Top Trending Business News & Highlights

One accord, three setbacks India's use of the EU trade pact to boil Turkey, Pakistan, and Bangladesh

The United States has also been affected by India's trade agreement with the European Union. The historic trade deal between India and the EU would not only affect Bangladesh and Pakistan but also the United States and Turkey. The agreement calls for the elimination or reduction of tariffs on more than 90% of EU goods exports to India, including hefty charges of up to 44% on machinery, 22% on chemicals, and 11% on pharmaceuticals, which will be phased down over time.Following nearly two decades of negotiations, officials announced on Tuesday that India and the European Union have achieved a free trade agreement to strengthen economic and strategic ties. Up to 2 billion people might be impacted by the agreement, which the president of the EU's executive body referred to as the "mother of all deals." The accord won't go into force for some months. The agreement between two of the largest markets in the world comes as Washington imposes high import taxes on both the EU bloc and the Asian behemoth, upsetting long-standing trade patterns and forcing major economies to look for new alliances. The FTA, which both India and the 27-nation EU refer to as "the mother of all deals," provides a "decisive boost" to the labor-intensive textile industry by improving price competitiveness and expanding market access in one of the most sophisticated consumer markets in the world, according to a note released today by the Indian Textile Ministry.

Published 29 Jan 2026 12:51 PM

India and New Zealand wrap up free trade negotiations despite persistently high US tariffs

Free trade agreement (FTA) talks between India and New Zealand came to an end on Monday amid hefty US tariffs that have unsettled investors and led to the cancellation of orders from India's biggest export market. In the context of 50% US tariffs, the New Zealand agreement, if signed, would be India's second free trade agreement (FTA) following the Oman agreement. It would also be the country's third accord this year as it works to diversify its exports.According to information made public by the government, Wellington would remove tariffs on 100% of its tariff lines for all Indian exports, while India has committed to lower tariffs on 95% of New Zealand exports. However, New Zealand's typical tariffs are among the lowest in the world—between two and three percent—and their removal could not immediately boost exports. In order to bring some symmetry to the agreement, New Zealand has "committed" to investing $20 billion in India over the next fifteen years in exchange for market access in a rapidly expanding Indian consumer market that is subject to high tariffs (over 15%). Because of the unfair tariff rates, New Zealand may benefit more from goods trade than India.In 2024–2025, bilateral trade between India and New Zealand was only $1.3 billion. "This FTA opens doors for Indian businesses in the region through well-integrated directional exports and gives our youth choices to learn, work, and grow on a global stage," stated Commerce Minister Piyush Goyal."India's strengths are expanding exports, supporting labor-intensive growth, and power services," stated Commerce Secretary Rajesh Agrawal. New Zealand's access to India's sizable and expanding economy is deeper and more reliable. These qualities are brought together by the migration of individuals, professionals, students, and skilled workers. The FTA contains provisions to address non-tariff barriers through improved regulatory cooperation, transparency, and streamlined customs, sanitary and phyto-sanitary (SPS) measures, and technical barriers to trade disciplines, according to the Commerce and Industry Ministry, in addition to tariff liberalization. According to the Ministry, "all systemic facilitations and fast-track mechanisms for imports that serve as inputs for our manufactured exports ensure that tariff concessions translate into effective and meaningful market access."

Published 22 Dec 2025 10:28 PM

What workers, brokers, and policyholders stand to gain from travelers' agreement to preserve 1,400 jobs in Canada

The Canadian business of Travelers will be acquired by Definity Financial Corp. The total value of the acquisition is $3.3 billion. Definity will become the fourth-largest property and liability insurer in Canada as a result of this transaction. Every one of Travelers Canada's 1,400 employees will continue to work there. Consumers can anticipate competitive pricing and additional options. Regulatory permission is needed for the deal. By early 2026, it should be closed.Definity Financial Corp. plans to pay $3.3 billion to acquire the Canadian operations of the US behemoth Travelers, one of the largest transactions in Canada's insurance industry in recent memory. This merger could change the competitive environment for both insurers and consumers. More than 1,400 Traveler employees across Canada will retain their employment when the two companies combine under a single brand, despite the fact that large acquisitions frequently result in job losses.Definity will move up from sixth place to become Canada's fourth-largest property and liability insurer as a result of the purchase. Its expanding presence in the insurance industry is demonstrated by the $6 billion in total yearly premiums it currently manages.

Published 28 May 2025 07:58 PM

Why did India decide to remove the "Google tax" in response to pressure from the US?

The Center intends to eliminate the 6% equalization levy (EL) it levies on digital advertisements as part of the 35 modifications to the Finance Bill, 2025, effective April 1, 2025.The Central government has suggested to eliminate the equalization levy on internet advertisements as part of revisions to the Finance Bill, 2025, a move that is anticipated to help American large technology companies and allay US worries about India being a high tariff country.As part of changes to the Finance Bill, 2025, the central government has proposed doing away with the equalization levy on online ads. This is expected to benefit big IT companies in the US and ease concerns about India being a high-tariff nation.The equalization charge, also referred to as the Google tax, will be eliminated by the Center on April 1. The clause is one of 59 changes to the Finance Bill that Finance Minister Nirmala Sitharaman made on Monday and presented to Parliament.

Published 25 Mar 2025 08:42 PM

Business

Business globally are the pillars of any economy and they contribute in huge amount to take any country ahead financially and economically and boost the country grwoth.

