Top Trending StartUps News & Highlights

Medibuddy reports FY25 revenue of Rs 725 Cr, reducing losses by 37%.

MediBuddy, a digital healthcare platform, reported a little increase in its operational scale in FY25 after growing by more than two times in the fiscal year that ended in March 2024. Nonetheless, the business was able to reduce its losses by 37% over that time. According to MediBuddy's annual financial records submitted to the Registrar of Companies (RoC), the company's operating revenue increased 12.3% year over year to Rs 724.6 crore in FY25 from Rs 645.4 crore in FY24.MediBuddy is a digital healthcare business that offers insurance services, lab testing, procedures, online and offline medical consultations, and medication delivery. Together, these services' revenue of Rs 722 crore continued to be the company's main source of income, with additional operating sources contributing Rs 2.5 crore. The company's total income in FY25 was Rs 743 crore after earning Rs 18.42 crore from non-operating sources, such as interest on current assets and fixed deposits, written-off liabilities, and other miscellaneous income.The cost of materials, which was Rs 333 crore in the previous fiscal year, accounted for the highest portion of total expenses at 38%. Employee benefits costs came next, rising slightly by 8% to Rs 176.8 crore, which included Rs 6 crore in ESOP costs. During the year, sales payout expenses, which include commissions paid to selling agents, decreased by 7% to Rs 155.47 crore. Additionally, the corporation spent Rs 32.5 crore on information technology and Rs 42.5 crore on safety and security. In FY25, additional overheads totalling Rs 138.7 crore included advertising, legal and professional fees, depreciation and amortisation, and financing charges.In the previous fiscal year, the Bengaluru-based company's total expenses stayed constant at Rs 879 crore. The company's losses were reduced by 37% to Rs 137 crore from Rs 215.7 crore in FY24 thanks to controlled spending and a 12% increase in sales.

Published 23 Dec 2025 11:33 PM

Urban Company Receives Penalty Notice and INR 56 Cr GST Demand

GST regulators believed that the startup's services, such painting and appliance repair, were within Section 9(5) of the CGST Act and would need to be taxed appropriately. Urban Company, which intends to challenge the ruling, further asserted that the demand notice will not affect the business's operations or finances. In addition, the GST authorities of Tamil Nadu, Maharashtra, and Haryana have sent the corporation at least three further demand notifications totalling INR 51.3 Cr.Unicorn Urban Company's hyperlocal servicesMaharashtra goods and service tax (GST) authorities have sent Urban Company Datalabs_in-article-icon a tax demand and penalty notice amounting INR 56.4 Cr.Unicorn hyperlocal services Maharashtra GST authorities have sent Urban Company a ₹56.4 crore tax demand and penalty notice for the April 2021–March 2025 period. The notice relates to alleged non-payment of GST on reimbursements to service providers, particularly over services like painting and appliance repair, and contains a primary tax of ₹51.3 crore and a penalty of ₹5.13 crore. Urban Company intends to file an appeal, claiming that the demand won't affect its business operations and that it has a compelling argument. This comes after several tax complaints from several states totalling ₹51.3 crore.

Published 21 Dec 2025 10:23 PM

The founder of Organic Harvest introduces the multi-brand venture RASA Group.

Former D2C brand Organic HarvestOrganic Harvest Datalabs_in-article-icon founder Rahul Agarwal has introduced his new multi-brand company, RASA Group. At the moment, RASA Group runs six verticals:Avani Infratech is a high-end, sustainable real estate and commercial infrastructure developer in Goa and Delhi-NCR. Agarwal told Inc42 that it began approximately four and a half years ago and is currently operating at INR 100 Cr ARR. Sarvagun: It specialises in providing ayurvedic therapies that are supported by evidence. RASA Group operates a boutique hospital in Vasant Kunj under this vertical, and it intends to grow throughout Delhi-NCR and beyond. AdventX is a Jim Corbett adventure vertical that now provides mild adventure activities for all ages, including paragliding and hot air ballooning. In Mahabaleshwar, a second site is under development. Friday Night Cars: It imports luxury American vehicles, changes their left-hand drive to right-hand drive, and then sells them to Indian HNIs.Jee Bhar Ke is a food and beverage vertical with four locations, rapid commerce, and a central kitchen. NexGen Drycleaners: Using a hub-and-spoke architecture, it seeks to organise the historically unstructured dry cleaning industry so that clients can track clothing and manage orders via the app for a more efficient experience.Each of these verticals was added at a different time. Sarvagun is the newest vertical introduced by the RASA Group, whereas Avani Infratech is the oldest. "I've been working on this informally for the past four years, and each brand began at a different moment. However, all of the brands were recently consolidated under one roof, according to Agarwal. Avani Infratech, Jee Bhar Ke, and NexGen Drycleaners are currently the main emphasis since they can be quickly scaled up, Agarwal said, adding that all the verticals are commercially functioning.

