Business

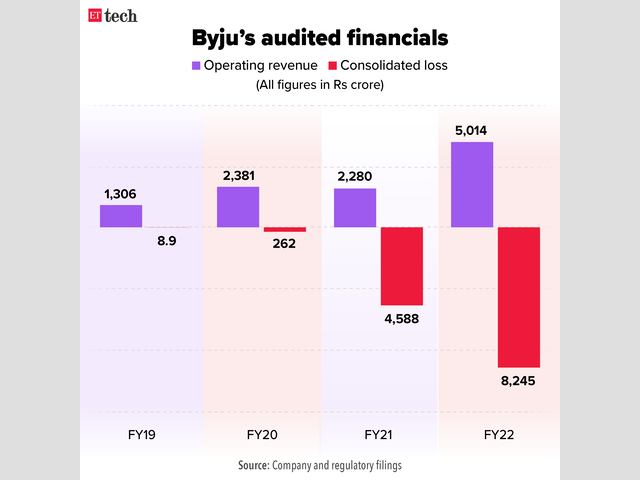

Byju's losses for FY22 surge to Rs 8,245 crore; a cash-strapped edtech company is valuing its rights offering at $500 million.

By Kajal Sharma - 12 Aug 2024 10:03 PM

Roughly Rs 3,800 crore, or over half of Byju's losses, have come from stressed assets like Whitehat Jr. and Osmo, two significant purchases the company made. However, the persistent concern over the $1.2 billion term loan has been noted by Byju's auditor BDO, who has stated that a "material uncertainty exists."Weeks after presenting its audited FY22 financials to investors during an annual general meeting in December, parent company of troubled edtech startup Byju, Think & Learn, finally submitted them with the registrar of companies (RoC).For FY22, the business had operating revenue of Rs 5,014 crore, but losses increased to Rs 8,245 crore. Byju's entire income, according to the company's regulatory filings, was about Rs 5,300 crore. Byju's operating revenue increased by 119% in FY22, but losses increased by 80% over the same time period.Improve Your Technological Proficiency with High-Value Skill Courses: IIM Lucknow's IIML Executive Programme in FinTech, Banking, and Applied Risk Management Product Management Professional Certificate from Indian School of BusinessRoughly Rs 3,800 crore, or over half of the losses, have come from highly leveraged assets like Whitehat Jr. and Osmo, two significant purchases the company made."We are pleased that our total revenue has increased by 2.2 times, but we also recognize that 45% of the losses are attributable to our underperforming companies, such as Osmo and Whitehat Jr. We have improved our operating financial circumstances through a number of initiatives, according to a statement from Byju's CFO, Nitin Golani. "While other businesses continue to grow, these businesses were significantly scaled down to cut losses in the following years.

"However, the persistent concern over the $1.2 billion term loan has been noted by Byju's auditor BDO, who has stated that a "material uncertainty exists." It did, however, add that the company's management is currently working to get the capital needed to pay off its debts to lenders by selling off assets. "Therefore, (management) has faith in the Company's ability to survive into the future. Furthermore, the management believes it is unlikely that the TLB loan will be granted based on a legal opinion."We are pleased that our total revenue has increased by 2.2 times, but we also recognize that 45% of the losses are attributable to our underperforming companies, such as Osmo and Whitehat Jr. We have improved our operating financial circumstances through a number of initiatives, according to a statement from Byju's CFO, Nitin Golani. "While other businesses continue to grow, these businesses were significantly scaled down to cut losses in the following years."However, the persistent concern over the $1.2 billion term loan has been noted by Byju's auditor BDO, who has stated that a "material uncertainty exists." It did, however, add that the company's management is currently working to get the capital needed to pay off its debts to lenders by selling off assets. "Therefore, (management) has faith in the Company's ability to survive into the future. Furthermore, the management believes it is unlikely that the TLB loan will be granted based on a legal opinion.