Top Trending Appointments News & Highlights

According to FT, Meta reduces stock rewards for the majority of employees by 5%.

As CEO Mark Zuckerberg invests billions of dollars in its artificial intelligence goals, Meta cut the annual payout of stock options for the majority of its employees by roughly 5%, according to a Financial Times report on Thursday.In the fierce AI race in Silicon Valley, Meta and other Big Tech companies are vying with one another to outbuild one another with enormous data centers. In January, the social media corporation stated that it anticipated spending between $115 billion and $135 billion on capital projects in 2026.According to the report, which cited people familiar with the situation, Meta has reduced equity-based incentives for the majority of its employees for the second consecutive year. According to the FT story, the corporation stunned some employees by reducing the stock reward by about 10% last year.The entity incorporates Meta's ambitious "metaverse" wager, which has resulted in losses of about $70 billion since 2021. According to President Donald Trump, Meta is investing $50 billion to develop a number of gigawatt-scale data centers across the United States, including one in rural Louisiana.

Published 20 Feb 2026 01:03 PM

In Barbados, Mia Mottley Earns a Historic Third Term

With her party capturing every seat in the House of Assembly, Barbados' Prime Minister Mia Mottley has achieved an unprecedented third straight election victory. For the third time, her party, the Barbados Labour Party (BLP), took home all 30 seats in Parliament. In the history of the island nation, the triumph represents a significant political turning point.Results of the Election 30/30 seats were won by BLP. Ralph Thorne, the leader of the opposition, was removed. Mottley is only the second leader to hold office for more than two terms in a row. During her speech of victory, Mottley promised to: Cut down on poverty Boost the infrastructure Boost medical care Boost traffic safetyPolitical Background The election brought to light two opposing strategies: Mottley's diplomacy with a global perspective, including climate activism Opposition emphasizes issues related to the domestic economy. Mottley has advocated debt-for-climate swaps and been a prominent global voice on debt reform for countries at risk from climate change. Barbados made a substantial improvement last year by bringing its debt-to-GDP ratio down to just about 100% from bond defaults in 2018.Global Response In addition to congratulating Mottley on her "clear electoral victory," U.S. Secretary of State Marco Rubio indicated interest in enhancing collaboration on: Control of crime Prevention of drug trafficking Security in the region Barbados continues to play a significant strategic role in the Caribbean.

Published 16 Feb 2026 05:46 PM

A former secretary of consumer affairs has been appointed to a key USISPF position.

The appointment of former Consumer Affairs Secretary Rohit Kumar Singh as Chair of the Global Value Chains Committee of the US–India Strategic Partnership Forum (USISPF) on February 9, 2026, marked a major step forward for India-US economic interaction. The action underscores the increased focus on reliable supply chains and reliable alliances.Selection of the Chair of USISPF's Global Value Chains Committee Rohit Kumar Singh, a former secretary of consumer affairs, has been named chair of the US-India Strategic Partnership Forum's Global Value Chains Committee. Singh, who has extensive administrative experience and a history of change, puts Indian policy knowledge at the center of debates about the global value chain in his new position. Rohit Kumar Singh's Identity A 1989-batch IAS officer from the Rajasthan cadre, Rohit Kumar Singh has a wealth of knowledge in economic governance. He was instrumental in reforming India's consumer protection laws while serving as Secretary of Consumer Affairs. His leadership earned praise for enhancing responsiveness and openness by fusing technology-driven governance with regulatory reform. In his new worldwide job, he is well-positioned to combine policy, industry, and international cooperation thanks to his administrative background.Why USISPF Is Important and What It Is Through cooperation between governments, corporations, and thought leaders, the US–India Strategic Partnership Forum (USISPF) is a premier forum that enhances strategic and economic connections between the US and India. It operates in a variety of industries, including supply chains, trade, technology, energy, and defense. At a time when global trade is fragmented and under geopolitical stress, USISPF is essential in facilitating conversation and coordinating policy agendas.

Published 10 Feb 2026 05:46 PM

Venugopal Jeyandran Reliance Retail Ventures Ltd.'s President and CEO was appointed.