Published 04 Dec 2025 05:53 PM

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/images/post_image/693058a82ccf4.webp)

![[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1](https://watstrending.com/assets/images/logo.png)

[Update] Aequs IPO: Issue Subscribed 3.4X On Day 1

Aequs’ IPO opened to robust demand on Day 1 with the issue getting oversubscribed 3.4X. Investors placed bids for 14.4 Cr shares against the 4.2 Cr shares available. The strong subscription came from retail investors, who oversubscribed their allotment 11.46X. These investors submitted bids for 8.81 Cr shares against 76.91 shares reserved for them. The non institutional investor (NII) part was oversubscribed 3.4X, with these investors submitting bids for 3.92 Cr shares against 1.15 Cr shares on offer. Within this, investors with a bidding sum of over INR 10 Lakh applied for 2.2 Cr shares, while those bidding for shares between INR 2 Lakh to INR 10 Lakh applied for 1.7 Cr shares.Meanwhile, the qualified institutional buyers (QIBs) were also active on day one, subscribing their quota by 66%. In contrast to the 2.26 Cr shares set aside for them, these investors bargained for 1.5 Cr shares. Foreign institutional investors bid for 1.48 lakh shares under the QIB segment. The employee quota was exceeded 6.7X, garnering bids for 12.57 shares against 1.87 Cr shares authorised for them.Contract manufacturing company AequsAequs Datalabs_in-article-icon initial public offerings (IPO) launched on a strong note today, getting oversubscribed within hours of opening. As of 13:15 IST, the offering received bids for 7.32 Cr shares against the 4.20 Cr shares available for subscription. This corresponds to an oversubscription of 1.72X. Leading the way were retail investors, who bid for 5.54 Cr shares instead of the 76.92 Lakh allotted for them, oversubscribing their quota 7.2X. Additionally, non-institutional investors (NIIs) overloaded their stake by 1.63X, placing bids for 1.88 Cr shares as opposed to the 1.15 Cr shares that were set aside for them. Employees of the company have also placed bids for 8.21 lakh shares, exceeding their stake by 4.42 times.As is customary with IPOs, qualified institutional buyers’ (QIBs) showed the least interest in Aequs’ public float on day one. These investors bid for 1.09 Cr shares against the 2.26 Cr shares on sale, equivalent to a 48% subscription. Aequs’ IPO contains a fresh issue of shares worth up to INR 670 Cr and an offer for sale (OFS) component of up to 2.03 Cr shares. Through OFS, investors like Amicus Capital, the Dempo family trusts, Ravindra Mariwala, and Raman Subramanian will sell their shares. Yesterday, December 2, the contract manufacturing company raised INR 413.9 Cr from anchor investors. As many as 33 investors subscribed to 3.3 Cr equity shares, of which around 57% shares were lapped by domestic mutual funds.

Published 03 Dec 2025 09:06 PM

StartUps

StartUps are the backbone of any country and in any Industry as these are the new ventures which entrepreneurs establish and then contribute to the nation growth and progress. The stratups will then grow and become unicorns and create thousands of employments in different sector boosting the economy and take it to the next level.

Grand Anicut's INR 100 Cr Debt Is Captured by WayCool

Waycool, the Chennai-based agriculture supply chain startup, has raised Rs 100 crore (approximately $12 million) in debt funding from Grand Anicut. In the past two years, this is the company's first significant infusion. According to the board's regulatory filing obtained from the Registrar of Companies (RoC), it plans to raise Rs 100 crore or $12 million by issuing 1,000 Series B6 debentures at an issue price of Rs 10,00,000 per. With a duration of 18 months, the debt has an annual coupon rate of 18%. According to the documents, the corporation intends to use the money for continuing commercial activities. For Waycool, this financing deal represents a major victory because the business has had difficulty raising capital in an equity round. Founded by Jayaraman KarthikWith an eye toward profitability by July of this year, the corporation also fired 200 employees across divisions in an effort to reduce costs. In FY23, Waycool's operating revenue increased by 62% to Rs 1,251 crore, but its losses increased by 89% to Rs 685 crore in the same time. It has not yet submitted its FY24 annual report. The lack of equity funding for agritech businesses is emphasized by Waycool's debt financing. Notably, over the previous several years, three companies—Waycool, Dehaat, and Ninjacart—have been on the verge of becoming unicorns. Still, the industry hasn't produced its first unicorn. TheKredible, a startup data analytics platform, reports that in 2024, agritech will continue to be among the least financed industries, with over 30 firms raising just $150 million.

Following the CEO's proposal to invest $100 million in a healthcare venture, PB Fintech gains 4%.

SUMMARY PB Fintech is anticipated to obtain board permission before making a one-time investment of $100 million to acquire a 30% share in a startup healthcare company. With a price target of INR 1,750 per share, brokerage company Bernstein has maintained its "outperform" rating on PB Fintech. In Q1 FY25, PB Fintech reported a consolidated net profit of INR 59.98 Cr, up from a loss of INR 11.9 Cr in the same quarter the previous year.In intraday trading today (September 30), shares of PB Fintech, the parent company of PolicyBazaarPolicyBazaar Datalabs_in-article-icon and Paisabazaar, increased by more than 4% to INR 1,715.40 apiece on the BSE following confirmation by chairman and group CEO Yashish Dahiya that the company is contemplating a move into the healthcare industry.After receiving board permission, PB Fintech is probably going to invest $100 million one time to purchase a 30% interest in a startup healthcare company, Dahiya said CNBC-TV18.A middle-class individual cannot afford to pay INR 78,000 per night for a bed, according to Dahiya, who also explained the company's decision to enter the healthcare industry. She added that PB Fintech's goal is to close the gap between hospitals and insurance providers. Last week, rumors of PB Fintech's intentions to enter the healthcare industry started to circulate. According to a September 27 exchange filing, Dahiya indicated on the most recent analyst call that the business was considering plans to join the healthcare industry.Investors have received enormous profits from PB Fintech since its 2021 public debut. The stock has increased by 42% from its listing price of INR 1,150 per share and by more than 67% from its INR 950 issue price. So far this year, it has increased by more than 107%.With a price objective of INR 1,750 per share, brokerage company Bernstein kept its "outperform" rating on PB Fintech last week. This suggests that the stock may rise by approximately 7% from its previous closing.The brokerage observed that the stock's fast growth, solid business plan, and cash generation had made investors optimistic about it. There's good cause to be optimistic. For the months of April through June, PB Fintech reported its third consecutive profitable quarter. In contrast to a loss of INR 11.9 Cr in the same period last year, the company reported a consolidated net profit of INR 59.98 Cr in the first quarter of the financial year 2024–25 (FY25).