ITC Q3 results: Net profit rises 10.8% to Rs 5,572 crore, beats estimates

India's ITC beat analysts' estimates for third-quarter profit on Monday as the consumer goods giant benefited from higher demand for its products ranging from cigarettes to noodles. The company's profit rose 10.8% to Rs 5,572 crore ($670.3 million) in the three months ended Dec. 31. Analysts on average had expected a profit of Rs 5,148 crore, according to data from LSEG. The company and peers have benefited as a crackdown oFY23.e smuggling of international cigarette brands reduced competition.Cigarettes account for more than 40% of ITC's topline. Revenue from operations rose 2% to Rs 17,665 crore, with the cigarettes business growing 3.6%. Bajaj Finance Ltd on Monday reported a 22.40 per cent year-on-year (YoY) rise in its consolidated third-quarter (Q3) profit for the ongoing financial year 2023-24 (FY24). The figure stood at Rs 3,638.95 crore in Q3 FY24 as against Rs 2,973 crore in the same period last fiscal. During the quarter under review, the non-bank lender's revenue from operations grew 31.28 per cent to Rs 14,161.09 crore from Rs 10,787.25 crore in Q3 FY23. Assets under management (AUM) grew by 35 per cent to Rs 3,10,968 crore as of December 31, 2023 from Rs 230,842 crore in Q3 FY23. Net interest income increased by 29 per cent in Q3 FY24 to Rs 7,655 crore from Rs 5,922 crore in Q3 FY23. In Q3 FY24, gross NPA (non-performing asset) and net NPA stood at 0.95 per cent and 0.37 per cent, respectively, as against 1.14 per cent and 0.41 per cent in the corresponding period last fiscal. The company also said it has provisioning coverage ratio of 62 per cent on stage 3 assets.Pre-provisioning operating profit increased by 27 per cent in Q3 FY24 to Rs 5,539 crore from Rs 4,351 crore in Q3 FY23

NTPC Q3 results: Profit up 7% at Rs 5,208 cr, income falls to Rs 43,574 cr

State-owned power giant NTPC on Monday reported over 7 per cent rise in consolidated net profit to Rs 5,208.87 crore for the December 2023 quarter, aided by energy sales through trading. Its net profit stood at Rs 4,854.36 crore in the year-ago period, a BSE filing said. The total income fell to Rs 43,574.65 crore in the quarter from Rs 44,989.21 crore in the same period a year ago.The company's expenses rose to Rs 38,782.22 crore from Rs 37,007.51 a year ago. "Revenue from operations for the quarter and nine months ended 31 December 2023 include Rs 2,117.12 crore and Rs 7,012.90 crore, respectively (Previous quarter and nine months Rs 1,984.92 crore and Rs 6,039.14 crore, respectively) on account of sale of energy through trading," the filing said. The Board of Directors of the company has also approved a second interim dividend of 2.25 per share (face value of Rs 10 each) for the financial year 2023-24 in their meeting held on January 29, 2024. The date of payment/dispatch of the dividend shall be February 22, 2024. The Board had declared the first interim dividend of 2.25 per share (face value of Rs 10 each) for the financial year 2023-24 in their meeting held on October 28, 2023, which was paid in November 2023.The average tariff of the company was Rs 4.57 per unit during April-December this fiscal compared to Rs 4.96 per unit a year ago.The gross electricity generation of NTPC increased to 89.467 billion units (BU) during the third quarter against 78.646 BU in the year-ago period. Coal output increased to 8.09 MMT in the quarter from 5.35 MMT a year ago. Its production also increased during April-December this fiscal to 19.92 MMT from 13.75 MMT.Plant load factor or capacity utilisation of coal-based thermal power plants improved to 75.95 per cent in the quarter from 68.85 per cent a year ago.Domestic coal supply improved to 60.23 MMT in the October-December quarter over 52.45 MMT in the same period last fiscal.Gas consumption improved to 2.26 MMSCMD from 1.13 MMSCMD. Imported coal supply stood at 2.15 MMT in the quarter against 1.57 MMT a year ago.NTPC Group's installed power generation capacity stood at 73,874 MW as of December 31, 2023.

Share Market Budget 2024 Expectations Live: Top Stocks to watch

On February 1, finance minister Nirmala Sitharaman will present an ‘interim’ budget as the government faces a general election this year, in April-May. There are the top stocks to watch before the interim budget to watch for. The benchmark equity indices ended Monday’s trading session in the positive territory. The NSE Nifty 50 gained 385 points or 1.80% to settle at 21,737.60, while the BSE Sensex soared 1240.90 points or 1.79% to 71,941.57. The broader indices ended in positive territory, with gain led by Largecap and Smallcap stocks. Bank Nifty index ended higher by 576.20 points or 1.28% to settle at 45,442.35. Energy and PSU Banks stocks outperformed among the other sectoral indices while Media and FMCG stocks shed. Over the last 5 days, BPCL shares have seen a notable increase of 3.53%, and in the last month, the growth has been substantial, reaching almost 9.31%. Assessing the medium and long-term performance, the stock has delivered exceptional returns, recording a surge of 30.49% in the last 6 months and an impressive 47.08% over the past year. Year-to-date, the stock has jumped by a noteworthy 9.01%. As the Indian e-commerce market continues to thrive, a robust last-mile infrastructure becomes paramount for seamless and efficient deliveries. Investments in improved road networks, strategically located delivery hubs, and advanced technology solutions for optimal route planning are essential. Particularly crucial in a market with a substantial volume of Cash-on-delivery (COD) orders, enhancing last-mile capabilities not only benefits e-commerce sellers but also offers logistics companies a cost-effective solution, steering away from expensive air deliveries. Additionally, anticipating reduced tax burdens, especially on fuel and operations, would further support the financial sustainability of courier companies, fostering a conducive environment for cost-effective operations. In tandem, advocating for e-commerce-friendly policies can propel the growth of the sector, indirectly benefiting courier companies. Streamlining licensing procedures, minimizing regulatory hurdles, and implementing measures that facilitate the smooth functioning of e-commerce operations will contribute to a thriving logistics ecosystem. Furthermore, recognizing the pivotal role played by small and medium-sized enterprises (SMEs) in the logistics sector, incentivizing their growth through financial support, simplified regulations, and improved access to credit can significantly boost the overall efficiency of e-commerce logistics in India. Finally, changes in taxation policies, especially related to customs duties and tariffs, can substantially impact import costs, providing e-commerce sellers with opportunities to minimize overall expenses and scale up their businesses rapidly,” said Raju Sinha, Chief Business Officer at Fship Logistics.