Jeyandran Venugopal, a senior executive from Flipkart, has been named President and CEO of Reliance Retail Ventures Ltd. (RRVL) by Reliance Industries Ltd. (RIL). In an effort to further accelerate growth in the fiercely competitive retail industry, India's largest retail conglomerate made the statement on December 3, 2025. This is a brand-new role that highlights RRVL's goal to implement an ambitious retail and omni-channel strategy and increase leadership depth.Background: Jeyandran Venugopal: Who Is He? In the Indian e-commerce industry, Jeyandran Venugopal is a well-known figure. He played a key role in growing the platform's operations and digital infrastructure while holding senior positions at Flipkart that were centred on technology, innovation, and customer experience. His move to Reliance Retail coincides with the company's rapid e-commerce expansion through JioMart, all the while preserving a robust offline retail presence in industries like fashion, electronics, luxury products, and grocery.Strategic Position in the Vision of RRVL Venugopal will collaborate closely with Isha Ambani, who leads RRVL's retail sector, in his capacity as President and CEO. Among his responsibilities will include Overseeing omni-channel integration and digital transformation Promoting innovation in consumer interactions and the supply chain Improving offline and online operations through data-driven decision-making increasing urban penetration and extending RRVL's reach throughout tier 2 and tier 3 cities His appointment demonstrates Reliance's desire to directly compete with Amazon, Walmart-Flipkart, and Tata Neu by utilising cutting-edge technology and customer data intelligence in addition to size.Reliance Retail Ventures Ltd. (RRVL), the retail holding company of Reliance Industries, is the biggest retail player in India. Its varied portfolio includes Trends, JioMart, Ajio, Reliance Fresh, and Hamleys Strategic alliances with international companies such as Burberry, Jimmy Choo, and Tiffany Recent acquisitions in fashion, food retail, and e-commerce that demonstrate a hyper-growth approach RRVL continued to dominate the market in terms of both revenue and physical store network in FY2024–2025, reporting record revenues.

Published 04 Dec 2025 06:11 PM

Appointments

Appointments

Yes Bank releases a list of senior hires.

Mumbai: Rajeev Uberoi was named senior group president for governance and controls and Anurag Adlakha was named senior group president and head of financial management and strategy by Yes Bank on Monday.Uberoi will be in charge of management governance, compliance, vigilance, legal (general counsel), company secretarial, and control responsibilities at Yes Bank. Uberoi was previously in charge of legal and audit at IDFC Bank.Adlaka, the former CFO of Jana Small Finance Bank, will be in charge of boosting Yes Bank's bottom line.According to a press release from the bank, both of the top personnel will answer directly to Ravneet Gill, managing director and chief executive officer.Additionally, the Yes Bank board of directors made it clear that the lender's liquidity and operational performance were strong, and that its financial condition was "sound and stable." To approve the financial results for the quarter that ended on June 30, 2019, the board will convene on July 17. In addition, the bank denied "unfounded speculation about, among other things, the bank's asset portfolio, future growth prospects, Board & management stability."Yes Bank shares were trading at ₹93.40 on the BSE at 11:45 a.m.Yes Bank shares were trading at ₹93.40 on the BSE at 11:45 a.m. Open up a world of advantages! Everything you need is right here, only a click away, including intelligent newsletters, real-time stock tracking, breaking news, and a customizable newsfeed! Register Now!

The Gurugram government brings in Yuzvendra Chahal to increase voter turnout.

The district government in Gurugram has adopted a novel strategy to promote voter turnout as the May 25 Lok Sabha elections approach.The district government in Gurugram has adopted a novel strategy to promote voter turnout as the May 25 Lok Sabha elections approach. The government has enlisted prominent musicians MD Desi Rockstar and Naveen Punia, as well as cricket player Yuzvendra Chahal of India, as brand ambassadors in an attempt to draw in voters, especially the younger generation.The district administration had already recruited singer Naveen Punia and "desi rockstar" MD as brand ambassadors to win over Gurugram voters before requesting Chahal's backing. It is expected of these well-known musicians to use their platform to interact with the public and use their work to inspire them to exercise their right to democracy.The government has introduced a first-of-its-kind app, “Voter In Queue,” to assist voters in ascertaining their exact place in the polling line and the approximate duration till their turn to cast a ballot. The Election Commission of India (ECI) has cleared the app for trial usage, and Gurgaon Deputy Commissioner Nishant Kumar Yadav revealed that on May 25, voters can monitor the lines at 367 polling booths in Gurgaon, 250 booths in Pataudi, and 455 booths in Badshahpur.In order to obtain an OTP and establish a direct communication channel with the booth level officer (BLO), voters can utilize the app to provide their location, voting booth, and voter ID. Every 30 to 60 minutes, the BLO will update the app with the number of individuals in line to cast their ballots.Voting centers have been established in Gurgaon's common spaces of high-rise buildings in an effort to make voting even easier. A Voters' Park has also been opened at Vikas Sadan by Haryana Chief Secretary TVSN Prasad. Additionally, officials have made sure that announcements from DC Yadav and the District Election Officer be aired in all of the city's multiplexes.With the Lok Sabha elections in Gurugram fast approaching, the district administration is trying to persuade people to use their democratic right to vote by including the younger generation through creative techniques and celebrity partnerships.

Kareena is pleased to be a national ambassador for UNICEF India.