Gharda Chemicals will create a new foundation to support entrepreneurs.

The foundation, which was established in collaboration with the Anjani Mashelkar Foundation, will support business owners who are committed to producing healthcare and core engineering innovations with a social conscience.The Mumbai-based company Gharda Chemicals, which produces polymers, veterinary medications, and insecticides, announced in a statement that it has established the KHG Innovation Foundation to support innovators developing technology that may close gaps and improve societal results.The foundation, which was established in collaboration with the Anjani Mashelkar Foundation, will support business owners who are committed to manufacturing healthcare and core engineering innovations with a social conscience.According to Nilesh Kulkarni, director of Gharda Chemicals, "the foundation is funded by Gharda's (founding chairman and managing director Keki Hormusji Gharda) personal wealth and the profits from the holding company." Gharda Medical and Advanced Technologies is the holding corporation.The non-profit foundation would have an initial endowment of about ₹30 crore, which will be refilled annually. The foundation has two options: it can invest or give grants to business owners. It will first concentrate on medical technology.mentoring and direction In addition to funding, the foundation will give the entrepreneurs access to mentorship, direction, and strategic counsel from thought leaders and industry professionals. Additionally, the announcement stated that KHGIF would "have tailored programs that support both for-profit and not-for-profit enterprises alike and drive pilot projects to help innovators scale for impact." India has set out to become a global leader in manufacturing and has started the process of becoming a developed nation in the near future. We think that attaining such status will require a strong emphasis on entrepreneurship together with innovation. Gharda, who turned 95 on Wednesday, stated in the statement that "establishing KHGIF is one among several such efforts that would be required as we proceed towards developing that capability."

CoinDCX Launches Web3 Mode To Make Crypto Purchases In INR Easier

OVERVIEW Users will have access to over 50,000 pre-launch, trending, and upcoming DeFi tokens thanks to the Web3 integration. Through the CoinDCX app, it will make it easier to buy and transfer tokens like Ethereum (ETH), MATIC, Tether (USDT), and USD Coin (USDC) in Indian rupees. In addition, CoinDCX has revealed a points airdrop to thank its current users.Moreover, the Web3 mode makes Web3 easily accessible through a simple INR on-ramp. Through the traditional CoinDCX app, users can purchase tokens such as ETH, Matic, USDT, USDC, and more using INR. These tokens can then be transferred to Web3 Mode for the purpose of acquiring assets within Web3.Users will be able to access pre-launch and emerging tokens from big and developing ecosystems including Base, Solana, Binance Smart Chain, Polygon, and ten more chains via the Web3 mode. Moreover, the Web3 mode makes Web3 easily accessible through a simple INR on-ramp.On June 25, cryptocurrency market CoinDCX revealed that its app has integrated Web3 mode, allowing users to access over 50,000 decentralized tokens in an INR-friendly format. According to CoinDCX CEO and co-founder Sumit Gupta, 15 million customers of the exchange can now use Web3 more easily thanks to this connection.Users will be able to investigate and purchase coins that aren't currently listed on centralized exchanges using the Web3 method.The group has been attempting to delve further into Web3. We are adamant about our goal of making Web3 and cryptocurrency more approachable and available to all Indians. This is significant to us since not many businesses or goods have that level of functionality worldwide. Making it is really difficult," Gupta said to Moneycontrol.Using its own SDK, Okto stack, CoinDCX was able to accomplish this integration, he claimed. With this integration, accessing Web3 offerings no longer requires 10 steps—just one click within the app. "We worked on the integration of this feature in the background for three to four months after we finished building it."

Jio Appoints Sidharth Kedia, Former CEO of NODWIN Gaming, To Lead Gaming Vertical

OVERVIEW Kedia left Nazara-backed NODWIN Gaming in October of last year, and in June she became the head of JioGames and senior vice president. Kedia has worked for Reliance Group twice. In order to promote its cloud gaming platform, Jio last year signed a 10-year strategic relationship with the French company Gamestream, whose partners include Ubisoft.Sidharth Kedia, a former NODWIN Gaming CEO, has joined Reliance Jio's JioGames gaming platform as its leader.Kedia left Nazara-backed NODWIN Gaming in October of last year, and in June she became the head of JioGames and senior vice president."I had joined RIL's media division in 2015." Jio was nearing the end of its development. I was asked by the chairman's office to oversee the PMO for the Jio "friends and family" launch in December 2015. Looking back, I'm incredibly proud to have been a part of this historic project, Kedia posted on LinkedIn."After ten years, I'm thrilled to be welcomed back into the RIL family and given the chance to grow Jiogames and create the massive gaming empire that India has been waiting for," he continued.It is important to remember that he left Reliance following his initial term there in 2019 and joined NODWIN Gaming, while listed gaming behemoth Nazara purchased the majority of the former in 2018. During his tenure, NODWIN Gaming expanded to become one of the top esports organizations in the nation, branching out into genres other than only competitions. Given the appointment, JioGames may now actively promote its fresh initiatives in the market. Jio's gaming section, led by Mukesh Ambani, intends to cater to both game producers and players.

