Top Trending Appointments News & Highlights

According to FT, Meta reduces stock rewards for the majority of employees by 5%.

As CEO Mark Zuckerberg invests billions of dollars in its artificial intelligence goals, Meta cut the annual payout of stock options for the majority of its employees by roughly 5%, according to a Financial Times report on Thursday.In the fierce AI race in Silicon Valley, Meta and other Big Tech companies are vying with one another to outbuild one another with enormous data centers. In January, the social media corporation stated that it anticipated spending between $115 billion and $135 billion on capital projects in 2026.According to the report, which cited people familiar with the situation, Meta has reduced equity-based incentives for the majority of its employees for the second consecutive year. According to the FT story, the corporation stunned some employees by reducing the stock reward by about 10% last year.The entity incorporates Meta's ambitious "metaverse" wager, which has resulted in losses of about $70 billion since 2021. According to President Donald Trump, Meta is investing $50 billion to develop a number of gigawatt-scale data centers across the United States, including one in rural Louisiana.

Published 20 Feb 2026 01:03 PM

In Barbados, Mia Mottley Earns a Historic Third Term

With her party capturing every seat in the House of Assembly, Barbados' Prime Minister Mia Mottley has achieved an unprecedented third straight election victory. For the third time, her party, the Barbados Labour Party (BLP), took home all 30 seats in Parliament. In the history of the island nation, the triumph represents a significant political turning point.Results of the Election 30/30 seats were won by BLP. Ralph Thorne, the leader of the opposition, was removed. Mottley is only the second leader to hold office for more than two terms in a row. During her speech of victory, Mottley promised to: Cut down on poverty Boost the infrastructure Boost medical care Boost traffic safetyPolitical Background The election brought to light two opposing strategies: Mottley's diplomacy with a global perspective, including climate activism Opposition emphasizes issues related to the domestic economy. Mottley has advocated debt-for-climate swaps and been a prominent global voice on debt reform for countries at risk from climate change. Barbados made a substantial improvement last year by bringing its debt-to-GDP ratio down to just about 100% from bond defaults in 2018.Global Response In addition to congratulating Mottley on her "clear electoral victory," U.S. Secretary of State Marco Rubio indicated interest in enhancing collaboration on: Control of crime Prevention of drug trafficking Security in the region Barbados continues to play a significant strategic role in the Caribbean.

Published 16 Feb 2026 05:46 PM

A former secretary of consumer affairs has been appointed to a key USISPF position.

The appointment of former Consumer Affairs Secretary Rohit Kumar Singh as Chair of the Global Value Chains Committee of the US–India Strategic Partnership Forum (USISPF) on February 9, 2026, marked a major step forward for India-US economic interaction. The action underscores the increased focus on reliable supply chains and reliable alliances.Selection of the Chair of USISPF's Global Value Chains Committee Rohit Kumar Singh, a former secretary of consumer affairs, has been named chair of the US-India Strategic Partnership Forum's Global Value Chains Committee. Singh, who has extensive administrative experience and a history of change, puts Indian policy knowledge at the center of debates about the global value chain in his new position. Rohit Kumar Singh's Identity A 1989-batch IAS officer from the Rajasthan cadre, Rohit Kumar Singh has a wealth of knowledge in economic governance. He was instrumental in reforming India's consumer protection laws while serving as Secretary of Consumer Affairs. His leadership earned praise for enhancing responsiveness and openness by fusing technology-driven governance with regulatory reform. In his new worldwide job, he is well-positioned to combine policy, industry, and international cooperation thanks to his administrative background.Why USISPF Is Important and What It Is Through cooperation between governments, corporations, and thought leaders, the US–India Strategic Partnership Forum (USISPF) is a premier forum that enhances strategic and economic connections between the US and India. It operates in a variety of industries, including supply chains, trade, technology, energy, and defense. At a time when global trade is fragmented and under geopolitical stress, USISPF is essential in facilitating conversation and coordinating policy agendas.

Published 10 Feb 2026 05:46 PM

Venugopal Jeyandran Reliance Retail Ventures Ltd.'s President and CEO was appointed.

Jeyandran Venugopal, a senior executive from Flipkart, has been named President and CEO of Reliance Retail Ventures Ltd. (RRVL) by Reliance Industries Ltd. (RIL). In an effort to further accelerate growth in the fiercely competitive retail industry, India's largest retail conglomerate made the statement on December 3, 2025. This is a brand-new role that highlights RRVL's goal to implement an ambitious retail and omni-channel strategy and increase leadership depth.Background: Jeyandran Venugopal: Who Is He? In the Indian e-commerce industry, Jeyandran Venugopal is a well-known figure. He played a key role in growing the platform's operations and digital infrastructure while holding senior positions at Flipkart that were centred on technology, innovation, and customer experience. His move to Reliance Retail coincides with the company's rapid e-commerce expansion through JioMart, all the while preserving a robust offline retail presence in industries like fashion, electronics, luxury products, and grocery.Strategic Position in the Vision of RRVL Venugopal will collaborate closely with Isha Ambani, who leads RRVL's retail sector, in his capacity as President and CEO. Among his responsibilities will include Overseeing omni-channel integration and digital transformation Promoting innovation in consumer interactions and the supply chain Improving offline and online operations through data-driven decision-making increasing urban penetration and extending RRVL's reach throughout tier 2 and tier 3 cities His appointment demonstrates Reliance's desire to directly compete with Amazon, Walmart-Flipkart, and Tata Neu by utilising cutting-edge technology and customer data intelligence in addition to size.Reliance Retail Ventures Ltd. (RRVL), the retail holding company of Reliance Industries, is the biggest retail player in India. Its varied portfolio includes Trends, JioMart, Ajio, Reliance Fresh, and Hamleys Strategic alliances with international companies such as Burberry, Jimmy Choo, and Tiffany Recent acquisitions in fashion, food retail, and e-commerce that demonstrate a hyper-growth approach RRVL continued to dominate the market in terms of both revenue and physical store network in FY2024–2025, reporting record revenues.