UNICEF India has named Bollywood star Kareena Kapoor Khan as its national ambassador. Her longstanding affiliation with the organization since 2014, during which she has acted as a Celebrity Advocate, is recognized with this esteemed status.Young Advocates: Supporting a Range of Issues UNICEF India announced the appointment of Kareena along with the introduction of its inaugural class of Youth Advocates, four exceptional persons who will act as peer leaders and advocates for important issues impacting children and youth. The causes that the Youth Advocates are fighting for are: Gauranshi Sharma from Madhya Pradesh, advocating for the right to play and disability inclusion. Uttar Pradesh native Kartik Verma is an advocate for child rights and climate action. Nahid Afrin from Assam, raising awareness about mental health and early childhood development. Vinisha Umashankar from Tamil Nadu, a budding innovator and STEM pioneer.Kareena's dedication to the rights of children Kareena Kapoor Khan's commitment to the rights and wellbeing of children is demonstrated by her affiliation with UNICEF India. She has given her voice to numerous projects as a Celebrity Advocate, bringing attention to topics including child safety, nutrition, and education. As she assumes her new position as National Ambassador, Kareena is well-positioned to further up her efforts and use her powerful platform to make a significant difference in the lives of children in India and around the world.Youth Empowerment and Change-Driven UNICEF India's selection of Youth Advocates is a great step in empowering youth and recognizing their ability to effect positive change. In addition to serving as an inspiration to their peers, these advocates will help shape programs and policies that deal with the urgent issues that young people face. Kareena Kapoor Khan and the Youth Advocates will work diligently to guarantee that every child's rights are upheld and their voices are heard, forming a strong team.Children's Better Future Kareena Kapoor Khan and the Youth Advocates represent a fresh commitment to UNICEF India's great goal, which is to uphold the rights and welfare of children. The group wants to give children a better future where their rights, safety, and growth are respected and valued via their combined efforts. Kareena Kapoor Khan's impact and her passion for children's rights will surely encourage others to join the campaign as she sets off on her new adventure, causing a ripple effect that reverberates throughout the country and beyond.

Japanese stocks fall on Yen support, yuan rebounds

Japanese stocks declined as the yen rose after the country’s top currency official warned against speculative moves in the foreign-exchange market.The yuan climbed following signs of support from Chinese authorities. Tokyo’s Topix index dropped as much as 1% after recording its biggest weekly gain in two years. South Korea’s equity benchmark also fell while mainland Chinese, Hong Kong and Australian shares inched higher — offering a mixed picture for the region. The offshore yuan rose as the dollar weakened and China’s central bank set a stronger-than-expected daily reference rate. The gap between the yuan’s daily fixing versus estimates was the widest since November, while Bloomberg calculations indicated the People’s Bank of China injected a net 40 billion yuan ($5.56 billion) in open market operations. Chinese Premier Li Qiang had earlier downplayed investor concerns of challenges facing the economy, saying Beijing was stepping up policy support to spur growth and systemic risks are being addressed. “Just saying the risks are not as much as people think is not going to draw investors back,” says Vey-Sern Ling, managing director at Union Bancaire Privee. “China is not just a ‘show me’ story for investors, it’s a ‘show me a lot more than I expect’ story Treasuries were mostly steady following a rally on Friday that wiped seven basis points from the 10-year yield. Australian and New Zealand bond yields ticked lower Monday. Those moves come ahead of a busy week of economic data that will include the Federal Reserve’s preferred inflation gauge due Friday. The core personal consumption expenditures index, which excludes food and energy costs, is seen rising 0.3% on the heels of its biggest monthly increase in a year. Inflation readings are also due in Australia, France, Italy and Spain later this week, offering clarity on rising prices as investors begin to position for rate cuts. US equity futures were little changed after a muted end to the week on Wall Street with the S&P 500 declining 0.1% and the Nasdaq index rising by the same margin on Friday. “Tightening usually causes recessions when it triggers financial crises that turn into credit crunches,” said Ed Yardeni, president of his eponymous research firm, said in a Monday note. “That sequence of events is unlikely now,” he said, citing the Fed’s use of emergency liquidity measures to address crises, such as the stress in the US banking system in March last year.

