Top Trending Acquisitions & Mergers News & Highlights

Invest in six mid-cap stocks with up to 47% upside potential from various sector groups to learn to deal with volatility.

These are unusual times, and they probably will be for a while. Think about the events of the last five days alone.The US Supreme Court overturned President Trump's tariff policy on Friday, Day One. The unpredictable Trump responded by enacting a 10% import tax on all goods. He increased the fee from 10% to 15% on Day Two, which was within 24 hours. For investors looking for growth potential without the usual volatility of small-cap stocks, mid-cap businesses can offer a sweet spot. These businesses are typically growing, gaining market share, and innovating, all of which can result in a significant increase in stock price.Market research archives

Published 25 Feb 2026 05:51 PM

Mubadala Capital and TWG will purchase Clear Channel Outdoor for $6.2 billion.

According to the business, Apollo Global Management funds have committed to investing preferred equity in the sale, while Mubadala Capital and TWG Global would provide equity financing for the transaction.A 45-day "go-shop" period is included in the agreement, according to Clear Channel Outdoor, which enables the business to request alternative takeover offers. Clear Channel Outdoor Holdings announced Monday that it had reached an agreement to be purchased by Mubadala Capital, in collaboration with TWG Global, for a sum of $6.2 billion. According to the agreement, shareholders of Clear Channel Outdoor would get $2.43 in cash per share, which is 71% more than the company's unchanged share price, the statement stated.

Published 10 Feb 2026 05:50 PM

Tax Question: Calculating capital gains tax on the sale of post-merger stock bl-premium-article-image

You originally paid ₹72,800 (700 shares * ₹104 per share) for the shares of Allahabad Bank that you purchased in 2013. After Allahabad Bank and Indian Bank merged in 2020, you were given 80 shares of Indian Bank instead of the initial 700 shares of Allahabad Bank.In 2013, I bought 700 shares of Allahabad Bank at an average price of ₹104. I received 80 shares of Indian Bank following the bank's 2020 merger. What is the price of the shares I must purchase in order to calculate my capital gain or loss if I decide to sell these shares right away?You originally paid ₹72,800 (700 shares * ₹104 per share) for the shares of Allahabad Bank that you purchased in 2013. After Allahabad Bank and Indian Bank merged in 2020, you were given 80 shares of Indian Bank instead of the initial 700 shares of Allahabad Bank.The nature of capital gain shall be Long term capital gain as the period of holding shall be calculated from the original share purchase, and not from the date of merger

Published 22 Dec 2025 10:30 PM

This Diwali, OOH ad sales increase by 20%, while data-driven campaigns increase DOOH share by 24%.

This year's Diwali brilliance extended beyond diyas and fireworks, illuminating billboards, computer screens, and Indian cityscapes. Brands transformed the outdoors into a canvas of color, emotion, and commerce by painting the streets with joyous tales in both Tier-II communities and busy metropolises. The outcome? For the Out-of-Home (OOH) advertising sector in India, this was one of the busiest holiday seasons to date. Due to early holiday planning, daring creative executions, and a swift transition to digital and data-led outdoor solutions, the industry saw impressive double-digit growth as consumer sentiment skyrocketed and advertiser confidence returned in full force.The OOH sector has grown significantly over this holiday season, which is indicative of both the restored vigor in consumer markets and economic optimism. Vaishal Dalal, co-founder of Excellent Publicity, emphasized this momentum and noted that the industry's growth trajectory is still strong. This holiday season, the OOH sector has experienced strong double-digit growth. OOH advertising revenues increased steadily across the country, from ₹4,140 crore in 2023 to ₹4,650 crore in 2024, and are expected to surpass ₹5,200 crore in 2025. The entire OOH ad expenditure increased by more than 15–20% year over year during Diwali, thanks to robust seasonal campaigns in industries including retail, FMCG, consumer durables, automotive, and BFSI."Internal estimates indicate a ~40% YoY increase in Diwali-related OOH bookings at Excellent Publicity, surpassing the industry average," he added. Early festive planning, strong advertiser confidence, and nearly full occupancy across premium billboard sites were credited with this spike.Vikas Nowal, CEO of Interspace Communications, echoed this pattern, stating that the company also experienced a notable Christmas bump. Our OOH company has performed well throughout the Diwali holiday season this year, with a projected 20% increase in sales over the previous year. Higher consumer involvement and greater advertising confidence throughout the festival period are reflected in this uptick," he continued. With companies aiming for both quantifiable engagement and widespread effect, both leaders concur that the OOH medium has become one of the most dependable and prominent options for festive storytelling.