Published 04 Dec 2025 06:11 PM

Appointments

Appointments

IIT Madras Is Taking Applications For A Number of Positions; See Details

Eligible candidates are encouraged to apply online to the Indian Institute of Technology (IIT) Madras for a variety of non-teaching positions. Applications are being accepted for a number of positions, including those of Junior Superintendent, Assistant Registrar, Chief Security Officer, Sports Officer, and Physical Training Instructor. March 12, 2024 is the deadline for submitting online applications via IIT Madras' official website. On the deadline, applications must be completed by 5:30 p.m. Applicants may apply for the position of Chief Security Officer if they have at least 15 years of relevant experience and a Master's degree from an accredited university with at least 55% of the possible points, or an equivalent CGPA. Candidates must have an excellent academic record and a master's degree with at least 55% marks, or an equivalent grade on a point scale, in order to be considered for the position of assistant registrar. Candidates must have an excellent academic record and a master's degree with at least 55% marks, or an equivalent grade on a point scale, in order to be considered for the position of assistant registrar. Applicants for the position of Junior Superintendent must hold a Bachelor's degree in Arts, Science, or Humanities, including Commerce, with at least 60% of the possible points or an equivalent CGPA, from an accredited university. Additionally, six years of administrative experience are required of these candidates. Expertise in utilizing computer office programs, such as Microsoft Word and Excel, is also preferred for the position.