Fashion Mogul Passes Elon Musk to Become Worlds Richest Person. What Is His Net Worth?

The world's richest man, Bernard Arnault, is the chairman and CEO of Moet Hennessy Louis Vuitton (LVMH), surpassing Elon Musk. According to Forbes, the French billionaire and his family's net worth increased by $23.6 billion to reach $207.6 billion. The report also stated that on Friday, Mr. Arnault's net worth surpassed that of the Tesla CEO, whose $204.7 billion fell 13% as a result of Mr. Musk losing more than $18 billion. Since 2022, the two billionaires have reportedly been in a tug-of-war over wealth, with Mr. Arnault apparently taking the lead late in the year.According to the report, LVMH, the company that owns luxury brands such as Dior, Bulgari, and Sephora, has a market capitalization of $388.8 billion, while Tesla's is $586.14 billion. The top 10 richest people in the world, as per Forbes' real-time billionaires list, are: The Arnault Family ($207.6 billion) is the owner. Elon Musk is worth $204.7 billion. Jeff Bezos ($181.3 billion)$142.2 billion for Larry Ellison Mark Zuckerberg (139.1 billion) Warren Buffett ($127.2 billion)Larry Page, worth $127.7 billion The $122.9 billion Bill Gates $121.7 billion for Sergey Brin Ballmer Steve (118.8 billion). However, the Bloomberg Billionaires Index, on the other hand, claims that Mr Musk is still the richest man in the world, with a net worth of $199 billion wealth. Elon Musk is followed by the founder of e-commerce giant Amazon Jeff Bezos with $184 billion of wealth, on the list. On the Bloomberg Billionaires Index, Bernard Arnault has occupied third place with a $183 billion net worth.

This $1.3 billion fund manager expects Teslas shares to gain 550% by 2030

Tesla Inc.’s slowing growth and shrinking profit have made it the weakest stock on the Nasdaq 100 this year. Fund manager David Baron is betting it will be a bump in the road for Elon Musk’s company before another parabolic rally.It’s a tough wager to make right now, after the electric-vehicle maker warned on Wednesday that it will expand at a “notably lower” pace this year, prompting a 12% plunge in the stock. It has now lost $209 billion in market value this month through Friday’s close. The manager of the Baron Focused Growth Fund expects Tesla’s stock to reach $1,200 by 2030, up 550% from current levels, citing its strong brand. Tesla and Musk’s privately held SpaceX were the fund’s largest holdings as of December 31. Last year, it climbed 28%, beating the 18% rise in its benchmark, the Russell 2500 Growth Index, and the S&P 500’s 24% gain. And despite Tesla’s outlook for slower sales growth this year — a result in part of the EV winter that’s gripping the entire industry — Baron still expects the stock to touch around $300 in about 12 months, from around $183 at Thursday’s close. “While he may not be growing 50% a year as the company thought,” Baron said in an interview, “this year in a tough environment he’s still growing volume by 15% to 20% per year and making us $7,000 per car of gross profit.” Tesla delivered 1.8 million cars in 2023, up 38% from the year before. This year, Wall Street analysts project unit sales will increase 17%. The company didn’t respond to an email seeking comment. The Tesla holding is a key to Baron’s goal of boosting his fund’s assets to $2 billion this year, from $1.3 billion as of December 31.The fund manager’s father, Wall Street veteran Ron Baron, is famously a big Musk bull. The elder Baron oversees the Baron Partners Fund, which a Bloomberg Intelligence study published in August found was alone among thousands of rivals to beat the Nasdaq 100 over the prior five, 10 and 15 years. As for SpaceX, David Baron projects its valuation will rise 20% in a year, double within three years and triple within five. The space and satellite company is worth $175 billion or more, Bloomberg reported last month. Baron, 43, became co-portfolio manager in 2018 with his father. The small- and mid-cap fund first bought Tesla shares in 2014. Its outperformance last year came as Tesla’s stock doubled, powered in no small part by its artificial-intelligence potential. Replicating that success in 2024 will be tough should Tesla struggle amid waning EV demand. “More investors are beginning to increasingly question the company’s growth narrative,” Toni Sacconaghi, an analyst at Sanford C. Bernstein, wrote in a note after the latest quarterly results. And while Tesla bulls often say innovation by the company can allow it to sustain a cost advantage and strong margins, “the counterargument is that the automotive industry is hyper-competitive, and carmakers have historically been unable to sustain cost advantages,” the analyst added.

