Bank of China Ltd. and BNP Paribas SA. Such licenses are open only to foreign banks and allow them to have additional branches and/or off-premise ATMs as well as to share ATMs among themselves, according to the Association of Banks in Singapore’s website.The MAS regulates and supervises more than 150 deposit-taking institutions in Singapore, ranging from full banks to finance companies, according to its website.

Teslas winter woes: A storm of challenges and disruption

Tesla is grappling with operational, strategic, and environmental challenges that impact its stock value and investor focus. The recent challenges placing Tesla in the headlines, including operational disruptions, strategic market adjustments, and technological limitations in cold weather, have impacted its stock price, contributing to a 13% decline in the past thirty days. Tesla's analysts are concerned about business growth, which has shown signs of deterioration in recent quarters. This, combined with the company's high valuation, makes some analysts cautious about Tesla's stock in the medium term.Despite these concerns, Tesla's diverse business operations beyond just manufacturing cars offer some optimism. Its advancements in other areas, like energy solutions and technology innovations, provide potential growth avenues. However, the company's core focus on car manufacturing is subject to market cyclicality, which currently does not favor bullish sentiments.Investors eagerly anticipate the release of the Q4 earnings report and guidance for the fiscal year 2024, as it will impact the company's stock valuation. Manufacturing efficiency and the number of vehicles manufactured are pivotal in influencing investors' interest. While some investors maintain a positive outlook based on potential long-term growth, Tesla’s overall sentiment is a mix of optimism and caution. Some investors and Tesla stock analysts have adopted a bearish stance due to the company's prevailing challenges and market dynamics. Tesla's Berlin gigafactory is pivotal to its European market growth. The Berlin gigafactory has recently halted operations due to supply chain issues linked to the Red Sea blockade. This crucial maritime channel is integral to global trade, and its disruption has had a domino effect, underlining the vulnerability of global manufacturing networks to geopolitical strife. The Berlin factory, known for its state-of-the-art production capabilities, now faces uncertainties that concern investors, particularly regarding potential delays in vehicle production and distribution. This halt impacts Tesla's operational efficiency and places added pressure on its stock value as the market reacts to these unforeseen challenges and the possible implications for Tesla's European market performance and overall global supply chain efficiency.In response to intensifying competition in China and Europe, Tesla has strategically reduced prices for select models in these key markets. This price adjustment is calculated to strengthen Tesla’s standing, especially in China, where the demand for affordable electric vehicles is rapidly expanding. While this strategy could potentially increase Tesla's market share in the short term, it raises crucial questions about its long-term effects on its profitability and financial health. These concerns are particularly pertinent for investors as they weigh the implications of Tesla's pricing strategy on its future revenue streams and overall market sustainability.

Indias most valuable PSU remains a wealth destroyer

Life Insurance Corporation of India (LIC) overtook State Bank of India on Wednesday to become India's most valuable state-run company in terms of market capitalisation. At the start of trading on Wednesday, LIC had a market capitalisation of ₹5.66 lakh crore, compared to SBI's ₹5.64 lakh crore, though SBI recovered from opening lows to reclaim the top spot for a brief period again. However, despite becoming India's most valued company, LIC has caused loss of investor wealth. The stock listed at a discount in May 2022, a level it only crossed on Tuesday, nearly two years after listing. Although the stock has crossed the retail IPO price of ₹904, it remains below the original IPO price of ₹949. Over the last 12 months, the stock has gained only 27%, compared to other PSE index constituents like REC, PFC, BHEL and HAL, which have gained anywhere between 140% to 250% over the same time frame. In fact, LIC shares are the second-worst performers on the Nifty PSE index over a 12-month period, only ahead of Container Corporation of India, which is up 25%. LIC remains India's biggest IPO where the government sold a 3.5% stake to mobilise over ₹21,000 crore. That is the only stake sold in the open market yet as the government continues to hold the remaining 96.5%. DIPAM Secretary Tuhin Kanta Pandey in his prior interactions with CNBC-TV18 had mentioned that an LIC Follow-On Public Offer (FPO) is not on the cards yet. Additionally, unlike other PSUs, LIC has been granted an exemption from complying with minimum public shareholding norms. It can achieve the 25% minimum public shareholding by May 2032, instead of the usual three years. LIC shares have recovered from their 52-week low of ₹530 and despite this rally are trading at 0.85 times price-to-embedded value. Shares of LIC are trading 0.6% lower at ₹887.2. The stock is up 11% over the last month.

Vivek Ramaswamy Quits US Presidential Race, Endorses Trump

Vivek Ramaswamy, a 38-year-old Indian-American entrepreneur and political novice who quickly created a name for himself with aggressive policy proposals and an outsized sense of confidence, has withdrawn over of the campaign for the Republican presidential nomination after finishing fourth in the Iowa caucuses, news agency Reuters reported. He then backed former President Donald J. Trump for the presidency. Ramaswamy, who was virtually unknown in political circles when he entered the campaign in February 2023, managed to pique the interest and support of Republican voters with his strong views on immigration and an America-first attitude. In terms of tone and philosophy, his campaign plan closely paralleled that of former President Donald Trump. Ramaswamy attempted to draw into Trump's conservative base, which had pushed him to victory in prior elections.He said, “Tonight, I have to face the truth. It was hard for me to accept, but we have looked at the facts. And the fact is, we did not get the result we hoped for tonight.”Ramaswamy had recently taken a harder stance against Trump, claiming that the former president’s legal troubles and strong political enemies made him a weak candidate. Trump responded by attacking Ramaswamy on social media, calling his campaign “deceitful” and “very sly,” in the first sign of hostility between them.Ramaswamy had been one of Trump’s biggest supporters during the campaign. He had praised Trump as “the greatest president of the 21st century” and stood by him despite the numerous criminal charges and obstacles to his candidacy.On Tuesday, Trump said on social media that his accuser had gained fame and money through "fabricated lies and political shenanigans" in the case.Former US President Donald Trump left Trump Tower on Wednesday morning as he heads back to Manhattan court where rape accuser E. Jean Carroll was poised to testify against him for $10 million defamation case.