Shares of Mamaearth Parent Honasa Fall 4% Following Significant Block Deal

SUMMARY: After closing at INR 457.70 last time, the shares opened at INR 440.60 per. The price of the shares at 10:00 AM on Tuesday was INR 441.35. Exchange data shows that 66.2 lakh shares, or 2% of the equity, were exchanged in a block deal.After 66.20 lakh shares, valued at Rs 439 each, were swapped in a block deal for Rs 291 crore, the shares of Honasa Consumer, the company that owns Mamaearth, fell 4%. Both Fireside Ventures and Sofina Ventures, who both own sizeable investments in Honasa Consumer, were probably the sellers in the purchase, which amounted to a 2% ownership. Tuesday saw a 4% decline in the value of Honasa Consumer's shares, which operates Mamaearth, following a block transaction involving the transfer of 66.20 lakh shares. A total of Rs 291 crore was transacted in this deal, which was completed at an average price of Rs 439 per share. It is the same as owning 2% of Honasa Consumer, Mamaearth's parent company.According to media sources, Sofina Ventures and Fireside Ventures were most likely the sellers in this deal. According to the most recent holdings data, Sofina Ventures owned 6.16% of Honasa Consumer's shares, while Fireside Ventures Investment Fund held 5.28% of the firm.

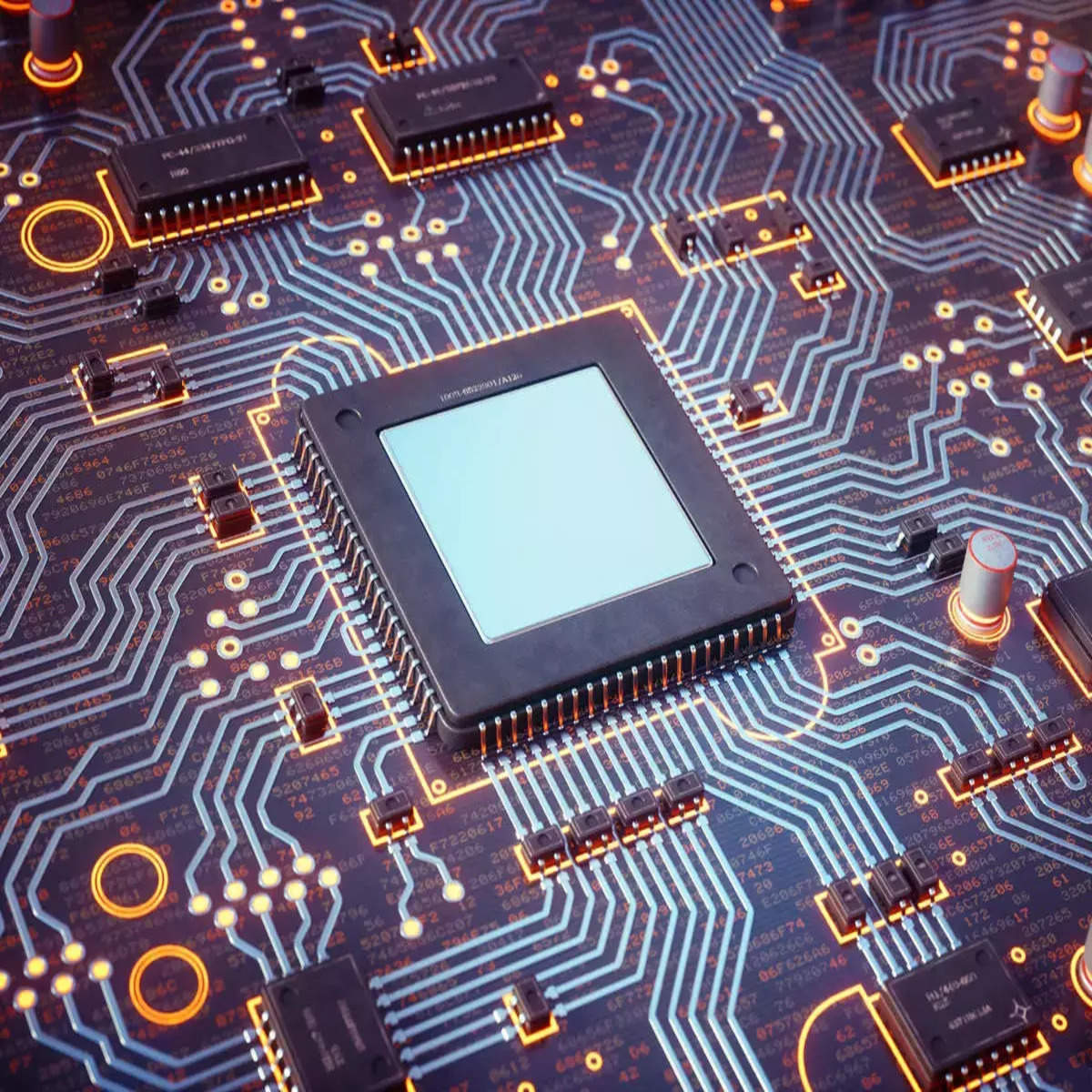

India's Semiconductor Hub May Eventually Become Bengaluru-Mysuru Kant, Amitabh

OVERVIEW According to Kant, the geographic belt is the most practical location for semiconductor manufacturing facilities because it provides a consistent supply of materials and electricity. He continued by saying that the current union government's main priority for the next five years will be to train young people in cutting-edge technological fields. According to Inc42, by 2030, the rapidly expanding Indian semiconductor market is expected to surpass $150 billion.The Bengaluru-Mysuru belt of Karnataka, according to former CEO of NITI Aayog and G20 Sherpa Amitabh Kant, provides the "best" ecosystem in India for semiconductor design and manufacture.Speaking on Thursday, June 6, at the India Global Innovation Connect event in Bengaluru, Kant stated that the region is the most practical place to build semiconductor fabrication facilities because it has a consistent supply of minerals and electricity."In India, the Bengaluru-Mysore belt of Karnataka has the best ecology (for semiconductor production) of any place. This requires minerals, water, and a consistent supply of energy, all of which are present in the area. Therefore, the belt might be the ideal location to advance both production and become the global hub for design, Kant continued. The former CEO of NITI Aayog stated that Bengaluru and Hyderabad already accounted for around 30–35% of India's current semiconductor design, and that the region could potentially design semiconductors for businesses worldwide.In response to a query concerning the planned location of the nation's first tech park centered around quantum computing, Kant stated that Karnataka was "no better place" to create a center for the cutting edge technology. According to Kant, the present union government's main priority for the ensuing five years will be equipping young people with skills in cutting-edge technology."This current government's primary focus for the next five years will be fully on apprenticeship and skill development. It won't just focus on the information technology industry; it will also address the creation of new jobs in developing fields, Kant continued.Additionally, he stated that more upskilling startups were required to assist in educating aspiring engineers in fields with great demand and developing technology. "More engineers are needed to help create the next generation of Indian enterprises. We