Govt halves equity infusion in OMCs to Rs 15K crore

NEW DELHI: Finance ministry has halved the amount of equity infusion in state-owned fuel retailers to Rs 15,000 crore to support their investments in energy transition projects, and also has deferred the plans to purchase crude oil worth Rs 5,000 crore to fill strategic underground storages. The ministry made this decision after considering the emerging trends in oil markets. “The plan for the purchase of crude oil worth Rs 5,000 crore for caverns at Mengaluru & Visakhapatnam has been recommended for deferral by the Department of Expenditure, Ministry of Finance. This recommendation takes into account the emerging trends in oil markets,” stated the finance ministry. India, as the world’s third-largest oil importer and consumer, relies on imports for over 80% of its oil requirements. In order to safeguard against supply disruptions, the country has established strategic storage facilities at three locations in southern India. These facilities have the capacity to store over 5 million tons of oil, providing a crucial buffer to ensure a stable and secure oil supply. In 2023, during the presentation of the national budget, finance minister Nirmala Sitharaman allocated Rs 30,000 crore for Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), and Hindustan Petroleum Corporation Ltd (HPCL) to support the energy transition plans. She also proposed Rs 5,000 crore for purchasing crude oil to fill strategic underground storages in Mangalore, Karnataka, and Visakhapatnam, Andhra Pradesh. These storages were established by the government as a precautionary measure against potential supply disruptions. While other state-owned oil companies such as Oil and Natural Gas Corporation (ONGC) and GAIL (India) Ltd have also outlined substantial investments to achieve net-zero carbon emissions, the equity support was specifically directed to the three fuel retailers. “Rs 30,000 crore capital support to OMCs (IOCL,BPCL, HPCL) for green energy and net zero initiatives: During Expenditure Finance Committee meeting held on November 30, 2023, it was decided maximum of Rs 15,000 crore could be provided for equity infusion into OMCs in FY 2023-24,” said the ministry.