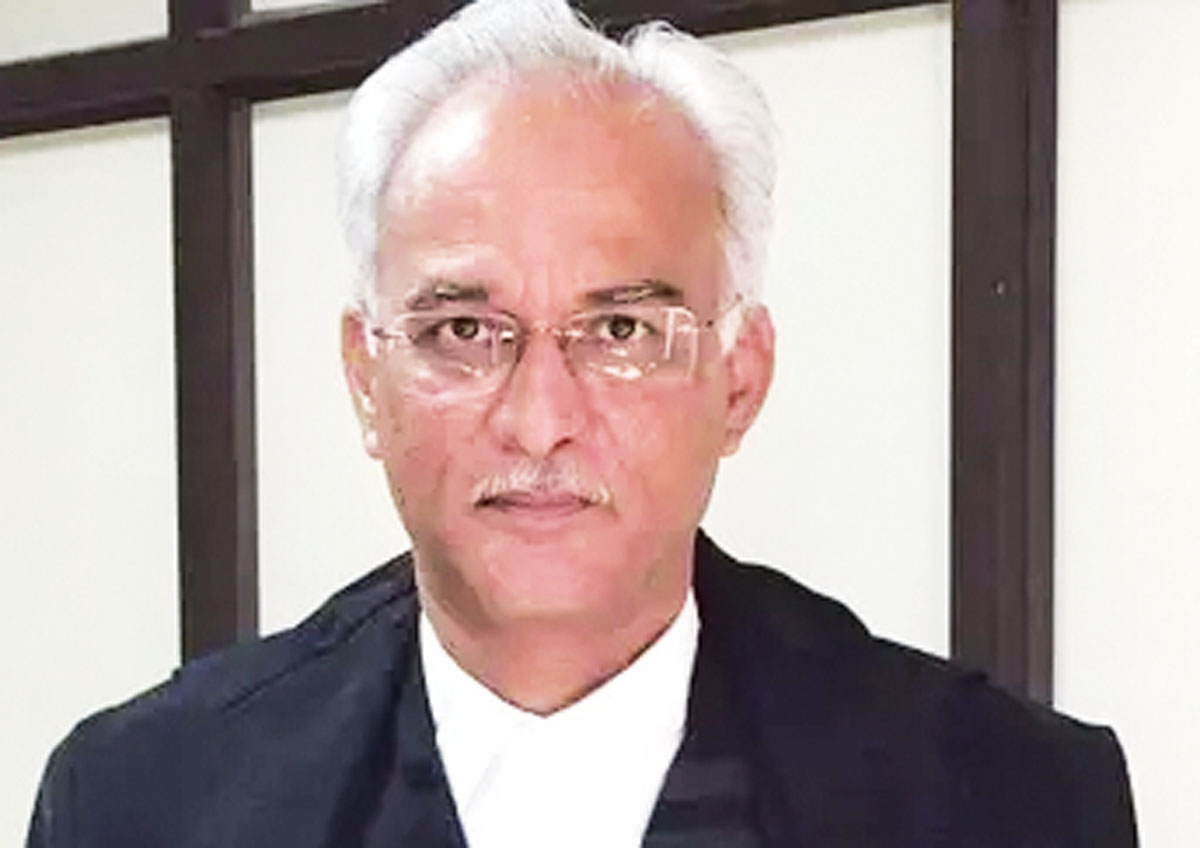

Gupta, Rajendra Prasad Selected as the New Advocate General of Rajasthan

Governor Kalraj Mishra approved the nomination of Senior Advocate Rajendra Prasad Gupta as the new Advocate General of Rajasthan.Governor Kalraj Mishra approved the nomination of Senior Advocate Rajendra Prasad Gupta as the new Advocate General of Rajasthan. As the replacement for the outgoing governor in December, this nomination represents a major shift in the legal leadership of the state. As MS Singhvi's replacement, Rajendra Prasad Gupta begins a new chapter in his tenure as Rajasthan's 19th Advocate General.Rajendra Prasad Gupta's Journey Rajendra Prasad Gupta was born on June 4, 1962, in Reed Village, Parbatsar Tehsil, Nagaur District. His educational and professional background is remarkable. After completing his schooling in his village, Gupta went on to seek higher education. He graduated in 1981 with a degree in business and then in 1985 obtained an LLB from Rajasthan University. His academic accomplishments didn't end there; in 1986, he also graduated with a degree in chartered accounting, demonstrating his broad skill set and commitment to his career. An Historical View of Rajasthan's Advocate General The States Reorganization Act of 1956, which created the State of Rajasthan and the Rajasthan High Court, also established the Office of the Advocate General of Rajasthan. As the state's first Advocate General, the late Shri G.C. Kasliwal, has had the privilege of representing the Government of Rajasthan in legal matters from the office's founding. The Rajasthan High Court has its main seat in Jodhpur and a division bench in Jaipur.Function and Role of the Advocate General Article 165 of the Indian Constitution designates the Advocate General as a constitutional authority, whose job it is to counsel the State Government on legal issues. This crucial position entails carrying out legal responsibilities as directed by the Governor and carrying out tasks authorized by the Constitution or any other active legislation. The Governor appoints the Advocate General to the position, and the Governor sets the Advocate General's salary.Legislative Authority and Obligations The Advocate General may attend State Legislature sessions and contribute to the legislative process without having a vote, as per Article 177 of the Constitution. Because of his special position, the Advocate General can provide legal insights into legislative talks, improving the quality and ensuring that the legislative framework complies with legal requirements.

Gupta Rajendra Prasad Selected as the New Advocate General of Rajasthan

Governor Kalraj Mishra approved the appointment of Senior Advocate Rajendra Prasad Gupta as the new Advocate General of Rajasthan. As the replacement for the outgoing governor in December, this appointment represents a major shift in the legal leadership of the state. As MS Singhvi's replacement, Rajendra Prasad Gupta begins a new chapter in his tenure as Rajasthan's 19th Advocate General. Visit https://www.bankersadda.com/current-affairs-6-february-2024 for more informatiom.Legislative Authority and Obligations The Advocate General may attend State Legislature sessions and contribute to the legislative process without having a vote, as per Article 177 of the Constitution. Because of his special position, the Advocate General can provide legal insights into legislative discussions, improving the quality and ensuring that the legislative framework complies with legal requirements. Crucial Exam Questions Who has been named Rajasthan's new Advocate General? When was the office of Advocate General of Rajasthan established, and who was the first person to hold it? What is the main constitutional authority that appoints the Advocate General, and what are their duties? What special privilege does the Advocate General have in the legislative process, as per Article 177 of the Constitution?

Parliament Budget Session LIVE updates LS talks about the adjourned Motion of Thanks

On the third day of the budget session, the Rajya Sabha got off to a tumultuous start, while the Lok Sabha began Question Hour. Afterwards, the Motion of Thanks to the President's Address was discussed by both Houses. Prior to their withdrawal, the Rajya Sabha deliberated on other bills introduced by private members.On Thursday, Union Finance Minister Nirmala Sitharaman unveiled the interim budget, which is her final one before the nation's mid-year elections. Based on its track record, she claimed, the Modi government will return in July to present a complete budget and wouldn't require announcements of last-minute concessions to enter the polls.The Budget did not include any modifications to the income tax slabs for import tariffs or other indirect taxes. Regarding the direct taxation aspect, Ms. Sitharaman suggested waiving unpaid tax requests up to ₹25,000 for the period ending in the 2009–10 fiscal year and up to ₹10,000 for the fiscal years 2010–11 through 2014–15. "A crore taxpayers" are expected to benefit from the measure, she said. With regard to startups and investments made by sovereign wealth or pension funds, as well as the tax exemption on specific income of some IFSC units, which is set to expire on March 31, the only significant modification to taxation was proposed.

Auto industry welcomes expansion of EV ecosystem

The automobile industry has welcomed the announcement of government expanding and strengthening the electric vehicle (EV) ecosystem by supporting manufacturing and charging infrastructure, in the Budget.“Greater adoption of e-buses for public transport networks will be encouraged through payment security mechanism,” Nirmala Sitharaman, Minister of Finance, said in her Budget speech.In her pre-election Budget, the FM also said that blending of compressed biogas into compressed natural gas for transport and piped natural gas will be mandatory. However, the government has not announced any extension of the Faster Adoption & Manufacturing of Electric Vehicles in India (FAME-II) scheme or the FAME-III scheme. In fact, it has cut the allocation by 44.43 per cent of FAME scheme to ₹2,671.33 crore from ₹4,807.40 crore in fiscal year 2023-24.In 2023-24, ₹5,171.97 crore was allocated for the scheme that came down to ₹4,807.40 crore in the revised estimates, spent by the end of the fiscal year. In 2022-23, ₹2,402.51 crore was spent under the scheme.But, the government has increased the budget allocation for the production-linked incentive (PLI) scheme to support the domestic production of futuristic vehicle technologies. It has been raised to ₹3,500 crore for 2024-25 from ₹483.77 crore in 2023-24. It has also raised the budget for the PLI scheme for advanced chemistry cell (ACC) and battery storage from ₹12 crore to ₹250 crore in 2024-25.Meanwhile, welcoming the announcement on EV infrastructure, Vinod Aggarwal, President-Society of Indian Automobile Manufacturers (SIAM), said, “The announcement on strengthening the Electric Vehicle ecosystem by supporting manufacturing and charging infrastructure, will boost the development and adoption of EVs in the country.”