need at least two million engineers with expertise in cutting-edge fields like data analytics and artificial intelligence for that. In order to close the supply gap, engineering colleges' curricula must be reorganized, realigned, and reoriented toward contemporary demands. Kant continued, "And this needs to be done rapidly.With initiatives like the INR 6,000 Cr India's Quantum Computing Mission and the INR 76,000 Cr Production-Linked-Incentive (PLI) scheme for semiconductor manufacturing, the Center hopes to capitalize on emerging technologies to drive the nation's product economy, advance the next stage of innovation, and support the startup ecosystem. The Tata Group recently announced the establishment of a semiconductor ATMP (a mix of assembly, testing, marking, and packaging) unit in Assam, at an estimated cost of INR 27K Cr, in response to these scandals.

DroneAcharya's Operating Revenue Soars 90%, Net Profit Doubles To 6.2 Cr in FY24

SUMMARY DroneAcharya's operating revenue climbed from INR 18.56 Cr in FY23 to INR 35.19 Cr in FY24, an almost 90% rise. The firm ascribed this rise to the business's constant and steady expansion as a drone solution supplier and drone-focused training institution. The startup's overall revenue increased to INR 37.35 Cr in FY24 from INR 19.13 Cr the previous year, including other revenues.In the fiscal year 2023–24 (FY24), the drone startup DroneAcharya Aerial Innovations, based in Pune, declared a consolidated profit after tax (PAT) of INR 6.2 Cr, over two times higher than the INR 3.42 Cr recorded in the same period of the previous fiscal year.Operating revenue for DroneAcharya climbed by about 90% from INR 18.56 Cr in FY23 to INR 35.19 Cr in FY24. The company's continuous and consistent growth as a drone solution provider and drone-centric training organization was credited by the startup for this increase.DroneAcharya, established in 2017 by Prateek Srivastava, provides a range of drone solutions for data processing, multi-sensor drone surveys, and pilot training, among other uses. Last year, the business ventured into the production of drones. In July 2023, it entered into a commercial production, assembly, and export agreement for drones and related goods with Gridbots Technologies, a robotics business based in Gujarat.The startup's overall revenue increased from INR 19.13 Cr to INR 37.35 Cr in FY24 when other income was factored in."At the moment, DroneAcharya is the top and most innovative DGCA-certified drone pilot training provider in India for the private sector. The company added in a statement that it has also made great progress in securing several international drone service projects, valuable industrial relationships with drone manufacturers, investments in drone-related businesses, and acquisitions of value-adding enterprises in India and throughout the world. DroneAcharya operated two DGCA-certified drone pilot training facilities in Pune and Gujarat up till last year. The corporation added two more new centers at IIT Ropar in Punjab and Jaipur in FY24, doubling the number. "The introduction of our line of type-certified agricultural spraying drones will be our first rollout for FY25. We are also steadily advancing internationally, emerging as one of India's foremostNoteworthy is the fact that DroneAcharya Aerial Innovations received an order earlier this year from the Adani Group to offer drone pilot training certified by the Directorate General of Civil Aviation (DGCA). Additionally, it obtained a contract in January from the Indian Army to supply advanced drone training and capacity building at the Mechanized Army Courses Group in Ahmednagar. It entered into an agreement with Vimaan Aerospace in February to supply drones, as well as services and training linked to drones.