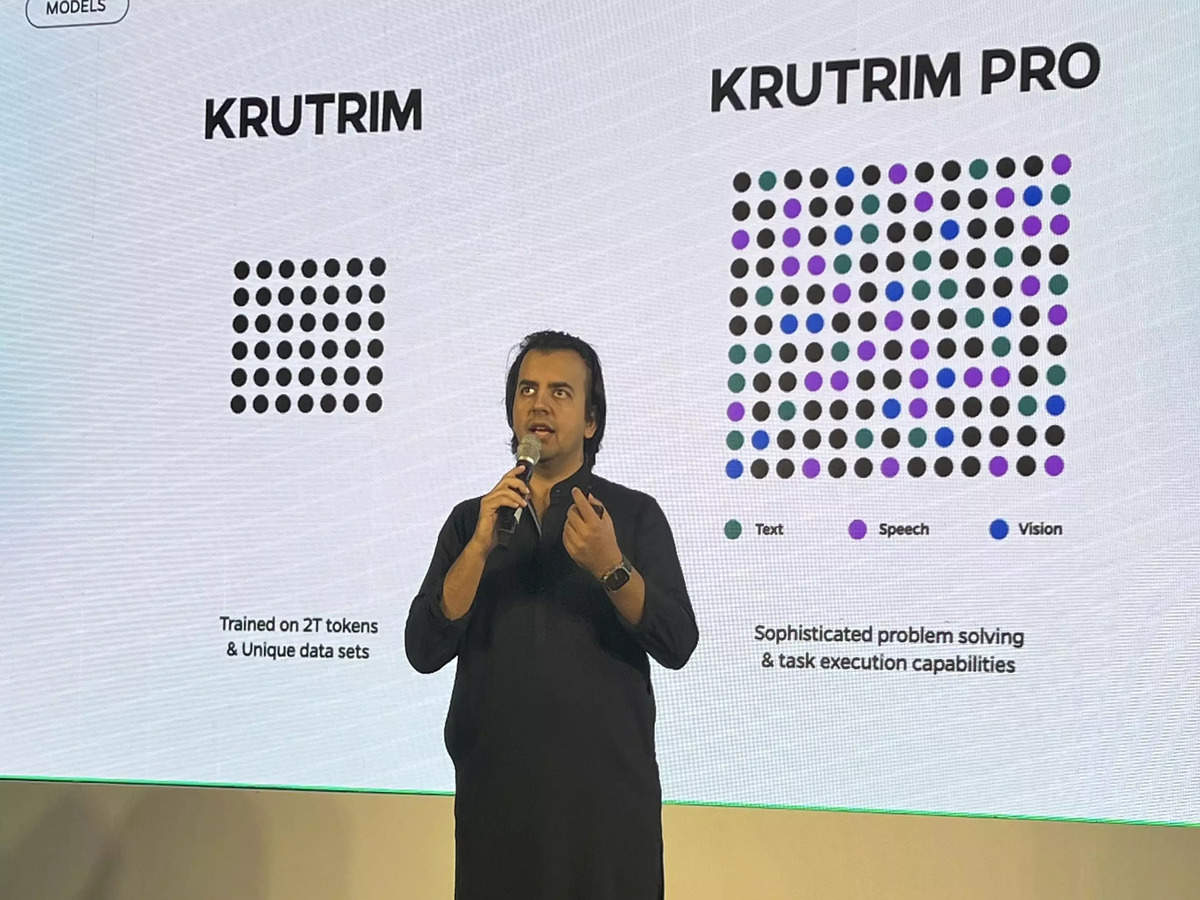

Ola founder’s Krutrim turns unicorn after raising $50 mn

BENGALURU: Ola founder Bhavish Aggarwal’s AI start-up Krutrim has turned unicorn after raising $50 million in equity. The round was led by investors including Matrix Partners India and others. Krutrim also becomes the country’s first AI start-up to attain a unicorn status. The funds raised will be instrumental in accelerating the company’s mission to revolutionise the AI landscape, drive innovation, and expand its reach globally, the start-up said. Bhavish Aggarwal, founder of Krutrim said, “India has to build its own AI, and at Krutrim, we are fully committed towards building the country’s first complete AI computing stack.” “We are thrilled to announce the successful closure of our first funding round, which not only validates the potential of Krutrim’s innovative AI solutions but also underscores the confidence investors have in our ability to drive meaningful change out of India for the world.” Last month, Krutrim unveiled its base Large Language Model (LLM). With the largest representation of Indian data used for its training, it powers generative AI applications for all Indian languages. Trained by a team of leading computer scientists, based in Bengaluru and San Francisco, this model will power Krutrim’s conversational AI assistant that understands and speaks multiple Indian languages fluently, it said. Krutrim is a family of Large Language Models, including Krutrim base and Pro that will have multimodal, larger knowledge capabilities, and many other technical advancements for inference. Trained on over 2 trillion tokens, Krutrim accomplishes better performance on multiple well known, global, LLM evaluation benchmarks including MMLU, HellaSwag, BBH, PIQA and ARC, the start-up said. Krutrim will be available in beta version for consumers in February 2024. Additionally, it will also be available as an API for enterprises and developers, seeking to create AI applications. The company is working on AI infra to develop indigenous data centers and eventually, server-computing, edge-computing and super-computers.

Yes Bank Q3 Results: Net profit soars 349.7% to Rs 231.6 crore; asset quality stable

Yes Bank Ltd's fiscal third-quarter profit surged more than fourfold but fell short of analysts' estimates. Net profit rose to Rs 231.6 crore for the quarter ended December 31 from Rs 51.5 crore a year ago, the bank said in a statement to stock exchanges on January 27. That compares with the Rs 415.1 crore quarterly profit estimate of brokerage Emkay Global.The lender's gross non-performing assets (NPA) remained steady at 2 percent in the three months ended December 31, while net NPA improved to 0.9 percent. Net interest income (NII) increased 2.3 percent from a year earlier. Operating profit rose 5.4 percent to Rs 864 crore.The bank also reported a 13.2 percent growth in deposits to Rs 2.4 lakh crore from last year. The current and savings account ratio (CASA) saw a slight decline to 29.4 percent in the quarter ended December 31 from 29.7 percent in the year earlier.

Bajaj Finance Q3 Preview: NII to rise 26%, net profit to jump 25% on strong AUM growth

All eyes will be on Bajaj Finance on January 29 as the non-banking financial company (NBFC) will declare its December quarter results. As per a poll of six brokerages, the lender's consolidated net profit is expected to rise 25 percent year-on-year to Rs 3,716 crore. An average of four brokerages shows that net interest income is expected to rise 26 percent YoY to Rs 9,344 crore. Stable asset quality and strong AUM (assets under management) growth will drive earnings, as per analysts. Bajaj Finance, on January 3, declared provisional numbers for the December quarter AUM. On the back of a strong festive season, the company's AUM crossed the Rs 3-lakh-crore mark for the first time in the quarter gone by, surging 35 percent YoY. As per the Q3 update, its deposit book grew by 35 percent to Rs 58,000 crore. During the quarter, it booked 98.6 lakh new loans, a YoY growth of 26 percent.According to domestic broking firm Motilal Oswal Financial Services margins and spreads are likely to decline sequentially by ~25 basis points and 15 basis points, respectively. Credit costs are expected to rise ~10 basis QoQ to ~1.7 percent. Axis Securities also sees margins declining by ~10-15 basis points QoQ owing to an inch-up in cost of funds. Inching up of the cost of funds is an industry-wide trend, noted Jefferies, due to the lagged repricing of MCLR-linked loans. In November 2023, the Reserve Bank of India asked Bajaj Finance to stop issuing new loans through its “eCOM” and “Insta EMI Card” for non-compliance with digital lending guidelines. It is important to watch out for management commentary on the same. Bajaj Finance Q3 results also come after RBI's caution against unsecured lending and risk-weightage increase for consumer credit. While analysts are confident of Bajaj Finance's liquidity position on the back of Rs 10,000 crore fundraising, it will be crucial to monitor management commentary on how Bajaj Finance's borrowing mix will change going ahead as banks' lending to NBFCs slows down. Apart from that, the Street will also be monitoring how new products are scaling up and if any segments are showing signs of stress.

How China Cannot Use Its Technology for Artificial Intelligence Because of US Intervention

The Biden administration is proposing requiring US cloud companies to determine whether foreign entities are accessing US data centers to train AI models, US Commerce Secretary Gina Raimondo said on Friday. "We can't have non-state actors or China or folks who we don't want accessing our cloud to train their models," Raimondo said in an interview with Reuters. "We use export controls on chips," she noted. "Those chips are in American cloud data centers so we also have to think about closing down that avenue for potential malicious activity." The Biden administration is taking a series of measures to prevent China from using US technology for artificial intelligence, as the burgeoning sector raises security concerns. The "know your customer" rule that was proposed was made available to the public on Friday and will be published the following Monday. It is significant, according to Raimondo. The US is "trying as hard as we can to deny China the compute power that they want to train their own (AI) models, but what good is that if they go around that to use our cloud to train their models?" she stated. Raimondo stated last month that Nvidia would not be permitted by Commerce "to ship is the most sophisticated, highest-processing-power AI chips, which would enable China to train their frontier models."For a variety of national security reasons, the US government is concerned about China developing sophisticated AI systems, so it has taken action to prevent Beijing from obtaining cutting-edge US technologies to bolster its armed forces. Under the proposed legislation, foreign nationals who register for or keep accounts using US cloud computing would have to provide identification through a "know-your-customer program or Customer Identification Program." Additionally, cloud computing companies would have to certify compliance on an annual basis, and it would set minimum standards for identifying foreign users.Raimondo said US cloud computing companies "should have the burden of knowing who their biggest customers are training the biggest models, and we're trying to get that information. With that information, what will we do? Depending on what we discover. President Joe Biden in October signed an executive order requiring developers of AI systems that pose risks to US national security, the economy, public health or safety to share the results of safety tests with the US government before they are released to the public.The Commerce Department intends to request those surveys from businesses in the near future. Companies will have 30 days to reply, Raimondo told Reuters. "Any company that doesn't want to comply is a red flag for me," she stated. Biden's "illegal" executive order is being implemented by Commerce, according to Carl Szabo, general counsel at the tech industry trade group NetChoice, "to force industry reporting requirements for AI." He went on to say that making US cloud providers disclose how non-US organizations were using their resources "for training large language models could deter international collaboration."