Published 21 Oct 2025 07:55 PM

Acquisitions & Mergers

Acquisitions & Mergers are the latest trend in the globe.

What You Need To Know Ahead of Microsofts Earnings on Tuesday

Tech titan Microsoft Corp. (MSFT), which just became the second company ever to reach a market capitalization of $3 trillion, is due to report its second-quarter fiscal 2024 earnings on Tuesday after the market closes. Analysts expect Microsoft to post its highest revenue in seven quarters and an uptick in EPS, while the company's AI-powered cloud services continue to soar. Analysts forecast that Microsoft will announce net income of $20.6 billion, or $2.77 per share, compared with $17.4 billion and $2.20, respectively, in the prior-year quarter, according to data compiled by Visible Alpha. The company is also expected to report total revenue of $61 billion, a nearly 16% improvement year-over-year and the sharpest increase in this area in close to two years. Microsoft's Intelligent Cloud quarterly revenue, which has roughly doubled in the last three years, is expected to reach an all-time high of $25.3 billion in the latest quarter, according to Visible Alpha. This would represent a roughly 18% increase YOY.While Microsoft's AI adoption might spell big gains for its top and bottom lines, the company has run into legal issues as a result as well. Late in 2023, the New York Times sued Microsoft and OpenAI for copyright infringement, contending that ChatGPT was trained using millions of copyrighted articles. The suit calls for "billions of dollars in statutory and actual damages." 6 The company is also being scrutinized by the U.K.'s competition watchdog, which is evaluating whether Microsoft's partnership with OpenAI could affect competition. Also recently, the Federal Trade Commission launched an inquiry into Microsoft and OpenAI as part of a broader look at investments and partnerships in the AI space.

Republic Day 2024: Over 1,100 personnel awarded Gallantry and Service medals. Details here

On the occasion of the Republic Day 2024, a total of 1132 personnel of Police, Fire Service, Home Guard and Civil Defence and Correctional Service have been awarded Gallantry and Service Medals, the Ministry of Home Affairs said in a statement on 25 January. Of these 1,132 personnel, President's Medal for Gallantry (PMG) has been awarded to two personnel, Medals for Gallantry (GM) to 275, President's Medals for Distinguished Service (PSM) to 102 and Medal for Meritorious Service (MSM) to 753. "On the occasion of the Republic Day, 2024, a total of 1132 personnel of Police, Fire Service, Home Guard and Civil Defence and Correctional Service have been awarded Gallantry and Service Medals," the Ministry of Home Affairs (MHA) said in a statement. Among the majority of the 277 Gallantry Awards, 119 personnel from Left-wing extremist-affected areas, 133 personnel from the Jammu and Kashmir region and 25 personnel from other regions are being awarded for their gallant action. Out of 277 gallantry medals, 275 GM have been awarded to 72 personnel from J&K Police, 18 personnel from Maharashtra, 26 personnel from Chhattisgarh, 23 personnel from Jharkhand, 15 personnel from Odisha, 8 personnel from Delhi, 65 personnel from CRPF, 21 personnel from SSB and the remaining personnel from the other states, Union Territories (UTs) and Central Armed Police Forces (CAPFs). Out of 102 President's Medals for Distinguished Service (PSM), 94 have been awarded to Police Service and four each to Fire Service and civil guard and Home Guard Service. Out of 753 Medals for Meritorious Service (MSM), 667 have been awarded to Police Service, 32 to Fire Service, 27 to Civil Defence and Home Guard Service and 27 to Correctional Service. As per the MHA, the government has taken many steps in recent years to rationalise and transform the entire award ecosystem of various awards. In this regard, sixteen gallantry and service medals (for police, fire service, home guard and Civil service) have been rationalised and merged into four medals: the President's Medal for Gallantry (PMG), Medal for Gallantry (GM), President's Medal for Distinguished Service (PSM), and the Medal for Meritorious Service (MSM).