WinZo announces selection of 18 gaming startups to represent India at Gamescom Latam

The games that are included come in a variety of categories and genres, such as chess, racing, physics-based challenges, cricket, riddles, and racing games. Eighteen gaming businesses have been chosen by the vernacular skill gaming platform WinZO and the Department for Promotion of Industry and Internal Trade's (DPIIT) Startup India to represent India at Gamescom Latam, one of the biggest games exhibitions in the world. Games from a variety of categories and genres are included on the list, such as chess, racing, physics-based challenges, cricket, riddles, and racing games. According to the organization, these businesses are based in both bigger cities like Nashik and smaller ones like Hyderabad, Chennai, Pune, Kolkata, Bengaluru, Mumbai, and Delhi NCR. The titles that have been chosen include the cross-platform game Gods Of Cricket, the role-playing game Tanhaji The Maratha Warrior, the first-person survival horror game Kamla: Indian Exorcism, the narrative-driven 3D action-adventure game Unsung Empire: The Cholas, and the action role-playing game Frontier Paladin. The list also includes Kurukshetra: Ascension, an epic strategic card warfare game, Mr. Racer, a racing game for cars, Spook-A-Boo, an arcade game, and My Dream House, a casual Match3D+Decor game. Other games include the real-time chess game Tale of Honor, the shooter game Laser Tanks, the tile-matching game Timmy's Toy Rush, the puzzle game DetectiveIQ, the cricket game Bharat Cricket Premier League, the adventure game Mumbai Gullies, the hypercasual action game Elemental Escape, and the simulation game Tea Garden Simulator, which allows users to build and run their own tea empire. WinZO stated that a panel of seasoned industry professionals, including Suresh K Reddy, the Indian ambassador to Brazil, and Rohit Kumar Singh, the former secretary of the Indian government, chose the games from a pool of more than 100 technology and gaming businesses and technological institutes. (Fundação Getulio Vargas' São Paulo School of Business Administration) were also part of the panel. "India is positioned to lead the way in technical innovation because to its foundation of cutting-edge inventions and dedication to developing domestic talent. In a statement, Singh stated, "WinZO exemplifies this trajectory, harnessing the power of Indian creativity and technology to impact the global stage significantly." India's entry into LATAM, propelled by the export of technology and intellectual property, opens up new opportunities for our technology entrepreneurs, according to Rajesh Kumar Singh, Secretary, DPIIT. Developers who participate in this program pursue their goals and help India become a global leader in technology exports."

By issuing bonds, Navi Finserv, owned by Sachin Bansal, raises INR 150 Cr.

SUMMARY: The investors include Rishad Kairus Dadachanji, Pervin Kairus Dadachanji, and Kairus Shavak Dadachanji, the chairman of the Dadachanji Group, who have contributed INR 110 Cr. This occurs months after the loan startup declared its intention to use NCDs to raise INR 600 Cr. Cofounded in 2012 by Sachin Bansal and Ankit Agarwal, Navi Finserv specializes in lending products such as home, auto, and personal loans.Navi Finserv, a fintech unicorn run by Sachin Bansal, reportedly obtained INR 150 Cr through the issuing of bonds from six individual investors, following the company's announcement months earlier of aspirations to fund up to INR 600 Cr through the issuance of Non-Convertible Debentures (NCDs).An hour ago

INR 21.6 Cr From Lightspeed To Pivot To Beauty Consultations For EkAneks Foxy Bags

SUMMARY: EkAnek passed a special resolution allocating 31,638 CCPS at a cost of INR 6,827.4 per to Lightspeed India, amounting to INR 21.6 Cr in total. Also, the business increased the number of stock options in its ESOP pool by 7,520, to 29,657. Foxy is an online store that was established in 2018 and offers a large selection of cosmetics, grooming, and beauty products.INR 21.6 Cr from Lightspeed to Pivot to Beauty Consultations for EkAnek's Foxy Bags. Parent company EkAnek of the beauty e-commerce platform Foxy has secured INR 21.6 Cr ($2.5 Mn) in a strategic financing round led by current investor Lightspeed India.

Indian startups have advanced significantly during the past five to ten years: Co-founder of Urban Company

NEW DELHI: Over the past five to ten years, Indian companies have made significant progress thanks to the government's Startup India program and other efforts.In the last five to ten years, Indian startups have made significant progress. The co-founder of an urban company"When I started 10 years back, we were a small ecosystem and the country had only one unicorn," Bhal said to IANS during a conversation. We are a today'sIn the last five to ten years, Indian startups have made significant progress. The co-founder of an urban company. In terms of unicorn count, the Indian Startup Ecosystem ranks third globally as of May 2024, with a total valuation of $349.67 billion.Speaking at the 'Vishesh Sampark Abhiyan', the co-founder said that the Startup India initiative helped "us brainstorm for hours and create a highly c https://www.dtnext.in/indian-startups-have-come-a-long-way-in-the-last-5-to-10-yrs-urban-company-co-founderThe co-founder claimed during the "Vishesh Sampark Abhiyan" that the Startup India program enabled "us think for hours and design a highly powerful