The largest cruise ship in the world sets sail, raising concerns about methane emissions

New York: The largest cruise ship in the world is scheduled to set sail for the first time on Saturday, but environmental organizations fear that the ship, which will be powered by liquefied natural gas, as well as future enormous cruise ships, will leak toxic methane into the atmosphere.Taking advantage of the rising popularity of cruises, Royal Caribbean International's Icon of the Seas, with a capacity of 8,000 passengers across 20 decks, sets sail from Miami. Although LNG burns more cleanly than conventional marine fuel and carries a higher risk of methane emissions, the ship is designed to run on LNG. Because of its short-term negative effects, environmental groups claim that methane leakage from ship engines poses an intolerable risk to the climate. "It's a step in the wrong direction," declared Bryan Comer, the head of the Marine Program at the environmental policy think tank, International Council on Clean Transportation (ICCT)."We would estimate that using LNG as a marine fuel emits over 120% more life-cycle greenhouse gas emissions than marine gas oil," he stated. Methane has warming effects that are 80 times worse over 20 years than those of carbon dioxide, so reducing emissions is essential to slowing the rise in global temperatures. Industry experts claim that low-pressure, dual-fuel engines found in cruise ships such as Icon of the Seas cause "methane slip," or the release of methane into the atmosphere during combustion. Although they are too tall to fit in a cruise ship, two additional engines that are used on bulk carriers or container ships produce less methane. According to Royal Caribbean, the new ship is 24% more carbon-efficient than what the International Maritime Organization (IMO), the global regulator of shipping, requires. The majority of the world's shipping fleet runs on very low sulfur fuel oil (VLSFO), which produces more greenhouse emissions than LNG, according to Steve Esau, chief operating officer of Sea-LNG, an industry advocacy group. It is "important to make sure that all the natural gas is converted to energy," according to Juha Kytola, director of R&D and Engineering at Wartsila, the company that created the engines on cruise ships. Cruise engines use natural gas to generate power in a cylinder. He added that Wartsila's natural gas engine technology emits 90% less methane than it did twenty to thirty years ago. What is not converted can escape during the combustion process and into the atmosphere, he said. According to research conducted in 2024 and supported by the ICCT and other partners, the average methane slip in cruise ship engines is estimated to be 6.4%. Methane slip is assumed by the IMO to be 3.5%. "Methane is coming under more scrutiny," stated Anna Barford, a nonprofit organization's Canada shipping campaigner, pointing out that the IMO stated last summer that addressing methane emissions is part of its efforts to reduce greenhouse gas emissions. Sixty-three percent of the 54 ships scheduled for delivery between January 2024 and December 2028 are anticipated to run on LNG, as reported by the Cruise Line International Association. Approximately six percent of the 300 cruise ships in operation today run on LNG. Modern cruise ships are being built to run on LNG, conventional marine gas oil, or bio-LNG, which is an alternative that makes up very little of the fuel used in the United States. According to Nick Rose, vice president of environmental, social, and governance at Royal Caribbean, the company will switch up its fuel mix as the market changes.

Entrepreneurship World Cup 2024 Malaysia Final Officially Announced

Kaula Lampur, Malaysia – In a momentous announcement at the RCEP Tech Forum, the Steering Committee members of the Entrepreneurship World Cup (EWC) Malaysia unveiled the details for the highly anticipated EWC Malaysia 2024 Final. The announcement was made by the Management Committee members, Raffles Chan and Zentrix Chiu, who provided a brief introduction to the Global Entrepreneurship Network and the rich history of the Entrepreneurship World Cup global final. The Steering Committee members present at the event included Herman Syah Abdul Rahim, Chief Investment Officer, Kumpulan Modal Perdana Sdn Bhd (KMP), Arsalaan (Oz) Ahmed, Chairman, mmob, and Melissa Chin representing Noor Amy Ismail, Chief Operating Officer, Malaysia Venture Capital Management (MAVCAP). The distinguished committee members discussed their crucial roles in EWC and highlighted the competition's significance for Malaysia. They emphasized how EWC contributes to fostering a robust economy, generating employment, and attracting innovation to the country. “EWC is not merely a contest, it is a catalyst for economic development, job creation and innovation. The innovations that will emerge from this competition have the potential to revolutionize industries, attract investments, and position our country as a leader in the respective sector.”, said Herman Syah Abdul Rahim“The EWC Malaysia provides a unique opportunity to profile Malaysian companies at an idea, early and growth stage to a global audience of potential clients and investors. The EWC Malaysia also fosters the growth of the Malaysian entrepreneurial eco-system and therefore also supports innovation and potential economic growth for the country.”, said Arsalaan (Oz) Ahmed.“As the largest Venture Capital in the country, we’re responsible to continue enhancing and strengthening our VC ecosystem. Bringing EWC to Malaysia is one of our initiatives in charting our future VC ecosystem globally.”, said Noor Amy Ismail. Karunjit Kumar Dhir, a Partner at Kuber Ventures and another member of the Steering Committee, was unable to attend the event. However, he extended his best wishes to the team for the successful launch of the EWC Malaysia 2024 Final.The EWC 2024 Malaysia Final promises to be a showcase of entrepreneurial talent and innovation, providing a platform for startups to gain international recognition and support. The event aims to bolster Malaysia's position in the global startup landscape, fostering economic growth and establishing the country as a hub for entrepreneurial excellence.Swethal Kumar, CEO of Startupscale360, expressed enthusiasm about being the proud national organizer of the Malaysia edition. He stated, "We are fully committed to making the Malaysian ecosystem more vibrant with the support of key enablers of the startup ecosystem. Our goal is to create more employment opportunities, attract international startups to the Malaysian market, bring forth innovations, and expand the business of Malaysian startups to the global market through the Entrepreneurship World Cup. It's more than just a competition; it's a golden opportunity to showcase innovative ideas on a global stage."