Asian stocks open mixed as US hits fresh highs

Equities in Asia traded mixed Friday in a sign investors are rethinking the optimism that propelled the region’s shares higher in the prior session, as fresh signs of persistent inflation appeared in the US.Shares in Australia were little changed while Japanese stocks nudged higher. Futures contracts for Hong Kong equities declined. The moves followed Thursday’s sharp rally for a gauge of the region’s shares, which touched the highest level in almost two years. Contracts for US stocks rose in early Asian trading after the S&P 500 index rose 0.3% to a fresh high Thursday — its 20th of the year — led by gains in industrials and banks. Reddit Inc. shares soared 48% on their debut. Other tech stocks faltered, with Apple Inc. and Alphabet Inc. falling against the backdrop of heightened regulatory pressure. The US Justice Department and 16 attorneys general are suing the iPhone maker for violating antitrust laws. In Europe, the company is said to be facing probes about whether it’s complying with the region’s Digital Markets Act. Apple shares fell more than 4%, wiping $115 billion in market value. US economic data supported the argument the Fed may be forced to backtrack on its rate reduction forecasts a day after the central bank indicated three 25 basis point cuts in 2024. Housing, manufacturing and labor-market data released Thursday in the US pointed to a resilient economy that could prompt the Federal Reserve to reduce interest rates slower than the market expects. The data pushed Treasuries down. The two-year Treasury yield rose three basis points Thursday, while the 10-year was less than one basis point higher. The upward pressure on yields supported an index of the dollar, which rose 0.4% in its previous session before steadying Friday. The yen inched higher to trade at around 151 per dollar in early Friday trading as Japan’s inflation accelerated to the quickest pace in four months. Markets will keep focused on whether the Bank of Japan might follow its first interest rate hike since 2007 with further raises later this year. Itchy Fingers Treasury Secretary Lawrence Summers said the Fed has “itchy fingers to start cutting rates,” which may not be necessary for some time given the strong economy and buoyant financial markets. “I don’t know why we’re in such a hurry,” Summers said. Societe Generale SA increased its S&P 500 year-end forecast to 5,500 from 4,750 — the highest forecast among strategists tracked by Bloomberg. “US exceptionalism is going from strength to strength,” wrote Manish Kabra, head of US equity strategy for the French bank. “Despite widespread market optimism, we view this as rational rather than excessive.” Central banks remained firmly in focus. The Swiss National Bank expectedly cut interest rates, weakening its currency against peers, while Mexico’s central bank also cut rates as expected. The moves could be a prelude to policy easing in the UK, Europe and the US. The Bank of England kept rates at a 16-year high of 5.25% Thursday. Two BOE hawks dropped their demands for hikes in a further sign the central bank is closer to rate cuts. The pound weakened on the news. Ahead in Asia, the Reserve Bank of Australia will release a financial stability review, while Taiwan will publish February jobs data. In commodities, oil held a two-day drop, with traders assessing the outlook for global interest rates and geopolitical tensions in the Middle East. Elsewhere, Bitcoin trading below $66,000, while gold fell after surging above $2,200 an ounce for the first time.

Stocks in Asia echo US gains on Fed rate signals

Asian equities rallied Thursday after US stocks touched fresh highs as the Federal Reserve indicated it would meet market expectations with three rate cuts this year.Australian, South Korean shares and equity futures for Hong Kong all advanced. Japanese stocks also rose after a Wednesday holiday as the nation’s exports grew for a third consecutive month, offering support for the economy. The S&P 500 index climbed 0.9% to a new high while the tech-heavy Nasdaq 100 index, which is more sensitive to policy, rose 1.2%. US futures climbed further in early Asian trading. The Magnificent Seven group of mega-caps powered to new highs. US small-caps, which typically do well when the economy is expanding, rose almost 2% for the best session in more than a month. Australian and New Zealand bonds rallied, echoing a rise in Treasuries. Gains were tilted toward the short end with two-year yields falling eight basis points and the 10-year falling by two basis points. The moves reflected an increase in expectations the Fed may cut as early as June. The dollar extended losses, while Treasuries steadied during Asian trading. Policymakers kept their outlook for three cuts in 2024 and moved toward slowing the pace of reducing their bond holdings, suggesting they aren’t alarmed by a recent uptick in inflation. While Jerome Powell continued to highlight officials would like to see more evidence that prices are coming down, he also said it will be appropriate to start easing “at some point this year.” “Asian markets are likely to see a wave of relief rally as traders gain confidence from a clearer view of the near-term picture,” said Hebe Chen, an analyst at IG Markets in Melbourne. “This enhanced sense of certainty is likely to be particularly appreciated by the Japanese market.” The Bloomberg dollar index extended losses after falling 0.4% Wednesday after the move in Treasuries. The yen pared an intraday loss against the greenback early Thursday after declines in the prior session to trade at around 151 per dollar. The New Zealand dollar also reversed earlier losses as gross domestic product data showed the country unexpectedly fell into a recession in the second half of 2023. Output in the fourth quarter contracted 0.1% to mark its second quarter of negative growth. In corporate news, shares in Micron Technology Inc., the largest US maker of computer memory chips, jumped in late trading on a surprisingly strong revenue forecast. Elsewhere, Tencent Holdings Ltd. plans to raise its stock buyback program to at least $12.8 billion this year. Gold rallied to trade over $2,200 an ounce for the first time following the Fed comments. A lower interest rate environment is typically positive for the precious metal, which doesn’t generate interest. Meanwhile, Bitcoin stemmed a recent decline to advance near $68,000. West Texas Intermediate, the US oil price, rose after a Wednesday drop.