‘As an artiste, I’m afraid of what is happening in India right now

It is a worrying trend that films in India today go through many forms of censorship, said Jeo Baby, whose recent film Kaathal – The Core shows Malayalam superstar Mammootty as a homosexual man, resetting the narrative of the gay community in popular cinema. The sensitive portrayal devoid of gay tropes – for long, the community has only been a fodder for humour – won many hearts.“But I’m afraid about what is happening in India right now. We are facing religious and political censoring. It is worrying not only for filmmakers, but all artistes,” Baby told PTI in an interview. Censorship is not something new to Jeo Baby, a self-proclaimed problem-maker. In January 2021, when he was all set to release his other critically acclaimed film, The Great Indian Kitchen, starring Nimisha Sajayan – which succinctly brought out how society stifles women and their freedom – Covid-19 restrictions made theatrical release impossible. But popular OTT platforms were not ready to touch the film, as the film also tackled a socio-political issue that was playing out at that time – menstruating women’s entry into Sabarimala temple. He finally had to release the film on a Malayalam streaming platform, Neestram. Luckily for Baby, just like Kaathal, The Great Indian Kitchen too captured people’s hearts despite the heaviness of the subject. And all those trending hashtags forced the mainstream OTT platforms to review their decision. Finally, three months after its release, Amazon Prime Video got the rights for the film.Jeo Baby said artistes must stand firm for their creative freedom. Overcoming challenges is part of the deal when one takes on the institution, said Baby.Ironically, 17 years later, a full-length feature film on the same subject brought him fans from across India, standing testimony to the fact that things change with time, something that artistes can derive hope from, he added.“There is no connection between the short film and Kaathal. Decriminalisation changed the status quo of the community in 2018. Kaathal is more about that. But since 2005, I have been studying a lot about this community. I read a lot about sexuality, about homosexual people, about LGBTQ+… I know they are normal people,” said Baby.

Board Appointments Announced by Lazard, Inc., Effective February 1, 2024

With effect from February 1, 2024, Lazard, Inc. announced the appointment of former PayPal CEO Dan Schulman and former US Chairman and Managing Partner of the Americas for Ernst & Young to its board of directors. As the CEO of PayPal, Dan Schulman, an accomplished executive and board member, oversaw the company's metamorphosis to completely change the way consumers transfer and manage money. At the moment, he is a member of the boards of Verizon Communications and Cisco Systems.Previous executive positions include CEO and President of Priceline Group, President at Sprint Nextel Corporation, Group President at American Express, and founding CEO of Virgin Mobile USA. Additionally, Mr. Schulman worked with AT&T for eighteen years, holding a number of positions, including President of the Consumer Markets Division. In addition to being vice-chair of the Economic Club of New York, he is on the boards of the Cleveland Clinic and the Council on Foreign Relations.He graduated from Middlebury College with a B.A. and New York University with an M.B.A. Stephen R. Howe Jr. is a highly esteemed CEO, member of boards, and specialist in corporate governance, audit, and financial services. He worked for Ernst & Young for 35 years. From 2012 to 2018, he guided the company to double-digit yearly growth in his most recent position as US Chairman, Managing Partner for the Americas, and a member of the Global Executive Board.Leading the Financial Services sector practice and managing client service teams for international financial institutions were among the previous positions held by the firm. At the moment, Mr. Howe is a member of the Royal Caribbean board. He is a member of the Liberty Science Center Board, the Peterson Institute for International Economics Board, and the Carnegie Hall Board of Trustees.

The government names one part-time and three full-time members for the 16th Finance Commission.

Soumya Kanti Ghosh, the group chief economic advisor of State Bank of India (SBI), has been selected as a part-time member.New Delhi: The finance ministry announced in a statement on Wednesday that the government has appointed three full-time and one part-time member to the Sixteenth Finance Commission (16th FC).According to the statement, the commission's full-time members are Niranjan Rajadhyaksha, executive director of Artha Global, former special secretary for expenditures and member of the 15th Finance Commission Ajay Narayan Jha.It further stated that Soumya Kanti Ghosh, the group chief economic advisor for State Bank of India (SBI), has been selected as a part-time member.According to the announcement, "it has been requested that the Sixteenth Finance Commission make its recommendations available by October 31, 2025, covering an award period of 5 years commencing 1st April, 2026."In order to propose a devolution formula for tax income between the Center and states, the government last month named Arvind Panagariya, a professor at Columbia University and former vice-chairman of NITI Aayog, as the 16th chairman of the Federal Communications Commission (FC).The government announced the terms of reference (ToR) for the 16th commission on November 29. In addition to reviewing the current arrangements for financing disaster management initiatives, the ToR asked the body to recommend ways to augment state resources for local bodies. Panagariya's appointment order was issued approximately one month later. Ritvik R. Pandey, a joint secretary in the Department of Revenue and an AS officer from the 1998 batch, was assigned as an officer on special duty for the 16th Finance Commission's advance cell on November 6th, with the rank and compensation of an extra secretary."The allocation between the States of the respective shares of such proceeds and the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them under Chapter I, Part XII of the Constitution," stated the original set of rules for the commission.The second ToR states, "The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States by way of grants-in-aid of their revenues under article 275 of the Constitution for the purposes other than those specified in the provisos to clause (1) of that article."The third treaty on resources (ToR) deals with the actions required to increase a state's consolidated fund in order to augment the resources of municipalities and panchayats, based on the recommendations of the corresponding state finance commissions.According to the statement, the 16th FC may examine current arrangements for funding disaster management activities while taking into account the funds established under the Disaster Management Act and offer pertinent recommendations.