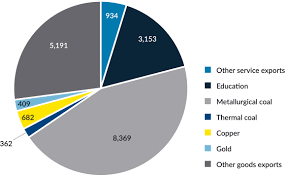

Indian investments key target of Western Australia’s minerals reforms

NEW DELHI : The state of Western Australia has implemented a series of reforms aimed at attracting investments in minerals and resources, including from India. In an interview with Mint, Western Australia deputy premier Rita Saffioti said there was much interest for greater investments and collaborations between Indian and Australian firms in the rare earths sector. The approvals reforms are aimed at supporting projects that assist with decarbonization, she said. Western Australia has been in focus for its supply of key critical minerals including lithium, nickel and cobalt, as well as rare earth metals, which are used in smartphones, computers, batteries and electronics. Australia accounts for roughly half of the world’s lithium production and has a similarly important position in cobalt production. It is also the fourth-largest rare-earths producer. Western Australia has attracted investments from Indian state-owned firms including NMDC Ltd. Indian mines minister Prahlad Joshi visited the state in 2022, following which the Indian government announced that a bilateral critical minerals investment partnership between the two sides had identified two lithium projects and three cobalt projects. “Investments under the partnership will seek to build new supply chains underpinned by critical minerals processed in Australia, that will help India’s plans to lower emissions from its electricity network and become a global manufacturing hub, including for electric vehicles," India’s mines ministry had said in a statement. Saffioti said her visit to India was also aimed at promoting Western Australia as an investment destination for private Indian companies. “There are opportunities for Indian investment in Western Australia through offtake agreements for key battery minerals," Saffioti said.

Amber, Titagarh Rail Systems in deal for train components business

Both TRSL and Amber group, via its wholly-owned subsidiary Sidwal Refrigeration Industries Pvt Ltd, will invest approximately ₹120 crore each to obtain around 50% each in the SPV.The SPV will set up a new facility in India to manufacture critical railway components and subsystems used in the manufacture of railway and metro coaches and will also make fresh equity investments into Titagarh Firema. Titagarh Firema SpA, Italy, is an associate company of the Titagarh group where govt of Italy is also an equity stake holder. The new SPV will also invest in Titagarh Firema while government of Italy will invest in the entity for which it has already taken approval from Invitalia, the Italians government’s investment arm. Under the agreement, Firema will grant Sidwal, Titagarh Rail as well as the SPV a preferred supplier status and right of first refusal (ROFR) for all their products.Titagarh Rail is involved in the railway rolling stock space for both freight and passenger rolling stocks. Apart from being an established railway wagon and metro coach manufacturer, it is also currently executing the projects of Vande Bharat trains, Surat, Ahmedabad, Pune metros as well as executing its first export order for passenger rail components received from Firema. Titagarh is targeting a capacity of almost 800-850 coaches per year in the coming years. The Amber group is a diversified B2B company having three business verticals: consumer durables, electronics and railway subsystems and mobility. Sidwal, an Amber group company, has emerged as a leader in the train air conditioner market and has also signed a technology licensing agreement with Ultimate group to manufacture passenger coach doors and gangways. Sidwal is also planning to enter the European market for its products portfolio, a company statement said.The strategic partnership in Firema will not only facilitate Sidwal’s entry into the European market, but will also give Sidwal a preferred access to Firema’s own demand, the statement added. Both companies are investing to grow capabilities and capacities for various products that can be exported to Europe such as train mechanical and electrical components by TRSL and HVAC, doors, gangways and pantry systems by Sidwal. Firema is one of the largest and reputed designers and manufacturers of passenger trains in Italy and has executed marquee projects in Italy and other parts of Europe. Firema has an order book of almost euro 1 billion for producing new coaches and has an existing capacity to produce upwards of 240 coaches per year and has plans to double this capacity.

Deal values in India plunge to $66 billion in 2023, investors cautious, reports Grant Thornton

There was a significant drop in deal values in India for the year 2023, reaching $66 billion, marking a decrease of over 50 percent, a recent report from consultancy firm Grant Thornton Bharat found. Released on January 19, the report found a decline of over 20 percent in deal volume, with 1,641 deals compared to the previous year. Shanthi Vijetha, a partner at Grant Thornton Bharat, pointed out several factors contributing to this. The lack of liquidity in international markets, volatile market conditions, and cautious investor sentiment were identified as key hindrances to deal activities throughout 2023."While India's focus on sustainability and environmental responsibility positions it as an attractive hub for global economic opportunities, overcoming challenges such as currency strength and global instability is crucial," added Vijetha. Merger and Acquisition Impact The report indicates a significant impact on merger and acquisition (M&A) deal values, which plummeted by 72 percent to $25.2 billion across 494 transactions. Outbound M&As were particularly affected, dropping to $3.2 billion from $17.9 billion in the previous year. The sluggish M&A trend in the first half of 2023 recorded deal values of only $7.8 billion. The largest transaction during this period was Suraksha Group's $2.5 billion acquisition of Jaypee in the real estate sector. Private Equity and IPO Trends On the private equity (PE) front, 2023 witnessed a 23 percent decline in both deal volume and value, with 1,045 deals amounting to $27.4 billion. The most significant deal in this category was Temasek Holdings' $2 billion investment in Manipal Health Enterprises.