42-year-old Amazon seller whose side hustle brings in $143,000 a month: Use these 3 simple steps to make more money

Woo is a 42-year-old ex-corporate consultant and Montessori school administrative director who lectures at the University of California, Irvine, runs an online emotional intelligence course and freelances as a business consultant.She also has a side hustle called Mind Brain Emotion where creates emotional intelligence-focused card games — 11 of them so far, on topics ranging from relationship skills to job interviews — and sells them on Amazon. The games brought in $1.71 million in revenue last year, or an average of $142,700 per month, according to documents reviewed by CNBC Make It. The side hustle’s success is due, at least partially, to a three-step process Woo followed, she says: Keep testing your idea after you’ve launched it, use the feedback to inform your next project and repeat the cycle.Woo’s first game was meant to help teachers and kids learn the basics of emotional intelligence, so she spent three months testing it in local schools before listing it on Amazon, she says. Once sales started coming in, she kept researching and testing the game — but instead of updating it, she used the feedback to create new versions for different topics and audiences. “Iteration is key,” says Woo. “For those who are risk-averse or perfectionistic, they may worry, ‘What if I make a mistake? What if I become irrelevant?’ Don’t be afraid to reinvent yourself.”Creating iterations of her card game, listing each new version as another product for people to buy, was a familiar pattern for Woo: She has changed careers several times, reinventing herself at each stop along the way. She helped train managers during stints at Deloitte and Cisco. She worked as a personal trainer. She got involved in school administration when her three children became preschool-aged, and ran a party decoration business called PropMama on the side. Mind Brain Emotion came along in 2018, as Woo studied for her master’s degree in education at Harvard University. She changes things up out of both personal and professional necessity, she says — she gets bored, learns something new, then figures out a way to monetize or share it with others.“A lot of these [changes] stem from my own pain,” she says. “I became a fitness trainer because I was training for a marathon ... My kids needed decorations for their parties, and I wanted to have fun designing them.” Woo isn’t the only entrepreneur who preaches reinvention over perfection as a way to develop a business and make more money. Silicon Valley startup accelerator Y Combinator often teaches founders to create “minimum viable products” and release them to the public as quickly as possible, to get real-world feedback from paying consumers, for example. “Done is better than perfect,” Tessa Barton, co-founder and co-CEO of photo editing app Tezza, told Make It in January.“You learn so much [more] by just getting stuff out,” added Barton, whose business brought in $26.5 million in sales last year. “Being on social media, people will just tell you what they like and don’t like. Then, you can improve as you go and let go of the fear of launching something.”

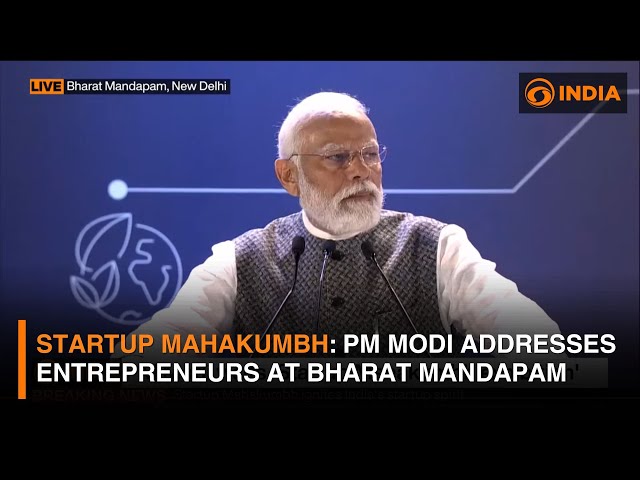

PM Modi To Address Entrepreneurs At Startup Mahakumbh

Prime Minister Narendra Modi will address entrepreneurs and all stakeholders at the 'Startup Mahakumbh' on Wednesday. The Prime Minister said that India's strides in the world of startups have been phenomenal in the last few years. In a post on X, PM Modi said, "At 10:30 AM tomorrow, I will be speaking at the Startup Mahakumbh, a forum which brings together stakeholders from the world of Startups, innovators and upcoming entrepreneurs. India's strides in the world of Startups have been phenomenal in the last few years." Startup Mahakhumbh 2024 commenced at Bharat Mandapam in New Delhi on 18 March. According to the Ministry of Electronics and IT, with the resounding theme of 'Bharat Innovates,' the event aims to serve as a catalyst for innovation, networking and growth opportunities across various sectors. Startup Mahakumbh, India's largest and first-of-its-kind startup event, registered record participation, serving as a vibrant platform for all stakeholders in the Indian startup ecosystem. The confluence of stakeholders and experts is expected to help further develop emerging sectors like DeepTech, AgriTech, BioTech, MedTech, AI, Gaming, etc, the Commerce Ministry said on Tuesday. "The event, designed to foster innovation and entrepreneurship across India, witnessed an unparalleled level of participation from leading investors, innovators and aspiring entrepreneurs. The event is hosting over 2000 startups, 1000+ investors, 100+ unicorns, 300+ incubators & accelerators, 3,000+ conference delegates, 10+ country delegations, 3000+ future entrepreneurs and 50,000+ business visitors from across the country. The event has witnessed vibrant discussions on way forward and networking between all the stakeholders," the ministry said. (ANI)