HUF like benefits for single mothers and more, what women want

With a few hours to go for Union Finance Nirmala Sitharaman’s Budget 2024 speech, Prime Minister Narendra Modi and President Droupadi Murmu have already set the tone of the Budget session and made it clear that ‘Nari Shakti’ will be the primary focus.As part of the CNBC-TV18 Budget Ballot initiative we placed ballot boxes at select locations across cities, and thousands of pleas and suggestions came in. A clear indication from women is that they want to achieve financial independence, and therefore want more initiatives for their education and financial security to reach that milestone. As of January 2022, females accounted for 48.04% of India’s total population of 1.42 billion, according to World Bank data. To understand what nearly half of the country’s population wants (and also the other half), CNBC-TV18 engaged with India's citizens for insight into their Budget wish list this year.Not that the government hasn’t already introduced many schemes, including PM Jan Dhan Yojana, Pradhan Mantri Matru Vandana Yojana, Beti Bachao Beti Padhao, Mahila Shakti Kendra and Mission Shakti among the many others, ensuring women empowerment is still a long road. Pune’s Sushma Arvind, who participated in the CNBC-TV18 Budget Ballot, has suggested to Finance Minister Nirmala Sitharaman that there must be a provision introduced in the Budget that allows single mothers to avail income tax benefits similar to those under the Hindu Undivided Family (HUF) provision. She suggests coining the facility Women Run Family (WRF). (An HUF is taxed separately from its members. Therefore, it can claim deductions or exemptions allowed under the tax laws separately.)She also wants an additional discount or special reduced income tax rates for women who have already worked and paid taxes for more than 15 years.Similarly, Bengaluru resident Asish has requested the FM to allow direct tax filing “jointly” by a married couple so that tax deductions of two individuals can be availed on a combined income.

Confident new Parliament building will have productive dialogues, says President Murmu

“We anticipate the Interim Budget 2024 to align with the government’s mission of uplifting the underprivileged and urge the government to introduce beneficiary schemes, especially as the General Sabha election approaches, focusing on the socio-economic empowerment of the marginalised.”“We hope for policies supporting our growth, particularly in Tier 2, 3, and 4 cities, aiming to integrate rural communities into the formal banking system.Incentivising FinTech dedicated to empowering SMEs through financial and technical interventions would mark a significant stride. Addressing loan disbursement including loans against gold/jewellery, we recommend regulations fostering collaboration between traditional banks and digital lenders for accessible loans,” Anuj Arora, Co-founder & COO, SahiBandhu Gold Loans said.“As we approach Budget 2024, we anticipate a continued focus on advancing India’s digital public infrastructure, a key pillar for realising the $5 trillion economy dream. I look forward to enhanced government initiatives fostering financial inclusion benefiting ‘Bharat’, not just India,” said Sarvjeet Virk, Co-founder & MD, Finvasia. “On the tech front, I hope to see further progress in establishing AI Centres of Excellence. I also expect more policies to enable public-private partnership to boost end-use-cases of generative and predictive AI and increase its adoption in India. The fintech industry, as usual, will be the flag bearer of innovation,” Virk added. “The landscape of online new car sales has experienced a substantial surge over the past 4-5 years, driven by an increasing preference for consumers buying cars digitally. We are expecting some key developments from the budget like a reduction in the GST rate that will support home-grown players in investing in newer technologies for enhanced mobility offerings on a global scale. Then, re-evaluation of the import structure for electric vehicles is also sought to address disparities in GST rates, providing a much-needed boost to the start-up community through government loans and investments. As an online new car market player, we are closely monitoring these developments, recognizing their potential impact on the electric vehicle market. Our commitment is to adapt our platform to the evolving landscape, ensuring that our customers have access to the latest and most sustainable automobile options. We look forward to the Union Budget introducing measures that not only support the growth of the electric vehicle industry but also contribute to a more sustainable and eco-friendly future,” Gaurav Aggarwal, CEO and Founder, CarLelo, A Capri Loans Venture said.