Everyman Media Group Earnings, Revenue Rose Despite Strikes

Premium cinema group Everyman Media (EMAN) said the resounding box office success of Barbie and Oppenheimer led to strong summer trading leaving it confident of meeting full year expectations. Unfortunately, both revenue and adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation) fell in the first half to 29 June, admittedly against strong prior year comparatives. Investors seemed unmoved by the upbeat outlook, with the shares dropping 1% to 55p capping a disappointing 12 months for shareholders with the shares down 44%. Chief executive Alex Scrimgeour commented: ‘We are pleased to report that trading continues to be in line with the board's expectations, having achieved robust interim results despite this year's major film titles falling in the second half of 2023. We remain confident in our prospects as we continue to be supported by a slate of high-quality second-half releases, a carefully expanded estate and new banking facilities which ensure we are well configured to take advantage of future opportunities.’Revenue fell 6% to £38.3 million in the first half, but strong trading in July and August transformed the picture with year-to-date revenue 13% higher at £60 million while EBITDA was 12% ahead at £11 million.Everyman expects to meet full-year consensus forecasts which call for revenue of £94.4 million, representing 20% growth, and EBITDA of £17.2 million compared with £7.9 million in 2022. Having opened three new venues in the first half, taking the estate to 41 cinemas and 141 screens, the company has a healthy pipeline of new opportunities.A new two-screen venue will open in Marlow in the current quarter, while a further five venues are planned for 2024 including a three-screen venue in Stratford in the third quarter.The firm agreed a new three-year loan facility of £35 million replacing a £25 million revolving credit facility and £15 million Covid interruption loan. Leisure analyst Mark Photiades at Canaccord Genuity commented: ‘The film slate for Q4 and beyond is strong with a number of major releases and independent films due including Wonka, Ferrari, Napoleon, Killers of the Flower Moon and the latest instalment of The Hunger Games.’Photiades left his forecasts unchanged but reiterated his buy rating, saying, ‘Everyman remains a premium brand, synonymous with offering a first-class cinema and hospitality experience & a best-in-class food and beverage offer prepared in-house.’

Kolte-Patil acquires two society redevelopment projects in Mumbai’s Dahisar and Versova with topline potential of ~Rs 545 crore

Kolte-Patil Developers Limited has signed two new society redevelopment projects in the western suburbs of Mumbai with total saleable area of ~3.06 lakh square feet translating into top-line potential of ~Rs 545 crore. Kolte-Patil Developers Limited, a Pune based real estate player with growing presence in Mumbai and Bengaluru, on Tuesday announced that it has signed two new society redevelopment projects in the western suburbs of Mumbai with total saleable area of ~3.06 lakh square feet translating into top-line potential of ~Rs 545 crore. The two acquired projects are at strategic locations in prime residential areas, Dahisar and Versova. With these additions, the company now has a total of fifteen projects in the Mumbai Metropolitan Region (MMR). The Dahisar project is well connected to the Western Express Highway. Further, the close proximity to the metro connecting via Andheri and its further expansion to the BKC add to the attractiveness of the project. The Company has demonstrated success in the Dahisar micro market following the execution of its residential redevelopment project, Vaayu. The Versova project has strong demand potential and access to rapidly expanding public infrastructure including the metro lines and the proposed Versova-Virar Sea Link which will provide coastal road connectivity between South Mumbai and Western suburbs. Rahul Talele, Group CEO, Kolte-Patil Developers Ltd, said, “I am happy to announce the addition of two new society redevelopment projects in the western suburbs of Mumbai. This marks another significant milestone in our journey to strengthen our presence in Mumbai that represents the largest real estate market in the country. These projects align with our strategic goals and we are confident that our active initiatives and growing presence in the society redevelopment space will continue to enhance our standing in the MMR market in a significant manner.”