MeitY Secretary Indias AI Regulations Won Stop Innovation

OVERVIEW According to S Krishnan, the government would prepare the legislation for artificial intelligence using the same methodology used to draft the DPDP Act. According to the MeitY secretary, India may have an advantage over other countries by enacting AI legislation later since it may examine and absorb the lessons from the mistakes made by others. The proposed AI legal framework is expected to be published by July of this year, according to statements made earlier this year by Rajeev Chandrasekhar, the minister of state for MeitY.Artificial intelligence (AI) would be regulated by the Center so as not to inhibit innovation in the field, according to S Krishnan, secretary of the Ministry of Electronics and Information Technology (MeitY).Before being made available to users on the Indian internet, all large-language models (LLMs), software that uses generative AI, artificial intelligence (AI) models, and algorithms that are being tested, in beta testing, or unreliable in any other way are required to obtain the "explicit permission of the government of India."On March 1, the ministry of electronics and information technology (MeitY) released a late-night advisory—a first for the entire world. It requested that all platforms make sure that their use of AI, generative AI, LLMs, or any other kind of algorithm "does not permit any bias or discrimination or threaten the integrity of the electoral process."Friday's advise, though not legally obligatory, is "signalling that this is the future of regulation," according to Rajeev Chandrasekhar, the union minister of state for electronics and information technology. "We are requesting that you (the AI platforms) abide by it as an advisory today."

Zomatos Latest Feature Now Enables Users To Make Healthier Decisions

SUMMARY: Using this new function, customers can be gently persuaded to select healthier options, preventing them from subsequently regretting their decision. Additionally, the company increased its platform cost to INR 5 per order last month from INR 4 previously. Zomato also revealed its fourth consecutive profitable quarter earlier in May.Zomato, the foodtech behemoth, has launched a new feature that will assist its consumers in choosing healthier options. This comes only a few days after the company extended its priority delivery services to Delhi, Hyderabad, and Pune.By using this new tool, customers can be gently encouraged to choose healthier options when placing their orders, helping them to avoid regretting their decisions later.Deepinder Goyal, the CEO and founder of Zomato, made the news on X."We just released a new function on Zomato – gently assisting our users in making healthier choices,” the post stated. First off, we've started recommending roti in place of naans."We just released a new function on Zomato – gently assisting our users in making healthier choices,” the post stated. First off, we've started recommending roti in place of naans."We have received tremendously favorable feedback for this functionality, and we are seeing a 7% attach rate for these recommendations. We intend to expand this soon to include additional meals and categories. For instance, when you add a dessert to your basket, we may suggest lower-calorie dessert options if you are in the mood for one," it stated.Zomato is also getting ready to add more meals and categories to this functionality. For example, when a user adds dessert to their cart, they may be shown alternatives with fewer calories if they are craving it. In addition, the company increased its platform fee from INR 4 to INR 5 each order last month. Zomato also revealed its fourth consecutive profitable quarter earlier in May. In the quarter that concluded on March 31 of the financial year 2023–24 (FY24), the company's consolidated profit after tax increased by 26.8% to INR 175 Cr from INR 138 Cr in the previous quarter. From INR 3,288 Cr in Q3 FY24 to INR 3,562 Cr during the quarter, operating revenue increased by more than 8%. On a quarterly basis, Zomato observed a decrease in the GOV of their meal delivery service. During the quarter under review, its GOV decreased from INR 8,486 Cr to INR 8,439 Cr. Yet, GOV increased 28% year over year.

Venture Catalysts $200 million fund, 9Unicorns, rebrands itself

New Delhi: Rebranding as 100Unicorns, 9Unicorns, a division of the multi-stage investment platform Venture Catalysts Group, has opened its second accelerator fund, targeting $200 million to invest in 200 national businesses.According to Apoorva Ranjan Sharma, managing director of Venture Catalysts Group and co-founder of 100Unicorns, the company intends to announce its first closure by November with the goal of pooling 30–50% of the total fund size.According to Sharma, 100Unicorns would provide early-stage enterprises with initial investments between $250,000 and $1 million in exchange for a 5–10% share. There may be additional opportunities for investments up to $3 million in subsequent rounds.Increasing the need The establishment of the new fund reflects the increasing need for early-stage capital in India, where investors have continued to support nascent businesses in spite of the financial winter. Tracxn data indicates that pre-seed, seed, and Series A funding saw significant growth in 2022 and 2023.Sharma emphasized that between 2015 and 2022, financing for the Indian startup sector increased fifteen times. "In the next ten years, I firmly believe that India will become the 'Startup Nation,' producing the greatest number of unicorns, entrepreneurs, and jobs created by startups."Startups with a $1 billion or higher valuation are considered unicorns. Based on information provided by the company, the Department for Promotion of Industry and Internal Trade (DPIIT) and Tracxn show that, with over 110,000 new enterprises operating nationwide, India currently has the third-largest startup ecosystem globally. There are 111 unicorns in the nation, and their aggregate worth is $350 billion. About 80–85% of the cash for the second fund would be invested in India; the remaining portion will be financed by partners in the US, West Asia, Southeast Asia, and African markets. According to Sharma, there are over 77,000 startups on the African continent, which is still a profitable region.