Ayodhya: Massive crowd throngs Ram temple as mandir opens its doors for devotees after ‘pran pratishtha’

Devotees gathered in large numbers since 3am to have darshan of the new Ram Lalla idol on the first morning after the consecration ceremony. A massive crowd thronged the Ram Mandir in Ayodhya as the grand temple opened its doors for devotees to offer prayers on Tuesday morning, a day after the 'pran pratishtha' ceremony of Ram Lalla. Devotees gathered in large numbers since 3am to have darshan (viewing) of the new Ram Lalla idol on the first morning after the consecration ceremony, news agency ANI reported. A large number of devotees, both locals and visitors from other states, gathered near the main gateway along the Ram Path leading to the temple complex late on Monday, seeking entry to the mandir premises. As a large crowd built up near the ceremonial gateway – decked up for the consecration ceremony – police told the devotees that the temple would open to the public from Tuesday.For devotees seeking darshan of Lord Ram Lalla, the Shri Ram Janmabhoomi Teerth Kshetra website has provided specific time slots – morning slot from 7am to 11:30am and afternoon slot from 2 pm to 7pm.‘Aarti’ timings include jagran/shringar at 6:30am and sandhya aarti at 7:30pm. One can obtain passes for the 'aarti' both offline and online. The offline passes are available at the camp office at Shri Ram Janmbhoomi, requiring a valid government identity proof. The 'pran pratishtha' of Ram Lalla in Ayodhya was held amid unbridled celebrations, with Prime Minister Narendra Modi performing the main rituals officiated by a select complement of priests. The 'pran pratishtha' ceremony of Lord Ram was held at 12.29pm on Monday. The ceremonial journey leading up to the mega event included a seven-day ritual that commenced on January 16.The ceremony was attended by people from all walks of life, including representatives of various tribal communities. Major spiritual and religious sect leader were also invited to the consecration ceremony. Built-in the traditional Nagara style, Shri Ram Janmbhoomi Mandir has a length (east-west) of 380 feet and a width of 250 feet. It stands 161 feet above the ground and is supported by a total of 392 pillars and 44 doors. The pillars and walls of the temple showcase intricately sculpted depictions of Hindu deities, Gods, and Goddesses. We are very pleased. Ayodhya has decked up like a bride. We are touched even more to come to terms with the fact that we are going to have 'darshan' of the Ram Lalla," ANI quoted Tejender Singh, a devotee from Chandigarh, as saying.Another devotee said he came all the way from Odisha for the darshan of Lord Ram in Ayodhya."I have come from Odisha's Puri to Ayodhya on bike to have darshan of Lord Ram Lalla. It was a journey of 1224 kilometres. I was very eager to have 'darshan' of Lord Ram Lalla. When I was asked on my way where I was going, I said that that I was going to have darshan of Lord Ram at the temple which was not built for over 500 years," he told ANIIn the sanctum sanctorum of Ram Mandir, the child-like Lord Ram is enthroned.

Mid-spec Tata Punch EV vs Top-end Tata Tiago EV: Cross-shopping Simplified

Tata Motors recently launched the Punch EV, introducing a new electric micro-SUV in our market. It sports a refreshed look and is based on a completely new electric car-only platform. The Punch EV joins Tata's lineup of electric vehicles, including the Tiago EV. If you are considering both the Punch EV and Tiago EV, we have simplified your decision-making process with a detailed comparison. Check it out. The mid-spec Punch EV Standard Range marginally undercuts the top-spec Tiago EV Long Range. It's important to note that, we are considering the Tiago EV configured with a 7.2 kW AC fast charger, which comes at a premium of Rs 50,000. Both the vehicles come standard with 3.3 kW AC charger. Considering the segment, the Punch EV is undoubtedly a larger vehicle than the Tiago EV, offering more space and a larger boot. It also has a longer wheelbase and that should result in more room inside the cabin. Things change in the features department, with no significant difference between the two cars. In fact, the Tiago EV offers additional features such as rain-sensing wipers, a larger 8-speaker sound system, and a tyre pressure monitoring system. On the other hand, the Punch EV rides on larger 15-inch wheels and comes equipped with 6 airbags. As seen in the table above, there is barely any difference between the two cars in terms of powertrain specifications. However, the Punch EV's electric motor produces slightly more power. In terms of claimed range, both deliver a similar range. Do note that you get a second powertrain choice with both cars: Medium Range in the Tiago EV and Long Range in the Punch EV. Ultimately, your decision will depend on whether to choose a larger micro-SUV or a hatchback with a smaller form factor, as both cars more or less offer a similar features set and power figures. Keeping the size factor aside, choosing the Punch EV means opting for a more modern product with an updated design. If you can configure it to higher-spec variants, you also get additional niceties like ventilated seats, and a larger infotainment and digital driver’s display. You also get the novelty factor of an SUVThe Tiago EV, on the other hand, is based on its petrol-powered counterpart, maintains the same design and feel, which might feel dated when compared to the Punch EV. Nevertheless, it does offer some additional conventional features if aesthetics are overlooked. That said, the new Punch EV is definitely the more modern product here and is our pick.