B Capital closes second Opportunities Fund at $750 million

Global investment firm B Capital, which has backed prominent Indian startups such as Byju's, Pharmeasy and Meesho, on Tuesday announced the close of its second Opportunities Fund at $750 million.The fund saw participation from existing and new investors as well as global private and public pensions, family offices, high-net-worth individuals, and sovereign wealth funds, the multi-stage investment firm said in a statement on Tuesday. Through this fund, the firm will actively look to make primary and secondary investments in later-stage companies across B Capital’s core sectors of technology, healthcare, and climate tech, with a focus on North America and Asia. “Our strategy is to back great founders early and to support them throughout their entrepreneurial journey. We are grateful for our investors, who enable us to continue to support our companies during a time when capital remains scarce," said Raj Ganguly, co-founder and co-CEO of B Capital.While a bulk of this fund, which the investment firm claims to be double the size of its previous fund, will be used to make follow-on investments in existing portfolio companies, it will also invest in new companies. B Capital had not responded to Mint's queries on the first fund till press time. “In this challenging environment for many private tech companies, we are pleased to have nearly doubled the capital we have available to back the best founders in the B Capital portfolio and other entrepreneurs we have closely followed," said Eduardo Saverin, co-founder and co-CEO, B Capital. In June, B Capital, through its new fund, invested in Icertis, an existing portfolio company that focuses on contract intelligence software and services companies such as Microsoft, Google and Daimler.

J&Ks new startup policy to boost entrepreneurial spirit in students, women and HNIs. All you need to know

The Jammu and Kashmir administration, chaired by Lieutenant Governor Manoj Sinha, on February 23 gave the nod to a fresh startup policy aimed at establishing 2,000 new startups in the Union Territory by 2027, an official spokesperson told PTI.The newly approved policy focuses on providing entrepreneurship support facilities to students, women, and entrepreneurs. Support will be extended through government, private entities, and high-net-worth individuals (HNIs) to facilitate the setup of startups, it added. The Administrative Council (AC) convened under the chairmanship of Lieutenant Governor Manoj Sinha approved the J&K startup policy 2024-27, superseding the policy announced in 2018.As part of the initiative, the Jammu and Kashmir administration plans to establish a Venture Capital Fund of ₹250 crore. An initial capital injection of up to ₹25 crore will be infused into the fund.The venture capital fund will primarily invest in recognised startups within J&K. Detailed modalities for the fund's creation and usage will be worked out in consultation with the finance department.The J&K Entrepreneurship Development Institute (JKEDI) is expected to develop a mechanism for the allotment of land to startups displaying significant growth potential. Furthermore, one-time assistance in the form of seed funding, up to ₹20 lakh (provided in four equal instalments), will be offered to startups recognised by JKEDI. This seed funding support will have a cap of 25 startups per year, aligning with budget constraints and the goal of effectively supporting a manageable number of startups.The government aims to establish 2,000 startups over the next three years. While prioritising quantity, the administration emphasises supporting a smaller number of carefully selected startups with seed funding.

What prevents a business from scaling sustainably?

School kids are familiar with the word ‘scale’ and most use it interchangeably with ‘ruler’. Technically they are wrong because scale and ruler are not the same. Simply put, a scale is a unit measured through a series of marks on a measuring tool or device, such as a ruler.Ensuring consistent product or service quality while scaling is vital. Quality control and customer satisfaction must not be compromised. Cash Flow Management: Rapid growth can strain cash flow. Managing expenses and revenue to avoid cash flow problems is crucial.

Karnataka Vikas Grameena Bank launches ‘Vikas Spoorty’

Scheme provides a hassle-free loan without collateral security and surety to meet the needs of small entrepreneurs, says KVGB’s Chairman Shreekanth M Bhandiwad Karnataka Vikas Grameena Bank (KVGB) has launched a new loan scheme called ‘Vikas Spoorty’ to strengthen the rural credit delivery system and also to motivate the common man to take up income-generating activities on a smaller scale. Launching this scheme in Dharwad, Shreekanth M Bhandiwad, Chairman of KVGB, said this scheme is a hassle-free loan without collateral security and surety aimed at meeting the genuine credit needs of small entrepreneurs. It links repayment of the loan to the small amounts contributed by them on a daily basis to their ‘Daily Deposit’ scheme of the bank (pigmy account) at their doorsteps. The loan accounts of such customers often become overdue not because of any intentional wilful default on their part, but because of the difficulty faced by them in visiting branches frequently to make repayment of small amounts. At the same time, on account of the subsistence level of income from their enterprises, they are not in a position to accumulate adequate savings to pay the monthly installment in one lump sum, he said. Customers who intend to take up income-generating activities such as manufacturing, retail trade, small business, artisan activity, handicrafts, and farm activities such as small dairy, poultry, sheep and goat units will be considered for extending need-based credit, he said. Under this scheme, people may avail a minimum loan of ₹50,000 and a maximum of ₹2,00,000. But the customer shall open a ‘Daily Deposit’ (pigmy) account and contribute regularly to it to service the repayment of instalment and interest for the loan, he added.