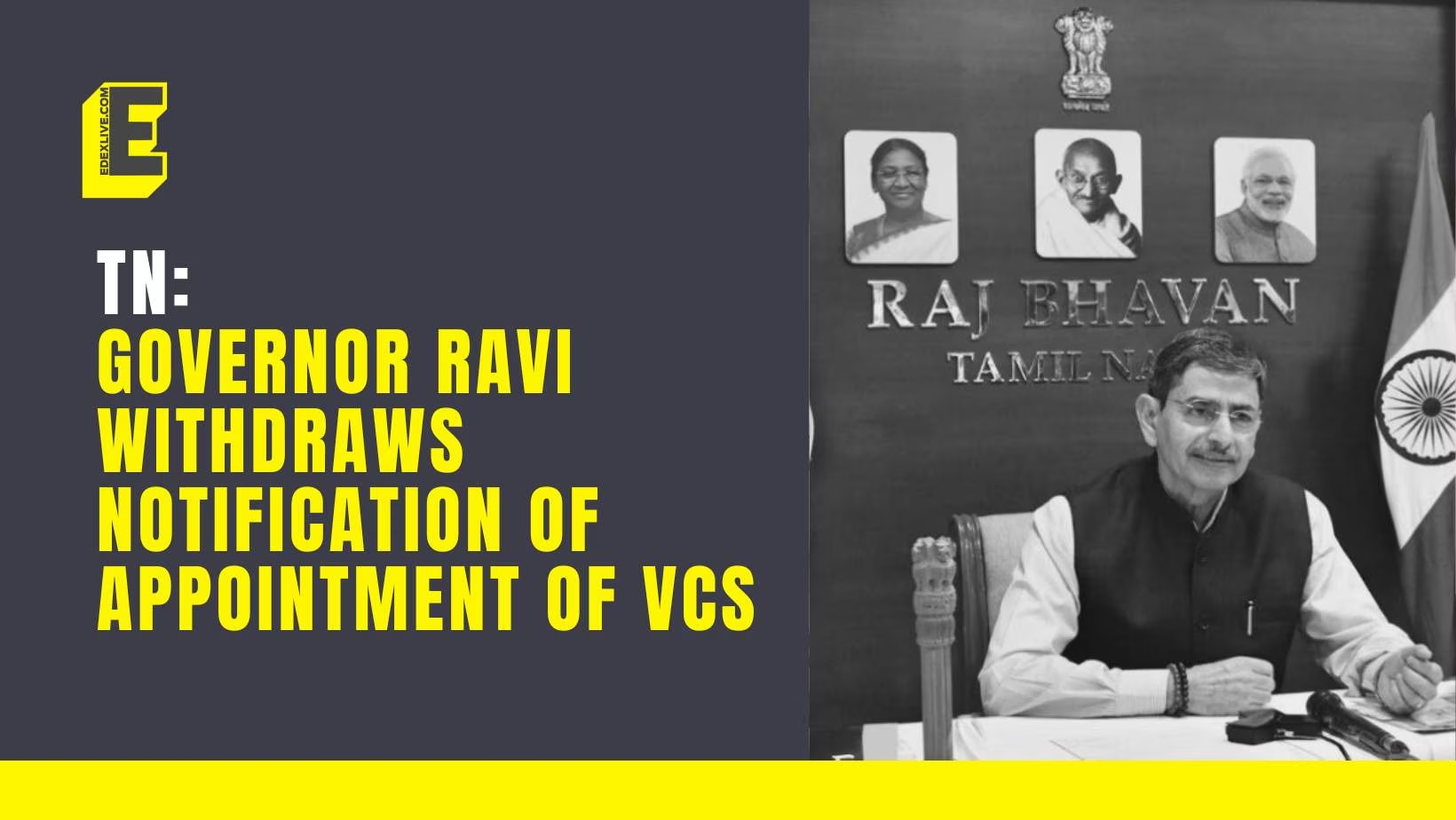

Tamil Nadu government retracts announcement about V-C appointments

This happened a few days after M K Stalin, the chief minister, met Ravi in response to the Supreme Court's recent recommendation that they work out their problems.In the midst of the current impasse between the Tamil Nadu government and Raj Bhavan regarding the vice chancellor appointments to three universities, governor R N Ravi revoked three notices he had sent out regarding the subject last year on Tuesday.This happened a few days after M K Stalin, the chief minister, met Ravi in response to the Supreme Court's recent recommendation that they work out their problems.According to a statement released by the Raj Bhavan, "the governor is hopeful that the government will now constitute search committees including a nominee of UGC (University Grants Commission) chairman in line with the judgments of constitutional courts." But he also demanded that the state revoke its three notices and proceed by sending out new ones to form search committees in compliance with the 2018 UGC regulations and rulings from the Supreme Court and lower courts.The Madras High Court's December 19, 2018, ruling, which ordered Puducherry's government and Puducherry Technological University to "amend statutory provisions governing the varsity to bring it in conformity with the UGC Regulations 2018," was cited by Governor Ravi. The statement from Raj Bhavan stated, "In view of this clear enunciation of the law, the Hon'ble Governor of Tamil Nadu, in his capacity as Chancellor of the concerned Universities, is confident that the Government of Tamil Nadu would withdraw its Notifications in deference to constitutional proprietary and legality." "...and awaits appropriate action in this regard from the Government of Tamil Nadu as soon as possible to ensure that the state's future and the cause of higher education are not negatively impacted."GOVT REACTION The Tamil Nadu government, led by the DMK, filed a case in the Supreme Court in November contesting the governor's notifications. Chief Minister M K Stalin led a delegation of senior ministers and bureaucrats to the Raj Bhavan on December 31 in response to the top court's directive that the two meet to resolve outstanding matters.

Aim to double AUM to Rs 20,000 crore by FY27, says HomeFirst MD & CEO

HomeFirst Finance will likely borrow Rs 4,000 crore in 2024-25 (April-March) to grow its loan book, managing director and chief executive officer Manoj Viswanathan, has said. “We have already tied up our requirement for this financial year. We are in discussion with banks for the next year. Most of them are looking to extend lines of credit to us,” he said.Currently, banks loans comprise 56% of the company’s borrowing mix. Going ahead, the non-banking financial company is looking to increase borrowings from development finance institutions, with the Reserve Bank of India has been cautioning non-bank lenders against over-reliance on bank borrowings. “Overall, we feel that our liability profile is balanced. We should not be having any issues for the next few years,” he said. The company’s assets under management stood at around Rs 9,000 crore as on December 31. It expects the AUM to grow to Rs 20,000 crore in the next three years. Housing loans comprise 86% of the AUM. Loan against property and shop loans comprise the remaining 14%.Around 68% of the book comprises loans to the salaried customer segment and the rest is to the self-employed segment. Loan disbursals surpassed Rs 1,000 crore in the December quarter.Currently, around 6% of disbursals are done through the co-lending route. The NBFC has co-lending partnerships with Central Bank of India and Union Bank of India. By the end of 2024-25, around 10% of disbursals will be done through the co-lending route.The company remains focused on increasing its return on equity (RoE). The RoE is expected to improve due to a growth in the loan book and higher leverage. “We are focused on return on equity. As we leverage the book, the return on assets will decline in any case. But, RoEs are improving in spite of net interest margins being lower,” Viswanathan said. The return on equity rose 210 basis points year-on-year to 15.8% in the December quarter.