Tiger Woods Net Worth and Businesses—PGA, Nike, Gatorade, and a Mini Golf Chain

Golf legend Tiger Woods may have parted ways with Nike after 27 years, but he has made millions from his career as a pro golfer and lucrative endorsement deals with other major brands including Gatorade, Rolex, and Monster Energy. Considered one of the best golfers of all time, Woods is one of the few billionaire athletes in the world—and is only the second active athlete who is a billionaire, behind NBA star LeBron James. Woods has a net worth of $1.1 billion as of January 2024, according to Forbes.1 Here's how Tiger Woods built his fortune. In his 27-year career as a professional golfer, Woods accumulated 106 worldwide wins and 15 majors. He has 82 PGA Tour wins, tied with golfer Sam Snead for the most PGA Tour wins in history.Throughout his career as a pro golfer, Woods has earned about $1.8 billion, according to an estimate by Forbes.1 Woods has also earned a record-setting $121 million in prize money from PGA tours.3 PGA Tour. "Career Earnings."However, Woods' impressive earnings from golf are not the only way he amassed his wealth—in fact, they account for less than 10% of his net worth, according to Forbes. The rest of his fortune comes from major endorsement deals and a series of business ventures.Woods' 27-year partnership with Nike certainly contributed to his massive fortune as the sporting company was his biggest backer. Woods' deal with Nike was said to be worth about $500 million throughout the life of the contract. That's not the only major partnership Woods had, though. The golfer had a lucrative tie-up with sports drink company, Gatorade, which paid him an estimated $100 million over several years. However, the company ended its partnership with Woods in 2010 after news of several extramarital affairs surfaced. AT&T and technology consulting company Accenture were also among the brands that ended their partnerships with Woods at the time. Woods partnered with energy drink company, Monster Energy, in 2016 and has continued his endorsement deal with them. The pro golfer has been seen playing out of a Monster-branded golf bag and has also represented the brand's other drink, Monster Hydro Super Sport since 2022.Several of Woods' businesses have to do with golf—he owns a golf course design firm, TGR Design, golf simulator tool Full Swing, as well as an indoor mini golf chain, Popstroke. Popstroke has nine locations across Florida, Arizona, and Texas and anticipates opening an additional 15 sites in 2024 and 2025.Woods is also a shareholder in global real estate development company Nexus Luxury Collection, along with singer Justin Timberlake. In October 2023, the company announced that Woods and Timberlake will be opening a sports and entertainment gastropub in St. Andrews, Scotland, through Nexus. The premium venue includes dining and lounge areas, and Woods' own Full Swing golf simulators.Woods is no stranger to real estate and has bought and sold multiple million-dollar properties. His home on Jupiter Island costs an estimated $54 million.

New Worker Classification Rule Could Disrupt the US Gig Economy

Uber drivers and other gig economy workers could be legally classified as employees under a new Department of Labor rule that goes into effect in March. The new rule already faces at least one lawsuit, filed by freelance writers who want to remain "independent contractors" rather than employees. Employees are entitled to overtime pay, minimum wage, and other benefits not available to contractors.While people who work as contractors value the flexibility, employment law experts say there's no reason employers couldn't offer flexible hours alongside employee status and the benefits that go along with it. App-based ride-sharing services such as Uber (UBER) and Lyft (LYFT) earned the title of “disruptors” for the way they drove traditional cab companies out of business. Now, they’re trying to fend off the disruption that could be coming for them, in the form of a new federal labor rule. A new regulation on worker classification released this month is already facing at least one legal challenge, and will likely see more pushback from gig economy companies whose business model it threatens. The new law could turn the gig economy upside down, and affect many of the estimated 22.1 million Americans who work as independent contractors, employment experts say. Earlier this month, the Department of Labor released details on a rule setting standards on when a worker counts as an employee as opposed to an independent contractor, entitling them to overtime pay, unemployment insurance, and a slew of other benefits under the law. The new rule, first proposed in 2022, is set to go into effect in March.This week, a group of freelancers, including three New Jersey-based writers, sued the Department of Labor to overturn the new rule. At least one major business lobbying group is also considering legal action. Should the government give “employee” status to workers currently classified as contractors, it would threaten the business models of companies such as Uber, Lyft, and Doordash (DASH), whose contract workers cost their employers much less than traditional employees would.Uber and the Flex Association—a trade group representing gig economy companies—both released statements last week saying that the rule would have no immediate impact on their businesses. “This rule does not materially change the law under which we operate, and will not impact the classification of the over one million Americans who turn to Uber to earn money flexibly,” Uber’s statement reads.