‘Shark Tank India’ judge Namita Thapar silences trolls who claimed she succeeded with ‘daddy’s money’

‘Shark Tank’ judge Namita Thapar recently silenced her naysayers with witty rebuttals on Reddit. The entrepreneur, who recently held an ‘Ask Me Anything’ session on Reddit, was initially taken aback when a Reddit user attacked her personally, stating that she would be nowhere with “Daddy’s money,” thereby implying that the entrepreneur owes her massive wealth to he father Satish Mehta, who found Emcure Pharmaceuticals. Instead of losing her cool, Thapar had a befitting reply for her hater. “I am a CA (first attempt)...MBA ...fantastic credentials ...I'm sure I would do just fine even without daddy money my friend!"Although the ‘Shark Tank India’ judge was backed by some users, one of them asked her how she could guide budding entrepreneurs on how to build their businesses, if she did not build her empire from scratch, to which the Thapar Entrepreneur Academy founder replied, “Scaling a family business requires an entrepreneurial mindset too. ”Before signing off, Thapar advised followers to check out the investments she mentioned in ‘Shark Tank India.’ "Check out my 18 investments in Season 1 and 16 in Season 2 (so far)...they are all diverse industries....the business has to excite me and i have the humility to back out where I feel I can't add value," she wrote. "But yes I am a 'selective' investor... that's my unapologetic style." One of the most celebrated names in India Inc. Thapar is the Executive Director of Emcure Pharmaceuticals. She is also a member of the jury at the popular startup-focused reality TV show ‘Shark Tank India’.Thapar is an alumna of the prestigious Fuqua School Of Business, Duke University. She has a networth of Rs 600 crore.

Vice-Chancellor Position Available at Central University; Pay: ₹ 2.10 Lakh

The deadline for registering to apply to be appointed vice-chancellor of Babasaheb Bhim Rao Ambedkar University (BBAU), Lucknow, has been extended by the Ministry of Education. The following websites have the advertisement and the application: https://www.education.gov.in and www.bbau.ac.in.The application form must be submitted by April 14, 2024. The monthly salary for this position is ₹ 2,10,000, plus a ₹ 11,250 Special Allowance in addition to other regular benefits. The terms and conditions outlined in the Act, University statutes, and ordinances will apply to the services. According to the official announcement, "As the head of both the academic and administrative departments, the vice-chancellor is expected to be a visionary who possesses demonstrated leadership qualities, administrative skills, and credentials in teaching and research." A minimum of ten years of experience as a professor in a university system or in a comparable role in a reputable research and/or academic administrative organization are required, as well as an exceptional academic record throughout. Preferably, the applicant shouldn't be older than 65." The BBAU Act of 1994 established Babasaheb Bhimrao Ambedkar University (BBAU) in Lucknow, a central university. Selection will be based on a list of candidates suggested by a committee established in accordance with the BBAU Act, 1994.

Karnataka Vikas Grameena Bank launches ‘Vikas Spoorty’

Karnataka Vikas Grameena Bank (KVGB) has launched a new loan scheme called ‘Vikas Spoorty’ to strengthen the rural credit delivery system and also to motivate the common man to take up income-generating activities on a smaller scale.Launching this scheme in Dharwad, Shreekanth M Bhandiwad, Chairman of KVGB, said this scheme is a hassle-free loan without collateral security and surety aimed at meeting the genuine credit needs of small entrepreneurs. It links repayment of the loan to the small amounts contributed by them on a daily basis to their ‘Daily Deposit’ scheme of the bank (pigmy account) at their doorsteps. The loan accounts of such customers often become overdue not because of any intentional wilful default on their part, but because of the difficulty faced by them in visiting branches frequently to make repayment of small amounts. At the same time, on account of the subsistence level of income from their enterprises, they are not in a position to accumulate adequate savings to pay the monthly installment in one lump sum, he said. Customers who intend to take up income-generating activities such as manufacturing, retail trade, small business, artisan activity, handicrafts, and farm activities such as small dairy, poultry, sheep and goat units will be considered for extending need-based credit, he said. Under this scheme, people may avail a minimum loan of ₹50,000 and a maximum of ₹2,00,000. But the customer shall open a ‘Daily Deposit’ (pigmy) account and contribute regularly to it to service the repayment of instalment and interest for the loan, he added.

The Mom Co.s Mompreneurs Show announces winners: HT CEO Praveen Someshwar mentored them

