Advertising/Media

Global TV advertising is changing, according to a WARC analysis.

By Kajal Sharma - 04 Sep 2025 09:13 PM

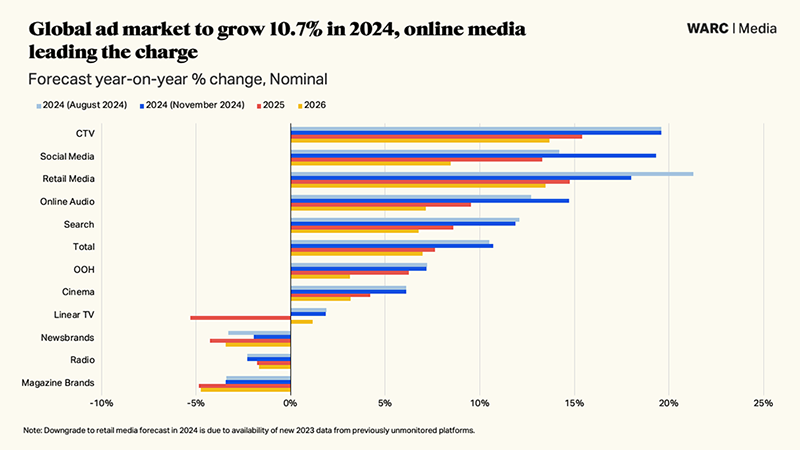

As consumers move away from traditional linear TV and toward connected TV—streaming videos watched on a smart TV or a TV with an internet connection—the nature of television media is evolving, and TV advertising opportunities are becoming more accessible.The question of what constitutes television in 2025 and whether TV advertising should be categorized by format, device, or media owner has been raised by this shift.The most recent Global Ad Trends: The Changing Shape of TV report from WARC looks at ten years of ad spend data to understand the decline of linear TV and the reactive rise of connected TV (CTV). It also looks at why definitions of "TV" are changing and how a variety of data, device, and creative forces will shape the future of TV.Globally, linear TV ad spending fell by 27.5% between 2014 and 2024, and by 50.8% when inflation was taken into account. Sector differences include a 42% decrease in linear TV spending on tech and electronics and a 12% increase in spending on household and domestic goods.

More than three-quarters of all TV investment is still allocated to linear TV, but more and more businesses are shifting their spending toward CTV, which, according to Nielsen, now makes up almost half of all TV usage in the US. According to WARC Media, the entire video market, excluding social media and YouTube, is expected to account for 15.9% of spending in 2025. Down from 41.3% in 2013 to just 12.4% presently ($143.9 billion), linear TV is predicted to fall to 11.3% next year, reaching $139.1 billion, the lowest level since 2005.Marketers are shown a strong desire to boost CTV spending, which is expected to reach $39.9 billion this year (or 3.4% of total share) and expand by 3.6% to $44.7 billion in 2026. According to Nielsen's 2025 Annual Marketer study, 56% of marketers worldwide intend to increase their OTT/CTV budgets, up from 53% in 2024. The Americas are expected to see the biggest growth, while APAC and Europe will see less.