Price cuts mar HUL’s Q3 show, posts flat revenue and profit growth

Consumer goods major Hindustan Unilever posted a flat 0.5% growth in net profit to ₹2,519 crore in the December quarter from ₹2,505 crore in the corresponding quarter last year. Its volumes grew at 2% year on year in the quarter ending December. Its sales growth was flat, registering a marginal decline of 0.3% to ₹14,928 crore due to price cuts taken by the company. “Looking forward we expect gradual recovery in market demand to continue aided by increased government spending, recovery in winter crop sowing and better crop realization. Rural income growths and winter crop yields are key factors that will determine the pace of recovery,” said Rohit Jawa, CEO and MD of HUL. The company also expects competitive intensity to stay due to benign commodity prices. Going ahead, the company expects price growth to be marginally negative if commodity prices remain where they are.“HUL remains well positioned to unlock this opportunity whilst navigating the short-term challenges,” Jawa added. Its earnings before interest tax depreciation and amortization (EBIDTA) expanded by 10 basis points year on year to 23.7% in Q3. The FMCG major gets three-fourths of its business from home care and BPC business. Both these businesses saw mid-single digit growth in volumes. The company’s sales were affected due pricing action. Its home care’s revenues fell by 1%, with the BPC segment posting no change. “Skin cleansing revenue declined due to the impact of price reductions taken to pass on the benefits of lower commodity costs to consumers. Market development actions in body wash continue to yield good results. While delayed winter impacted skin care performance in the quarter, premium non-winter portfolios continued to do well,” said HUL in its press release.Food and refreshment business however saw a low-to single digit fall in volumes, as this segmental revenues went up by 1%. The company said that tea further strengthened value and volume market leadership, with green tea and flavoured tea performing well“Coffee grew in double-digits driven by pricing. Health Food Drinks delivered competitive modest price-led growth driven by Plus range,” HUL said.During the quarter, it launched Knorr Korean K-Pot noodles; and Bru Gold in Vanilla, Caramel and Hazelnut flavours.

Retail Retail’s net profit jumps 32% to ₹3,165 crore on festive fervour

Reliance Retail’s third quarter net profit grew 31.9% growth to ₹3,165 crore from ₹2,400 crore in the same quarter last year. Its revenue from operations also registered a 23.8% growth to ₹74,373 crore in the festive quarter, aided by aggressive store expansions. The Isha Ambani-led company added 252 stores during the quarter. On a YoY basis, its store count is higher by 1,549 to a total of 18,774 stores as of December 2023 end. “Reliance Retail has delivered strong performance during the festive quarter. Our business success is intricately woven into the larger fabric of India's economic growth, and together, we are shaping a compelling story of innovation and world class possibilities for the future,” said Isha M Ambani, executive director of Reliance Retail Ventures.Its footfalls grew by a robust 40.3%. Its digital and new commerce businesses now contribute to 19% of its revenue. “The retail segment has delivered an impressive financial performance with its rapidly expanding physical as well as digital footprint,” said Mukesh D Ambani, chairman and managing director, Reliance Industries.All its business segments exhibited double digit growth in the December quarter. Its mainstay grocery business grew by 41%. “Stores witnessed strong growth in non-food categories led by general merchandise & home and personal care. Catalogue expansion across home, cookware, furnishings and travel needs have enabled consumers in extending their shopping mission at Smart Bazaar as a one stop destination,” the company said.Its nascent consumer brands business also grew 3x aided by distribution reach. The company which re-launched Campa line of soft drinks said that its beverage, general merchandise and stapes are driving growth momentum of its own brands. It had also launched its staples business under the brand name Independence.It also launched new namkeens and sweets under Masti Oye! Brand, along with Deluxe assorted toffees under Toffeeman. The festival and wedding season also drove business in its fashion and lifestyle segments with good performance from its jewels business. “Tira is expanding its store network across top tier cities and has received strong customer traction. The business has delivered strong performance across various operating metrics including sales productivity, average bill value, repeats,” the company said.

Sundar Pichai asks Google employees to brace for more job cuts

San Francisco, Google CEO Sundar Pichai has reportedly warned employees to brace themselves for more job cuts this year.Google, which has let go over a thousand employees across various departments in the last one week or so, is likely to go for more job cuts, reports The Verge, citing an internal memo."We have ambitious goals and will be investing in our big priorities this year," Pichai told employees in the memo."The reality is that to create the capacity for this investment, we have to make tough choices," he added. In the memo, Pichai said that latest "role eliminations are not at the scale of last year's reductions, and will not touch every team". "But I know it's very difficult to see colleagues and teams impacted," the Google CEO added.The layoffs this year are about "removing layers to simplify execution and drive velocity in some areas"."Many of these changes are already announced, though to be upfront, some teams will continue to make specific resource allocation decisions throughout the year where needed, and some roles may be impacted," Pichai further wrote.After laying off nearly 1,000 employees last week, Google is also reportedly slashing "a few hundred" more jobs in its advertising sales team as part of an ongoing restructuring exercise. Philipp Schindler, Google's chief business officer, told staff in a memo that the fresh job cuts "were the result of changes to how Google's sales team operated", Business Insider reported.A Google spokesperson also confirmed that "a few hundred roles globally are being eliminated" as part of the restructuring.In January last year, Google cut its workforce by 12,000 people, or around 6 per cent of its full-time employees.