Ankush Aggarwal Returns To Ola Cabs Ride-Hailing Business Amid Restructuring

Ankush Aggarwal, brother of Ola Cabs founder Bhavish Aggarwal, has rejoined the ride-hailing company following a period with Ola Electric amid organizational changes at Ola Cabs.Ankush Aggarwal is a member of the "CXO team," as the top executive group is internally called.This action follows the resignation of Hemant Bakshi, the company's CEO, a few months after he joined the startup.Bakshi quit his job a month ago. Even though he left Hindustan Unilever to join Ola Cabs in September 2023, the firm announced his appointment in January of this year.According to ET, Aggarwal will have a variety of duties at Ola Cabs, similar to what he did at the manufacturer of electric vehicles. He is also scheduled to take up the position of CEO of Ola Financial Services.He was Ola Electric's chief business officer.Ola has been contacted by Inc42 to provide feedback on the development. The response will determine how the story is updated. It is important to remember that Ola Cabs and Ola Financial Services are separate entities from Ola Electric Mobility, which was established by Bhavish Aggarwal, and are under the ownership of ANI Technologies.In addition to Ankush Aggarwal, whose loan startup Avail Finance was purchased by ANI Technologies in 2022, other executives on the CXO team include Sidharth Shakdher, chief business officer, and Kartik Gupta, chief financial officer. Gupta and Shakdher have both worked with Ola Cabs for a short time—less than 1.5 years.According to the article, Bhavish Aggarwal is likely to take the lead in the business following these modifications and is reportedly focused on making a profit. The current management at the company will collaborate with Bhavish Aggarwal, who is basically back reviewing the daily statistics of the ride-hailing service, an insider told ET. In India, Ola Cabs, which was established in 2010, is a competitor of Uber and BluSmart. The business has let go of workers in two rounds of layoffs in the previous two years prior to Bakshi's resignation. It let go of 200 workers from Ola Cabs, Ola Electric, and Ola Financial Services in January of last year. From INR 1,522.3 Cr in the prior fiscal year to INR 772.2 Cr in FY23, ANI Technologies' consolidated net loss almost halved. From INR 1,970.4 Cr in FY22 to INR 2,799.3 Cr in FY23, operating revenue increased by 42%. Ola Cabs recently stated that, in contrast to an EBITDA loss of INR 66 Cr in the same period last year, its India mobility division broke even with "segment-adjusted" EBITDA of over INR 250 Cr in FY23. The

Sidhi Dalmia, a former executive at Goldman Sachs, joins VCats Syndicate Fund as a founding partner and co-leader.

Sidhi Dalmia, a senior executive at Goldman Sachs, has joined Mumbai-based Venture Catalysts as a founding partner and co-lead for their recently formed syndicate fund, VC Grid.In addition to Goldman Sachs, Dalmia has several executive roles at The Chesapeake Group, Bennett, Coleman & Co., Sumedha Fiscal Services, and Srei Group.She has worked in a number of major cities, including Mumbai, Hyderabad, Bangalore, Kolkata, and New York.According to the venture capital firm, Dalmia has played a pivotal role in propelling the establishment of VC Grid in recent months and solidifying its value proposition in the investment landscape.According to the company statement, she has coordinated fundraising efforts across a variety of industries, including technology, retail, FMCG, logistics, distressed assets, and infrastructure. She has also negotiated cross-border M&A transactions, facilitated venture capital investments, and given strategic advice to startups."She combines her financial acumen and leadership skills with a wealth of experience and knowledge in venture capital, early-stage investments, and creating sustainable enterprises. As we want to increase the value for family offices, legacy companies, and entrepreneurs, we are excited to collaborate with her," stated Apoorva Ranjan Sharna, managing director and founder of Venture Catalysts++.Family offices, corporate VCs, and U-HNIs make up the VC Grid network, which is dedicated to funding high-alpha projects from seed to Series A, with an investment range of $500K to $1.5M. Apart from providing financial support, the community also hopes to provide entrepreneurs with market access and commercial prospects by utilizing the combined knowledge and assets of its member investors. Venture Catalysts plans to conclude investment for VC Grid later this year with a total corpus of INR 900 Cr (about $110 Mn), according to a report published earlier this month by Inc42. Sources said at the time that the syndicate planned to bring the total number of limited partners to 100 by year's end, with 32 family offices already on board.

Where in the United States can you see the northern lights this weekend?

Here you may find the most recent news updates and breaking stories from India and around the globe.This weekend, a strong geomagnetic storm that reached Earth might provide residents as far south as Alabama and Northern California with a display of the northern lights, according to officials. People in more expansive parts of the map may be able to see the aurora borealis if the weather is right.The storm could produce an amazing light show in the night sky, but it has prompted government forecasters to warn of possible interruptions to satellite operations, the electricity grid, and communications networks."The aurora is really the gift from space weather, if you happen to be in an area where it's dark and cloud free and relatively unpolluted by light," Rob Steenburgh, a space scientist with the National Oceanic and Atmospheric Administration's Space Weather Prediction Center, told reporters on Friday morning.Friday night's map of the northern lights The center's map indicates that Friday night, the aurora could be visible over a large portion of the northern United States. The map's red line indicates the aurora forecast's southern range.For the best chance of seeing the northern lights, locals should evacuate the city, according to the National Weather Service's St. Louis office. On social media, the office posted, "Get away from city lights into a dark, rural surrounding and look north." "Aside from some clouds associated with a passing front, much of the time looks mostly clear."On its website, the forecast center states that one does not have to be right underneath the aurora to see it. Rather, it may be seen from a distance of up to 620 miles.When asked if there was any prospect of a nocturnal spectacle in the San Francisco Bay Area, the weather service office expressed less optimism. The office said, "Probably not, but I'll still look up while walking my dog."