As The Mompreneurs Show finalised the winners among the mom-led startups, HT Media MD and CEO Praveen Someshwar held a masterclass as a distinguished mentor for the final set of mom entrepreneurs. Praveen shared his real-life learnings from his time in Pepsi to Hindustan Times, experiences and advice about building brands.The Mompreneurs show is a hunt for India's top mom-led startups. Fever FM and Radio One are the radio partners. Startup India, the government's nodal body to support Startups, was among the support partners. The Mom Co. is the sponsor of Mompreneurs. Stride Ventures, a renowned venture debt fund, joined the show promising the winner $10,000 cash prize in the form of a grant over and above the cash and media assets of ₹1 crore that the Good Glamm Group has committed for the winners. During his mentorship masterclass, Praveen Someshwar was asked several questions on brand building, growth, investing in branding versus performance marketing, investment and strategic landscape etc. Before joining the Hindustan Times, Praveen Someshwar led PepsiCo's business in the food and beverage sector across Asia. Previously based in Hong Kong, he managed all PepsiCo businesses across Asia, excluding China and India.As per the data released by the National Statistical Office, retail inflation in the food basket was at 8.66 per cent in February, marginally up from 8.3 per cent in the previous month. The Reserve Bank of India has been tasked by the government to ensure retail inflation remains at 4 per cent with a margin of 2 per cent on either side. Last month, the central bank projected the CPI inflation at 5.4 per cent for the current fiscal (2023-24) and recorded at 5 per cent in January-March quarter.

Director of Program Hiring at IIT Delhi, Pay: ₹ 2.67 Lakh

Applications are being accepted by IIT Delhi for contract positions in a number of projects. For more information, interested and qualified candidates should visit the institute's official website. March 18, 2024 is the deadline to show up for the walk-in test/interview. Contractual or consolidated pay appointments will be made, and these will be renewed annually for the length of the project. "Applications are invited for dynamic individuals to manage the operations and to establish linkages with the industry," states the official notification from IIT Delhi. For the positions of Program Director (1) (Academic and Operations) and Program Director (1) (Partnerships and Development), the institute has called for qualified candidates. Candidates must possess a PhD with first class standing or its equivalent from a previous degree in the relevant field and a stellar academic record overall in order to be considered for the position of Program Director (1) (Academic and Operations). a minimum of ten years following a doctorate in teaching, research, or industry, along with an outstanding publication or exceptional industry experience, It would be ideal to have a highly skilled engineer or technician with a first-class MSc or MTech and at least ten years of experience. The preference will go to candidates with an MBA from a reputable university, or with previous experience managing international programs in a learning environment, outstanding communication skills in English, and proficiency with Microsoft Office or a comparable program. Salary ₹ 1,44,000-1,54,000-1,64,000-1,77,000-1,90,000-2,03,000-2,19,000-2,35,000-2,51,000-2,67,000/per month will be the Program Director's monthly allowance.

Navigating Child Support in Texas: A Comprehensive Guide

Child support is a critical component of family law in Texas, designed to ensure the financial well-being of children even when parents are no longer together. Whether you’re initiating child support proceedings for the first time or seeking adjustments to existing arrangements, a thorough understanding of the process is essential. In this comprehensive guide, we’ll dive deeper into key aspects of child support law in the state of Texas, covering who pays, why it’s ordered, how amounts are determined, and more.In the state of Texas, the responsibility of providing financial support for children falls on both parents, regardless of their marital or relationship status. Typically, the parent without primary physical custody is ordered to pay child support. This obligation persists until the child reaches the age of eighteen or graduates from high school, whichever occurs later. Understanding this fundamental responsibility is crucial for parents navigating the complexities of child support in Texas. It not only underscores the legal obligation but also emphasizes the importance of ensuring the child’s needs are met even in the wake of familial changes. Being sued by the Texas Attorney General’s Office for child support, medical support, back child support, or paternity can be a complex and intimidating process. In such situations, having experienced legal representation is paramount to protect your rights and interests. Our law firm specializes in representing both mothers and fathers in these cases, ensuring that your side of the story is effectively communicated and your rights are safeguarded. Appearing in IV-D Courts in Texas without proper legal guidance can be overwhelming, making it imperative to consult with experienced attorneys who understand the intricacies of child support proceedings. While the Texas Family Code provides guidelines for determining child support, the court has the discretion to consider various factors. These factors go beyond mere financial considerations and include the child’s age, financial needs, each parent’s ability to contribute, available financial resources, time spent with the child, childcare expenses, and whether either parent has custody of another child. By comprehensively evaluating these factors, the court aims to make decisions that prioritize the “best interests of the child.” This overarching principle ensures that the child’s well-being remains at the forefront of any child support determination. Navigating the intricacies of child support orders involves understanding the legal definitions of a parent. In Texas, a legal parent includes the child’s mother, a married man presumed to be the child’s father, a court-determined biological father, someone who signed an Acknowledgment of Paternity (AOP), or an adoptive mother or father. This broad definition forms the basis for establishing child support obligations. Child support orders are integral to family law cases involving children, covering scenarios such as visitation, child custody, paternity establishment, and legal naming of a child’s father. The primary goal is to provide financial stability for children growing up in single-parent households, emphasizing the legal duty of all parents to support their children. The duration of child support varies based on circumstances. In Texas, a court may order support until the child turns 18, graduates from high school, marries, is emancipated by court order, or remains disabled. This flexibility ensures that child support obligations are tailored to the specific needs of the child and the circumstances of the parents. In cases where the child is disabled, the court may order a parent to provide financial support indefinitely. This underscores the commitment of the legal system to ensure that children with special needs continue to receive the necessary care and assistance.