2024 will be a perilous year for the world economy as geopolitical tensions ramp up, top economists warn

The year 2024 will likely be a stormy one for the global economy as growth slows and geopolitical tensions ramp up around the world, according to a World Economic Forum survey. The foundation polled over 60 chief economists ahead of its annual meeting, which is taking place in the Swiss ski resort town of Davos this week. More than half the respondents said the world economy will get weaker this year, and 70% predicted looser financial conditions – implying that they believe central banks, including the US Federal Reserve, will start lowering interest rates at some point in 2024. Over 80% of the economists surveyed by the WEF expect geopolitical tensions to drive up stock-market volatility and economic uncertainty, while around three-quarters of those polled said they're expecting artificial intelligence to boost innovation in advanced economies this year. "Amid accelerating divergence, the resilience of the global economy will continue to be tested in the year ahead," WEF managing director Saadia Zahidi said. "Though global inflation is easing, growth is stalling, financial conditions remain tight, global tensions are deepening and inequalities are rising." Wall Street executives have been fretting about heightened geopolitical volatility since war broke out in the Middle East in October, although those worries didn't stop stocks from charging higher over the final two months of 2023. Despite their gloomy outlooks, the Chicago Board Options Exchange's VIX index – a widely-followed Wall Street "fear gauge" – is trading close to its lowest level since before the pandemic, suggesting that traders aren't so worried.

India emerges strong amid global economic challenges, feels Citis Tyler Dickson

Tyler Dickson, head of investment banking at Citi feels that India stands out as a shining star in Asia in the midst of global macroeconomic challenges, The Economic Times reported. Dickson expressed bullish sentiments about India's mergers and acquisition (M&A) segment and equity market activities, during an interview with the paper.Questioned about his thoughts on how well India has fared amid the global macroeconomic challenges compared to other emerging markets in Asia, Dickson noted that the country is currently the fifth-largest economy globally and is poised to climb to the third position. The enthusiasm of Indian business leaders, coupled with the 'China plus one' strategy, makes India an attractive market for global investors, he said. Citi sees it as one of the best opportunities for both Indian and international clients, it reported. On the environment regarding M&As and tighter global liquidity conditions, Dickson felt that India's M&A market remains robust at around $85 billion despite global challenges. While the debt capital markets (DCM) face challenges due to fluctuating rates, Citi maintains a positive long-term perspective on the M&A landscape in India, he added. In terms of deal activity he feels that higher interest rates globally indicate slower economic growth and necessitate adjustments in deal activity. He however noted that stability in the cost of capital is crucial, and that as the market recalibrates, confidence will increase. The focus on quality in earnings, cash flow, and growth becomes more significant in a higher interest rate environment, he added. Further, Dickson also expressed a long-term bullish outlook on technology, considering it a fundamental driver of growth, the report said. While acknowledging the challenges faced during the "technology winter," Citi is cautiously optimistic about increased activity levels for technology companies in M&A, ECM, and DCM in 2024, he added. Acknowledging that there is a "financing wall in the 2025-2026 era", characterized by the need to refinance debt at higher costs, Dickson said Citi emphasises that this debt is not super expensive. The bank sees an opportunity for the global market to adjust to this reality, considering historical periods with more expensive debt, it said.