Star Health Insurance Q3 results: Net profit rises 37.5% to Rs 289.55 cr

The largest standalone health insurer, Star Health Insurance, posted a 37.5 per cent year-on-year (Y-o-Y) growth in net profit to Rs 289.55 crore during the third quarter of the financial year 2023-24, as compared to Rs 210.47 crore in the year-ago period, supported by healthy growth in premium and a fall in commissions expenditure.The net profit jumped by 131 per cent from Rs 125.30 crore in Q2 FY24.The new business premium of the company increased by 16 per cent (Y-o-Y) to Rs 3,605.81 crore from Rs 3,096.68 crore. The net investment income of the firm jumped 40.58 per cent to Rs 162.64 crore from the year ago.The net commission of the health insurer dropped 13.11 per cent (Y-o-Y) to Rs 349.85 crore from Rs 402.64 crore. The solvency ratio of the insurer rose to 223 per cent from 217 per cent. The minimum regulatory requirement is 150 per cent.The combined ratio, which is a measure of the profitability of the general insurer, increased to 97.30 per cent from 94.81 per cent in the year-ago period. A combined ratio of less than 100 is considered to be better; it indicates that the insurer is earning more through premiums as compared to claims paid and the operating expense incurred. Therefore, it is better for the company if the combined ratio is lower.The claims ratio of the company was 67.69 per cent, up from 63.75 per cent in Q2 FY24. The health insurance industry typically witnesses higher claims during the monsoon period due to rainy season-related diseases, whereas historically, insurance premium income is higher towards the end of the financial year considering the tax benefits available to policyholders.

Samsung Galaxy S24 Ultra Review: The most feature packed flagship

Over the past couple of years, Samsung has consistently launched flagship devices at the beginning of the year, and these devices often maintain their top positions in the market throughout the year. The latest addition to this trend is the Samsung Galaxy S24 Ultra, unveiled at the global 'Galaxy Unpacked' event in San Jose. After using the device for the past 10 days, it has left a positive impression. The device is priced at ₹1,29,999, slightly higher than last year's S23 Ultra. But is it worth the investment? Let's delve into the details. I have hands-on experience with previous Ultra models, including the Note series, and the S24 Ultra has made significant advancements. Samsung has slimmed down the sides for this year's model, making it a delight to hold. The titanium frame adds a touch of sophistication, and the phone feels slightly lighter compared to last year's device. On the right edge, you'll find the power and volume buttons, while the bottom edge features the lone USB-C port and a slot for the S Pen. The S Pen employs the tried-and-tested push mechanism for easy ejection, making it convenient to grab even when not directly looking at the screen. Despite its lightweight feel, the stylus appears to be durable. The S Pen is very responsive to the S24 Ultra's display. I appreciate its versatility for note-taking, colouring, drawing, and the added functionality of using the S Pen button as a remote camera shutter. The phone features a 120 Hz adaptive refresh rate and a 6.80-inch touchscreen display, protected by Gorilla Glass Armor. Let’s just say the 6.8-inch 1440 x 3120 OLED screen is the centrepiece of the S24 Ultra. It is perfectly sharp and crisp and with the huge screen, the viewing experience is delightful. The display is exceptionally bright, providing no difficulty in reading emails and messages outdoors, even under direct sunlight. With a brightness of 2,600 nits, a 40% upgrade over the S23 Ultra, and the added protection of Gorilla Glass Armor with an effective anti-reflective coating, the S24 Ultra's screen ensures both durability and visual clarity.

Piramal Enterprises suffers ₹2,378-crore Q3 loss due to AIF provisioning

Piramal Enterprises Ltd, the financial services arm of the Piramal Group, on Monday (January 29) reported a consolidated net loss of ₹2,377.6 crore for the third quarter that ended December 31, 2023. The exceptional loss of ₹3,339.8 crore has to do with its investments in alternative investment funds (AIFs). In the corresponding quarter last year, Piramal Enterprises posted a net profit of ₹3,545.4 crore, the company said in a regulatory filing. The company's revenue from operations declined 11.9% to ₹2,475.7 crore against ₹2,811.2 crore in the corresponding period of the preceding fiscal. The total assets under management (AUM) is up 6% quarter-on-quarter and 9% year-on-year, excluding the impact of AIF provisions. Provisions of ₹3,540 crore, taken according to RBI circular on AIF investments, led to a reduction in AUM. The company remains confident of the full recovery of the AIF investments. Interest income also fell to ₹1,931 crore from ₹2,006 crore in the year-ago period. However, the total expenses of the company stood at ₹2,414 crore against ₹2,807 crore in the same period a year ago, Piramal Enterprises said. Ajay Piramal, Chairman of Piramal Enterprises Ltd, stated, "In response to the RBI circular issued in December, we made complete provisions for our investments in AIFs, subsequently removing them from our AUM. Our confidence in the full recovery of these investments remains strong, which is evident in the positive payment record thus far. We have made substantial enhancements to our net interest margins, achieved robust fee income growth, and optimized opex (operating expense) ratios to deliver a strong core operating profit. Our commitment is to further enhance profitability by optimising operating leverage in our growth business and reducing the contribution of the legacy business." On January 27, Piramal Enterprises announced its intention to sell the entire direct investment of 20% of the fully paid-up equity share capital held in Shriram Investment Holdings Pvt Ltd (formerly known as Shriram Investment Holdings Ltd) to Shriram Ownership Trust (SOT), for a consideration of ₹1,440 crore.The transaction is subject to receipt of requisite regulatory approvals by SOT and is expected to be completed before March 31, 2024, PEL had said in a separate regulatory filing. The contribution of SIHPL in the revenue of the company for the year ende

The state governor has appointed Sanjay Shukla (IAS: 1995: MP) as PS.