THIS WEEK IN ENTERPRENEURSHIP POLICY + RESEARCH

Welcome to ‘The Startup State’ - a weekly bulletin from the GEN Policy and Research team highlighting key entrepreneurship news, reports, commentary and features from around the world. The GEN Atlas is the world’s largest entrepreneurship policy compendium, featuring over 350 case studies from 70 countries. Our latest entry to be updated examines Germany’s Better Regulation Program - a wide-reaching initiative to reduce red tape, simplify regulations, and improve the overall quality of policymaking. Read the Atlas entryThe UNDP, the presidents of Rwanda and Ghana, and Nigeria’s digital economy minister Bosun Tijani used Davos to launch ‘Timbuktoo’, an ambitious pan-African development initiative with the aim to mobilize $1bn capital to create 10 million jobs and transform 100 million lives. It will include legislative reform, derisking investment, and ‘university innovation pods’, among other efforts to strengthen African entrepreneurship ecosystems (UNDP). Saudi Arabia has boosted its Aramco Ventures unit by $4bn, more than doubling the state oil company’s overall venture capital funds (Aramco).The United Kingdom’s technology secretary Michelle Donelan has announced a government “scaleup policy sprint” with the aim of matching US levels of VC investment as a share of GDP by 2030 - which would mean an additional £5bn ($6.3bn) per year into British startups (Sifted | Speech transcript).Nigeria’s minister of women affairs and social affairs Uju Kenedy-Ohaneye has launched a new unit in the SME Development Agency of Nigeria dedicated to supporting women and youth entrepreneurship (Blueprint) Publications and analysis This World Bank report examines ten years of data behind a public-private matching grant program to answer the question of whether public funding can help startups innovate and subsequently improve their performance. This Tony Blair Institute for Global Change report sets out how the UK can reset its historically aid-focused African engagement approach to embrace emerging economic opportunities and achieve mutual prosperity and cooperation. This World Economic Forum and Schwab Foundation Global Alliance for Social Entrepreneurship report is the first, comprehensive global dataset to estimate the size and scope of social enterprise worldwide. It finds 10 million social enterprises globally, with $2 trillion annual revenue and 200 million jobs.This World Economic Forum report introduces a multidimensional framework to assess the quality of growth across 107 countries globally. It characterizes nations’ economic growth across four dimensions: innovativeness; inclusiveness; sustainability; and resilience. This World Economic Forum and Cambridge Centre for Alternative Finance report reveals new data on the rapidly evolving fintech ecosystem and the opportunities fintech activities are offering traditionally underserved consumers and businesses.

These innovators are accelerating the aviation industrys transition to net-zero

Aviation accounts for 2% of global greenhouse gas emissions and, with air travel projected to increase, these emissions are poised to escalate.The Sustainable Aviation Challenge on UpLink called for innovators who accelerate the development and adoption of sustainable aviation fuel and other propulsion solutions.16 Top Innovators were selected as winners and will gain visibility opportunities, special event invitations and curated introductions to industry partners and potential funders. According to the International Energy Agency (IEA), aviation accounts for 2% of global greenhouse gas emissions and with air travel projected to increase over this decade, these emissions are only poised to climb. The challenge is to reinvent flying and make it compatible with our global net-zero emissions targets. Decarbonizing aviation is one of the toughest challenges of the clean energy transition and one that will require many technological breakthroughs and a concerted effort by innovators, industry, governments, and finance providers. To accelerate and support the transformation of aviation and expedite its journey to net-zero, UpLink and the First Movers Coalition have launched the Sustainable Aviation Innovation Challenge to identify and accelerate the most innovative and promising start-ups in this sector. With 130 high-quality submissions received from around the globe, 16 Top Innovators were selected by industry partners to join the UpLink Innovation Ecosystem. To this end, we’re excited to announce the cohort of Sustainable Aviation Top Innovators to accelerate the development and adoption of Sustainable Aviation Fuel (SAF) and other propulsion solutions, with the broader vision of enhancing the viability of promising start-ups in this space. Innovation ignites the spark, but collaboration fuels progress. These 16 innovators are now plugged into World Economic Forum formal programming and a support ecosystem of industry partners and investors to scale up their ventures through business and technology collaborations.

The impact of supporting a new generation of entrepreneurs.