Fitch expects RBI to cut interest rates by 75 basis points in FY25

Mumbai, Federal Bank on Tuesday reported 23 per cent increase in consolidated net profit at Rs 1,035.42 crore for December quarter 2023-24, helped by a sharp decline in provisions and also surge in non-interest income. On a standalone basis, the private sector lender's net profit in the quarter increased 25 per cent to Rs 1,007 crore, its highest ever. The growth in the core NII was constrained because of narrowing of net interest margin at 3.19 per cent from the 3.55 per cent in the year-ago period, and the 18 per cent asset growth provided a limited succour. Chief executive and managing director Shyam Srinivasan said the bank has posted 19 per cent growth in deposits by giving higher rates, but was quick to add that the deposit growth is from individual clients which will yield dividends over a period of time. He admitted that the bank has not been able to deliver on its guidance of expanding NIMs in the second half of FY24 due to the challenging external environment where funds are coming at a higher cost, and added that it will look at maintaining NIM at the 3.20 per cent level in the near term. The net advances at the end of the December quarter stood at Rs 199,185 crore, 18% year-on-year (YoY) growth over Rs 168,173 crore in Q3FY23. In the previous quarter, the bank had reported net advances at Rs 192,817 crore.The retail book was up by 24% YoY in Q3Y24, while the business banking book registered an 18% YoY growth. The bank also reported a 23% YoY growth in gold loans.The deposits in the said quarter stood at Rs 239,591 crore and were up 19% versus Rs 201,408 crore in Q3FY23. On a quarter-on-quarter (QoQ) basis, the uptick was 3% against Rs 232,868 crore in Q2FY24.The bank reported a slight uptick in its gross non-performing assets (NPAs) in Q3FY24 at Rs 2.29% on a sequential basis against 2.26% in Q2FY24. However, GNPA was down YoY from 2.43% in Q3FY23. The net NPA was flat on a QoQ basis at 0.64% in Q3FY23. In the year-ago period, the lender had reported NNPA at 0.73%.The PCR improved by 189 bps YoY and 5 bps QoQ, while the collection efficiency ensured recoveries upgradations of Rs 290 crore, the company filing said. The PCR remains elevated at 11-quarter high.The returns on assets for Q3FY24 stood at 1.39% versus 1.36% in Q2FY24 and 1.33% in Q3FY23. The net interest margins (NIMs) were reported at 3.19%, down from 3.22% in Q2FY24 and 3.55% in Q3FY23.The bank reported its October-December quarter earnings during market hours and the share fell 0.55% to the day's low of Rs 152.10.Federal Bank posted strong growth in the branch network, adding 65 new branches in FY24.

Wondrlab purchases a Polish digital firm

WebTalk is a Polish agency that Wondrlab purchases in a cash and equity transaction. WebTalk acquires an undisclosed financial stake in Wondrlab. WebTalk clients gain from the acquisition since it gives them access to Wondrlab platforms. The largest acquisition made by Wondrlab to date, this is its fifth. Wondrlab has raised $7 million and intends to make 26 acquisitions. The company has opened its European hub and aims to generate revenue of Rs 200 crore. Jarek Ziebinski..

"Transaction value decreased by 9% and consumer retail deals fell by a third in 2023, according to Grant Thornton Bharat

According to a Grant Thornton Bharat report, deal activity in the retail, e-commerce, and consumer sectors decreased by a third in volume in 2023 as investors grew wary due to high inflation, several companies implementing wage freezes, and workforce reductions. The number of consumer sector mergers and acquisitions and private equity funding deals fell to 331 in the most recent calendar year from 514 the year before. The value of these deals decreased by 9% to $8.6 billion from $9.3 billion, with the ecommerce sector leading the majority of this decline.The value of e-commerce transactions almost halved to 3.3 billion, but the quantity fell 70% to 124 deals. However, deal activity in the apparel and retail sectors increased seven times, with Reliance Retail leading the way with nearly $1.6 billion raised from Qatar Investment.

Up to $50 million may be raised by a Trump-affiliated SPAC through convertible notes and warrants.

In a filing, Digital World Acquisition—the blank-check company that is going to merge with the media company owned by former US President Donald Trump—said that it could raise as much as $50 million through the issuance of convertible notes or warrants. Shares of Digital World dropped 9.2% to $20.30 on A publicly traded shell company known as a special purpose acquisition company, or SPAC, raises capital with the goal of merging with a private company within two years of floating its shares. The merger allows the private company to go public.Digital World said in the filing with the U.S. Securities and Exchange Commission that it was still in talks to raise funds through alternative options after some potential investors expressed interest, though it added there was no certainty that the talks will be successful.The blank-check company declared that it would forfeit the $530.5 million that remained from the $1 billion in PIPE that it had raised. The SPAC raised $1 billion through PIPE in 2022, but the investors had the option to back out of their commitments when the merger with Trump Media and Technology Group was not completed by the September 2022 deadline.Truth Social is a social media platform run by Trump Media & Technology Group. (Editing by Shounak Dasgupta; reporting by Akash Sriram in Bengaluru)