Government News

How to Ease Rising External Debt-Service Pressures in Low-Income Countries

By - 30 Jan 2024 10:06 PM

|

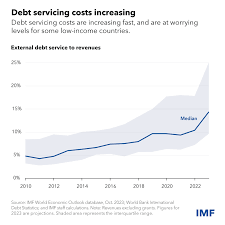

WASHINGTON DC, Jan 29 (IPS) - As 2024 starts, the good news is that there haven’t been any notable requests by a low-income country for comprehensive debt relief since Ghana’s, more than a year ago. Despite this, vulnerabilities remain, with high debt servicing costs a growing challenge for low-income countries. Financing pressures due to relatively high interest payments and the pace at which low-income countries need to repay debt are straining budgets.

That prevents these countries from spending more on essential services or the critical investment needed to attract business, create jobs, improve prosperity, and build climate resilience.One important metric is the share of revenues the government collects from its population through taxes and other fees that goes to pay its foreign creditors. While the scale of the burden differs greatly across countries, it’s generally about two and a half times higher than a decade earlier.In addition, central banks have significantly raised borrowing costs to tame inflation. That makes it costlier for governments to raise new debt or refinance existing debt. While central banks may be done raising rates, it is not clear when they will start to cut, and this uncertainty may be reflected in volatile financial market conditions.

They need to refinance about $60 billion of external debt each year, about three times the average in the decade through 2020.But with many competing demands for financing, including from advanced and emerging market economies that are also trying to adapt to climate change, there’s a significant risk of a liquidity crunch—failure to raise sufficient financing at an affordable cost. That could in turn lead to a destabilizing debt crisis.One factor was higher government borrowing and deficits to mitigate the impact of the pandemic and other external economic shocks. This has increased the level of debt and consequently the cost of servicing it. It’s encouraging that this trend is reversing as countries bring primary deficits back in line with pre-pandemic levels. |