UpLink, launched in 2020 by the World Economic Forum in collaboration with Deloitte and Salesforce, is building an open innovation platform ecosystem fostering entrepreneurial solutions for global challenges aligned with the UN Sustainable Development Goals (SDGs). Since its inception, it has grown into a vibrant community of purpose-driven entrepreneurs, investors, visionary organizations and experts. It has hosted 51 Innovation Challenges, bringing forth nearly 6,500 innovative solutions worldwide, recognizing 442 of these as 'Top Innovators' and 46 as 'Top Investors.' More than 250 ecosystem partners from across sectors have supported these innovators through catalytic funding, expertise, and other acceleration opportunities. UpLink aims to accelerate the growth and impact of early-stage entrepreneurs, build innovation ecosystems of diverse stakeholders, and shift perceptions of innovation's role in achieving the SDGs. These innovators, carefully selected for their impactful and sustainable solutions, are integrated into a dynamic ecosystem for growth, collaboration, and increased global visibility.Since early 2023, UpLink has started to implement a robust impact management and measurement strategy following industry best practices, to better support and showcase the positive transformation led by its Top Innovators. Here are the key impact highlights reported by UpLink Top Innovators in UpLink's 2023 Annual Impact Report:

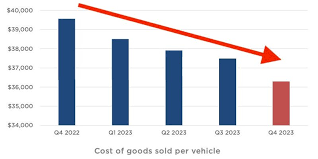

This chart shows how Tesla can keep cutting prices and stay ahead of the competition

Tesla keeps lowering the price of its cars.It's taken a margin hit, but its input costs are going down too.Tesla's price war sent shock waves through the industry, and the fallout is far from over.Still, Elon Musk's electric automaker is lapping the competition as old-guard automakers like Ford and General Motors switch to electric vehicles.That's in large part thanks to tremendous cost savings found in manufacturing.The average cost of building a Tesla in the fourth quarter fell once again, according to the company's earnings report released Wednesday. On average, Tesla spent just over $36,000 per vehicle it sold in the October to December period, down from over $37,000 per vehicle in the same quarter in 2023.At the same time, Tesla has been selling its vehicles for cheaper, showing Tesla's might over its competitors when it comes to EV pricing.Tesla has always had a lot of room to run on pricing, given its industry-leading profit margins. But Elon Musk's strategy to slash prices has chipped away at its once-40% gross margins, bringing them down to 17.6% in the fourth quarter.Still, that's far above the industry average of around 9%.While Tesla continues to play with prices, other automotive CEOs have warned against the practice. Stellantis CEO Carlos Tavares said last week he was keen to stay out of any EV price wars, but stopped short of mentioning Tesla by name. "If you go and cut pricing disregarding the reality of your costs, you will have a bloodbath. I am trying to avoid a race to the bottom," he said.Last year, Ford CEO Jim Farley compared Musk's strategy to that of Henry Ford."I think what he's going to learn is product freshness means a lot," Farley said of Musk at the time. "The product gets commoditized and then you lose your pricing premium. That's a really dangerous thing."

Netflixs password crackdown worked. It could have more tricks to lure subscribers.

Netflix added almost 30 million subscribers in 2023 after cracking down on password sharing in May.Customers balked at the idea, but in the end Netflix prevailed.AdvertisementWhen Netflix announced it was mulling a ban on password sharing a few years ago, subscribers immediately balked. Many threatened to ditch their subscriptions, screaming #CancelNetflix, while others followed through and decisively closed their accounts.Nobody liked the idea. I certainly didn't. But let's be honest: We knew this had to happen.For years, Netflix turned a blind eye to password sharing, even winkingly encouraging it on social media. But that was when Netflix was in an exponential growth phase that carried the company to its 2021 share price high of more than $690. In 2022, Netflix reported losing subscribers for the first time in more than a decade — about 200,000 accounts in the first quarter of that year and close to 1 million in the second.Couple those losses with the fact that the streaming landscape had become much more crowded than it was in 2007 when Netflix first started offering its library online. Think Hulu, Disney+, Prime Video, Paramount+, and others. So, say you're one of Netflix's co-CEOs: You see your company is bleeding subscribers, your competitors are circling you like vultures, and, at the end of the day, you're beholden to your shareholders.And wow, look, an internal analysis report drops on your desk. It reveals that there are about 100 million households around the world who are accessing Netflix without a paid account, including a cheap Business Insider reporter leeching off his ex.In the third quarter of 2023, Netflix reported that it added 8.8 million subscribers, vastly exceeding expectations. The fourth quarter numbers yielded even better results: 13.1 million global subscribers for a total of more than 260 million, Business Insider's Lucia Moses reported. That's a gain of nearly 30 million over 2022. Two moves likely helped Netflix boost those numbers, according to Jadrian Wooten, an economics professor at Virginia Tech who writes the newsletter Monday Morning Economist.While Netflix was preparing its password-sharing crackdown, it introduced an ad-based subscription at about $7 a month, which was $3 less than its cheapest ad-free offering at the time and slightly cheaper than a Hulu account. The company also provided an option for households to add users to their existing accounts for about $8 a month. "So that was sort of a move that was done both to geographically expand to other countries and offer a cheaper version, but it also introduces sort of this second tier for people who were sharing an account, and they could then bump down to that next part," Wooten told BI. "So the idea is they wouldn't pay for a full account on their own, but maybe if they lost access, they would drop down to that ad-tier part."

TVS Motor Q3 net profit rises 59% to ₹479 crore

New Delhi, TVS Motor Company on Wednesday reported a 59 per cent increase in its consolidated net profit to Rs 479 crore for the third quarter ended December 31, 2023, riding on the back of robust sales across markets. The company posted a consolidated net profit of Rs 301 crore in the October-December period of the last fiscal. Revenue from operations rose to Rs 10,114 crore in the December quarter as against Rs 8,066 crore in the year-ago period, TVS Motor Company said in a regulatory filing.On a standalone basis, the company reported a net profit of Rs 593 crore for the October-December quarter, a growth of 68 per cent as compared with Rs 353 crore in the third quarter of 2022-23 fiscal. Revenue from operations rose to Rs 8,245 crore in the third quarter as compared with Rs 6,545 crore in the same period of last fiscal.TVS said total two-wheeler sales rose to 10.63 lakh units in the third quarter as against 8.36 lakh units a year ago.Two-wheeler exports rose to 2.16 lakh units in the period under review from 2.07 lakh units in the year-ago period.