The Madhya Pradesh government reorganized its administrative structure, assigning new assignments to eighteen IAS officers and giving thirteen others more responsibility in different departments.On Sunday, the Madhya Pradesh government reorganized its administrative team, giving 18 IAS officers new assignments and giving 13 other officers greater duties in a variety of departments.This is a list of the officers that have been given new duties. The announcement states that Manu Srivastava, Additional Chief Secretary (ACS) for Technical Education, will take over as the ACS of the Energy Department. Sanjay Shukla, the Public Health Engineering Department's current Principal Secretary (PS), has been assigned to the governor of the state. Sukhbir Singh, the incoming PS of Food Processing and Horticulture, will be replaced as Principal Secretary of the Public Works Department (PWD) by DP Ahuja, the outgoing PS to the Governor.The Jail Department's Principal Secretary is now Manish Rastogi. The Tribal Affairs Department's Principal Secretary is now E Ramesh Kumar. In addition, he now holds the additional responsibility of Commissioner of the Department of Religious Trusts and Endowments and the Department of Tribal Affairs. The commissioner of higher education will be Nishant Varwade. Dr. Ramrao Bhosle is now the Commissioner of the Social Justice and Empowerment of Persons with Disabilities Department, having previously served as the Commissioner of the Women and Child Development Department.Sophia Farooqui Wali, a commissioner of the Khadi Village Industries Board, has been appointed to the position of commissioner for the Department of Women and Child Development.Manish Singh, the former commissioner of public relations, has been appointed to the position of Registrar at the Madhya Pradesh State Consumer Redressal Disputes Commission. The Water and Land Management Institute's (Walmi) new director is Tarun Rathi. Saurabh Kumar Suman has been appointed as the Department of Backward Class and Minority Welfare's Director/Commissioner. The position of Managing Director at the Handicrafts Handloom Development Corporation and the Madhya Pradesh Khadi Village Industries Board has been filled by Mohit Bundas. The position of managing director at Women Finance and Development Corporation has been awarded to Nidhi Nivedita.The department of minority welfare and backward classes has appointed Kumar Purushottam as deputy secretary. The department responsible for Free Nomadic and Semi-Nomadic Tribes now has Neeraj Vashishtha as its director. Deputy Secretary of the Forest Department Kishore Kanyal, the collector who was fired for verbally abusing the driver in Shulajalpur, has been promoted.

The Energy Department has appointed Manu Srivastava (IAS: 1991: MP) as Additional Chief Secretary (ACS).

New Delhi: The recently established government of Madhya Pradesh started the transfer of eighteen Indian Administrative Service (IAS) officers in a significant bureaucratic reorganization. Manu Srivastava, who is well-known for his contributions to the energy industry, has been promoted to Additional Chief Secretary in the Department of Power and Renewable Energy, one of the major changes. Prior to his noteworthy involvement in the field of renewable energy, Manu Srivastava was instrumental in guaranteeing his state's uninterrupted electricity supply. His previous work in the Indian government entailed managing natural gas affairs, demonstrating the breadth and depth of his administrative knowledge.Manu Srivastava, who holds an IIT-Delhi degree in Electrical Engineering, adds thirty years of expertise to his new role, including an impressive fifteen years in the energy industry. Notably, he oversaw the ground-breaking 750 MW Rewa Project, which broke grid parity and won the President's Award from the World Bank Group. This project was a turning point in India's solar energy history.The only other project in India that serves an institutional clientele is the Rewa Project, which provides electricity to Delhi Metro. The project's case study has received recognition on a global scale and is being taught at Singapore Management University and Harvard University courses.Apart from his accomplishments in large-scale solar projects, Manu Srivastava has been instrumental in putting solar rooftop initiatives into action with the lowest prices in the nation. He is currently working with NITI Aayog to bring solar rooftop projects to healthcare facilities around the country without receiving funding from the government or beneficiaries.Prior to his noteworthy involvement in the field of renewable energy, Manu Srivastava was instrumental in guaranteeing his state's uninterrupted electricity supply. His previous work in the Indian government entailed managing natural gas affairs, demonstrating the breadth and depth of his administrative knowledge.

The Delhi Government is hiring engineers, and GATE scores are needed.

Assistant executive engineer applications are being accepted by Delhi State Industrial and Infrastructure Development Corporation Limited (DSIIDC), a public sector organization under the Delhi Government. The application must be submitted by February 29th. Those who meet the requirements can apply by going to the official website. Ten open positions are to be filled by the recruitment drive: two for assistant executive engineer (Electrical) and eight for assistant executive engineer (Civil).Age Limit for DSIIDC Recruitment in 2024 Candidates cannot be older than 35 years old.Recruitment by DSIIDC 2024: Application Cost There is a 500 ₹ application fee. Candidates who are female or who fall under the SC, ST, or PWD categories are not required to pay the fee. Recruitment by DSIIDC in 2024: The Selection Process Candidates will be chosen based on their performance in GATE 2021, GATE 2022, and GATE 2023. DSIIDC 2024 Recruitment: Academic Requirements: Civil Assistant Executive Engineer: Candidates must have earned a minimum of 50% in their full-time civil engineering degree from an accredited university. Electrical Assistant Executive Engineer: Candidates should possess a full-time electrical engineering degree from a recognised university with a minimum 50 per cent score.